To apply for a home equity loan, borrowers must provide proof of income such as recent pay stubs, tax returns, and W-2 forms to verify financial stability. Lenders also require documentation of homeownership, including the current mortgage statement and property tax bills, to assess the property's equity. Additionally, identification documents like a driver's license and bank statements may be needed to complete the application process and confirm borrower credentials.

What Documents Are Needed for a Home Equity Loan Application?

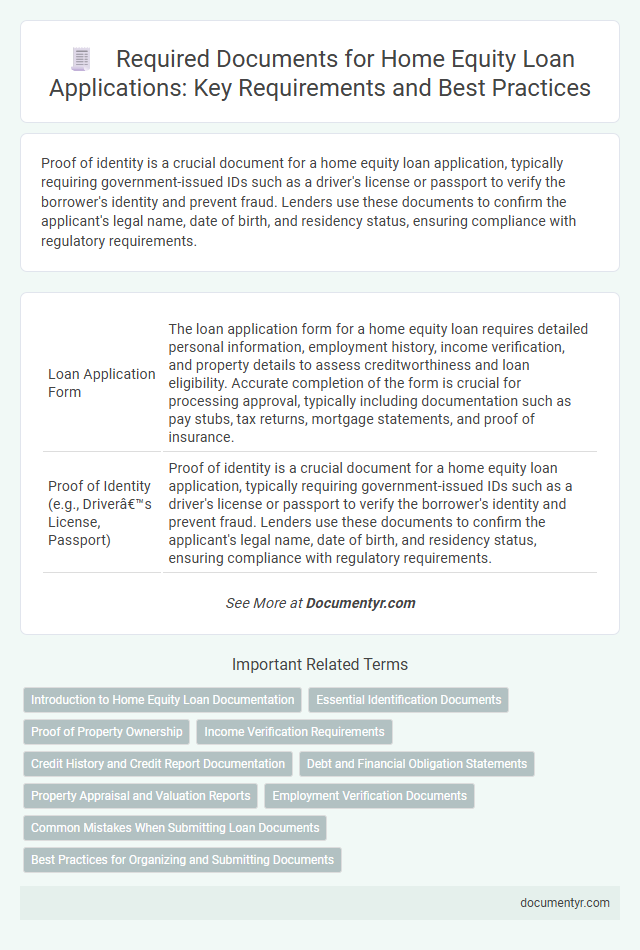

| Number | Name | Description |

|---|---|---|

| 1 | Loan Application Form | The loan application form for a home equity loan requires detailed personal information, employment history, income verification, and property details to assess creditworthiness and loan eligibility. Accurate completion of the form is crucial for processing approval, typically including documentation such as pay stubs, tax returns, mortgage statements, and proof of insurance. |

| 2 | Proof of Identity (e.g., Driver’s License, Passport) | Proof of identity is a crucial document for a home equity loan application, typically requiring government-issued IDs such as a driver's license or passport to verify the borrower's identity and prevent fraud. Lenders use these documents to confirm the applicant's legal name, date of birth, and residency status, ensuring compliance with regulatory requirements. |

| 3 | Proof of Social Security Number | Proof of Social Security Number is a critical document for a home equity loan application, typically verified through a Social Security card, W-2 forms, or a tax return. Lenders require this information to confirm identity, assess creditworthiness, and comply with federal regulations such as the USA PATRIOT Act. |

| 4 | Proof of Income (Recent Pay Stubs) | Recent pay stubs serve as critical proof of income when applying for a home equity loan, demonstrating current earnings to lenders. Providing multiple pay stubs, typically covering the last 30 days, helps establish consistent income and improves approval chances. |

| 5 | W-2 Forms | W-2 forms are essential for a home equity loan application as they verify consistent income and employment history, which lenders use to assess borrower reliability. Submitting W-2 forms from the past two years helps establish financial stability required to secure favorable loan terms. |

| 6 | Recent Tax Returns | Recent tax returns, typically from the past two years, are essential documents for a home equity loan application as they provide lenders with verified income information and financial stability. These returns help assess your repayment ability by detailing earnings, deductions, and any additional sources of income. |

| 7 | Bank Statements | Bank statements are essential documents for a home equity loan application, providing lenders with a clear view of your income, expenses, and financial stability over time. These statements typically need to cover the last two to three months, demonstrating consistent cash flow and the ability to manage debt responsibly. |

| 8 | Mortgage Statement | A current mortgage statement is essential for a home equity loan application as it provides proof of the existing loan balance and monthly payment history. This document allows lenders to assess the borrower's equity and estimate the available credit for the loan. |

| 9 | Property Deed | The property deed is a crucial document for a home equity loan application, proving legal ownership and ensuring the lender's claim on the property. This deed must be current and free of liens, confirming that the borrower holds clear title to the home used as collateral. |

| 10 | Homeowners Insurance Policy | A current homeowners insurance policy is required for a home equity loan application to verify the property's protection against damages that could affect its value. Lenders use this document to ensure the collateral is adequately insured throughout the loan term, reducing their financial risk. |

| 11 | Property Tax Statements | Property tax statements are essential documents for a home equity loan application, verifying the property's tax status and ensuring there are no outstanding liabilities. Lenders use these statements to assess the borrower's financial responsibilities and the property's value stability. |

| 12 | Credit Report Authorization | A credit report authorization form is essential for a home equity loan application, granting lenders permission to access your credit history and assess your creditworthiness. This document allows accurate evaluation of your financial stability, helping determine loan eligibility and terms. |

| 13 | Debt Information (List of Liabilities) | A comprehensive list of liabilities including credit card balances, auto loans, student loans, and outstanding mortgages is essential for a home equity loan application. Detailed documentation such as recent statements or payoff amounts helps lenders assess overall debt-to-income ratios and financial stability. |

| 14 | Appraisal Report (may be requested) | An appraisal report may be requested during a home equity loan application to determine the current market value of the property, providing the lender with a reliable basis for loan approval and amount. This document is crucial for verifying that the home's equity sufficiently covers the loan amount, reducing the lender's risk. |

| 15 | Employment Verification Letter | An Employment Verification Letter is a crucial document for a home equity loan application, confirming the borrower's current job status, salary, and length of employment to assess income stability and repayment ability. Lenders rely on this letter to verify consistent employment, which directly impacts loan approval and terms. |

Introduction to Home Equity Loan Documentation

Applying for a home equity loan requires specific documentation to verify your financial status and property details. Proper preparation of these documents can streamline the approval process and ensure accuracy.

- Proof of Income - Pay stubs, tax returns, or W-2 forms demonstrate your ability to repay the loan.

- Property Documentation - Recent mortgage statements and property tax bills establish ownership and equity value.

- Credit Information - Credit reports and scores help lenders assess your creditworthiness and loan risk.

Essential Identification Documents

When applying for a home equity loan, providing essential identification documents is crucial to verify your identity. Lenders typically require a valid government-issued ID such as a driver's license or passport.

Proof of Social Security number, often through a social security card or tax document, is also necessary for the application process. These identification documents help prevent fraud and ensure compliance with lending regulations.

Proof of Property Ownership

| Document | Purpose | Details |

|---|---|---|

| Proof of Property Ownership | Verifies legal ownership of the property used as loan collateral | Title deed or property deed showing your name as the owner. Mortgage statements or property tax receipts may also be requested to confirm ownership status. |

| Property Appraisal Report | Determines current market value of the property | Professional appraisal document evaluating property value affects loan amount eligibility. |

| Identification Documents | Confirms borrower's identity | Government-issued photo ID such as a driver's license or passport. |

| Income Verification | Assesses borrower's repayment ability | Recent pay stubs, W-2 forms, or tax returns. |

Income Verification Requirements

Income verification is a critical component when applying for a home equity loan. Lenders require specific documents to assess your financial stability and repayment ability.

- Pay stubs - Recent pay stubs provide proof of your current earnings.

- Tax returns - Copies of your last two years' tax returns help verify overall income and consistency.

- Bank statements - Bank statements demonstrate additional income sources and cash flow.

Providing accurate and complete income documentation increases the likelihood of loan approval.

Credit History and Credit Report Documentation

When applying for a home equity loan, lenders require detailed credit history documentation to assess the applicant's financial reliability. A comprehensive credit report provides insights into past borrowing behavior and current debt levels.

The credit report must include information from major credit bureaus such as Experian, Equifax, and TransUnion. This report highlights payment history, outstanding balances, and any delinquencies. Accurate credit documentation helps lenders determine loan eligibility and interest rates.

Debt and Financial Obligation Statements

When applying for a home equity loan, lenders require detailed debt and financial obligation statements to assess your repayment capacity. These documents typically include credit card statements, auto loan balances, and any outstanding personal loans. Providing accurate and up-to-date information helps streamline the approval process and ensures a clear understanding of your financial commitments.

Property Appraisal and Valuation Reports

Property appraisal and valuation reports are critical documents required for a home equity loan application. These reports determine the current market value of the property, ensuring accurate loan amounts based on equity.

- Property Appraisal Report - A licensed appraiser evaluates the property's condition and comparables to establish its fair market value.

- Valuation Report - Provides a detailed analysis of the property's worth using market data, recent sales, and neighborhood trends.

- Loan-to-Value Ratio Assessment - Utilizes appraisal values to calculate the maximum allowable loan amount relative to the property's equity.

Employment Verification Documents

Employment verification documents are a crucial part of the home equity loan application process. These documents help lenders confirm Your current job status and income stability.

Commonly required employment verification documents include recent pay stubs, W-2 forms, and employment verification letters from Your employer. These papers demonstrate consistent earnings and job reliability, which are essential for loan approval.

Common Mistakes When Submitting Loan Documents

What documents are needed for a home equity loan application? Applicants typically need proof of income, recent tax returns, credit reports, and property-related documents. Missing or incorrect paperwork often causes delays or rejection.

What are common mistakes when submitting loan documents for a home equity loan? Failing to provide updated financial statements or incomplete property appraisals frequently results in application setbacks. Ensuring accuracy and completeness is essential for smooth processing.

What Documents Are Needed for a Home Equity Loan Application? Infographic