To open a stock brokerage account, you typically need a valid government-issued ID such as a passport or driver's license, proof of address like a utility bill or bank statement, and your Social Security number or tax identification number for tax reporting purposes. Some brokers may also require employment details and financial information to assess suitability and comply with regulatory requirements. Ensuring all documents are up-to-date and accurate can streamline the account opening process and avoid delays.

What Documents Are Needed for Stock Brokerage Account Opening?

| Number | Name | Description |

|---|---|---|

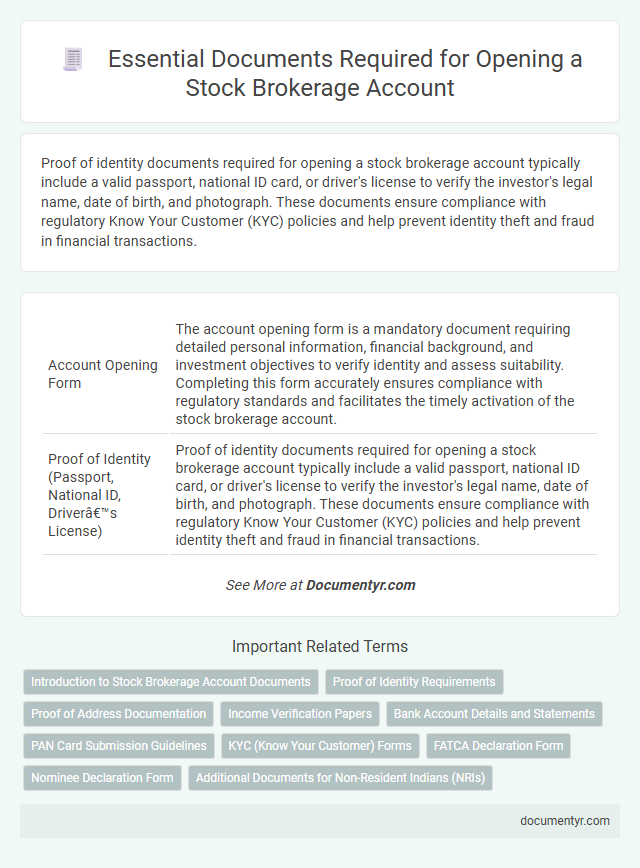

| 1 | Account Opening Form | The account opening form is a mandatory document requiring detailed personal information, financial background, and investment objectives to verify identity and assess suitability. Completing this form accurately ensures compliance with regulatory standards and facilitates the timely activation of the stock brokerage account. |

| 2 | Proof of Identity (Passport, National ID, Driver’s License) | Proof of identity documents required for opening a stock brokerage account typically include a valid passport, national ID card, or driver's license to verify the investor's legal name, date of birth, and photograph. These documents ensure compliance with regulatory Know Your Customer (KYC) policies and help prevent identity theft and fraud in financial transactions. |

| 3 | Proof of Address (Utility Bill, Bank Statement, Lease Agreement) | Proof of address is a mandatory document when opening a stock brokerage account, typically accepted forms include recent utility bills, bank statements, or lease agreements dated within the last three months. These documents verify the investor's residential address and help fulfill regulatory compliance and anti-fraud measures in stock trading platforms. |

| 4 | PAN Card (Permanent Account Number, applicable in India) | A PAN Card (Permanent Account Number) is a mandatory document for opening a stock brokerage account in India, serving as a primary proof of identity and financial traceability for tax purposes. It enables brokerage firms to comply with government regulations, facilitating seamless trading and investment activities by linking transactions to the investor's unique tax identity. |

| 5 | Tax Identification Number (TIN, as needed by jurisdiction) | A Tax Identification Number (TIN) is a crucial document for opening a stock brokerage account, as it verifies your identity for tax reporting purposes and compliance with local regulations. Brokerage firms require the TIN to accurately report capital gains, dividends, and other taxable events to tax authorities according to jurisdiction-specific laws. |

| 6 | Bank Account Proof (Cancelled Cheque, Bank Statement) | Bank account proof, such as a cancelled cheque or a recent bank statement, is essential for verifying your financial identity and facilitating smooth fund transfers when opening a stock brokerage account. These documents confirm your bank details, enabling secure linking of your trading account to your savings or current account for seamless transactions. |

| 7 | Income Proof (Salary Slip, Income Tax Return, Employer Certificate) | Income proof is essential for opening a stock brokerage account, typically requiring recent salary slips, Income Tax Return (ITR) documents, or an employer certificate to verify financial stability and source of funds. These documents help brokers assess the investor's creditworthiness and comply with regulatory Know Your Customer (KYC) guidelines. |

| 8 | KYC (Know Your Customer) Form | The KYC (Know Your Customer) form is a mandatory document required for stock brokerage account opening to verify the investor's identity and prevent fraudulent activities. It typically includes personal identification details, proof of address, and financial information, ensuring compliance with regulatory standards set by financial authorities. |

| 9 | FATCA Declaration (Foreign Account Tax Compliance Act) | Stock brokerage account opening requires submission of identity proof, address proof, and a completed FATCA Declaration form to comply with the Foreign Account Tax Compliance Act, ensuring reporting of foreign financial assets and preventing tax evasion. The FATCA Declaration includes details about U.S. citizenship or residency and accounts held outside the U.S., which brokers use to report to the IRS as mandated by international tax regulations. |

| 10 | Nominee Declaration Form | The Nominee Declaration Form is essential for appointing a beneficiary who will receive the securities in the event of the account holder's demise, ensuring smooth transfer without legal complications. This document typically requires identification details of both the account holder and the nominee, making it a critical part of the stock brokerage account opening process. |

| 11 | Photographs (Passport-sized Photos) | Passport-sized photographs are essential for opening a stock brokerage account as they serve as a primary means of identity verification, ensuring compliance with regulatory requirements. Typically, two to three recent passport-style photos with a white background, clear facial features, and no accessories are required to complete the application process efficiently. |

| 12 | Signature Specimen | A signature specimen is a crucial document required for stock brokerage account opening to verify the investor's identity and authenticate transactions. This signed sample ensures protection against forgery and facilitates compliance with regulatory norms in the financial sector. |

| 13 | Trading Agreement/Client Agreement | A Trading Agreement or Client Agreement is essential for stock brokerage account opening as it legally outlines the terms and conditions, rights, and obligations between the investor and brokerage firm. This document typically requires the investor's signature, identity verification, and agreement to comply with brokerage policies and regulatory requirements. |

| 14 | Risk Disclosure Document | The Risk Disclosure Document is essential for stock brokerage account opening as it outlines potential investment risks and compliance requirements mandated by regulatory authorities such as the SEC or FINRA. Investors must review and sign this document to acknowledge their understanding of market volatility, margin risks, and the brokerage's liability limitations before trading can commence. |

| 15 | Power of Attorney (if applicable) | A Power of Attorney document is required for stock brokerage account openings when an individual authorizes another person to manage their investments on their behalf, ensuring legal authority for trading and decision-making. This document must be notarized and submitted alongside identity proofs, KYC forms, and address verification to comply with regulatory standards. |

| 16 | Demat Account Opening Form | The Demat Account Opening Form is a critical document required for opening a stock brokerage account, capturing essential personal details, KYC (Know Your Customer) information, and nominee details. This form must be submitted along with identity proof (such as PAN card), address proof, and a cancelled cheque to facilitate seamless dematerialization and trading of shares. |

| 17 | CRS Form (Common Reporting Standard, if required) | A CRS Form (Common Reporting Standard) is required for stock brokerage account opening to comply with international tax regulations aimed at preventing tax evasion through financial accounts. This form collects information about the account holder's tax residency and is essential for brokerage firms to report financial data to relevant tax authorities under the global CRS framework. |

| 18 | Professional Status Declaration (Occupation Details) | To open a stock brokerage account, submission of a Professional Status Declaration detailing occupation, employer name, designation, and annual income is essential for regulatory compliance and risk assessment. This documentation helps brokers evaluate investor suitability and adhere to Know Your Customer (KYC) guidelines mandated by financial authorities. |

| 19 | Investor Profile Questionnaire | The Investor Profile Questionnaire is a critical document for stock brokerage account opening, capturing essential details about an investor's financial status, investment objectives, risk tolerance, and trading experience to ensure compliance and appropriate investment recommendations. Regulatory requirements demand accurate completion of this questionnaire to tailor brokerage services and safeguard both the investor and the firm from unsuitable investment risks. |

| 20 | Consent for Electronic Communication | Consent for electronic communication is essential when opening a stock brokerage account to ensure regulatory compliance and receive important disclosures, account statements, and trade confirmations digitally. Investors must provide explicit consent through a signed agreement or digital acknowledgment, allowing the broker to send communications via email or secured online portals. |

Introduction to Stock Brokerage Account Documents

Opening a stock brokerage account requires submitting specific documents to verify identity and financial status. These documents ensure compliance with regulatory standards and facilitate smooth account setup.

- Proof of Identity - Valid government-issued ID such as a passport or driver's license to confirm your identity.

- Proof of Address - Recent utility bill or bank statement showing your current residential address.

- Financial Information - Details on income, employment, or net worth to assess suitability for trading and investment.

Proof of Identity Requirements

| Proof of Identity Requirements for Stock Brokerage Account Opening | |

|---|---|

| Government-Issued Photo ID | Valid passport, driver's license, or state ID card serves as primary identification to verify your identity. |

| Social Security Number (SSN) or Tax Identification Number (TIN) | Required for tax reporting purposes and matching your identity with government records. |

| Proof of Address | Recent utility bill, bank statement, or lease agreement with your name and address confirms residency. |

| Additional Identification | Secondary documents may include a birth certificate or a utility bill if further verification is necessary. |

| Compliance with KYC Regulations | These identity proofs ensure adherence to Know Your Customer rules to prevent fraud and money laundering. |

Proof of Address Documentation

Proof of address documents are essential for opening a stock brokerage account to verify your residential details. These documents ensure compliance with regulatory requirements and prevent identity fraud.

- Utility Bills - Recent utility bills such as electricity, water, or gas statements serve as valid proof of address.

- Bank Statements - Official bank statements showing your name and residential address are commonly accepted.

- Government-Issued Documents - Documents like tax assessments, voter ID cards, or rental agreements may also be used to verify your address.

Submitting accurate proof of address documents speeds up the account approval process and establishes your credibility with the brokerage firm.

Income Verification Papers

Income verification papers are essential when opening a stock brokerage account. Common documents include recent pay stubs, tax returns, and bank statements that demonstrate a steady source of income. Providing these ensures your financial capacity is accurately assessed for investment purposes.

Bank Account Details and Statements

Bank account details are essential when opening a stock brokerage account to facilitate seamless fund transfers. Providing accurate account numbers and bank branch information ensures smooth transactions between your brokerage and bank.

Bank statements serve as proof of financial stability and help verify your identity and income sources. Most brokerages require recent statements, typically from the last three months. Ensuring these documents are up-to-date accelerates the account approval process.

PAN Card Submission Guidelines

Opening a stock brokerage account requires submitting key documents, with the PAN card being mandatory for identity verification. The PAN card uniquely identifies investors and ensures compliance with financial regulations.

The PAN card must be submitted in a clear, readable format, either as a scanned copy or a physical document during account opening. Brokerage firms verify PAN details to prevent fraudulent activity and link all transactions to the investor's profile.

KYC (Know Your Customer) Forms

What documents are required to open a stock brokerage account? KYC (Know Your Customer) forms are essential to verify the identity and address of the investor. These typically include government-issued photo ID, proof of address, and financial details.

FATCA Declaration Form

Opening a stock brokerage account requires submitting several essential documents to comply with regulatory standards. One critical document is the FATCA Declaration Form, which helps financial institutions meet international tax compliance requirements.

- Identity Proof - A government-issued ID such as a passport or driver's license to verify your identity.

- Address Proof - Utility bills or bank statements confirming your residential address.

- FATCA Declaration Form - A form declaring your tax residency status to ensure adherence to the Foreign Account Tax Compliance Act regulations.

Nominee Declaration Form

Opening a stock brokerage account requires submitting several key documents, including identity proof, address proof, and PAN card. Among these, the Nominee Declaration Form is crucial for assigning a beneficiary to your account.

The Nominee Declaration Form ensures smooth transfer of securities and funds in case of the account holder's demise. It provides legal clarity and protection for the investor's assets within the brokerage account.

What Documents Are Needed for Stock Brokerage Account Opening? Infographic