To complete a student loan consolidation, you need to gather key documents including your current loan statements, proof of income, and identification. Lenders typically require recent pay stubs or tax returns to verify your financial status and eligibility. Having these documents ready ensures a smooth and efficient consolidation process.

What Documents are Necessary for Student Loan Consolidation?

| Number | Name | Description |

|---|---|---|

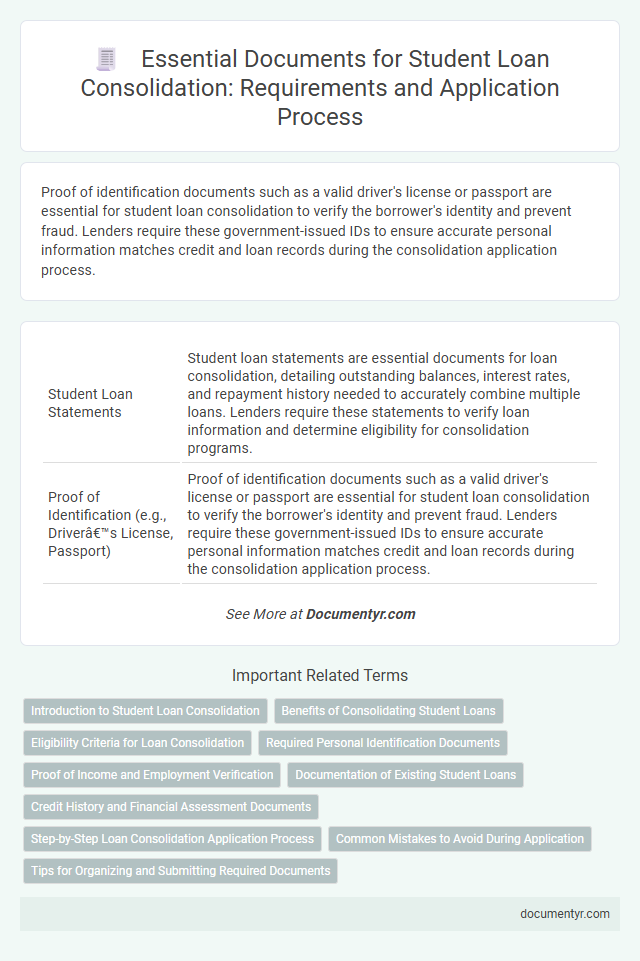

| 1 | Student Loan Statements | Student loan statements are essential documents for loan consolidation, detailing outstanding balances, interest rates, and repayment history needed to accurately combine multiple loans. Lenders require these statements to verify loan information and determine eligibility for consolidation programs. |

| 2 | Proof of Identification (e.g., Driver’s License, Passport) | Proof of identification documents such as a valid driver's license or passport are essential for student loan consolidation to verify the borrower's identity and prevent fraud. Lenders require these government-issued IDs to ensure accurate personal information matches credit and loan records during the consolidation application process. |

| 3 | Social Security Number | Student loan consolidation requires providing a valid Social Security Number (SSN) to verify identity and access credit information accurately. Lenders use the SSN to ensure eligibility and consolidate multiple federal or private student loans into a single account. |

| 4 | Federal Student Aid (FSA) ID | A Federal Student Aid (FSA) ID is essential for student loan consolidation as it serves as your legal electronic signature for accessing and managing your federal student aid online. Along with the FSA ID, documents such as your Social Security number, federal student loan information, and income verification are typically required to complete the consolidation application process. |

| 5 | Proof of Income (Pay Stubs, Tax Returns, W-2 Forms) | Proof of income is essential for student loan consolidation and typically includes recent pay stubs, tax returns from the past two years, and W-2 forms, which verify your employment and earnings. Lenders use these documents to assess your repayment ability and determine eligibility for consolidation terms. |

| 6 | Current Loan Servicer Information | Current loan servicer information, including recent statements or account numbers, is essential for student loan consolidation to verify existing loan details and balances. Providing accurate servicer contact information ensures streamlined communication and efficient processing of the consolidation application. |

| 7 | Loan Account Numbers | Student loan consolidation requires submitting documents that include loan account numbers to accurately identify each individual loan for repayment purposes. Providing precise loan account numbers from original lenders or loan servicers ensures the consolidation application process is streamlined and error-free. |

| 8 | Consolidation Application Form | The consolidation application form is the primary document required for student loan consolidation, containing essential borrower information and details about existing loans to be consolidated. Accurate completion of this form ensures a streamlined review process by loan servicers and supports eligibility verification for consolidation benefits. |

| 9 | Repayment Plan Selection Documents | Repayment plan selection documents for student loan consolidation typically include recent loan statements, income verification such as pay stubs or tax returns, and a completed repayment plan request form from the loan servicer. These documents help determine eligibility and tailor the consolidation plan to fit the borrower's financial situation. |

| 10 | Proof of Graduation or Enrollment Status | Proof of graduation or current enrollment status is essential for student loan consolidation, typically requiring official transcripts, a diploma, or a current enrollment certificate issued by the educational institution. These documents verify the borrower's academic standing, ensuring eligibility for consolidation programs and supporting accurate loan application processing. |

| 11 | Authorization for Credit Check | An Authorization for Credit Check is a crucial document for student loan consolidation, granting lenders permission to access your credit report to assess your financial history and eligibility. This authorization enables lenders to evaluate your creditworthiness, income, and debt-to-income ratio to determine the best consolidation options. |

| 12 | Employer Information | Employer information is crucial for student loan consolidation applications, typically requiring the employer's name, address, and contact number to verify current employment status. Detailed pay stubs or employment verification letters may also be requested to confirm income and job stability during the consolidation process. |

| 13 | Co-signer Information (if applicable) | For student loan consolidation, the co-signer's personal identification details, such as Social Security number, proof of income, credit history, and contact information, are essential to assess creditworthiness. Lenders may also require co-signer's tax returns and employment verification to complete the loan consolidation application process. |

| 14 | Spouse Income Documentation (if married, for income-driven plans) | For student loan consolidation under income-driven repayment plans, spouses must provide income documentation such as recent tax returns, W-2 forms, or pay stubs to accurately assess household income. This documentation ensures correct calculation of monthly payments based on combined income, crucial for married borrowers filing jointly. |

| 15 | Power of Attorney or Legal Representative Documents (if applicable) | Power of Attorney or Legal Representative documents are essential for student loan consolidation if you appoint someone to act on your behalf, granting them authority to manage or negotiate your loan terms. These legally binding documents must clearly specify the representative's rights and be submitted along with your consolidation application to ensure proper authorization and processing. |

Introduction to Student Loan Consolidation

Student loan consolidation is a financial strategy that combines multiple federal student loans into a single loan with a unified interest rate. This process simplifies repayment and can potentially reduce monthly payments by extending the loan term.

- Loan Servicer Information - Provides details about the current loan servicer handling your individual student loans.

- Federal Student Loan Documents - Includes promissory notes and statements required to verify loan balances and terms.

- Personal Identification - Necessary documents such as Social Security number and government-issued ID to confirm borrower identity.

Gathering the necessary documentation ensures a smooth and efficient student loan consolidation process.

Benefits of Consolidating Student Loans

Student loan consolidation can simplify repayment by combining multiple loans into a single monthly payment. Understanding the necessary documents ensures a smooth consolidation process and access to key financial benefits.

- Proof of Income - Documents like pay stubs or tax returns verify your ability to meet consolidated loan payments.

- Loan Information - Recent statements from all existing student lenders provide details needed for accurate consolidation.

- Personal Identification - Government-issued ID confirms your identity and helps prevent loan fraud during application.

Eligibility Criteria for Loan Consolidation

To qualify for student loan consolidation, borrowers must provide proof of federal student loans and maintain a good credit standing. Essential documents include loan statements, personal identification, and income verification.

Eligibility criteria for loan consolidation focus on having eligible federal student loans and demonstrating the ability to make monthly payments on the consolidated loan. Borrowers typically need documentation like Social Security number, employment details, and a history of loan repayments. These requirements help lenders assess and approve consolidation applications efficiently.

Required Personal Identification Documents

What personal identification documents are required for student loan consolidation? You must provide a valid government-issued ID such as a passport or driver's license. These documents verify your identity and help prevent fraud during the loan consolidation process.

Proof of Income and Employment Verification

Proof of income and employment verification are critical documents required for student loan consolidation to assess the borrower's ability to repay consolidated loans. Lenders use these documents to confirm financial stability and ensure accurate calculation of repayment plans.

- Proof of Income - This typically includes recent pay stubs, tax returns, or W-2 forms that demonstrate the borrower's current earnings.

- Employment Verification - A letter from the employer or a recent employment contract confirming the borrower's job status and duration.

- Consistency Check - Lenders cross-reference income and employment documents to validate authenticity and determine eligible repayment options.

Documentation of Existing Student Loans

Documentation of existing student loans is essential for successful loan consolidation. Lenders require detailed records of all current federal and private student loans to verify amounts and terms.

These documents typically include original loan agreements, recent statements, and payoff information from loan servicers. Accurate documentation ensures proper calculation for interest rates and repayment plans during the consolidation process.

Credit History and Financial Assessment Documents

Student loan consolidation requires specific documents to verify credit history and conduct a comprehensive financial assessment. Key credit history documents include recent credit reports from major credit bureaus, proof of existing loan balances, and payment histories. Financial assessment documents typically involve income verification, tax returns, and bank statements to evaluate repayment capacity accurately.

Step-by-Step Loan Consolidation Application Process

Gathering essential documents is crucial for a smooth student loan consolidation process. Required documents include your loan statements, Social Security number, and proof of income or employment. These materials help verify your eligibility and complete your application accurately.

Start by collecting all federal student loan details from your loan servicers, which outline balances and terms. Next, prepare identification documents such as a government-issued ID and your Social Security card. Having these ready ensures you can fill out the consolidation application without delays.

Submit the consolidation application by providing your personal information, loan details, and repayment plan choice. Review all entered data carefully before sending the application to avoid errors. The consolidation process typically takes a few weeks, during which your documents are verified for approval.

Common Mistakes to Avoid During Application

When applying for student loan consolidation, essential documents include your loan statements, proof of income, identification, and Social Security number. Missing or inaccurate paperwork can lead to delays or application denials.

Common mistakes to avoid include submitting incomplete forms and failing to disclose all existing loans. Ensure all information is accurate and up-to-date to streamline the approval process and secure better loan terms.

What Documents are Necessary for Student Loan Consolidation? Infographic