Lenders require several key documents to approve an auto loan, including proof of income such as pay stubs or tax returns to verify your ability to repay the loan. A valid government-issued ID and proof of residence are essential to confirm your identity and address. Additionally, lenders may request vehicle information like the title, purchase agreement, and insurance details to ensure the car meets loan criteria.

What Documents Are Necessary for Auto Loan Approval?

| Number | Name | Description |

|---|---|---|

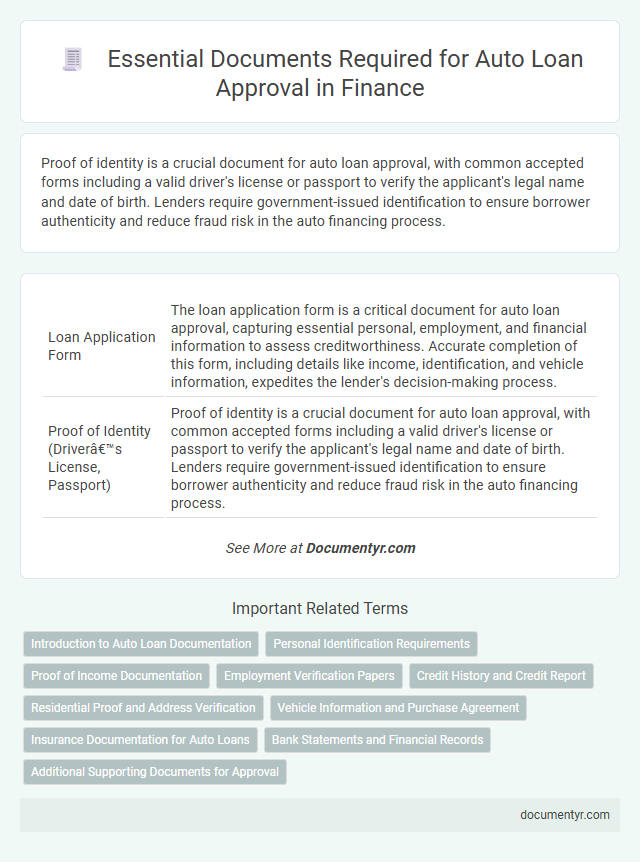

| 1 | Loan Application Form | The loan application form is a critical document for auto loan approval, capturing essential personal, employment, and financial information to assess creditworthiness. Accurate completion of this form, including details like income, identification, and vehicle information, expedites the lender's decision-making process. |

| 2 | Proof of Identity (Driver’s License, Passport) | Proof of identity is a crucial document for auto loan approval, with common accepted forms including a valid driver's license or passport to verify the applicant's legal name and date of birth. Lenders require government-issued identification to ensure borrower authenticity and reduce fraud risk in the auto financing process. |

| 3 | Proof of Address (Utility Bill, Lease Agreement) | Proof of address is essential for auto loan approval and can be demonstrated through documents such as a recent utility bill or a valid lease agreement, which confirm the borrower's current residence. Lenders require these documents to verify identity and assess creditworthiness, ensuring the applicant meets regional lending criteria. |

| 4 | Proof of Income (Pay Stubs, Bank Statements, Tax Returns) | Proof of income is crucial for auto loan approval, commonly verified through recent pay stubs, bank statements, or tax returns, which demonstrate the borrower's ability to repay the loan. Lenders typically require at least two to three months of pay stubs or bank statements and the most recent tax returns to assess consistent income and financial stability. |

| 5 | Employment Verification Letter | An employment verification letter is crucial for auto loan approval as it confirms the borrower's current job status, income stability, and length of employment, which helps lenders assess creditworthiness. This document typically includes the employer's contact information, job title, salary details, and employment start date, providing essential validation of financial reliability. |

| 6 | Credit Report | A detailed credit report is essential for auto loan approval as it provides lenders with a comprehensive history of your creditworthiness, including payment history, outstanding debts, and credit inquiries. Lenders use this report to assess risk and determine loan terms, making an accurate and up-to-date credit report crucial for successful financing. |

| 7 | Vehicle Information (Purchase Agreement, Bill of Sale, VIN) | Vehicle information plays a crucial role in auto loan approval, requiring key documents such as the purchase agreement, bill of sale, and vehicle identification number (VIN) details. These documents verify the car's ownership, price, and legal status, enabling lenders to assess loan eligibility accurately. |

| 8 | Proof of Insurance | Proof of insurance is a critical document required for auto loan approval, demonstrating the borrower's ability to cover potential damages and financial liabilities. Lenders mandate this to mitigate risk, ensuring the vehicle is protected throughout the loan term. |

| 9 | Proof of Down Payment (Bank Statement, Receipts) | Proof of down payment is crucial for auto loan approval and can be demonstrated through recent bank statements or official payment receipts showing the transfer or withdrawal of funds. Lenders require these documents to verify the applicant's financial contribution and assess their creditworthiness for the loan. |

| 10 | Social Security Number (SSN Document/Card) | Lenders require a valid Social Security Number (SSN) document or card to verify the borrower's identity and credit history during auto loan approval. The SSN helps financial institutions access credit reports and assess the applicant's creditworthiness accurately. |

| 11 | References (Personal or Professional) | Auto loan approval requires providing personal or professional references to verify creditworthiness and reliability; these references typically include names, contact information, and relationships to the applicant. Lenders use this information to assess the applicant's trustworthiness and ability to repay the loan, making accurate and reliable references crucial for successful auto loan processing. |

| 12 | Trade-In Documentation (if applicable) | Trade-in documentation essential for auto loan approval includes the vehicle title, current registration, and a signed bill of sale, along with any payoff information if the trade-in vehicle has an existing loan. Providing a recent vehicle appraisal or trade-in value estimate helps lenders accurately assess the trade-in's contribution toward the new loan amount. |

| 13 | Residency Status Documents (Green Card, Visa) | Lenders require residency status documents such as a Green Card or valid Visa to verify legal residency and assess eligibility for auto loan approval. Providing proof of residency ensures compliance with lender policies and facilitates seamless verification of the applicant's identity and legal status. |

| 14 | Signed Disclosures and Consent Forms | Signed disclosures and consent forms are essential documents for auto loan approval, ensuring borrowers acknowledge credit checks, loan terms, and data privacy policies. These legally binding forms protect lenders by verifying borrower consent and confirming understanding of loan obligations and fees. |

Introduction to Auto Loan Documentation

Auto loan approval requires specific documentation to verify a borrower's identity, financial stability, and creditworthiness. Proper preparation of these documents streamlines the loan process and increases the chances of approval.

- Proof of Identity - Valid government-issued ID such as a driver's license or passport confirms the borrower's identity.

- Proof of Income - Recent pay stubs, tax returns, or bank statements demonstrate the borrower's ability to repay the loan.

- Credit Information - Credit reports or scores provide insight into the borrower's financial history and risk level.

Submitting complete and accurate documentation is essential for timely auto loan approval.

Personal Identification Requirements

Personal identification is a crucial component for auto loan approval as lenders must verify the borrower's identity to prevent fraud. Accurate and valid identification documents establish trust and ensure compliance with legal requirements during the auto loan process.

- Government-issued ID - A valid driver's license or passport confirms the borrower's identity and residency status.

- Social Security Number (SSN) - The SSN is required for credit checks and income verification to assess creditworthiness.

- Proof of Address - Recent utility bills or lease agreements verify the borrower's current residential address to validate contact information.

Proof of Income Documentation

Proof of income documentation is critical for auto loan approval as it verifies the borrower's ability to repay the loan. Lenders require accurate and current income records to assess financial stability and creditworthiness.

- Pay Stubs - Recent pay stubs show consistent earnings and employment status, serving as primary proof of income.

- Tax Returns - Tax returns provide a comprehensive income history, helping lenders verify self-employment or irregular income sources.

- Bank Statements - Bank statements confirm deposits and overall financial health, supporting income verification and loan eligibility.

Employment Verification Papers

Employment verification papers are essential documents for auto loan approval, confirming your job status and income stability. Lenders require these papers to assess your ability to repay the loan.

Common employment verification documents include recent pay stubs, employment verification letters, and tax returns. Bank statements may also support your income claims. Providing accurate and up-to-date employment information speeds up the loan approval process.

Credit History and Credit Report

Credit history plays a crucial role in auto loan approval, as it reflects your past borrowing and repayment behavior. Lenders require a detailed credit report to assess your financial reliability and risk level. This report contains information like payment history, outstanding debts, and credit inquiries essential for loan determination.

Residential Proof and Address Verification

Proof of residence is a critical document required for auto loan approval, as it confirms the applicant's current living address. Lenders typically accept utility bills, rental agreements, or bank statements as valid residential proof.

Address verification ensures the legitimacy of the residence and helps prevent fraud during the loan process. Some lenders may conduct physical verification or use digital address verification services to authenticate the provided documents.

Vehicle Information and Purchase Agreement

What vehicle information is required for auto loan approval? Lenders need detailed data about the car, including make, model, year, and VIN. This information verifies the collateral value and ensures the loan matches the vehicle's specifics.

Why is a purchase agreement essential for approving an auto loan? The purchase agreement outlines the sale terms, price, and conditions between buyer and seller. It confirms the transaction details, helping lenders assess the loan amount and payment schedule accurately.

Insurance Documentation for Auto Loans

Insurance documentation is a critical requirement for auto loan approval, as lenders need proof that the vehicle is protected against potential damages or losses. This documentation typically includes a valid auto insurance policy that meets the lender's minimum coverage standards.

Submit a copy of the insurance policy declaration page showing comprehensive and collision coverage details. Lenders may also require the insurance provider's contact information to verify the policy's authenticity during the loan approval process.

Bank Statements and Financial Records

Bank statements play a crucial role in auto loan approval by providing lenders with a clear view of your income consistency and spending habits. Financial records, including pay stubs and tax returns, help verify your ability to repay the loan. Lenders use these documents to assess creditworthiness and determine loan terms tailored to your financial situation.

What Documents Are Necessary for Auto Loan Approval? Infographic