Business loan applications require essential documents such as financial statements, including balance sheets, income statements, and cash flow statements, to demonstrate the company's financial health. Lenders also require tax returns, business licenses, and legal documents like articles of incorporation to verify business legitimacy. Additionally, a detailed business plan and personal financial information of the owners are often necessary to assess creditworthiness and repayment ability.

What Documents Are Needed for Business Loan Applications?

| Number | Name | Description |

|---|---|---|

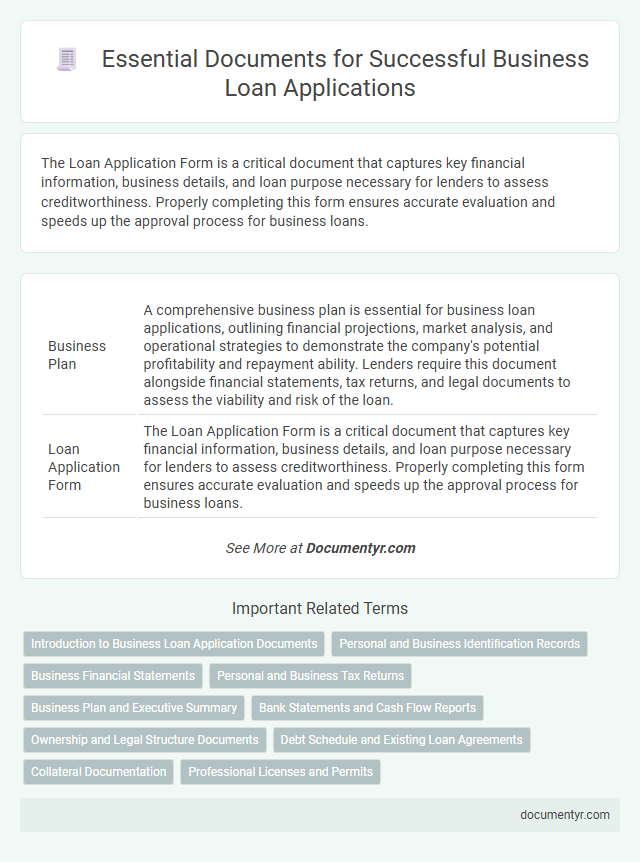

| 1 | Business Plan | A comprehensive business plan is essential for business loan applications, outlining financial projections, market analysis, and operational strategies to demonstrate the company's potential profitability and repayment ability. Lenders require this document alongside financial statements, tax returns, and legal documents to assess the viability and risk of the loan. |

| 2 | Loan Application Form | The Loan Application Form is a critical document that captures key financial information, business details, and loan purpose necessary for lenders to assess creditworthiness. Properly completing this form ensures accurate evaluation and speeds up the approval process for business loans. |

| 3 | Business License | A valid business license is a crucial document required for business loan applications as it verifies the legal authorization of the business to operate within a specific jurisdiction. Lenders use this license to confirm the legitimacy and compliance of the business before approving financing. |

| 4 | Articles of Incorporation/Organization | Articles of Incorporation or Organization serve as critical documents in business loan applications, establishing the legal existence and structure of the company. Lenders use these documents to verify ownership, business type, and legitimacy before approving financing. |

| 5 | Employer Identification Number (EIN) | The Employer Identification Number (EIN) serves as a vital identifier for business loan applications, enabling lenders to verify the legal existence and tax status of the company. Including a valid EIN alongside financial statements, tax returns, and business licenses ensures a comprehensive submission that meets most lender requirements. |

| 6 | Personal Identification (e.g., driver’s license, passport) | Lenders require valid personal identification documents such as a driver's license or passport to verify the borrower's identity during business loan applications. These documents ensure compliance with anti-fraud regulations and protect against identity theft in the loan approval process. |

| 7 | Personal Credit Report | Lenders require a personal credit report to assess the borrower's creditworthiness and repayment history when applying for a business loan. This report typically includes credit scores, outstanding debts, payment history, and any derogatory marks, providing critical insight into the applicant's financial responsibility. |

| 8 | Business Credit Report | A business credit report is a critical document for loan applications, providing lenders with detailed insights into the company's credit history, payment behavior, and outstanding debts. Including this report helps demonstrate the business's financial responsibility and creditworthiness, which are key factors lenders assess when approving loans. |

| 9 | Personal Tax Returns | Lenders require personal tax returns, typically from the past two to three years, to assess the applicant's individual income, financial stability, and ability to repay the business loan. These documents provide a detailed record of earnings, deductions, and taxable income, serving as a critical component in verifying personal financial health. |

| 10 | Business Tax Returns | Business tax returns are critical documents in business loan applications, providing lenders with detailed financial history and proof of income stability over multiple fiscal years. These returns typically include profit and loss statements, balance sheets, and the IRS Form 1120, which help verify the business's ability to repay the loan. |

| 11 | Bank Statements (personal and business) | Bank statements, both personal and business, are crucial documents for business loan applications as they provide lenders with a clear view of cash flow, financial stability, and spending patterns. Typically, lenders require statements from the past three to six months to assess the borrower's ability to repay the loan and manage business expenses effectively. |

| 12 | Balance Sheet | A detailed balance sheet is essential for business loan applications, as it provides a snapshot of the company's financial health by outlining assets, liabilities, and equity. Lenders analyze this document to assess the business's ability to repay the loan and determine creditworthiness. |

| 13 | Profit and Loss Statement (Income Statement) | A Profit and Loss Statement (Income Statement) is essential for business loan applications as it details a company's revenues, expenses, and net profit over a specific period, demonstrating financial health and operational efficiency. Lenders analyze this document to assess profitability trends and the borrower's ability to generate sufficient cash flow for loan repayment. |

| 14 | Cash Flow Statement | A detailed cash flow statement is crucial for business loan applications as it demonstrates the company's ability to generate sufficient liquidity to cover loan repayments. Lenders evaluate cash inflows and outflows to assess the business's financial health and repayment capacity. |

| 15 | Accounts Receivable Aging Report | An Accounts Receivable Aging Report is crucial for business loan applications as it provides detailed insights into outstanding invoices categorized by their due dates, helping lenders assess the company's cash flow and credit risk. This document demonstrates the borrower's ability to manage receivables and maintain liquidity, directly influencing loan approval decisions and terms. |

| 16 | Accounts Payable Report | The Accounts Payable Report is essential for business loan applications as it details outstanding liabilities and helps lenders assess the company's short-term financial obligations. Providing an updated report demonstrates transparency and allows the lender to evaluate cash flow management and payment reliability. |

| 17 | Collateral Documentation | Collateral documentation for business loan applications typically includes property deeds, vehicle titles, equipment appraisals, and inventory lists to verify asset ownership and value. Lenders require these documents to assess the security of the loan and reduce risk by ensuring that pledged assets can cover the loan amount in case of default. |

| 18 | Debt Schedule | A detailed debt schedule outlining all existing liabilities, including loan types, balances, interest rates, and repayment terms, is crucial for business loan applications to assess creditworthiness and debt capacity. Lenders rely on this documentation to evaluate the applicant's current financial obligations and ensure the new loan fits within the overall debt structure. |

| 19 | Ownership and Affiliation Details | Business loan applications typically require detailed ownership and affiliation documents such as ownership structure certificates, shareholder agreements, and records of parent or subsidiary companies. Providing accurate and up-to-date proof of ownership percentages, partnership details, and affiliations with other business entities helps lenders assess risk and verify the applicant's legal and financial standing. |

| 20 | Commercial Lease Agreement | Lenders require a Commercial Lease Agreement to verify the business's physical location, lease terms, and monthly rental obligations as part of the business loan application process. This document substantiates the company's operating expenses and helps assess financial stability and risk. |

| 21 | Legal Contracts or Agreements | Business loan applications require key legal contracts or agreements such as Articles of Incorporation, partnership agreements, and shareholder agreements to verify the business structure and ownership. Lenders also request contracts related to leases, vendor agreements, and existing loan agreements to assess legal obligations and financial risk. |

| 22 | Business Insurance Documentation | Business loan applications require comprehensive business insurance documentation, including proof of liability insurance, workers' compensation policies, and property insurance certificates to demonstrate risk management and protect lender interests. Lenders prioritize these documents to assess the borrower's ability to mitigate potential losses and ensure loan security. |

| 23 | Resumes of Owners and Key Managers | Resumes of owners and key managers are essential for business loan applications as they demonstrate the leadership team's expertise, experience, and ability to manage the business effectively. Detailed resumes highlighting professional backgrounds, industry experience, and relevant accomplishments help lenders assess the management team's capacity to drive business success and mitigate risk. |

| 24 | Current Business Debt Schedule | A comprehensive current business debt schedule listing all outstanding loans, credit lines, and creditor details is essential for business loan applications to demonstrate existing liabilities and repayment history. Lenders analyze this schedule to assess financial stability and credit risk before approving new financing. |

Introduction to Business Loan Application Documents

Applying for a business loan requires a comprehensive set of documents to demonstrate financial stability and business viability. Lenders use these documents to evaluate your creditworthiness and repayment ability.

Common documents include financial statements, tax returns, and business plans. Preparing these materials accurately can streamline the loan approval process and improve your chances of securing funding.

Personal and Business Identification Records

| Personal Identification Records | |

|---|---|

| Government-Issued ID | Driver's license, passport, or state ID to verify the applicant's identity and citizenship status. |

| Social Security Number (SSN) | Required for credit checks and to confirm the applicant's financial history and creditworthiness. |

| Proof of Residency | Utility bills, lease agreements, or bank statements showing the applicant's current residential address. |

| Personal Tax Returns | Usually the last 2 years of IRS tax returns to evaluate personal income stability and capacity to repay the loan. |

| Business Identification Records | |

| Business License or Registration | Official documentation confirming the business is legally registered and authorized to operate in its jurisdiction. |

| Employer Identification Number (EIN) | IRS-issued business tax ID used for tax reporting and identity validation of the business entity. |

| Articles of Incorporation or Organization | Documents that establish the business entity's legal structure and ownership details. |

| Operating Agreement or Bylaws | Internal documents outlining the management structure, roles, and operational procedures of the business. |

| Business Tax Returns | Typically the past 2 years' returns, reflecting business income, expenses, and overall financial health. |

Business Financial Statements

Business financial statements are crucial documents required for loan applications. These include the income statement, balance sheet, and cash flow statement, which provide lenders with a clear picture of your company's financial health. Accurate and up-to-date financial records increase the likelihood of loan approval and favorable terms.

Personal and Business Tax Returns

What documents are essential for business loan applications? Lenders require personal and business tax returns to verify income and financial stability. These documents provide a clear picture of your financial history and help assess loan eligibility.

Business Plan and Executive Summary

Submitting a well-prepared business plan is essential for business loan applications, as it outlines your company's goals, strategies, and financial projections. An executive summary provides a concise overview of the business plan, highlighting key points that lenders need to understand quickly. These documents demonstrate your business's potential and credibility, increasing the likelihood of loan approval.

Bank Statements and Cash Flow Reports

Bank statements and cash flow reports are critical documents required for business loan applications. These papers provide lenders with a clear picture of a business's financial health and repayment capability.

- Bank Statements - Showcase the business's account activity, reflecting consistent income and expenses over a specified period.

- Cash Flow Reports - Detail the inflow and outflow of cash, highlighting the business's operational efficiency and ability to meet financial obligations.

- Financial Transparency - Both documents ensure transparency, helping lenders assess risk and validate the business's creditworthiness.

Submitting accurate and thorough bank statements and cash flow reports significantly strengthens a business loan application.

Ownership and Legal Structure Documents

Ownership and legal structure documents are essential for business loan applications as they verify the legitimacy and framework of the business. Lenders require these documents to assess ownership details and legal responsibilities.

- Articles of Incorporation - This document establishes the business as a legal entity and outlines its structure and purpose.

- Partnership Agreement - Defines the roles, responsibilities, and ownership percentages among partners in a business partnership.

- Operating Agreement - Details the management structure and ownership stakes within a limited liability company (LLC).

Debt Schedule and Existing Loan Agreements

When applying for a business loan, providing a comprehensive debt schedule is crucial. This document outlines all current debts, including amounts owed, payment due dates, and interest rates.

Existing loan agreements must also be submitted to give lenders a clear understanding of your current financial obligations and repayment terms. These agreements detail the conditions of prior loans, helping assess your creditworthiness and risk level. Accurate documentation of debts and agreements facilitates a smoother loan approval process.

Collateral Documentation

```htmlCollateral documentation is essential for securing a business loan, as it provides lenders with assurance of repayment. Common collateral includes real estate, equipment, inventory, or accounts receivable.

You must provide detailed documents proving ownership and value of the collateral, such as property deeds, equipment invoices, or inventory lists. Accurate and up-to-date collateral records strengthen the loan application and increase approval chances.

```What Documents Are Needed for Business Loan Applications? Infographic