To complete an international wire transfer, essential documents include a valid identification such as a passport or government-issued ID, the recipient's full name and bank details including IBAN or SWIFT/BIC code, and proof of the source of funds for compliance with anti-money laundering regulations. Bank account statements or invoices may also be required to verify the legitimacy of the transfer. Providing accurate and complete documentation ensures smooth processing and reduces the risk of delays or rejection.

What Documents Are Needed for International Wire Transfers?

| Number | Name | Description |

|---|---|---|

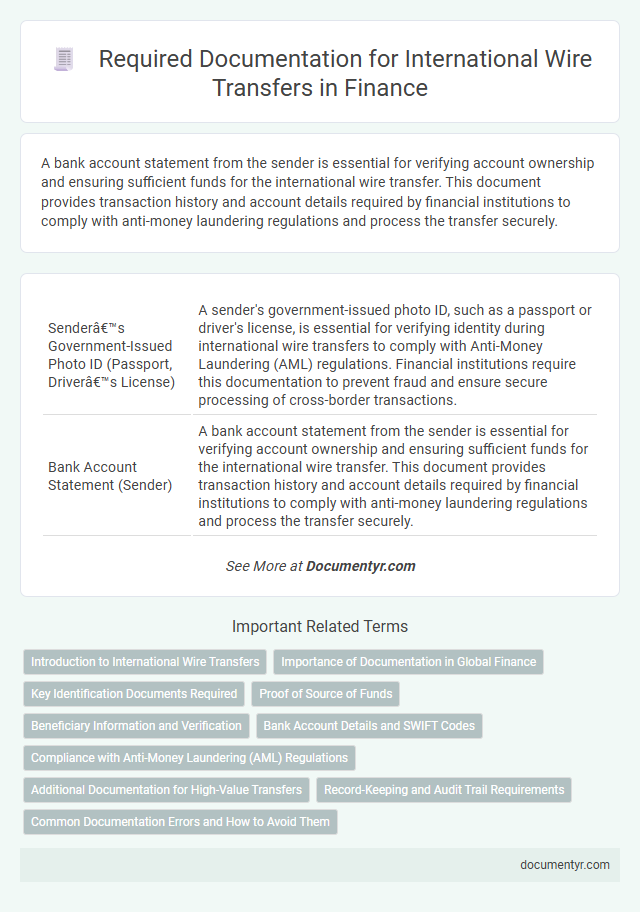

| 1 | Sender’s Government-Issued Photo ID (Passport, Driver’s License) | A sender's government-issued photo ID, such as a passport or driver's license, is essential for verifying identity during international wire transfers to comply with Anti-Money Laundering (AML) regulations. Financial institutions require this documentation to prevent fraud and ensure secure processing of cross-border transactions. |

| 2 | Bank Account Statement (Sender) | A bank account statement from the sender is essential for verifying account ownership and ensuring sufficient funds for the international wire transfer. This document provides transaction history and account details required by financial institutions to comply with anti-money laundering regulations and process the transfer securely. |

| 3 | Beneficiary’s Full Name | The beneficiary's full name must exactly match the name on their bank account to ensure the international wire transfer is processed without delays or rejections. Inaccurate or incomplete beneficiary name information can lead to failed transactions and additional verification requirements from financial institutions. |

| 4 | Beneficiary’s Bank Name | The beneficiary's bank name must be accurately provided to ensure smooth processing of international wire transfers, as it verifies the correct financial institution receiving the funds. This detail is critical for compliance with global banking regulations and helps prevent transaction delays or errors. |

| 5 | Beneficiary’s Bank Account Number/IBAN | The beneficiary's bank account number or International Bank Account Number (IBAN) is a crucial document required for international wire transfers to ensure funds are accurately directed to the recipient's account. Financial institutions rely on the IBAN to verify account authenticity and facilitate cross-border transactions while minimizing errors and delays. |

| 6 | Beneficiary’s SWIFT/BIC Code | The beneficiary's SWIFT/BIC code is essential for international wire transfers, ensuring the accurate identification of the recipient's bank in the global financial network. This unique identifier facilitates secure and efficient routing of funds across borders, minimizing errors and delays in the transaction process. |

| 7 | Payment Purpose/Reason for Transfer | International wire transfers require the sender to provide a clear payment purpose or reason for the transfer, often documented through invoices, contracts, or letters of explanation. Regulatory compliance mandates detailed descriptions to prevent money laundering and ensure transparency in cross-border financial transactions. |

| 8 | Source of Funds Declaration/Proof | International wire transfers require a Source of Funds Declaration or proof to verify the legitimacy of the money being transferred, which can include bank statements, salary slips, sale receipts, or tax documents depending on the sender's jurisdiction. Financial institutions mandate these documents to comply with anti-money laundering (AML) regulations and ensure transparency in cross-border transactions. |

| 9 | Invoice or Contract (Supporting Document for Business Transfers) | For international wire transfers related to business transactions, providing an invoice or contract is essential as these documents verify the purpose and legitimacy of the transfer, facilitating compliance with regulatory requirements. Accurate invoices or contracts detail the transaction amount, parties involved, and payment terms, ensuring smooth processing and reducing the risk of delays or compliance issues. |

| 10 | Remittance Application Form (Bank’s Wire Transfer Form) | The Remittance Application Form, also known as the Bank's Wire Transfer Form, is a critical document required for international wire transfers as it captures essential details like the sender's and recipient's bank information, transfer amount, currency, and purpose of the transaction. Accurate completion of this form ensures compliance with anti-money laundering regulations and enables smooth processing of cross-border payments. |

| 11 | Proof of Address (Sender) | Proof of address for the sender in international wire transfers typically requires a recent utility bill, bank statement, or government-issued document showing the sender's name and current residential address. Financial institutions enforce this requirement to comply with anti-money laundering (AML) regulations and verify the identity of the sender accurately. |

| 12 | OFAC Screening Forms (if required) | International wire transfers often require OFAC screening forms to ensure compliance with U.S. Treasury sanctions regulations, preventing transactions with sanctioned entities or countries. These forms typically include the sender's and recipient's identification details and a declaration affirming that the transfer does not violate OFAC restrictions. |

| 13 | Tax Identification Number (if applicable) | International wire transfers typically require the sender's and recipient's Tax Identification Number (TIN) to comply with tax regulations and prevent fraud. Providing the correct TIN ensures smooth processing by financial institutions and meets reporting requirements set by tax authorities globally. |

| 14 | Authorization Letter (if transferring on behalf of someone else) | An authorization letter is essential for international wire transfers when sending funds on behalf of another person, providing legal consent and detailing the transfer specifics to prevent fraud. This document must be signed, often notarized, and include the account holder's identification and clear instructions to ensure compliance with banking regulations. |

| 15 | Regulatory Compliance Documents (KYC/AML forms) | International wire transfers require regulatory compliance documents such as Know Your Customer (KYC) forms, which verify the identity of the sender and recipient, and Anti-Money Laundering (AML) forms that assess and mitigate the risk of illicit financial activities. These documents are mandated by financial authorities to ensure transparency, prevent fraud, and comply with global financial regulations. |

| 16 | Beneficiary’s Contact Details | Beneficiary's contact details, including full name, address, phone number, and email, are essential for international wire transfers to ensure accurate recipient identification and facilitate communication if discrepancies arise. Banks and financial institutions require this information to comply with regulatory protocols and to verify the transaction's legitimacy. |

Introduction to International Wire Transfers

International wire transfers enable secure movement of funds across borders. Understanding the required documents ensures smooth and timely transactions.

- Identification Proof - Valid government-issued ID verifies your identity for compliance and security purposes.

- Recipient Details - Accurate beneficiary information, including bank account number and SWIFT/BIC code, is essential for correct fund delivery.

- Transaction Purpose Documentation - A statement explaining the transfer's purpose may be required to comply with regulatory and anti-money laundering laws.

Importance of Documentation in Global Finance

Accurate documentation is crucial for successful international wire transfers, ensuring compliance with global financial regulations and preventing transaction delays. Key documents include the sender's identification, beneficiary details, and proof of transaction purpose.

Financial institutions require these documents to verify the legitimacy of funds and to combat money laundering and fraud. Proper documentation enhances transparency and trust in cross-border financial operations.

Key Identification Documents Required

International wire transfers require precise documentation to ensure compliance with banking regulations and secure transaction processing. Key identification documents validate your identity and authorize the transfer.

- Government-Issued Photo ID - A valid passport or national ID card verifies the sender's identity for security purposes.

- Proof of Address - Utility bills or bank statements confirm the sender's residential address to prevent fraud.

- Bank Account Information - Details such as account number, SWIFT/BIC code, and IBAN facilitate accurate and timely fund transfers.

Proof of Source of Funds

Proof of source of funds is a critical document required for international wire transfers to comply with anti-money laundering regulations. Commonly accepted proofs include bank statements, pay stubs, tax returns, or sale agreements demonstrating the legitimate origin of the transferred funds. Providing clear and verifiable evidence helps financial institutions ensure transparency and prevent illegal activities during cross-border transactions.

Beneficiary Information and Verification

What beneficiary information is required for an international wire transfer? You need to provide the beneficiary's full name as registered with their bank and their complete address for accurate processing. Verifying the beneficiary's bank account number and the International Bank Account Number (IBAN) ensures the funds are sent correctly.

How do banks verify the beneficiary's details during an international wire transfer? Banks cross-check the beneficiary's identification documents, such as a passport or government-issued ID, to confirm authenticity. This verification step helps prevent fraud and ensures compliance with international financial regulations.

Bank Account Details and SWIFT Codes

Bank account details are essential for processing international wire transfers accurately. These details include the account number, account holder's name, and the bank's full name and address.

SWIFT codes play a crucial role in identifying the recipient's bank globally. Providing the correct SWIFT code ensures that your funds reach the intended international bank promptly and securely.

Compliance with Anti-Money Laundering (AML) Regulations

International wire transfers require specific documentation to ensure compliance with Anti-Money Laundering (AML) regulations. Providing accurate and thorough information helps prevent illegal activities and ensures smooth transaction processing.

Essential documents often include a valid identification form, proof of the source of funds, and detailed beneficiary information such as full name, account number, and bank details. Financial institutions may also request a completed wire transfer form and declarations regarding the purpose of the transfer. You must comply with these requirements to avoid delays and regulatory issues during your international transactions.

Additional Documentation for High-Value Transfers

International wire transfers require standard documents such as a valid government-issued ID, the sender's bank account details, and the recipient's banking information including SWIFT or IBAN codes. For high-value transfers, additional documentation is often necessary to comply with regulatory and anti-money laundering policies. These may include proof of source of funds, detailed transaction purpose explanations, and enhanced due diligence forms requested by financial institutions.

Record-Keeping and Audit Trail Requirements

International wire transfers require precise documentation to ensure compliance with regulatory standards and maintain a clear audit trail. Proper record-keeping supports transparency and facilitates audits by financial institutions and regulatory bodies.

- Transaction Authorization Forms - These documents verify the identity and consent of the sender and recipient, essential for regulatory compliance.

- Bank Statements and Transfer Receipts - They provide proof of transaction and serve as evidence for financial reconciliation and audits.

- Correspondence and Supporting Invoices - These records justify the purpose of the transfer and help establish the legitimacy of funds movement.

Maintaining thorough documentation ensures accountability and smooth regulatory inspections in international wire transfers.

What Documents Are Needed for International Wire Transfers? Infographic