An LLC must gather several key documents for annual tax filing, including the Form 1065 (U.S. Return of Partnership Income) if it is treated as a partnership, or Form 1120 if taxed as a corporation. Members also need their Schedule K-1 forms to report individual shares of income, deductions, and credits. Maintaining accurate financial statements, such as profit and loss reports, helps ensure compliance and accurate reporting to the IRS.

What Documents Does an LLC Need for Annual Tax Filing?

| Number | Name | Description |

|---|---|---|

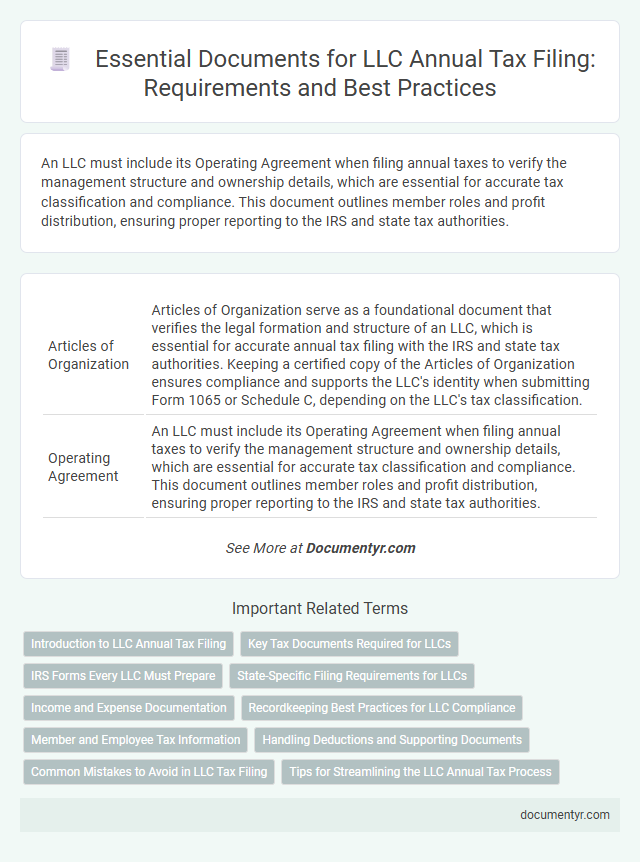

| 1 | Articles of Organization | Articles of Organization serve as a foundational document that verifies the legal formation and structure of an LLC, which is essential for accurate annual tax filing with the IRS and state tax authorities. Keeping a certified copy of the Articles of Organization ensures compliance and supports the LLC's identity when submitting Form 1065 or Schedule C, depending on the LLC's tax classification. |

| 2 | Operating Agreement | An LLC must include its Operating Agreement when filing annual taxes to verify the management structure and ownership details, which are essential for accurate tax classification and compliance. This document outlines member roles and profit distribution, ensuring proper reporting to the IRS and state tax authorities. |

| 3 | EIN Confirmation Letter (IRS Form SS-4) | An LLC requires the EIN Confirmation Letter (IRS Form SS-4) as a critical document for annual tax filing to verify its Employer Identification Number with the IRS. This letter ensures accurate tax reporting and is essential for filing federal tax returns, opening bank accounts, and maintaining compliance. |

| 4 | Annual Report | An LLC must prepare and submit an Annual Report detailing financial statements, member information, and business activities to maintain compliance and support accurate tax filing. This report, often required by state authorities, serves as a critical document alongside the LLC's tax returns for annual financial disclosure. |

| 5 | IRS Form 1065 (Partnership Return, if multi-member LLC) | An LLC with multiple members must file IRS Form 1065, the Partnership Return, to report its income, deductions, credits, and other relevant financial information for annual tax filing. Along with Form 1065, the LLC needs to provide Schedule K-1 to each member, detailing their share of the partnership's income and expenses for accurate individual tax reporting. |

| 6 | IRS Schedule K-1 (for each member, if multi-member LLC) | An LLC must prepare IRS Schedule K-1 for each member, detailing their share of income, deductions, and credits to accurately report individual tax liabilities. This form is essential for multi-member LLCs to ensure compliance with IRS guidelines and proper distribution of tax information among members. |

| 7 | IRS Form 1120 (if LLC elected C-Corp taxation) | An LLC that has elected C-Corp taxation must file IRS Form 1120, the U.S. Corporation Income Tax Return, which requires detailed financial statements, including income, deductions, credits, and tax liability information. Supporting documents such as balance sheets, profit and loss statements, and records of taxable income and expenses are essential to accurately complete Form 1120 and comply with IRS annual tax filing requirements. |

| 8 | IRS Form 1120S (if LLC elected S-Corp taxation) | LLCs that have elected S-Corp taxation must file IRS Form 1120S for their annual tax return, reporting income, losses, deductions, and credits. Key supporting documents include Schedule K-1 for each shareholder, as well as accurate financial statements and records of business expenses to ensure compliance and proper tax calculation. |

| 9 | State Annual Tax Return | An LLC must file a State Annual Tax Return including the Articles of Organization, Operating Agreement, and the most recent financial statements or Profit and Loss statement. Accurate bookkeeping records and the LLC's federal tax identification number (EIN) are essential to complete the filing and comply with state tax requirements. |

| 10 | State Franchise Tax Return | An LLC must prepare its State Franchise Tax Return, which typically requires a copy of the Articles of Organization, the operating agreement, and the federal Schedule C or K-1 forms to report income correctly. Accurate financial statements and prior year tax returns are essential to ensure compliance with state-specific franchise tax obligations and avoid penalties. |

| 11 | IRS Form 1040 with Schedule C (if single-member LLC, sole proprietorship) | Single-member LLCs classified as sole proprietorships must file IRS Form 1040 with Schedule C to report income and expenses for annual tax purposes. Essential documents include the LLC's financial statements, receipts for deductible expenses, and records of income to accurately complete Schedule C and ensure compliance with IRS requirements. |

| 12 | Payroll Tax Filings (if applicable) | LLCs with employees must include payroll tax filings such as Form 941 for quarterly federal tax returns and Form W-2 for wage reporting in their annual tax documentation. Proper submission of state payroll tax reports and timely deposits of Social Security, Medicare, and unemployment taxes ensure compliance with IRS and state regulations. |

| 13 | Sales Tax Filings (if applicable) | LLCs must maintain accurate sales tax records, including sales receipts, exemption certificates, and periodic sales tax returns, to ensure compliance during annual tax filings. Timely submission of state-specific sales tax reports and payment documentation is crucial to avoid penalties and reconcile collected taxes. |

| 14 | Business Bank Statements | Business bank statements provide essential financial data required for accurate annual tax filing of an LLC, reflecting cash flow, expenses, and income. These statements must be meticulously organized and reconciled to support reported figures and ensure compliance with IRS regulations. |

| 15 | Receipts and Invoices | Receipts and invoices are critical documents for an LLC's annual tax filing, serving as proof of business expenses and income to accurately report deductions and revenue. Maintaining detailed and organized records of all receipts and invoices ensures compliance with IRS regulations and supports the legitimacy of claimed tax positions. |

| 16 | Financial Statements (Income Statement, Balance Sheet) | LLCs must prepare accurate financial statements, including the income statement and balance sheet, to report revenue, expenses, assets, and liabilities for annual tax filing. These documents are critical for IRS Form 1065 and Schedule K-1 preparation, ensuring compliance and accurate allocation of profits among members. |

| 17 | Depreciation Schedules | An LLC must maintain accurate depreciation schedules detailing the cost, useful life, and accumulated depreciation of business assets to properly report deductions on annual tax filings. These schedules are essential for calculating depreciation expenses that reduce taxable income, complying with IRS guidelines under Section 179 and MACRS. |

| 18 | Previous Year’s Tax Returns | Previous year's tax returns are crucial for an LLC's annual tax filing as they provide a reference point for income, deductions, and credits claimed, ensuring consistency and accuracy in reporting. Maintaining copies of federal, state, and local tax returns helps streamline the preparation process and supports compliance with IRS and state tax authorities. |

| 19 | Expense Documentation | LLCs must maintain detailed expense documentation such as receipts, invoices, bank statements, and mileage logs to accurately report deductible business expenses on their annual tax filings. Proper organization of these documents ensures compliance with IRS regulations and maximizes eligible deductions, reducing the overall tax liability. |

| 20 | Member Contribution and Distribution Records | LLCs must maintain detailed member contribution and distribution records to accurately report capital accounts and ensure compliance with IRS requirements during annual tax filing. These documents include capital contribution agreements, records of cash or property contributions, distribution logs, and supporting financial statements to substantiate income allocations and tax deductions. |

| 21 | Proof of Estimated Tax Payments | LLCs must provide proof of estimated tax payments when filing annual taxes, which typically includes Form 1040-ES for individual members or Form 1120-W for corporate entities. Accurate records of these payments ensure compliance with IRS deadlines and prevent underpayment penalties. |

Introduction to LLC Annual Tax Filing

Annual tax filing for an LLC involves submitting specific financial documents that detail the company's income, expenses, and overall financial activity. Understanding the required documents ensures compliance with tax authorities and avoids penalties.

You need to prepare Form 1065, also known as the U.S. Return of Partnership Income, if the LLC has multiple members. Single-member LLCs typically file a Schedule C attached to the owner's personal tax return. Other essential documents include profit and loss statements, balance sheets, and member K-1 forms outlining each member's share of income.

Key Tax Documents Required for LLCs

LLCs must gather specific documents to ensure accurate and timely annual tax filing. Proper documentation supports compliance with IRS requirements and simplifies the tax preparation process.

- Form 1065 or 1120 - Partnerships LLCs file Form 1065, while corporations file Form 1120 for tax reporting.

- K-1 Statements - Individual members receive Schedule K-1 to report their share of income, deductions, and credits.

- Financial Statements - Profit and loss statements and balance sheets provide essential data for tax calculations and audit purposes.

IRS Forms Every LLC Must Prepare

LLCs must prepare specific IRS forms for accurate annual tax filing. Proper documentation ensures compliance and avoids penalties.

- Form 1065 (Partnership Return) - Required for multi-member LLCs to report income, deductions, and profits.

- Schedule C (Form 1040) - Single-member LLCs file this to report business income and expenses on the owner's personal return.

- Form 1120 (Corporate Tax Return) - Used if the LLC elects to be taxed as a corporation.

- Schedule K-1 - Provides each member with their share of income, deductions, and credits for reporting on personal tax returns.

- Form 941 - For LLCs with employees, this form reports quarterly payroll taxes to the IRS.

Your LLC's tax filing accuracy depends on timely preparation of these IRS forms.

State-Specific Filing Requirements for LLCs

What documents does an LLC need for annual tax filing in different states? Each state has unique filing requirements that can include an annual report, a franchise tax return, and a state-specific income tax form. LLCs must also provide their federal tax return documents and any state-mandated certificates or schedules required for compliance.

Income and Expense Documentation

Maintaining accurate income and expense documentation is essential for your LLC's annual tax filing. These records ensure compliance and support accurate reporting to tax authorities.

- Income Statements - Detailed records of all revenue sources the LLC received during the tax year.

- Receipts and Invoices - Documentation of sales, services provided, and payments received to verify income entries.

- Expense Records - Comprehensive proof of all deductible business expenses, including bills, receipts, and bank statements.

Recordkeeping Best Practices for LLC Compliance

An LLC must maintain comprehensive financial records, including income statements, expense receipts, and bank statements, to ensure accurate annual tax filings. Proper organization of these documents supports compliance with IRS requirements and simplifies the preparation of Schedule C or Form 1065, depending on the LLC's tax classification. Implementing systematic recordkeeping best practices, such as digital storage and regular reconciliation, minimizes errors and audit risks for LLC owners.

Member and Employee Tax Information

For annual tax filing, an LLC must gather essential member tax information, including Schedule K-1 forms that report each member's share of income, deductions, and credits. Accurate member details ensure proper IRS reporting and compliance.

Employee tax information is also crucial, requiring W-2 forms for wages paid and related payroll tax filings such as Form 941. You must keep detailed records to support all reported employee compensation and tax withholdings.

Handling Deductions and Supporting Documents

For annual tax filing, an LLC must maintain accurate records of all income and expenses to support deductions claimed on its tax return. Key documents include receipts, invoices, bank statements, and payroll records that validate business expenses.

Handling deductions requires organized documentation such as mileage logs, home office expenses, and proof of asset purchases or depreciation. These supporting documents ensure compliance with IRS regulations and maximize eligible tax benefits for your LLC.

Common Mistakes to Avoid in LLC Tax Filing

| Document | Description | Common Mistakes to Avoid |

|---|---|---|

| Form 1065 (U.S. Return of Partnership Income) | Reports the LLC's income, deductions, gains, and losses to the IRS. | Failing to file on time; Incorrectly reporting income or expenses; Omitting required schedules. |

| Schedule K-1 | Reports each member's share of the LLC's income, deductions, and credits for individual tax filing. | Providing late or inaccurate K-1 forms to members; Not matching information between Form 1065 and K-1. |

| Operating Agreement | Defines ownership percentages and profit distribution among LLC members. | Not updating changes in ownership or profit sharing; Using outdated versions causing tax reporting discrepancies. |

| Financial Statements | Includes balance sheet, income statement, and cash flow statement to support reported tax information. | Inaccurate or incomplete financial records; Mixing personal and business expenses; Not reconciling accounts. |

| Employer Identification Number (EIN) | Identification number used for tax reporting purposes. | Using incorrect EIN on tax forms; Failing to apply for an EIN when required. |

| Member Contribution Records | Documentation of money or assets contributed by members to the LLC. | Not documenting member contributions properly; Confusing contributions with loans or distributions. |

| Expense Receipts and Invoices | Proof of business expenses claimed on tax returns. | Missing receipts; Claiming personal expenses as business costs; Not organizing documentation. |

What Documents Does an LLC Need for Annual Tax Filing? Infographic