Immigrants applying for an ITIN must submit a completed IRS Form W-7 along with valid identification documents such as a passport, national identification card, or U.S. visa. Supporting documents proving foreign status and identity are essential, including birth certificates or immigration documents. Tax return forms or a letter from a withholding agent may also be required to validate the application.

What Documents Does an Immigrant Need for ITIN Application?

| Number | Name | Description |

|---|---|---|

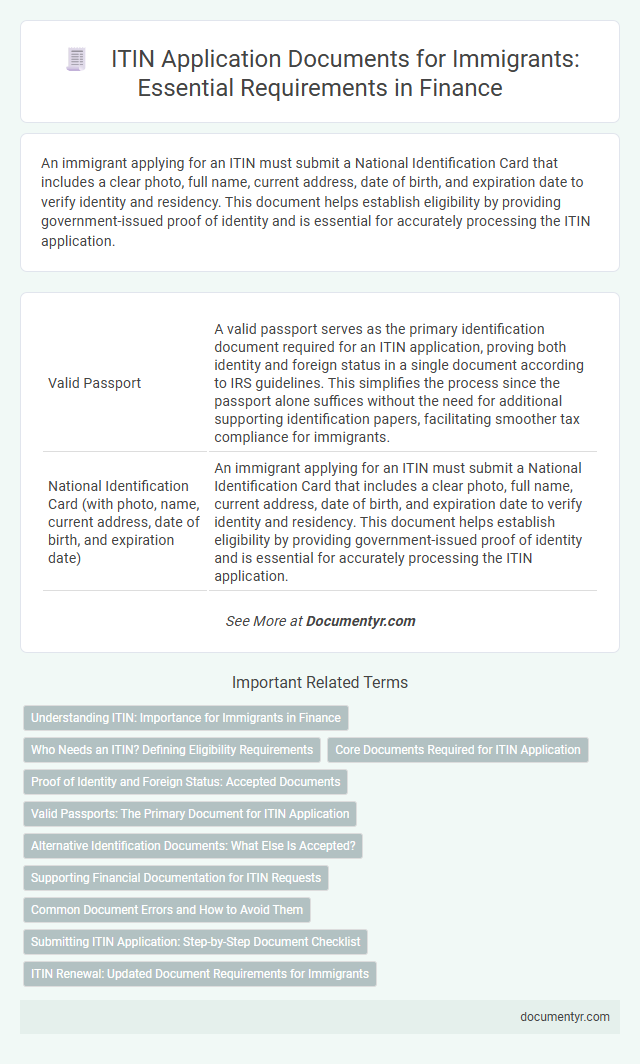

| 1 | Valid Passport | A valid passport serves as the primary identification document required for an ITIN application, proving both identity and foreign status in a single document according to IRS guidelines. This simplifies the process since the passport alone suffices without the need for additional supporting identification papers, facilitating smoother tax compliance for immigrants. |

| 2 | National Identification Card (with photo, name, current address, date of birth, and expiration date) | An immigrant applying for an ITIN must submit a National Identification Card that includes a clear photo, full name, current address, date of birth, and expiration date to verify identity and residency. This document helps establish eligibility by providing government-issued proof of identity and is essential for accurately processing the ITIN application. |

| 3 | U.S. Visa | An immigrant applying for an ITIN must submit a valid U.S. visa along with the IRS Form W-7, proof of foreign status, and identity documents such as a passport or national identification card. Supporting documents may also include a birth certificate, U.S. visa, or admission stamp to verify residency and eligibility. |

| 4 | Foreign Birth Certificate | A foreign birth certificate is a critical document required for an ITIN application as it verifies the applicant's identity and foreign status. This document must be original or certified, containing details like the applicant's full name, date of birth, and place of birth to meet IRS verification standards. |

| 5 | Foreign Medical Records (for dependents under 6) | Foreign medical records serve as valid proof of identity and foreign status for dependents under six years old when applying for an Individual Taxpayer Identification Number (ITIN). These records must be official documents issued by a medical professional or facility and include the child's name and date of birth to meet IRS requirements. |

| 6 | Foreign School Records (for dependents under 18) | Foreign school records serve as essential proof of identity and foreign status when applying for an ITIN for dependents under 18, demonstrating enrollment and age. These documents must be official, including transcripts, report cards, or enrollment verification issued by the educational institution abroad to meet IRS requirements. |

| 7 | Driver’s License (U.S. or Foreign) | A valid driver's license, whether issued by a U.S. state or a foreign country, serves as a primary identification document when applying for an Individual Taxpayer Identification Number (ITIN). The license must clearly display the applicant's name, photograph, and expiration date to meet the Internal Revenue Service (IRS) verification requirements. |

| 8 | U.S. State Identification Card | An immigrant applying for an Individual Taxpayer Identification Number (ITIN) must provide a valid U.S. State Identification Card as proof of identity and residency, which verifies their legal presence in the United States. This card, issued by the state's Department of Motor Vehicles or equivalent agency, is essential alongside other documents such as a passport or immigration status documents to satisfy IRS requirements. |

| 9 | U.S. Citizenship and Immigration Services (USCIS) Photo Identification | Immigrants applying for an ITIN must submit valid U.S. Citizenship and Immigration Services (USCIS) photo identification, such as a passport with a U.S. visa or an Employment Authorization Document (EAD), to verify their identity. These documents must be current, government-issued, and clearly display the applicant's photograph, name, and expiration date to meet IRS requirements. |

| 10 | Foreign Voter Registration Card | A Foreign Voter Registration Card is not accepted as a valid document for an Individual Taxpayer Identification Number (ITIN) application because it does not establish foreign status or identity. Instead, the IRS requires documents such as a passport, national identification card, or U.S. visa to verify identity and foreign status for ITIN processing. |

| 11 | U.S. Military Identification Card | An immigrant applying for an ITIN must provide a valid U.S. Military Identification Card as proof of identity and foreign status. This document is accepted by the IRS because it contains essential personal information needed to verify the applicant's identity during the ITIN application process. |

| 12 | Foreign Military Identification Card | An immigrant applying for an ITIN must provide specific identification documents, including a valid Foreign Military Identification Card, which serves as primary proof of identity and foreign status. The card must be current and include the applicant's photograph for acceptance by the IRS during the ITIN application process. |

| 13 | IRS Form W-7 (Application for IRS Individual Taxpayer Identification Number) | The IRS Form W-7 (Application for IRS Individual Taxpayer Identification Number) requires immigrants to submit original or certified copies of identification documents such as a valid passport, national identification card, or U.S. visa, along with supporting evidence proving foreign status and identity. Additional documentation may include U.S. federal tax return copies unless an exception applies, ensuring compliance with IRS regulations for ITIN issuance. |

| 14 | Federal Tax Return (if required) | An immigrant applying for an ITIN must include a valid Federal Tax Return unless exempt under specific IRS provisions. Acceptable tax returns generally include Form 1040, Form 1040NR, or Form 1040PR, accurately completed and signed to validate the ITIN application process. |

| 15 | Entry Permit | Immigrants applying for an ITIN must submit a valid entry permit, such as a visa or I-94 arrival-departure record, to prove lawful presence in the United States. This document verifies eligibility alongside identification and foreign status documents required by the IRS. |

| 16 | Rental Agreement or Lease (for address verification, if applicable) | A rental agreement or lease serves as a crucial document for address verification when applying for an ITIN, ensuring the IRS can confirm the applicant's residential location. Including a valid, signed lease with accurate address details supports the submission by validating the applicant's physical address during the ITIN processing. |

| 17 | Social Security Administration Letter (if applicable) | An immigrant applying for an ITIN must submit a valid passport and a Social Security Administration (SSA) denial letter if eligible for an SSN but not issued one. The SSA denial letter serves as critical documentation proving ineligibility for an SSN, facilitating the IRS approval of the ITIN application. |

| 18 | Supporting Documentation for Tax Treaty Benefits (if applicable) | Immigrants applying for an ITIN and claiming tax treaty benefits must submit a completed Form W-7 along with a valid passport as the primary identification document and a completed tax return. Supporting documentation includes a completed IRS Form 8233 or a treaty statement specifying the treaty article, the type of income, and the claim for reduced withholding under the applicable tax treaty. |

Understanding ITIN: Importance for Immigrants in Finance

| Document Type | Description | Importance for ITIN Application |

|---|---|---|

| Passport | Official government-issued identification with photo and biographic information. | Primary document proving identity and foreign status, essential for ITIN approval. |

| Foreign Birth Certificate | Records birth details outside the United States, including name and date of birth. | Supports verification of identity and foreign status if the passport is unavailable. |

| Visa or Admission Stamp | Indicates lawful entry and status in the United States, issued by the Department of Homeland Security. | Confirms lawful presence, necessary for IRS documentation compliance. |

| U.S. Social Security Card (if applicable) | Documents issuance of a Social Security Number (SSN) if you have one. | Ensures no duplicate issuance of ITIN if legally authorized for a SSN. |

| Federal Income Tax Return | The tax return requiring an ITIN, such as Form 1040 or 1040NR. | Demonstrates the reason for requesting an ITIN and validates filing requirements. |

| Supporting Identification Letters | Letters from financial institutions or government agencies confirming identification. | Supplement documentation when primary documents are unavailable or insufficient. |

Understanding your ITIN (Individual Taxpayer Identification Number) is crucial for immigrants engaging in financial activities in the U.S. It enables tax filing and compliance when a Social Security Number is not available. Proper documentation facilitates a smooth ITIN application process, impacting your financial credibility and tax responsibilities.

Who Needs an ITIN? Defining Eligibility Requirements

An Individual Taxpayer Identification Number (ITIN) is required for immigrants who are not eligible for a Social Security Number but must fulfill U.S. tax obligations. The primary purpose of the ITIN is to ensure proper reporting and payment of federal taxes by nonresident and resident aliens, as well as their spouses and dependents.

You need an ITIN if you are a nonresident alien required to file a U.S. tax return, a U.S. resident alien based on the substantial presence test, or a dependent or spouse of these individuals. Eligibility extends to foreign nationals who have U.S. tax reporting duties but lack authorization to obtain a Social Security Number.

Core Documents Required for ITIN Application

To apply for an Individual Taxpayer Identification Number (ITIN), you must submit specific core documents that verify your identity and foreign status. These documents are essential to ensure your application is processed accurately.

The primary documents include a valid passport or a combination of government-issued photo identification such as a national ID card, visa, or birth certificate. You are also required to provide proof of foreign status, which can be supported by documents like a U.S. Citizenship and Immigration Services (USCIS) photo identification card or a foreign voter registration card.

Proof of Identity and Foreign Status: Accepted Documents

To apply for an Individual Taxpayer Identification Number (ITIN), immigrants must provide valid proof of identity and foreign status. Accepted documents include a passport, which serves as the most reliable proof, or a combination of documents such as a national identification card, U.S. driver's license, and foreign birth certificate. Other acceptable documents are a visa issued by the U.S. Department of State, or U.S. Citizenship and Immigration Services (USCIS) authorization papers, all verified to confirm identity and foreign status for IRS processing.

Valid Passports: The Primary Document for ITIN Application

What documents are required for an immigrant to apply for an ITIN?

Valid passports serve as the primary document for ITIN applications, proving identity and foreign status. An unexpired passport is the most reliable and widely accepted proof when submitting Form W-7 to the IRS.

Alternative Identification Documents: What Else Is Accepted?

When applying for an Individual Taxpayer Identification Number (ITIN), you must submit specific identification documents. These documents verify your identity and foreign status to the IRS.

Alternative identification documents accepted include a passport, national identification card, or U.S. visa. Other options are a foreign driver's license or a birth certificate when accompanied by a photo ID. The IRS requires original documents or certified copies from issuing agencies to process your application successfully.

Supporting Financial Documentation for ITIN Requests

Immigrants applying for an ITIN must provide specific financial documents to validate their income and tax obligations. These supporting documents ensure the IRS can accurately process your ITIN request and verify your financial status.

- Federal Tax Return - Submit a complete federal tax return to demonstrate your income and tax liability.

- Bank Statements - Provide recent bank statements to confirm your financial transactions and account activity.

- Pay Stubs or Income Statements - Include pay stubs or official income documents to verify your earnings and employment status.

Common Document Errors and How to Avoid Them

Immigrants applying for an ITIN must submit specific documents to verify identity and foreign status. Avoiding common errors in these documents is crucial to ensure timely processing.

- Incorrect or Incomplete Identification Documents - Using expired passports or submitting copies instead of original or certified documents can delay ITIN approval.

- Failure to Include Required Supporting Documents - Missing tax return attachments or lack of proof for foreign status often causes application rejection.

- Improper Formatting of Documents - Submitting blurry scans or unsigned forms can lead to processing errors and extended wait times.

Submitting ITIN Application: Step-by-Step Document Checklist

Applying for an Individual Taxpayer Identification Number (ITIN) requires immigrants to submit specific documents to the IRS. Proper documentation ensures the application process is smooth and compliant with tax regulations.

- Valid Passport - Serves as the primary identification document verifying the applicant's foreign status and identity.

- Completed Form W-7 - The official IRS application form for an ITIN, accurately filled out and signed by the applicant.

- Federal Tax Return - Required in most cases to demonstrate the need for an ITIN, showing intent to file taxes.

- Supporting Identification - If no passport is available, other documents like a national ID card, U.S. visa, or birth certificate must be included.

- Letter from a U.S. Taxpayer or Financial Institution - Required to validate the applicant's tax status or financial need when applicable.

Following this document checklist helps immigrants successfully submit their ITIN application to the IRS without delays or rejections.

What Documents Does an Immigrant Need for ITIN Application? Infographic