To resolve a credit card dispute, essential documents include the credit card statement highlighting the disputed transaction, copies of receipts or proof of purchase, and any correspondence with the merchant. Providing a detailed written explanation of the issue supports the dispute process. Maintaining organized records accelerates resolution and ensures accuracy in claim verification.

What Documents Are Required for Credit Card Dispute Resolution?

| Number | Name | Description |

|---|---|---|

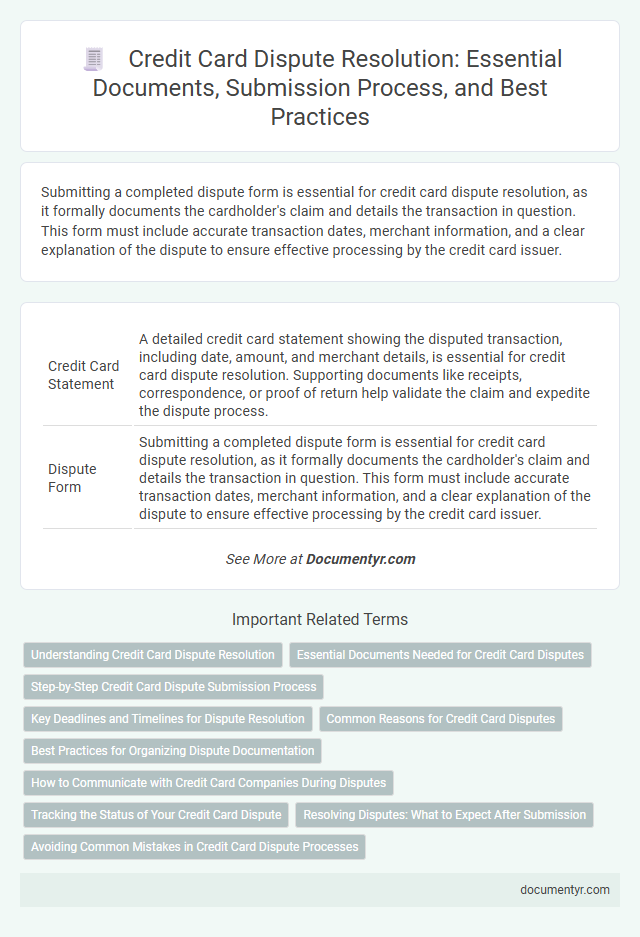

| 1 | Credit Card Statement | A detailed credit card statement showing the disputed transaction, including date, amount, and merchant details, is essential for credit card dispute resolution. Supporting documents like receipts, correspondence, or proof of return help validate the claim and expedite the dispute process. |

| 2 | Dispute Form | Submitting a completed dispute form is essential for credit card dispute resolution, as it formally documents the cardholder's claim and details the transaction in question. This form must include accurate transaction dates, merchant information, and a clear explanation of the dispute to ensure effective processing by the credit card issuer. |

| 3 | Transaction Receipt | A transaction receipt is a crucial document for credit card dispute resolution, providing proof of purchase details such as date, amount, merchant name, and transaction description. This receipt supports validation of the disputed charge and helps financial institutions verify legitimacy during the investigation process. |

| 4 | Proof of Payment | Proof of payment documents such as bank statements, transaction receipts, or credit card statements are essential for substantiating disputed charges during credit card dispute resolution. These records provide verifiable evidence to support claims of unauthorized transactions or billing errors, facilitating a faster and more accurate resolution process. |

| 5 | Correspondence with Merchant | Key documents for credit card dispute resolution include all correspondence with the merchant, such as emails, letters, and messages that detail the transaction issue or attempted resolution. These records provide essential evidence to support your claim by documenting communication timelines and merchant responses. |

| 6 | Police Report (if fraud suspected) | A police report is essential for credit card dispute resolution when fraudulent transactions are suspected, as it provides official documentation that helps verify the claim and supports the investigation process. This report, alongside transaction records and correspondence with the credit card issuer, strengthens the case for reversing unauthorized charges. |

| 7 | Affidavit of Unauthorized Transaction | An Affidavit of Unauthorized Transaction is a crucial document in credit card dispute resolution, providing a sworn statement that confirms the transaction was not authorized by the cardholder. This affidavit, along with the credit card statement highlighting the disputed charge, is essential for initiating the investigation and ensuring compliance with financial regulations for chargeback processing. |

| 8 | Identity Proof | Identity proof documents required for credit card dispute resolution typically include government-issued IDs such as a passport, driver's license, or national ID card to verify the cardholder's authenticity. These documents help financial institutions confirm the identity of the claimant and prevent fraudulent disputes. |

| 9 | Account Holder’s Authorization Letter | The account holder's authorization letter is a crucial document for credit card dispute resolution, granting permission to the bank or dispute resolution agency to investigate and act on behalf of the cardholder. This letter must include the cardholder's full name, account details, a clear statement authorizing the dispute process, and a valid signature to ensure the legitimacy of the claim. |

| 10 | Supporting Evidence (emails, screenshots, chat logs) | Supporting evidence such as emails, screenshots, and chat logs play a crucial role in credit card dispute resolution by providing verifiable proof of transactions and communication discrepancies. These documents help financial institutions authenticate claims, facilitating faster and more accurate dispute processing. |

| 11 | Chargeback Request Form | The Chargeback Request Form is a crucial document for credit card dispute resolution, containing essential details such as transaction date, amount, merchant information, and reason for dispute. Providing accurate and complete information on this form significantly increases the chances of a successful chargeback claim with the card issuer or payment processor. |

| 12 | Acknowledgment of Dispute | An Acknowledgment of Dispute document serves as formal proof that the credit card issuer has received and recognized the cardholder's dispute claim, playing a critical role in initiating the investigation process. It typically includes the dispute reference number, date of acknowledgment, and details of the disputed transaction, ensuring clear communication and tracking between the cardholder and the issuer. |

| 13 | Merchant Response/Investigation Report | The Merchant Response or Investigation Report is a crucial document in credit card dispute resolution, detailing the merchant's findings and evidence related to the transaction in question. This report typically includes transaction receipts, communication records, delivery confirmations, and any other relevant proof that supports the merchant's claim against the disputed charge. |

| 14 | Delivery Proof (shipping confirmation, tracking details) | For credit card dispute resolution related to non-received goods, providing delivery proof such as shipping confirmation emails and tracking details is essential to verify the transaction status and support the claim. These documents demonstrate whether the item was dispatched and its current location, helping the card issuer assess liability accurately. |

| 15 | Cancellation Confirmation | Cancellation confirmation documentation, such as an official letter or email from the credit card issuer, serves as critical evidence in credit card dispute resolution to prove the account closure date and terms. Including transaction records, dispute forms, and communication logs alongside the cancellation confirmation strengthens the case for resolving unauthorized or disputed charges effectively. |

Understanding Credit Card Dispute Resolution

Understanding credit card dispute resolution involves identifying the necessary documents to support your claim. Providing accurate documentation ensures a smoother and faster resolution process.

Essential documents include your credit card statement showing the disputed charge and any receipts or proof of transaction. Additionally, correspondence with the merchant and any relevant written communication help validate the dispute.

Essential Documents Needed for Credit Card Disputes

| Document Type | Description | Importance in Dispute Resolution |

|---|---|---|

| Credit Card Statement | The billing statement showing the disputed transaction | Serves as proof of the charge you are contesting |

| Transaction Receipts | Receipts or invoices related to the transaction in question | Helps verify the purchase date, amount, and merchant details |

| Dispute Letter or Form | A formal written statement explaining the dispute | Initiates the dispute process and outlines your claim |

| Correspondence Records | Emails, messages, or letters exchanged with the merchant or credit card issuer | Documents attempts made to resolve the issue directly |

| Identification Proof | Government-issued ID such as a driver's license or passport | Verifies your identity during the dispute process |

| Police Report | Report filed in cases of stolen card or fraudulent transactions | Required for disputes involving fraud for formal investigation |

Step-by-Step Credit Card Dispute Submission Process

To initiate a credit card dispute, gather essential documents such as the transaction receipt, your credit card statement, and any relevant correspondence with the merchant. Submit a formal dispute letter including detailed information about the transaction in question and attach the supporting documents. Monitor the dispute status through your credit card issuer's online portal or customer service until resolution is confirmed.

Key Deadlines and Timelines for Dispute Resolution

Credit card dispute resolution requires specific documentation to validate the claim. Essential documents include the original credit card statement, transaction receipts, and any correspondence with the merchant.

Submitting these documents promptly is crucial to meet the card issuer's dispute deadlines. Typically, disputes must be filed within 60 days from the statement date containing the disputed charge. Failure to adhere to this timeline may result in the claim being denied or unresolved.

Common Reasons for Credit Card Disputes

Resolving credit card disputes requires submitting specific documents that support the claim. Proper documentation helps clarify the nature of the dispute and facilitates a faster resolution process.

- Transaction Receipts - These prove the original purchase and are essential when disputing unauthorized or incorrect charges.

- Billing Statements - Highlighting the disputed charge on the statement helps verify the claim with the credit card issuer.

- Correspondence Records - Emails or letters exchanged with the merchant provide evidence for disputes related to refunds or service issues.

Best Practices for Organizing Dispute Documentation

Effective credit card dispute resolution relies heavily on meticulous documentation. Organizing these documents systematically enhances the chances of a favorable outcome.

- Keep Transaction Records - Maintain detailed receipts, statements, and proof of payment to support your dispute claim.

- Document Communication - Save emails, call logs, and any correspondence with the credit card issuer or merchant for reference.

- Prepare a Dispute Summary - Create a clear, concise summary outlining the issue, relevant dates, and amounts for quick review.

How to Communicate with Credit Card Companies During Disputes

What documents are required for credit card dispute resolution? You need to gather your billing statements, a copy of the disputed transaction receipt, and any correspondence with the merchant. Collecting these documents helps support your case when communicating with your credit card company.

How should you communicate with credit card companies during disputes? Maintain clear and detailed records of all conversations, including dates, representative names, and key points discussed. Use written communication like emails or letters to create a formal paper trail, which strengthens your position.

Tracking the Status of Your Credit Card Dispute

Tracking the status of your credit card dispute requires maintaining organized records of all correspondence and documentation submitted to your credit card issuer. Essential documents include your original credit card statement, the dispute form or letter, and any communication records such as emails or phone call logs.

Regularly checking your credit card account online or contacting customer service helps keep you informed about the progress of your dispute. Collecting proof of delivery or confirmation numbers for your submitted documents ensures you have evidence in case of any discrepancies during the resolution process.

Resolving Disputes: What to Expect After Submission

When you submit a credit card dispute, the financial institution reviews the provided documents carefully to validate your claim. Understanding the required documents helps expedite the resolution process and ensures accurate assessment.

- Dispute Form - A completed dispute form outlining the transaction details and reason for dispute is essential for initiating the process.

- Proof of Purchase - Receipts, invoices, or transaction confirmations serve as evidence supporting your claim of unauthorized or incorrect charges.

- Correspondence Records - Copies of emails or communication with the merchant can demonstrate attempts to resolve the issue prior to formal dispute submission.

After submission, expect the card issuer to investigate the claim, which may take up to 30 to 90 days depending on the complexity and cooperation from involved parties.

What Documents Are Required for Credit Card Dispute Resolution? Infographic