To claim financial aid as an independent student, essential documents include your most recent federal income tax returns, W-2 forms, and proof of any untaxed income. You must also provide verification of your independent status through documentation such as a signed statement or legal documentation if applicable. Submitting accurate and complete records ensures a smooth financial aid application and maximizes your eligibility.

What Documents are Necessary for Claiming Financial Aid as an Independent Student?

| Number | Name | Description |

|---|---|---|

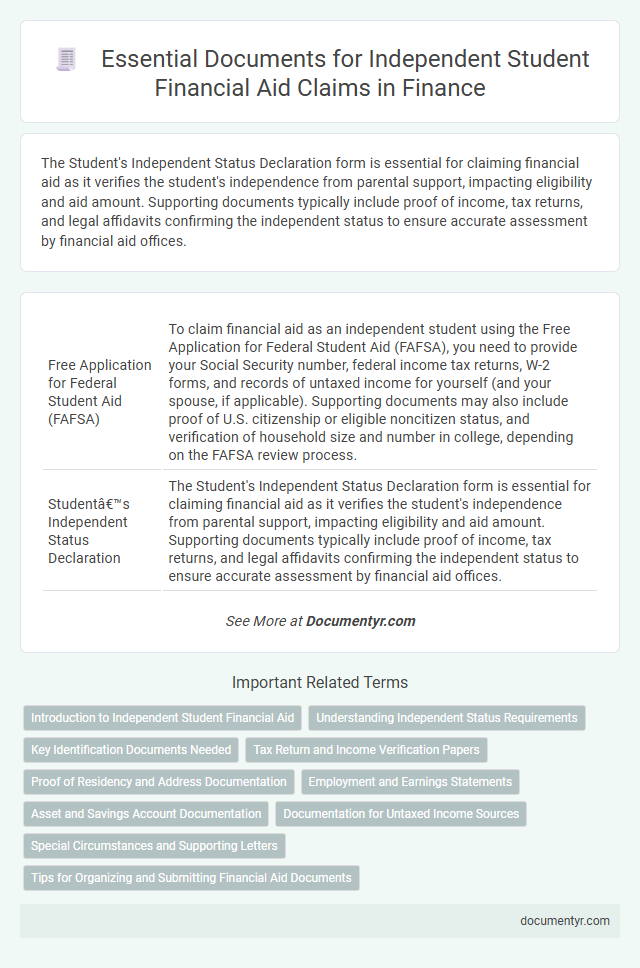

| 1 | Free Application for Federal Student Aid (FAFSA) | To claim financial aid as an independent student using the Free Application for Federal Student Aid (FAFSA), you need to provide your Social Security number, federal income tax returns, W-2 forms, and records of untaxed income for yourself (and your spouse, if applicable). Supporting documents may also include proof of U.S. citizenship or eligible noncitizen status, and verification of household size and number in college, depending on the FAFSA review process. |

| 2 | Student’s Independent Status Declaration | The Student's Independent Status Declaration form is essential for claiming financial aid as it verifies the student's independence from parental support, impacting eligibility and aid amount. Supporting documents typically include proof of income, tax returns, and legal affidavits confirming the independent status to ensure accurate assessment by financial aid offices. |

| 3 | Federal Income Tax Return (IRS Form 1040) | Submitting a complete Federal Income Tax Return (IRS Form 1040) is essential for independent students to verify income and qualify for federal financial aid, providing detailed information on earnings, tax payments, and allowances. The IRS Form 1040 supports accurate calculation of the Expected Family Contribution (EFC) by the FAFSA, impacting eligibility for Pell Grants, federal student loans, and work-study programs. |

| 4 | W-2 Wage and Tax Statements | W-2 Wage and Tax Statements are essential for verifying earned income when claiming financial aid as an independent student, providing detailed information on wages and tax withholdings from employers. Accurate submission of W-2 forms helps financial aid offices assess eligibility and determine the correct amount of aid based on reported income. |

| 5 | Proof of Untaxed Income (e.g., benefits statements) | Proof of untaxed income, such as Social Security benefits statements, veterans' non-education benefits, and child support received, is essential when claiming financial aid as an independent student. These documents verify income sources not reported on tax returns, enabling accurate assessment of financial need by aid administrators. |

| 6 | Proof of Legal Guardianship or Ward of Court Status (if applicable) | To claim financial aid as an independent student with legal guardianship or ward of court status, you must provide official court documents such as guardianship orders or wardship declarations that verify your legal status. These documents serve as critical proof to the financial aid office, ensuring eligibility for aid based on your independent status. |

| 7 | Emancipation Documentation (if applicable) | Emancipation documentation, such as a court order proving legal emancipation, is essential for independent students claiming financial aid to verify their status. Including official emancipation papers ensures accurate assessment of eligibility and access to need-based aid. |

| 8 | Proof of Homelessness or At-Risk Status (if applicable) | Proof of homelessness or at-risk status for independent students claiming financial aid typically requires documentation such as a letter from a homeless shelter, school district liaison, or social services agency verifying the student's living situation. Additional acceptable documents include a signed self-certification form outlining the circumstances, or court or agency records confirming foster care status or unaccompanied youth condition. |

| 9 | Dependency Override Request (if applicable) | Claiming financial aid as an independent student requires submission of key documents including tax returns, proof of income, and identification, with special attention to a Dependency Override Request if applicable, which must include a detailed personal statement and third-party verification to justify independence from parental information. This request enables the financial aid office to reassess dependency status when unusual circumstances prevent standard parental data submission, directly impacting eligibility and award calculations. |

| 10 | Social Security Number Documentation | A valid Social Security Number (SSN) is required to verify identity and eligibility when applying for financial aid as an independent student. Providing an official Social Security card or an equivalent government-issued document ensures accurate processing of federal aid applications and compliance with Department of Education regulations. |

| 11 | State Financial Aid Application (if required) | Submitting a completed State Financial Aid Application is essential for independent students seeking financial aid, as it verifies eligibility and ensures access to state-specific grants, scholarships, and loan programs. Required documents typically include proof of independence, income verification such as tax returns or W-2 forms, and residency status documentation to confirm qualification for state aid. |

| 12 | Financial Aid Verification Worksheet | The Financial Aid Verification Worksheet is essential for independent students to confirm the accuracy of their FAFSA information, requiring documentation such as tax returns, income statements, and proof of independent status. Submitting a completed worksheet ensures timely processing of financial aid by verifying income, household size, and residency details accurately. |

| 13 | Proof of Citizenship or Eligible Noncitizen Status | To claim financial aid as an independent student, essential documents include a valid U.S. passport, birth certificate, or certificate of naturalization as proof of citizenship, or for eligible noncitizens, a Permanent Resident Card (Green Card), Arrival/Departure Record (I-94), or Employment Authorization Document (EAD). These documents establish federal eligibility and must be submitted to the financial aid office to verify status and qualify for grants, loans, or work-study programs. |

| 14 | Selective Service Registration Proof (if required) | Independent students must provide Selective Service Registration proof if they were born after 1960 and are required to register, as this documentation verifies eligibility for federal financial aid programs. Acceptable proof includes a Selective Service registration card, a verification letter from the Selective Service System, or confirmation of exemption status, which schools use to validate compliance with federal law. |

| 15 | Student’s Identification (Driver’s License, Passport) | To claim financial aid as an independent student, submitting valid identification documents such as a driver's license or passport is essential for verifying identity. These documents ensure compliance with federal aid requirements and help prevent fraud during the application process. |

| 16 | Bank Statements and Asset Documentation | Bank statements are essential to verify an independent student's current financial status, reflecting income, expenses, and available funds over a specific period. Asset documentation, including property deeds, investment portfolios, and savings account records, is required to accurately assess the student's net worth and eligibility for financial aid. |

Introduction to Independent Student Financial Aid

| Introduction to Independent Student Financial Aid |

|---|

| Independent students have unique financial aid requirements compared to dependent students. Financial aid programs recognize independence as a separate status, affecting eligibility and documentation. Understanding the necessary documents streamlines the application process and ensures timely assistance. |

| Key Documents Required for Claiming Financial Aid as an Independent Student |

|

| Importance of Accurate Documentation |

| Submitting complete and accurate documents ensures eligibility verification and prevents delays in financial aid processing. Independent students benefit from understanding documentation requirements to maximize their aid opportunities. |

Understanding Independent Status Requirements

Independent students must provide specific documents to verify their status when applying for financial aid. Understanding the criteria set by federal guidelines is crucial to ensure eligibility.

Required documents often include proof of income, tax returns, and legal documentation supporting independent status. These requirements help financial aid offices accurately assess the student's financial need without parental information.

Key Identification Documents Needed

Claiming financial aid as an independent student requires submitting key identification documents to verify your status and eligibility. These documents ensure the financial aid office can accurately assess your application and provide the appropriate support.

Essential documents include a government-issued photo ID such as a driver's license or passport to confirm your identity. You must also provide your Social Security Number or Tax Identification Number for financial verification and record tracking.

Tax Return and Income Verification Papers

What documents are necessary for claiming financial aid as an independent student? Tax return forms such as the IRS Form 1040 are essential to verify your income accurately. Income verification papers, including W-2 forms and recent pay stubs, support the financial information reported on tax returns.

Proof of Residency and Address Documentation

Proof of residency and address documentation are critical for independent students applying for financial aid to establish their eligibility and verify their living situation. These documents help financial aid offices confirm that students meet residency requirements set by federal and state regulations.

- Utility Bills - Recent utility bills such as electricity, water, or gas statements serve as official proof of your current address and residency status.

- Lease Agreement - A signed lease or rental agreement provides evidence of your independent housing arrangement and residency duration.

- Government-Issued ID - An ID card or driver's license displaying your current address verifies your identity and residency for financial aid purposes.

Employment and Earnings Statements

Employment and earnings statements are crucial documents for claiming financial aid as an independent student. These documents verify Your income and employment status, ensuring accurate financial assessment.

- Recent Pay Stubs - Provide current proof of income and employment consistency over recent months.

- W-2 Forms - Summarize annual earnings from all employers, essential for verifying total income.

- 1099 Forms - Document non-wage income such as freelance work or contract jobs, crucial for a complete income overview.

Asset and Savings Account Documentation

When claiming financial aid as an independent student, thorough documentation of assets and savings accounts is essential. These documents provide a clear picture of your financial status, which directly impacts aid eligibility.

Required documents include recent bank statements showing current balances in savings, checking, and other asset accounts. Students must also provide records of investment accounts, such as stocks, bonds, or mutual funds, as these contribute to total asset value. Accurate and up-to-date documentation ensures precise evaluation by financial aid offices, facilitating an appropriate aid package.

Documentation for Untaxed Income Sources

When claiming financial aid as an independent student, proper documentation of untaxed income sources is essential. This includes records such as Social Security benefits statements, child support received, and veteran's non-educational benefits. Gathering these documents helps ensure accurate reporting and maximizes eligibility for financial assistance.

Special Circumstances and Supporting Letters

Claiming financial aid as an independent student often requires documentation of special circumstances that affect your financial situation. Supporting letters play a crucial role in validating these unique conditions to aid the financial aid office's decision-making process.

- Special Circumstances Documentation - Provide official documents like court orders, medical records, or proof of unusual expenses that demonstrate financial hardship or independence.

- Supporting Letters - Submit letters from social workers, counselors, or other professionals who can attest to your financial independence or hardship.

- Personal Statement - Include a detailed letter explaining your special circumstances and why standard financial information does not reflect your situation.

Collecting and submitting comprehensive special circumstances documentation and supporting letters increases the likelihood of receiving tailored financial aid as an independent student.

What Documents are Necessary for Claiming Financial Aid as an Independent Student? Infographic