To prepare for an IRS tax audit, gather essential documents such as income statements, expense receipts, bank statements, and previous tax returns to verify reported figures. Maintain supporting evidence for deductions and credits claimed, including charitable donation receipts, mortgage interest statements, and business expense records. Organizing these documents systematically ensures efficient verification and strengthens your ability to prove compliance with tax laws.

What Documents Do You Need for IRS Tax Audit Proof?

| Number | Name | Description |

|---|---|---|

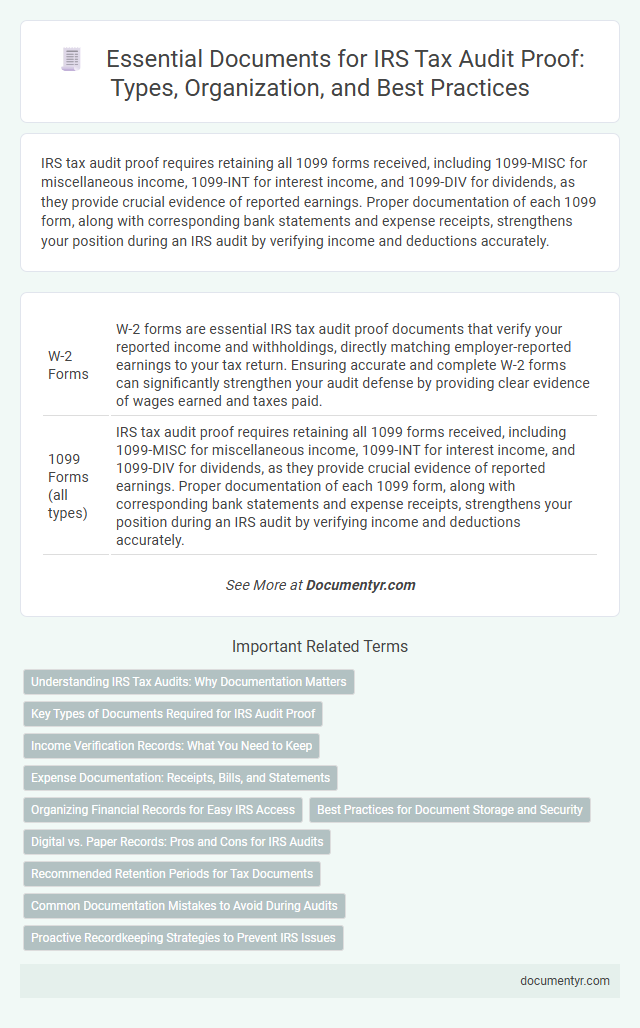

| 1 | W-2 Forms | W-2 forms are essential IRS tax audit proof documents that verify your reported income and withholdings, directly matching employer-reported earnings to your tax return. Ensuring accurate and complete W-2 forms can significantly strengthen your audit defense by providing clear evidence of wages earned and taxes paid. |

| 2 | 1099 Forms (all types) | IRS tax audit proof requires retaining all 1099 forms received, including 1099-MISC for miscellaneous income, 1099-INT for interest income, and 1099-DIV for dividends, as they provide crucial evidence of reported earnings. Proper documentation of each 1099 form, along with corresponding bank statements and expense receipts, strengthens your position during an IRS audit by verifying income and deductions accurately. |

| 3 | Bank Statements | Bank statements serve as critical evidence during an IRS tax audit, providing a detailed record of all deposits, withdrawals, and transactions that support reported income and expenses. Maintaining organized bank statements for at least six years enhances accuracy and compliance by verifying claims made on tax returns and identifying any discrepancies or unreported income. |

| 4 | Pay Stubs | Pay stubs serve as vital proof of income during an IRS tax audit, verifying wages, tax withholdings, and employment dates. Maintaining organized pay stubs alongside W-2s and bank statements strengthens audit documentation and helps substantiate reported earnings accurately. |

| 5 | Receipts (business, medical, charitable) | Receipts for business expenses, medical costs, and charitable donations are essential documents to support deductions during an IRS tax audit, providing concrete evidence of expenditures claimed on tax returns. Maintaining organized and itemized receipts helps substantiate the validity of reported expenses, reducing the risk of disallowed deductions and potential penalties. |

| 6 | Invoices | Invoices are crucial documents for IRS tax audit proof, providing detailed records of transactions, dates, amounts, and parties involved. Maintaining organized, original invoices supports expense verification, income reporting, and substantiates deductions claimed on tax returns. |

| 7 | Canceled Checks | Canceled checks serve as crucial proof of payment during an IRS tax audit, verifying expenses and income claims by clearly showing the transaction date, amount, and payee information. Retaining canceled checks along with corresponding invoices, receipts, and bank statements enhances the credibility of your financial records and supports accurate tax reporting. |

| 8 | Credit Card Statements | Credit card statements are essential IRS tax audit proof documents as they verify business expenses, support deductions, and confirm payment dates related to income or purchases. Maintaining organized, itemized statements with clear business transaction records substantiates claims and prevents discrepancies during the audit process. |

| 9 | Purchase Agreements | Purchase agreements are critical documents for IRS tax audit proof, providing clear evidence of asset acquisition dates, prices, and terms that substantiate deductions or capital gains claims. Maintaining detailed purchase agreements alongside supporting invoices and payment records strengthens your tax audit defense by validating reported financial transactions. |

| 10 | Lease Agreements | Lease agreements serve as crucial documentation during an IRS tax audit to verify rental income, terms of occupancy, and expense deductions related to property leasing. Accurate copies of signed lease contracts, rent payment records, and any amendments help substantiate reported figures and defend against potential discrepancies identified by auditors. |

| 11 | Mortgage Statements | Mortgage statements are essential documents for IRS tax audit proof as they verify the interest paid, which directly affects deductions claimed on Schedule A. Maintaining accurate records of annual mortgage statements from lenders helps substantiate mortgage interest deductions and ensures compliance with tax reporting requirements. |

| 12 | HUD-1 Settlement Statements | HUD-1 Settlement Statements are critical documents for IRS tax audit proof as they provide a detailed account of real estate transactions, including closing costs and financial disclosures necessary to verify reported income and deductions. Maintaining accurate and complete HUD-1 forms helps substantiate claims related to property purchase, sale, and associated expenses during an IRS audit. |

| 13 | Property Tax Statements | Property tax statements are essential documents for IRS tax audit proof as they verify the amount of property tax paid and support deductions claimed on tax returns. Maintaining accurate and consistent property tax records, including payment receipts and assessment notices, helps substantiate asset values and tax liability during an audit. |

| 14 | Investment Statements (brokerage, retirement) | Investment statements from brokerage accounts and retirement funds are essential documents for IRS tax audit proof, providing detailed records of asset purchases, sales, dividends, and capital gains. These statements verify reported income and deductions, ensuring compliance and supporting the accuracy of your tax return. |

| 15 | Mileage Logs | Mileage logs must include detailed records of dates, destinations, and miles driven to substantiate business-related travel expenses during an IRS tax audit. Accurate, contemporaneous mileage documentation supported by receipts or appointment records enhances credibility and compliance with IRS requirements. |

| 16 | Travel Expense Reports | Travel expense reports for an IRS tax audit require detailed documentation including receipts for transportation, lodging, meals, and incidental expenses, along with mileage logs and purpose of travel statements. Maintaining accurate and thorough travel records supports deductions and substantiates legitimate business-related travel costs during the audit process. |

| 17 | Utility Bills | Utility bills serve as crucial evidence during an IRS tax audit, verifying your residential address and supporting claims for deductions related to home office expenses or energy credits. Maintaining organized records of electricity, water, gas, and internet bills for the audit period strengthens your ability to substantiate reported deductions and ensure compliance with IRS documentation requirements. |

| 18 | Insurance Statements | Insurance statements such as homeowners, auto, and health insurance policies provide critical proof of coverage and expense claims during an IRS tax audit. Maintaining organized records of premium payments, claim details, and policy documents verifies deductions and supports income verification in financial assessments. |

| 19 | Medical Bills | Medical bills supporting IRS tax audit proof should include detailed statements from healthcare providers with patient information, dates of service, itemized services rendered, and payment receipts to verify deductions accurately. Maintaining organized records of insurance claims, Explanation of Benefits (EOB), and proof of out-of-pocket expenses strengthens audit compliance and substantiates medical expense claims on tax returns. |

| 20 | Health Insurance Forms (Form 1095-A/B/C) | Health insurance forms, including Form 1095-A, 1095-B, and 1095-C, serve as critical IRS tax audit proof by verifying enrollment in qualified health coverage and eligibility for premium tax credits under the Affordable Care Act. Maintaining accurate copies of these documents ensures substantiation of reported coverage periods, avoiding penalties and facilitating compliance during tax audits. |

| 21 | Donation Acknowledgments | Donation acknowledgments required for IRS tax audit proof include official receipts or letters from the charitable organization that specify the donor's name, the amount donated, and the date of the contribution, ensuring compliance with IRS substantiation rules. Maintaining bank statements, canceled checks, or credit card statements that correlate with the donation further supports the validity of charitable contributions during tax audits. |

| 22 | Childcare Records | To provide proof during an IRS tax audit related to childcare expenses, maintain detailed childcare records including receipts, canceled checks, and provider statements specifying dates, costs, and services rendered. Accurate documentation of the caregiver's taxpayer identification number (TIN) or Social Security Number (SSN) is essential to validate eligibility for the Child and Dependent Care Credit. |

| 23 | Tuition Statements (Form 1098-T) | Tuition Statements (Form 1098-T) serve as critical documentation for IRS tax audit proof by reporting qualified educational expenses paid to eligible institutions, which directly impact education credits and deductions. Maintaining accurate copies of Form 1098-T alongside receipts and payment records strengthens your audit defense by verifying the claimed tuition expenses with IRS records. |

| 24 | Student Loan Interest Statements (Form 1098-E) | Student Loan Interest Statements (Form 1098-E) are essential documents for IRS tax audit proof as they verify the amount of interest paid on qualified student loans, which can be claimed as a deduction. Retain copies of all 1098-E forms received from loan servicers during the audit period to substantiate your reported student loan interest deduction. |

| 25 | Business Licenses | Business licenses serve as critical documentation during an IRS tax audit to verify the legitimacy and legal authorization of your business operations. Maintaining copies of current and past business licenses, along with any associated renewal certificates, helps substantiate your compliance with local and state regulations, which the IRS may scrutinize to confirm your reported business activities. |

| 26 | Partnership Agreements | Partnership agreements are critical documents in an IRS tax audit as they detail profit distribution, ownership percentages, and roles, providing proof of how income and deductions are allocated among partners. Maintaining accurate, signed, and dated partnership agreements supports transparency and substantiates reported tax information to meet IRS requirements effectively. |

| 27 | Prior Year Tax Returns | Prior year tax returns serve as critical documentation during an IRS tax audit, providing a comprehensive record of reported income, deductions, and credits that auditors use to verify current filings. Maintaining accurate copies of Forms 1040, W-2s, 1099s, and supporting schedules from previous years ensures you can substantiate your tax positions and promptly address any discrepancies identified by the IRS. |

| 28 | Schedules and Tax Worksheets | To provide proof during an IRS tax audit, it is essential to have all relevant schedules such as Schedule A for itemized deductions, Schedule C for business income, and Schedule E for rental income, along with supporting tax worksheets that detail calculations and document expenses or income sources. These documents validate the figures reported on your tax return and assist in substantiating deductions, credits, and income claims to the IRS auditor. |

| 29 | Correspondence with IRS | Maintain organized records of all IRS correspondence, including audit notices, letters, and written communications as essential proof during a tax audit. Retain copies of submitted tax returns, supporting documentation such as W-2s, 1099s, receipts, and any responses sent to the IRS to substantiate your tax positions. |

| 30 | Employment Contracts | Employment contracts are vital documents for IRS tax audit proof as they verify income, job title, and employment tenure, directly supporting reported wages and withholding amounts. Review signed agreements, amendments, and payment records to substantiate salary claims and demonstrate compliance with tax regulations. |

Understanding IRS Tax Audits: Why Documentation Matters

Understanding IRS tax audits is essential for ensuring compliance and avoiding penalties. Proper documentation serves as proof of your reported income, deductions, and credits during an audit.

IRS tax audits require thorough proof to verify the accuracy of your tax returns. Key documents include W-2 forms, 1099s, expense receipts, bank statements, and loan agreements. Maintaining organized records helps substantiate your claims and expedites the audit process.

Key Types of Documents Required for IRS Audit Proof

Maintaining proper documentation is crucial for IRS tax audit proof to verify income, deductions, and credits. Clear and organized records help substantiate your tax return and resolve disputes efficiently.

- Income Records - Include W-2 forms, 1099s, and bank statements to confirm all sources of income reported.

- Expense Receipts - Collect receipts, invoices, and canceled checks to validate deductible business and personal expenses.

- Supporting Documents - Retain contracts, loan agreements, and correspondence related to tax claims and deductions.

Income Verification Records: What You Need to Keep

What income verification records are essential to keep for an IRS tax audit proof? Maintaining accurate income documents helps substantiate your reported earnings and minimize audit risks. Key records include W-2 forms, 1099s, pay stubs, and bank statements that demonstrate consistent income sources.

Expense Documentation: Receipts, Bills, and Statements

Expense documentation is crucial during an IRS tax audit to substantiate your reported deductions and ensure compliance. Receipts, bills, and bank statements serve as primary evidence for verifying business expenses and personal deductions.

Receipts must clearly indicate the date, vendor, and amount paid, providing a detailed account of each transaction. Bills and statements complement receipts by offering additional verification and context for expenses claimed on your tax return.

Organizing Financial Records for Easy IRS Access

Organizing financial records is crucial for providing clear and accessible proof during an IRS tax audit. Essential documents include income statements, bank statements, receipts, and expense records, all categorized by date and type. Maintaining these records in a systematic and retrievable manner ensures efficient IRS access and smooth audit processing.

Best Practices for Document Storage and Security

Maintaining proper documentation is essential for IRS tax audit proof and ensures accurate verification of financial information. Best practices for document storage and security protect sensitive data and facilitate smooth audit processes.

- Keep organized and complete records - Store all relevant tax documents such as receipts, invoices, bank statements, and expense reports in clearly labeled folders.

- Use secure digital storage solutions - Protect electronic documents with encryption and password access to prevent unauthorized access and data breaches.

- Maintain backups regularly - Save copies of important tax records in separate physical or cloud-based locations to avoid data loss due to hardware failure or theft.

Following these best practices improves your readiness and confidence during an IRS tax audit.

Digital vs. Paper Records: Pros and Cons for IRS Audits

Maintaining thorough documentation is crucial when preparing for an IRS tax audit to verify income, deductions, and credits. Choosing between digital and paper records impacts the ease and reliability of providing audit proof.

- Digital Records Offer Easy Accessibility - Digital files can be quickly searched and shared during an IRS audit, facilitating timely responses.

- Paper Records Provide Tangible Backup - Physical documents serve as hard copies that the IRS may trust for authenticity and original signatures.

- Compliance and Security Vary by Format - Digital records require secure storage and proper backups, while paper records risk damage or loss over time.

Recommended Retention Periods for Tax Documents

| Document Type | Description | Recommended Retention Period |

|---|---|---|

| Tax Returns | Copies of filed federal and state tax returns for each year | At least 7 years |

| Income Records | W-2s, 1099s, bank statements, and any documents showing income sources | Minimum of 3 years from the tax filing date |

| Expense Receipts | Receipts, invoices, and other proofs of deductible expenses | 3 to 7 years, depending on the nature of the expense |

| Employment Tax Records | Payroll records, tax deposits, and employee documentation | At least 4 years after the due date of the tax return |

| Property Records | Documents showing purchase, improvement, and sale of assets | Keep for as long as you own the property plus 7 years after disposal |

| Bank and Credit Card Statements | Statements supporting income and expense claims on tax returns | 3 years, unless involved in ongoing audits or disputes |

| Proof of Charitable Contributions | Receipts and acknowledgment letters from qualified organizations | 3 to 7 years, matching your records of deductions claimed |

Common Documentation Mistakes to Avoid During Audits

IRS tax audits require thorough documentation to verify your reported income and deductions. Essential documents include income statements, bank records, receipts, and expense logs.

Common mistakes during audits involve missing receipts, inconsistent data, and poorly organized files. Avoid these errors by maintaining accurate, detailed records and cross-checking statements before submission.

What Documents Do You Need for IRS Tax Audit Proof? Infographic