To apply for student loan deferment, borrowers must typically provide a completed deferment request form, proof of enrollment or qualifying status such as unemployment or economic hardship, and a written statement explaining the reason for deferment. Supporting documents may include pay stubs, medical records, or school transcripts depending on the deferment type. Submitting accurate and timely documentation helps ensure the deferment request is processed without delays.

What Documents Are Required for Student Loan Deferment?

| Number | Name | Description |

|---|---|---|

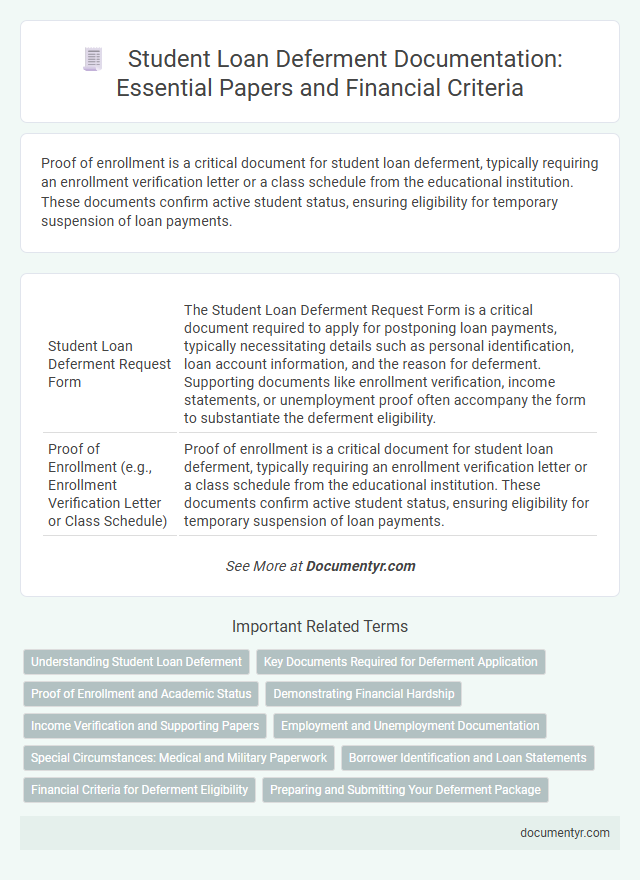

| 1 | Student Loan Deferment Request Form | The Student Loan Deferment Request Form is a critical document required to apply for postponing loan payments, typically necessitating details such as personal identification, loan account information, and the reason for deferment. Supporting documents like enrollment verification, income statements, or unemployment proof often accompany the form to substantiate the deferment eligibility. |

| 2 | Proof of Enrollment (e.g., Enrollment Verification Letter or Class Schedule) | Proof of enrollment is a critical document for student loan deferment, typically requiring an enrollment verification letter or a class schedule from the educational institution. These documents confirm active student status, ensuring eligibility for temporary suspension of loan payments. |

| 3 | Financial Hardship Documentation (if applicable) | Financial hardship documentation required for student loan deferment typically includes recent pay stubs, unemployment benefits statements, tax returns, or a letter from an employer confirming reduced hours or job loss, demonstrating an inability to make loan payments. Supporting documents such as bank statements or medical bills may also be necessary to substantiate the financial difficulties faced by the borrower. |

| 4 | Unemployment Documentation (if applicable) | Student loan deferment for unemployment typically requires official documentation such as a recent termination letter, unemployment benefits statements, or a certification of unemployment status from the state employment office. These documents confirm eligibility and must be submitted alongside the deferment request to the loan servicer. |

| 5 | Military Service Orders (if applicable) | Military service orders are essential documents required for student loan deferment to verify active duty status, enabling borrowers to temporarily postpone loan payments without penalty. Lenders typically require official enlistment papers or deployment orders to process deferment applications under military service provisions. |

| 6 | In-School Deferment Form | The In-School Deferment Form requires detailed enrollment verification from your educational institution, including your student status and expected graduation date, to qualify for postponing loan payments. Lenders may also request your most recent tuition statement or course schedule to confirm full-time enrollment and eligibility for deferment. |

| 7 | Graduate Fellowship Program Documentation (if applicable) | Graduate Fellowship Program participants seeking student loan deferment must provide official fellowship award letters, proof of enrollment or program participation, and a detailed description of the fellowship's duration and terms. Lenders often require submission of academic transcripts and certification from the program director to validate continuous student status and eligibility for deferment. |

| 8 | Rehabilitation Training Program Documentation | Student loan deferment requires submission of Rehabilitation Training Program Documentation, which typically includes official enrollment verification, progress reports, and completion certificates from an accredited rehabilitation institution. These documents confirm active participation in qualifying programs, enabling temporary suspension of loan payments under federal student loan policies. |

| 9 | Proof of Eligibility for Government Assistance (if applicable) | Proof of eligibility for government assistance during student loan deferment typically requires official documents such as a state or federal benefits award letter, unemployment compensation statements, or a notice of eligibility for public assistance programs. Providing these documents validates the deferment request and ensures compliance with lender or servicer requirements for government-supported deferment options. |

| 10 | Supporting Medical Documentation (if applying due to disability or illness) | Supporting medical documentation for student loan deferment due to disability or illness must include a detailed physician's statement specifying the nature, severity, and estimated duration of the condition that impairs the borrower's ability to work or attend school. Medical records, treatment plans, and hospital reports further validate the disability claim and must accompany the deferment application to satisfy lender or servicer requirements. |

| 11 | Loan Servicer Cover Letter (if required) | A Loan Servicer Cover Letter is required for student loan deferment to formally request eligibility based on specific circumstances like unemployment or in-school status. This cover letter must include the borrower's name, account number, reason for deferment, and supporting documentation to ensure accurate processing by the loan servicer. |

| 12 | Recent Loan Statement | A recent loan statement is essential for student loan deferment, as it verifies current loan status and outstanding balance. Lenders require this document to confirm eligibility and ensure the deferment request aligns with the borrower's repayment schedule. |

Understanding Student Loan Deferment

Student loan deferment allows borrowers to temporarily pause or reduce their loan payments under specific conditions. To apply for deferment, borrowers must provide documentation such as proof of enrollment in school, unemployment status, or economic hardship. Lenders often require submitting a deferment request form along with supporting documents to verify eligibility and approve the deferment period.

Key Documents Required for Deferment Application

What documents are required for student loan deferment? Key documents typically include your deferment application form and proof of eligibility, such as enrollment verification or unemployment status. Supporting documents like income statements or medical certifications may also be necessary.

Proof of Enrollment and Academic Status

Student loan deferment requires specific documentation to verify eligibility, with proof of enrollment and academic status being crucial. These documents confirm the borrower's current educational involvement and support the deferment request effectively.

- Proof of Enrollment - A current enrollment certificate or official letter from the educational institution verifying active student status.

- Academic Status - Documentation such as transcripts or a registrar's statement showing full-time or part-time academic standing.

- Institution Verification - An official document confirming the institution's accreditation and the borrower's registration period.

Demonstrating Financial Hardship

When applying for a student loan deferment due to financial hardship, specific documents are essential to support your request. These documents provide proof of your current financial situation and justify the deferment period needed.

Commonly required documents include recent pay stubs, tax returns, or a letter from an employer indicating reduced income or job loss. Bank statements and proof of unemployment benefits may also be necessary to demonstrate the extent of financial difficulty. Medical bills or disability documentation can serve as additional evidence if hardship is related to health issues.

Income Verification and Supporting Papers

Student loan deferment requires specific documentation to prove eligibility, particularly focusing on income verification and supporting papers. These documents help lenders understand your current financial situation and justify the deferment request.

- Recent Pay Stubs - Provide the latest pay stubs to verify your current income level and employment status.

- Tax Returns - Submit recent tax returns as official proof of annual income and financial history.

- Support Letters - Include letters from your employer or financial aid office confirming deferment eligibility and income conditions.

Submitting complete and accurate documents ensures your student loan deferment application is processed smoothly and without delay.

Employment and Unemployment Documentation

Employment and unemployment documentation are essential when applying for student loan deferment. These documents verify your current work status and eligibility for deferment based on income or job loss.

Common employment documents include recent pay stubs, employer verification letters, and tax returns. Unemployment documentation may involve state unemployment benefit statements or job search logs to support your deferment request.

Special Circumstances: Medical and Military Paperwork

Student loan deferment requires specific documentation to verify eligibility, especially under special circumstances like medical or military situations. These documents confirm your inability to make payments temporarily due to these unique conditions.

For medical deferment, a physician's certification or medical records detailing the condition and expected recovery time are necessary. Military deferment generally requires active duty orders or deployment papers to prove service status during the deferment period.

Borrower Identification and Loan Statements

Borrower identification is essential for processing student loan deferment requests, typically requiring a valid government-issued ID such as a passport or driver's license. Loan statements must be submitted to verify the loan details, including account numbers and outstanding balances. Providing accurate identification along with recent loan statements ensures your deferment application is properly reviewed and approved.

Financial Criteria for Deferment Eligibility

Student loan deferment allows borrowers to temporarily postpone payments based on financial hardship. Understanding the required documents and financial criteria is essential to qualify for deferment benefits.

- Income Verification - Recent pay stubs, tax returns, or a letter from an employer demonstrate reduced or insufficient income to meet financial criteria for deferment eligibility.

- Financial Hardship Proof - Documentation such as unemployment benefits statements or medical expense receipts validate financial hardship affecting the borrower's ability to pay.

- Loan Account Information - A current loan statement or account summary from the loan servicer is necessary to verify the borrower's eligibility and outstanding balance for deferment processing.

What Documents Are Required for Student Loan Deferment? Infographic