To open a high-yield savings account, you need to provide a valid government-issued ID, such as a driver's license or passport, along with your Social Security number for identity verification. Proof of address is often required, which can be a recent utility bill or bank statement. Some institutions may also require an initial deposit via check or electronic transfer to activate the account.

What Documents Are Needed to Open a High-Yield Savings Account?

| Number | Name | Description |

|---|---|---|

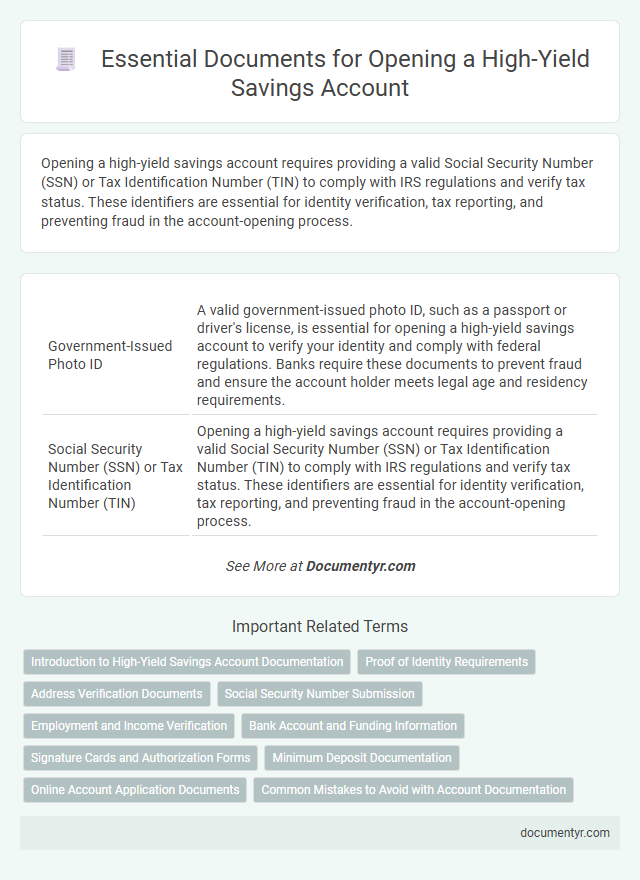

| 1 | Government-Issued Photo ID | A valid government-issued photo ID, such as a passport or driver's license, is essential for opening a high-yield savings account to verify your identity and comply with federal regulations. Banks require these documents to prevent fraud and ensure the account holder meets legal age and residency requirements. |

| 2 | Social Security Number (SSN) or Tax Identification Number (TIN) | Opening a high-yield savings account requires providing a valid Social Security Number (SSN) or Tax Identification Number (TIN) to comply with IRS regulations and verify tax status. These identifiers are essential for identity verification, tax reporting, and preventing fraud in the account-opening process. |

| 3 | Proof of Address (utility bill, lease, bank statement) | To open a high-yield savings account, providing proof of address is essential and can be satisfied with documents such as a recent utility bill, a valid lease agreement, or a bank statement showing your current residential address. These documents verify your residency and help financial institutions comply with regulatory requirements like anti-money laundering (AML) laws. |

| 4 | Employment Information (if required) | To open a high-yield savings account, financial institutions typically require employment information such as your current employer's name, job title, and proof of income to verify your financial stability. This documentation helps banks assess risk and comply with regulatory requirements like Know Your Customer (KYC) and anti-money laundering (AML) policies. |

| 5 | Initial Deposit Information (bank account details or check) | Opening a high-yield savings account requires submitting your initial deposit, which can often be provided via a linked bank account transfer or a physical check. Accurate bank account details, such as the routing and account numbers, are essential to ensure a seamless deposit process and immediate account activation. |

| 6 | Contact Information (phone number, email address) | To open a high-yield savings account, providing accurate contact information such as a valid phone number and email address is essential for account verification and communication. Financial institutions rely on these details to send transaction alerts, update account statuses, and facilitate secure access to online banking services. |

| 7 | Signature Card or Authorization Form | A Signature Card or Authorization Form is essential for opening a high-yield savings account, serving as a legal document that verifies the account holder's identity and grants permission for account transactions. Financial institutions use this form to record authorized signatures, preventing unauthorized access and ensuring compliance with banking regulations. |

| 8 | Citizenship or Residency Documentation (if applicable) | To open a high-yield savings account, applicants must provide valid citizenship or residency documentation such as a passport, permanent resident card, or government-issued ID to verify their legal status. Financial institutions require these documents to comply with federal regulations and ensure account holder eligibility. |

Introduction to High-Yield Savings Account Documentation

Opening a high-yield savings account requires specific documentation to verify identity and financial information. These documents ensure compliance with banking regulations and protect your account security.

You will typically need a government-issued ID, such as a passport or driver's license, and proof of address like a utility bill or bank statement. Some institutions may also request your Social Security number or tax identification number for tax reporting purposes.

Proof of Identity Requirements

What documents are required to open a high-yield savings account for proof of identity? Financial institutions typically require a government-issued photo ID, such as a passport or driver's license. This ensures compliance with anti-fraud and Know Your Customer (KYC) regulations.

Address Verification Documents

To open a high-yield savings account, financial institutions require proof of address to verify your residency. Accepted address verification documents must be recent and clearly display your name and address.

Common documents used for address verification include utility bills, such as electricity or water statements, bank statements, and government-issued correspondence like tax notices. Lease agreements or mortgage statements also serve as valid proof. These documents help banks comply with regulatory requirements and prevent identity fraud.

Social Security Number Submission

To open a high-yield savings account, submitting your Social Security Number (SSN) is essential for identity verification and tax reporting purposes. Financial institutions require the SSN to comply with federal regulations and to prevent fraud.

Your SSN allows the bank to verify your credit history and confirm your eligibility for the account. Without this critical document, the application process for a high-yield savings account cannot be completed successfully.

Employment and Income Verification

Opening a high-yield savings account requires thorough verification of your employment and income to ensure financial stability. Banks use these documents to assess your ability to maintain and grow the account.

- Recent Pay Stubs - Pay stubs provide proof of current employment and detail your income over recent pay periods.

- Employment Verification Letter - This document, issued by your employer, confirms your job status, position, and length of employment.

- Tax Returns or W-2 Forms - These official records verify your annual income and are used for comprehensive income assessment.

Bank Account and Funding Information

Opening a high-yield savings account requires specific documentation to verify your identity and funding source. Providing accurate bank account and funding information ensures a smooth account setup process.

- Government-Issued ID - Valid identification such as a driver's license or passport is required to confirm your identity.

- Social Security Number (SSN) - Your SSN helps the bank perform background checks and report interest earned to the IRS.

- Funding Source Details - Linking an existing bank account or providing routing and account numbers allows initial deposits and transfers.

Having these documents ready expedites approval and access to your high-yield savings account benefits.

Signature Cards and Authorization Forms

Opening a high-yield savings account requires specific documentation to verify identity and authorize account management. Signature cards and authorization forms are essential to establish account control and access privileges.

- Signature Card - Captures the account holder's official signature for identity verification during transactions.

- Authorization Form - Grants permission for account access and outlines authorized users or representatives.

- Compliance Requirement - Both documents ensure adherence to banking regulations and secure account operations.

Minimum Deposit Documentation

| Document Type | Description | Purpose |

|---|---|---|

| Identification (ID) | Government-issued ID such as a driver's license, passport, or state ID card | Verifies identity to comply with KYC (Know Your Customer) regulations |

| Proof of Address | Recent utility bill, bank statement, or lease agreement showing current address | Confirms residency for account verification and regulatory compliance |

| Social Security Number (SSN) or Tax Identification Number (TIN) | SSN card or TIN documentation | Required for tax reporting and identity confirmation |

| Minimum Deposit Evidence | Bank transfer receipt, check, or electronic funds transfer confirmation | Validates that minimum deposit requirements are met to activate the account |

| Initial Deposit Source Documentation | Documentation showing source of initial deposit if required, such as pay stub or savings withdrawal | Ensures funds are legitimate and complies with anti-money laundering (AML) policies |

Online Account Application Documents

To open a high-yield savings account online, you need to provide a valid government-issued ID such as a passport or driver's license. Proof of address, like a utility bill or bank statement, is also required to verify your residency. Additionally, your Social Security number or Tax Identification Number is necessary to complete the application process and comply with federal regulations.

What Documents Are Needed to Open a High-Yield Savings Account? Infographic