To claim a tax deduction for charitable donations, you must provide a receipt or written acknowledgment from the qualified charitable organization, detailing the donation amount and date. For donations exceeding $250, the IRS requires a formal acknowledgment letter that specifies whether any goods or services were received in return. Maintaining bank statements, canceled checks, or credit card statements also supports your claim and ensures compliance with tax regulations.

What Documents Are Required for Claiming a Tax Deduction for Charitable Donations?

| Number | Name | Description |

|---|---|---|

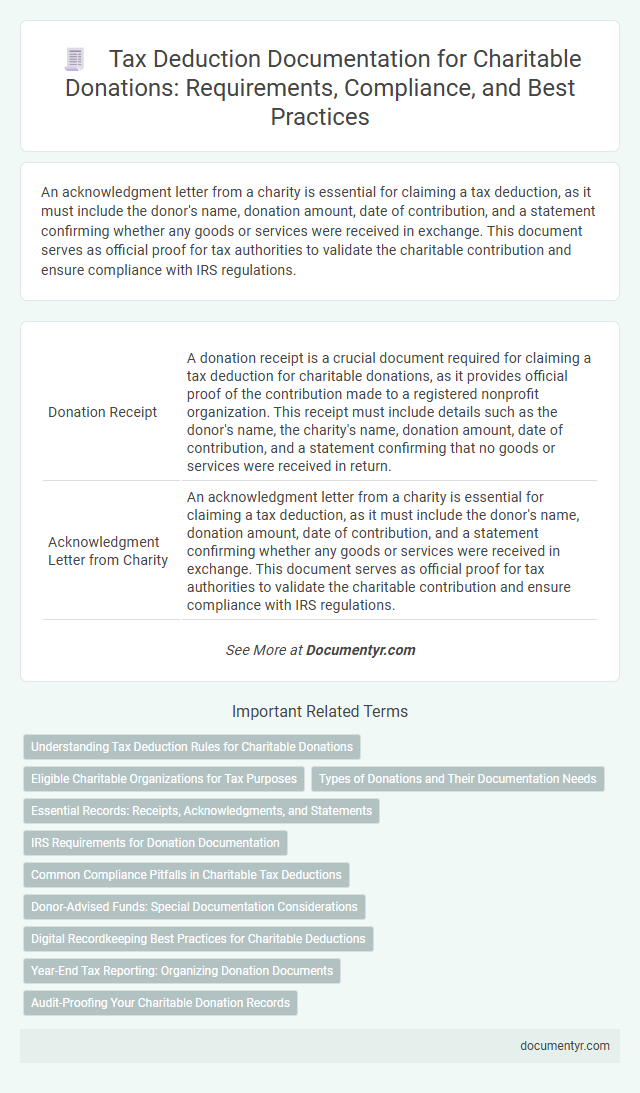

| 1 | Donation Receipt | A donation receipt is a crucial document required for claiming a tax deduction for charitable donations, as it provides official proof of the contribution made to a registered nonprofit organization. This receipt must include details such as the donor's name, the charity's name, donation amount, date of contribution, and a statement confirming that no goods or services were received in return. |

| 2 | Acknowledgment Letter from Charity | An acknowledgment letter from a charity is essential for claiming a tax deduction, as it must include the donor's name, donation amount, date of contribution, and a statement confirming whether any goods or services were received in exchange. This document serves as official proof for tax authorities to validate the charitable contribution and ensure compliance with IRS regulations. |

| 3 | Bank Statement | A bank statement is essential for claiming a tax deduction for charitable donations as it provides proof of payment and transaction details, corroborating the donation amount and date. Tax authorities often require this document alongside official donation receipts to validate and process the deduction accurately. |

| 4 | Canceled Check | A canceled check serves as critical proof of charitable donations, clearly documenting the amount paid and the recipient organization, which is essential for claiming tax deductions. The IRS requires such substantiation to verify that donations were actually made and to the correct qualified charity, ensuring compliance with tax deduction rules. |

| 5 | Payroll Deduction Records | Payroll deduction records must include detailed proof of donations withheld directly from an employee's salary, showing the amount, date, and recipient charity to qualify for tax deductions. These records are essential for verifying contributions when filing returns and ensuring compliance with tax authorities. |

| 6 | Written Communication from Charity (e.g., email confirmation) | To claim a tax deduction for charitable donations, written communication from the charity, such as email confirmations or official receipts, is essential as it verifies the donation amount and date. This documentation must clearly state the charity's name, donation value, and acknowledgment of non-receipt of goods or services to comply with IRS requirements. |

| 7 | IRS Form 1098-C (for vehicle donations) | IRS Form 1098-C is a critical document required for claiming tax deductions on vehicle donations to qualified charitable organizations, providing details such as the vehicle description, fair market value, and donation date. Accurate submission of Form 1098-C alongside the IRS Schedule A ensures compliance and eligibility for tax benefits related to vehicle contributions. |

| 8 | IRS Form 8283 (Noncash contributions over $500) | To claim a tax deduction for charitable donations exceeding $500 in noncash contributions, taxpayers must complete IRS Form 8283, which requires detailed descriptions, fair market values, and signatures from both the donor and the charity. Proper documentation including receipts, appraisals for items valued over $5,000, and the completed Form 8283 ensures compliance with IRS regulations and maximizes deduction eligibility. |

| 9 | Qualified Appraisal (for noncash donations over $5,000) | A Qualified Appraisal is mandatory for noncash charitable donations exceeding $5,000 to substantiate the fair market value claimed for tax deduction purposes, prepared by a qualified, certified appraiser. This document must include a detailed description of the donated property, the valuation method used, and the appraiser's signature to comply with IRS requirements and avoid disallowance of the deduction. |

| 10 | Fair Market Value Documentation | Fair market value documentation for charitable donations includes official receipts from the charity stating the donation amount and date, along with a qualified appraisal for non-cash contributions exceeding $5,000. IRS Form 8283 must be filed for non-cash donations over $500, supported by detailed descriptions and valuation evidence to substantiate the claimed deduction. |

| 11 | Itemized List of Donated Property | An itemized list of donated property is required to claim a tax deduction for charitable donations, detailing each item's description, condition, and appraised value. IRS Form 8283 must be completed for non-cash donations exceeding $500, and donors should retain receipts or written acknowledgments from the charity. |

| 12 | Proof of Donation Delivery/Transfer | To claim a tax deduction for charitable donations, proof of donation delivery or transfer is essential, typically including official receipts from the charity that detail the donor's name, donation amount, and date. Electronic bank statements, cancelled checks, or credit card statements also serve as valid evidence to substantiate the transfer of funds to the charitable organization. |

| 13 | Credit Card Statement | A credit card statement must clearly show the date, amount, and recipient of the charitable donation to qualify as valid documentation for a tax deduction. The statement should be retained along with the official receipt from the charity to ensure full compliance with IRS requirements. |

| 14 | Financial Institution Transaction Record | Claiming a tax deduction for charitable donations requires a financial institution transaction record such as bank statements or credit card receipts that clearly show the date, amount, and recipient organization. This proof ensures compliance with IRS regulations by verifying the donation's legitimacy and supporting accurate tax reporting. |

| 15 | Copy of Charity’s IRS Tax-Exempt Status | A copy of the charity's IRS tax-exempt status, typically provided as a 501(c)(3) determination letter, is essential for substantiating tax deductions on charitable donations. This document confirms the organization qualifies as a tax-exempt entity under IRS rules, ensuring donors can claim the deduction legitimately on their tax returns. |

Understanding Tax Deduction Rules for Charitable Donations

Claiming a tax deduction for charitable donations requires specific documentation to ensure compliance with tax authorities. Proper understanding of these rules helps taxpayers maximize their eligible deductions.

- Receipts from Charitable Organizations - Official receipts must include the donor's name, donation amount, date, and the organization's registration number to validate the deduction.

- Proof of Non-Cash Donations - Appraisals or valuation documents are required for donations of property, assets, or goods to establish fair market value.

- Tax Form Documentation - Accurate completion of tax forms such as Schedule A or local equivalents is essential to report charitable contributions correctly.

Eligible Charitable Organizations for Tax Purposes

| Document Type | Description | Purpose |

|---|---|---|

| Receipt from Eligible Charitable Organization | Official donation receipt issued by a registered charity recognized by the tax authorities. | Proof of donation amount and confirmation that the organization qualifies for tax deductions. |

| Tax Identification Number of Charity | Unique identifier assigned to the charitable organization by the tax authority. | Verifies the charity's eligibility status for tax deduction claims. |

| Bank Statement or Credit Card Statement | Statement showing the transaction details of the donation payment. | Supports proof of payment to the eligible charitable organization. |

| Written Acknowledgment | Letter or email from the charitable organization confirming donation receipt. | Required if no official receipt is provided but donation eligibility must be proven. |

| Charity Registration Certificate (Optional) | Certificate demonstrating the organization's official registration with the relevant tax department. | Assists in verifying the organization's valid status as an eligible charitable entity. |

Types of Donations and Their Documentation Needs

Claiming a tax deduction for charitable donations requires specific documentation based on the type of donation made. Understanding the necessary paperwork ensures your contributions are properly recognized by tax authorities.

- Cash Donations - A bank statement, canceled check, or receipt from the charity is required to validate monetary contributions.

- Non-Cash Donations - Detailed receipts describing the donated items and their fair market value must be provided, especially for property or goods.

- Large Donations Over $500 - An appraisal and Form 8283 are needed to substantiate the value of high-value property donations for tax deduction claims.

Essential Records: Receipts, Acknowledgments, and Statements

Claiming a tax deduction for charitable donations requires specific documents to verify your contributions. These essential records include receipts, acknowledgments, and statements from the charitable organizations.

- Receipts - Provide proof of your monetary or property donation along with the date and amount.

- Acknowledgments - Written confirmations from the charity that verify the donation and its tax-deductible status.

- Statements - Year-end summaries detailing all contributions made throughout the tax year for accurate record-keeping.

Maintaining these documents is crucial for substantiating charitable deductions during tax filing.

IRS Requirements for Donation Documentation

The IRS requires specific documentation to claim a tax deduction for charitable donations. Proper records ensure compliance and maximize eligible deductions.

For donations under $250, a bank record or a written communication from the charity suffices. Contributions of $250 or more need a written acknowledgment from the organization detailing the donation amount and whether any goods or services were received.

Common Compliance Pitfalls in Charitable Tax Deductions

To claim a tax deduction for charitable donations, you need official receipts from the registered charity, proof of payment, and detailed records of non-cash donations. Common compliance pitfalls include missing documentation, incorrect valuation of donated items, and failure to ensure the charity's tax-exempt status. You must maintain thorough and accurate records to avoid disallowed deductions and potential audits.

Donor-Advised Funds: Special Documentation Considerations

When claiming a tax deduction for charitable donations through Donor-Advised Funds (DAFs), you must obtain a contemporaneous written acknowledgment from the fund. This documentation should include the name of the DAF, the donation amount, and a statement confirming no goods or services were received in exchange. You should also retain records of the fund's distribution to the qualified charity to satisfy IRS requirements.

Digital Recordkeeping Best Practices for Charitable Deductions

Proper documentation is essential for claiming a tax deduction for charitable donations, including receipts or acknowledgment letters from qualified organizations. Digital recordkeeping enhances accuracy and ensures all necessary information is securely stored.

Maintain clear digital copies of donation receipts that include the organization's name, donation date, and amount. Use reliable software or cloud services designed for financial records to organize and back up your documents. Consistently update your digital files after each donation to facilitate smooth tax filing and audits.

Year-End Tax Reporting: Organizing Donation Documents

Organizing donation documents is essential for year-end tax reporting to ensure accurate claim of charitable deductions. Proper records include receipts, acknowledgment letters, and proof of payments from qualified charitable organizations.

You must retain these documents to support your tax deduction claims and comply with IRS regulations. Keeping a well-organized folder simplifies the process of verifying your contributions during tax filing.

What Documents Are Required for Claiming a Tax Deduction for Charitable Donations? Infographic