To complete an IRA account rollover, key documents include the most recent account statements from both the existing and receiving financial institutions, as well as a rollover request form provided by the new IRA custodian. A copy of a valid government-issued ID and a completed IRS Form 5498 or 1099-R may be required to ensure proper reporting of the rollover transaction. Accurate documentation helps avoid tax penalties and ensures compliance with IRS rollover rules.

What Documents Are Necessary for IRA Account Rollovers?

| Number | Name | Description |

|---|---|---|

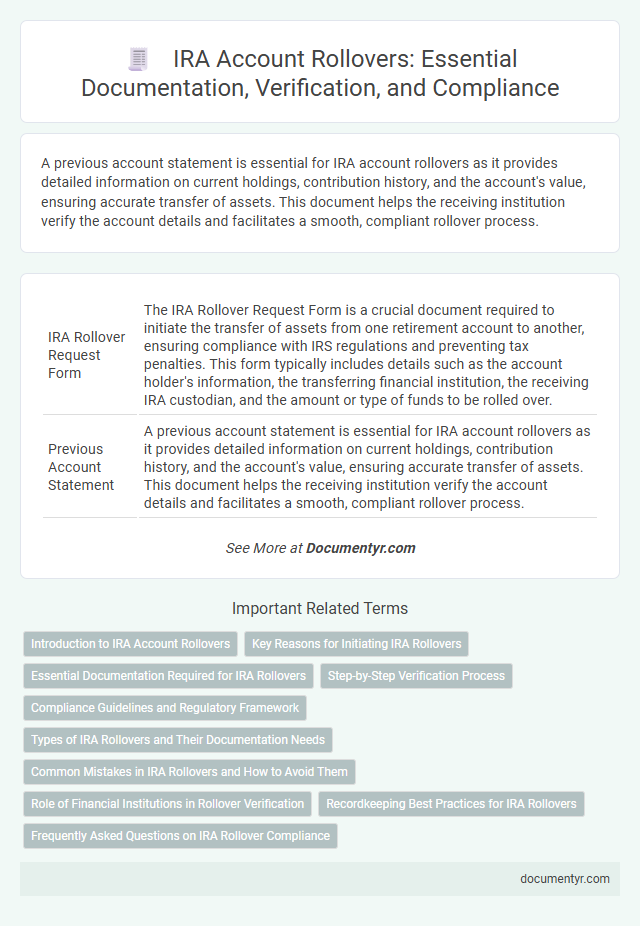

| 1 | IRA Rollover Request Form | The IRA Rollover Request Form is a crucial document required to initiate the transfer of assets from one retirement account to another, ensuring compliance with IRS regulations and preventing tax penalties. This form typically includes details such as the account holder's information, the transferring financial institution, the receiving IRA custodian, and the amount or type of funds to be rolled over. |

| 2 | Previous Account Statement | A previous account statement is essential for IRA account rollovers as it provides detailed information on current holdings, contribution history, and the account's value, ensuring accurate transfer of assets. This document helps the receiving institution verify the account details and facilitates a smooth, compliant rollover process. |

| 3 | IRA Rollover Acceptance Letter | The IRA rollover acceptance letter serves as a crucial document confirming that the receiving financial institution has agreed to accept the transferred funds, ensuring compliance with IRS regulations. This letter typically includes key details such as the account holder's information, rollover amount, and the effective date of the transaction, facilitating a smooth and traceable IRA rollover process. |

| 4 | Distribution Request Form | The Distribution Request Form is essential for initiating an IRA account rollover, detailing the amount and account information needed for the transfer. Financial institutions require this form to process rollovers accurately while ensuring compliance with IRS guidelines. |

| 5 | Rollover Certification Form | The Rollover Certification Form is a crucial document required for IRA account rollovers as it verifies the transaction complies with IRS regulations, preventing tax withholding and penalties. This form must be accurately completed and submitted alongside account statements and identification documents to ensure a smooth transfer of retirement assets. |

| 6 | 1099-R Tax Form | The 1099-R tax form is essential for IRA account rollovers as it reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts. Proper submission of Form 1099-R ensures accurate tax reporting and helps avoid penalties during the rollover process. |

| 7 | 5498 Tax Form | The IRS Form 5498 is essential for IRA account rollovers as it reports contributions, rollovers, and the fair market value of the account to both the account holder and the IRS. This tax document verifies rollover transactions and ensures compliance with IRS regulations, aiding in accurate tax reporting and avoiding penalties. |

| 8 | Beneficiary Designation Form | The Beneficiary Designation Form is essential for IRA account rollovers, ensuring the proper transfer of assets to designated heirs upon the account holder's death. Accurate completion of this form prevents legal complications and guarantees alignment with estate planning goals. |

| 9 | Transfer of Assets Form | The Transfer of Assets Form is a critical document required for IRA account rollovers, enabling the seamless movement of funds between financial institutions while preserving tax advantages. This form typically includes account holder information, details of the current and receiving custodians, and specifies the type and amount of assets being transferred. |

| 10 | Account Application Form | The Account Application Form is essential for IRA account rollovers, as it collects crucial personal and financial information required to initiate the transfer. It ensures compliance with IRS regulations and facilitates accurate processing of rollover contributions. |

| 11 | Rollover Confirmation Notice | The Rollover Confirmation Notice is a critical document that verifies the successful transfer of funds from one IRA account to another, ensuring compliance with IRS rollover rules and preventing potential tax penalties. This notice typically includes essential details such as the rollover amount, date of transfer, and the receiving financial institution's information, which must be retained for accurate record-keeping and reporting during tax filing. |

| 12 | Direct Rollover Authorization Letter | A Direct Rollover Authorization Letter is essential for IRA account rollovers as it authorizes the transfer of funds directly from one retirement account to another, ensuring a tax-free and penalty-free process. This document must include specific details such as the account holder's information, the sending and receiving financial institutions, and the amount to be rolled over to facilitate a smooth transaction. |

| 13 | Trustee-to-Trustee Transfer Form | The Trustee-to-Trustee Transfer Form is a critical document that authorizes the direct transfer of IRA assets between financial institutions, ensuring tax-free rollover transactions. Accurate completion of this form, including account details and signatures, is essential to prevent unintended distributions and maintain the tax-advantaged status of the IRA rollover. |

| 14 | Identification Documents (e.g., Driver’s License, Passport) | Identification documents such as a valid driver's license or passport are essential for IRA account rollovers to verify the account holder's identity and ensure compliance with IRS regulations. Financial institutions typically require these documents to process the rollover securely and prevent fraudulent activities. |

| 15 | Supporting Tax Documents | Supporting tax documents necessary for IRA account rollovers include Form 1099-R, which reports distributions from retirement accounts, and Form 5498, detailing contributions and rollover amounts to the IRA. Maintaining these documents ensures accurate reporting to the IRS and facilitates seamless tax filings during the rollover process. |

Introduction to IRA Account Rollovers

IRA account rollovers allow the transfer of retirement savings from one account to another without tax penalties. Understanding the necessary documentation is crucial for a smooth rollover process.

- Account Statements - Recent account statements from both the current and receiving IRA confirm balances and account details.

- Rollover Request Form - This form authorizes the existing custodian to transfer funds to the new IRA provider.

- Identification Documents - A valid government-issued ID verifies your identity during the rollover process.

Key Reasons for Initiating IRA Rollovers

Initiating an IRA account rollover requires specific documents to ensure a smooth transfer of funds. Key paperwork includes a completed rollover request form, a recent account statement, and valid identification.

You also need the distribution form from the existing retirement account and a direct transfer form to the new IRA provider. These documents help avoid tax penalties and ensure compliance with IRS regulations. Clear documentation supports accurate record-keeping and protects your retirement assets.

Essential Documentation Required for IRA Rollovers

IRA account rollovers require specific documentation to ensure a smooth transfer of funds. Proper paperwork helps maintain tax advantages and avoid penalties.

- Account Statements - Recent statements from your existing IRA show current balances and transactions.

- Rollover Request Form - This form authorizes the transfer of funds between financial institutions.

- Identification Documents - Valid government-issued ID verifies your identity during the rollover process.

Step-by-Step Verification Process

To complete an IRA account rollover, gather essential documents including your current IRA statements, the distribution form from your existing account, and a completed rollover request form from the receiving financial institution. Verification starts by confirming account ownership and the eligible rollover amount with these documents.

Next, submit the distribution form to your current custodian, ensuring all personal details and account numbers match precisely. The receiving institution then reviews the rollover request form alongside confirmation of funds being eligible and timely to avoid tax penalties.

Once the distribution is approved, track the transfer of funds either through a direct rollover or a 60-day indirect rollover. Verification concludes by obtaining a formal confirmation from the new IRA custodian that the rollover deposit is complete and correctly recorded.

Maintain copies of all documentation for tax reporting and future reference. This step-by-step verification process safeguards against errors that could trigger IRS penalties or unintended taxes.

Compliance Guidelines and Regulatory Framework

To complete an IRA account rollover, you need official account statements, a completed rollover request form, and identification documents like a government-issued ID. Compliance guidelines require verifying the account holder's identity and ensuring the rollover meets IRS regulations to avoid tax penalties or early distribution fees. The regulatory framework mandates timely processing--typically within 60 days of distribution--to maintain the tax-deferred status of your retirement funds.

Types of IRA Rollovers and Their Documentation Needs

| Type of IRA Rollover | Required Documents | Notes |

|---|---|---|

| Traditional IRA to Traditional IRA | Account statements, rollover request form | Proof of distribution may be required to avoid tax penalties |

| Traditional IRA to Roth IRA (Roth Conversion) | Conversion paperwork, IRS Form 1099-R, tax withholding election form | Tax implications apply; documentation important for reporting |

| 401(k) to Traditional IRA | Plan distribution form from 401(k), IRA account information, rollover authorization form | Direct rollover preferred to prevent tax withholding |

| 401(k) to Roth IRA | Distribution form, IRS Form 1099-R, IRA account details, rollover form | Consider tax due on pre-tax contributions |

| Roth IRA to Roth IRA | Account statements, rollover request documentation | No tax consequences if rollover is completed within 60 days |

| Inherited IRA Rollovers | Death certificate, beneficiary designation forms, rollover or transfer paperwork | Special rules apply; documentation critical for compliance |

| IRA to Employer-Sponsored Plan | IRA distribution form, plan acceptance letter, rollover request | Verify plan's acceptance of IRA rollovers |

Your IRA rollover requires accurate documentation to ensure a smooth transfer and avoid tax penalties.

Common Mistakes in IRA Rollovers and How to Avoid Them

When rolling over an IRA account, essential documents include your current IRA statement, a distribution request form, and the receiving account information. Common mistakes in IRA rollovers often involve missing paperwork or incorrect account details, leading to delays or unintended tax consequences. You can avoid these issues by double-checking all forms and consulting with a financial advisor to ensure compliance with IRS rules.

Role of Financial Institutions in Rollover Verification

Financial institutions play a crucial role in verifying documentation for IRA account rollovers. They require specific documents to ensure compliance with IRS regulations and to facilitate a smooth transfer of assets.

You must provide a completed rollover request form and proof of identity to initiate the process. Additional documents may include prior account statements and a distribution statement from the original IRA custodian.

Recordkeeping Best Practices for IRA Rollovers

Proper documentation is crucial for smooth IRA account rollovers and to ensure compliance with IRS regulations. Maintaining accurate records protects against tax penalties and facilitates future account management.

- Rollover Request Form - This form initiates the transfer and verifies your intent to roll over funds between IRA accounts.

- Account Statements - Statements from both the distributing and receiving institutions confirm transaction dates and amounts.

- IRS Form 1099-R - This form reports distributions from retirement accounts and is essential for tax reporting purposes.

- Receipt Confirmation - Documentation from the receiving IRA custodian acknowledging the deposit completes the recordkeeping process.

- Rollover Timing Documentation - Proof that funds were rolled over within the 60-day window ensures tax-free status of the transaction.

Consistently organizing and securely storing these documents enhances transparency and supports audit readiness in IRA rollovers.

What Documents Are Necessary for IRA Account Rollovers? Infographic