Small business loan applications typically require financial statements, including balance sheets, income statements, and cash flow projections to demonstrate business viability. Owners must also provide personal and business tax returns, bank statements, and a detailed business plan outlining the purpose and repayment strategy for the loan. Supporting documents such as legal business licenses, incorporation papers, and credit reports further strengthen the application by verifying legitimacy and creditworthiness.

What Documents Are Needed for Small Business Loan Application?

| Number | Name | Description |

|---|---|---|

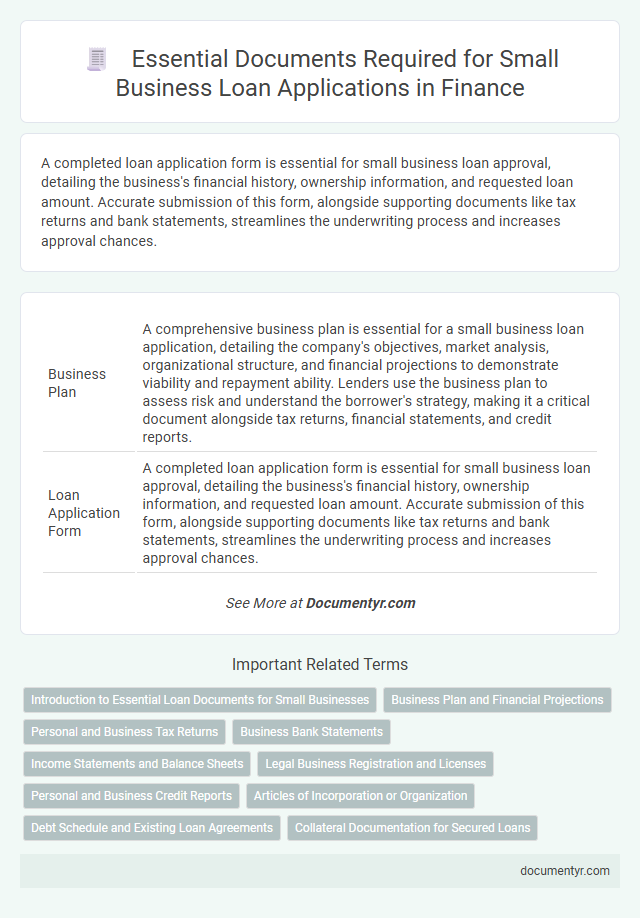

| 1 | Business Plan | A comprehensive business plan is essential for a small business loan application, detailing the company's objectives, market analysis, organizational structure, and financial projections to demonstrate viability and repayment ability. Lenders use the business plan to assess risk and understand the borrower's strategy, making it a critical document alongside tax returns, financial statements, and credit reports. |

| 2 | Loan Application Form | A completed loan application form is essential for small business loan approval, detailing the business's financial history, ownership information, and requested loan amount. Accurate submission of this form, alongside supporting documents like tax returns and bank statements, streamlines the underwriting process and increases approval chances. |

| 3 | Personal Identification (e.g., Driver’s License, Passport) | Small business loan applications require valid personal identification documents such as a government-issued driver's license or passport to verify the applicant's identity and maintain compliance with lending regulations. Lenders rely on these IDs to conduct background checks and ensure the legitimacy of the loan request, reducing the risk of fraud. |

| 4 | Personal Credit Report | A personal credit report is essential for a small business loan application, as lenders use it to assess the borrower's creditworthiness and financial responsibility. This report includes credit history, outstanding debts, and payment patterns, which influence approval decisions and loan terms. |

| 5 | Business Credit Report | A comprehensive business credit report provides lenders with essential financial history, credit scores, and payment behavior, which are critical for evaluating a small business loan application. Including an updated business credit report alongside financial statements, tax returns, and a detailed business plan significantly improves the chances of loan approval. |

| 6 | Personal Tax Returns | Personal tax returns from the past two to three years are essential for small business loan applications, providing lenders with a clear view of the applicant's income stability and financial responsibility. These documents help verify reported earnings and assess creditworthiness, which are critical factors in loan approval decisions. |

| 7 | Business Tax Returns | Business tax returns, including IRS Form 1120, 1120S, or 1065, provide lenders with critical financial history and proof of income stability when evaluating small business loan applications. These documents help verify the business's revenue, expenses, and taxable income, thereby supporting the loan approval process. |

| 8 | Bank Statements | Bank statements for the past three to six months are essential documents for a small business loan application as they demonstrate consistent cash flow and financial stability to lenders. Accurate and detailed bank statements help verify income, expense patterns, and the overall financial health of the business, increasing the likelihood of loan approval. |

| 9 | Balance Sheet | A comprehensive balance sheet is essential for a small business loan application as it provides lenders with a snapshot of the company's assets, liabilities, and equity, demonstrating financial stability and creditworthiness. Accurate and up-to-date balance sheet data enables lenders to assess the business's ability to repay the loan and manage financial risks effectively. |

| 10 | Profit and Loss Statement (P&L) | A Profit and Loss Statement (P&L) is essential for small business loan applications as it provides lenders with a detailed overview of the business's revenue, costs, and net profit over a specific period. This financial document helps demonstrate the company's profitability and operational efficiency, critical factors in assessing loan eligibility and repayment capacity. |

| 11 | Cash Flow Statement | A detailed cash flow statement is essential for a small business loan application as it demonstrates the company's ability to generate sufficient revenue to cover expenses and repay the loan. Lenders analyze cash flow statements to assess the timing and reliability of cash inflows and outflows, ensuring the borrower's financial stability and repayment capacity. |

| 12 | Accounts Receivable Aging Report | An Accounts Receivable Aging Report is essential for small business loan applications as it provides detailed insight into outstanding invoices categorized by their due dates, helping lenders assess cash flow stability and credit risk. This report must be recent and clearly delineate current versus overdue receivables to support the loan approval process effectively. |

| 13 | Accounts Payable Aging Report | The Accounts Payable Aging Report is essential for a small business loan application as it details outstanding liabilities and payment schedules, providing lenders clear insight into the company's short-term financial obligations. Accurately presenting this report demonstrates the business's ability to manage cash flow and meet creditor commitments, which directly influences creditworthiness evaluation. |

| 14 | Legal Business Documents (e.g., Articles of Incorporation, Business License) | Small business loan applications require legal business documents such as Articles of Incorporation, which establish the company's legal existence, and a valid Business License to verify the business's authorization to operate. Lenders often also request partnership agreements, certificates of assumed name, or other official registrations to ensure compliance and legitimacy. |

| 15 | Ownership and Affiliations Documentation | Small business loan applications require ownership and affiliations documentation such as business registration certificates, articles of incorporation, partnership agreements, and any documentation proving equity ownership or shareholder structure. Lenders also typically request personal identification documents for all owners and disclosure of any affiliate companies or entities that may impact the business's financial standing. |

| 16 | Debt Schedule | A detailed debt schedule listing current liabilities, including loan balances, interest rates, repayment terms, and monthly payments, is essential for a small business loan application to assess financial obligations accurately. Lenders use this document to evaluate the business's debt management capacity and overall creditworthiness. |

| 17 | Collateral Documentation | Collateral documentation required for small business loan applications typically includes property titles, vehicle registrations, equipment appraisals, and inventory lists that demonstrate tangible assets available to secure the loan. Accurate and up-to-date appraisal reports and ownership proofs increase the likelihood of loan approval by validating the value and legal claim over the collateral offered. |

| 18 | Franchise Agreement (if applicable) | A franchise agreement is crucial for a small business loan application when the business operates as a franchise, outlining the terms and responsibilities between franchisor and franchisee to validate the business model. Lenders review the franchise agreement to assess financial obligations, operational guidelines, and the overall risk profile associated with the franchise. |

| 19 | Commercial Lease Agreement (if applicable) | A Commercial Lease Agreement is essential for small business loan applications when financing requires proof of physical business premises, detailing the lease terms, rent obligations, and property use authorization. Lenders assess this document to evaluate the borrower's stability, operational costs, and the viability of the business location as collateral security. |

| 20 | Business Insurance Documentation | Business insurance documentation is essential for a small business loan application, serving as proof of risk management and financial responsibility. Lenders typically require certificates of insurance for general liability, property, and workers' compensation policies to ensure the business is protected against potential losses. |

Introduction to Essential Loan Documents for Small Businesses

Applying for a small business loan requires submitting specific documents to verify your business's financial health and credibility. These essential loan documents include financial statements, tax returns, and a detailed business plan. Preparing these materials thoroughly increases your chances of securing the necessary funding.

Business Plan and Financial Projections

A comprehensive business plan is essential for a small business loan application as it outlines the company's goals, market analysis, and operational strategy. Clear financial projections demonstrate the business's ability to generate revenue and repay the loan.

The business plan should include detailed descriptions of the product or service, target market, and competitive landscape. Financial projections must cover income statements, cash flow forecasts, and balance sheets for at least three to five years. Lenders rely on these documents to assess risk and the potential for business growth, making them critical components of the loan application process.

Personal and Business Tax Returns

Securing a small business loan requires thorough documentation to verify financial stability. Personal and business tax returns are crucial components of this process.

- Personal Tax Returns - Lenders use your personal tax returns to evaluate your individual financial background and creditworthiness.

- Business Tax Returns - These documents provide a detailed view of your business's income, expenses, and overall financial performance.

- Consistency Verification - Comparing personal and business tax returns helps lenders ensure the accuracy of reported earnings and financial health.

Business Bank Statements

Business bank statements are essential documents for a small business loan application. They provide lenders with a clear picture of cash flow, revenue consistency, and financial stability.

These statements typically cover the last three to six months of transactions. Providing accurate and up-to-date bank statements strengthens your loan application by demonstrating financial responsibility.

Income Statements and Balance Sheets

Income statements are vital documents for small business loan applications, showcasing your business's revenue, expenses, and profitability over a specific period. Lenders use balance sheets to evaluate your company's financial position by detailing assets, liabilities, and equity at a specific point in time. Providing accurate and up-to-date income statements and balance sheets helps demonstrate financial stability and increases the likelihood of loan approval.

Legal Business Registration and Licenses

Legal business registration and appropriate licenses are crucial documents for a small business loan application. These validate your business's legitimacy and compliance with regulatory requirements.

- Business registration certificate - This verifies your company's legal formation with the state or local government.

- Employer Identification Number (EIN) - Issued by the IRS, this identifies your business for tax purposes.

- Operational licenses and permits - Required based on industry and location, these confirm your business is authorized to operate.

Providing these documents establishes your business's credibility, increasing your chances of loan approval.

Personal and Business Credit Reports

Personal and business credit reports are essential documents in a small business loan application. Lenders use these reports to evaluate the creditworthiness and financial history of both the business owner and the company.

The personal credit report reflects the individual's ability to manage debt, while the business credit report provides insight into the company's payment history and financial stability. Accurate and updated credit reports increase the chances of securing favorable loan terms.

Articles of Incorporation or Organization

Articles of Incorporation or Organization are essential documents required during a small business loan application. These documents prove the legal formation and structure of the business to lenders.

- Proof of Legal Entity - Articles of Incorporation or Organization verify the business is officially registered as a corporation or LLC.

- Ownership and Structure Details - These documents outline business ownership, management, and organizational framework, which lenders review for risk assessment.

- Compliance with State Regulations - Providing these articles confirms the business complies with state registration requirements, a critical factor for loan eligibility.

Debt Schedule and Existing Loan Agreements

| Document | Description | Importance for Loan Application |

|---|---|---|

| Debt Schedule | A detailed list of all current debts, including creditors, balances, interest rates, and payment terms. | Shows lenders your existing financial obligations and helps evaluate your repayment capacity. |

| Existing Loan Agreements | Contracts from previous loans outlining terms, conditions, and repayment schedules. | Confirms your current loan commitments and any potential liabilities affecting new loan approval. |

Providing a comprehensive debt schedule and copies of existing loan agreements strengthens your small business loan application by demonstrating transparency and financial responsibility.

What Documents Are Needed for Small Business Loan Application? Infographic