Essential documents for opening a joint bank account include valid identification such as a passport or driver's license, proof of address like utility bills or lease agreements, and Social Security numbers or tax identification numbers for all account holders. Banks may also require completed application forms signed by all parties and, in some cases, income verification or employment details to comply with regulatory requirements. Ensuring all documentation is accurate and up-to-date facilitates a smooth account opening process and avoids unnecessary delays.

What Documents Are Necessary for Opening a Joint Bank Account?

| Number | Name | Description |

|---|---|---|

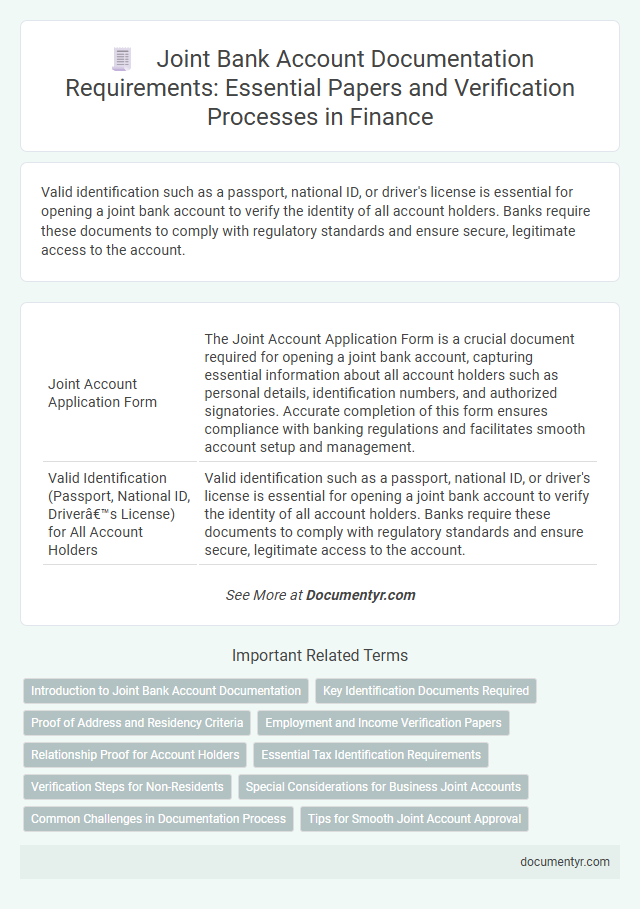

| 1 | Joint Account Application Form | The Joint Account Application Form is a crucial document required for opening a joint bank account, capturing essential information about all account holders such as personal details, identification numbers, and authorized signatories. Accurate completion of this form ensures compliance with banking regulations and facilitates smooth account setup and management. |

| 2 | Valid Identification (Passport, National ID, Driver’s License) for All Account Holders | Valid identification such as a passport, national ID, or driver's license is essential for opening a joint bank account to verify the identity of all account holders. Banks require these documents to comply with regulatory standards and ensure secure, legitimate access to the account. |

| 3 | Proof of Address (Utility Bill, Bank Statement, Lease Agreement) | Proof of address is a crucial document when opening a joint bank account, typically accepted forms include recent utility bills, bank statements, or lease agreements that clearly display the applicants' names and residential addresses. Banks require these documents to verify the identity and residency of each account holder to comply with regulatory standards and prevent fraud. |

| 4 | Social Security Number or Tax Identification Number | Opening a joint bank account requires each account holder to provide their Social Security Number (SSN) or Tax Identification Number (TIN) as key identification for tax reporting and identity verification. Banks use these numbers to ensure compliance with federal regulations and to track interest earnings for tax purposes. |

| 5 | Employment or Income Proof (Pay Stub, Employment Letter, Tax Return) | Employment or income proof is essential for opening a joint bank account, typically including recent pay stubs, an official employment letter, or the latest tax return documents to verify financial stability and income sources. Banks use these documents to assess the account holders' ability to maintain the account and meet minimum balance requirements. |

| 6 | Signature Card | A Signature Card is a crucial document required for opening a joint bank account, as it contains the signatures of all account holders to verify identity and authorize transactions. This card helps banks authenticate authorized users and prevent fraud by maintaining a record of valid signatures for comparison during account activities. |

| 7 | Marriage Certificate (if applicable) | A marriage certificate is essential for opening a joint bank account when the account holders are spouses, as it verifies the marital relationship and ensures compliance with bank policies. Banks require this document to prevent fraud, confirm identity, and facilitate joint ownership of financial assets. |

| 8 | Power of Attorney (if applicable) | Power of Attorney documents are necessary for opening a joint bank account when one account holder authorizes another individual to act on their behalf, providing legal authorization for transactions and account management. This document must be notarized and submitted along with identity proofs and address verification to comply with the bank's regulatory requirements. |

| 9 | Consent/Authorization Forms | Opening a joint bank account requires signed consent or authorization forms from all account holders, ensuring legal agreement and shared access to the account. These documents verify each person's identity, confirm their consent to the terms, and authorize the bank to manage the account jointly. |

| 10 | Initial Deposit Proof | Initial deposit proof for opening a joint bank account typically includes a bank statement, digital or physical receipt, or a canceled check confirming the transaction. This documentation establishes the legitimacy of funds and fulfills the bank's regulatory requirements for account activation. |

| 11 | FATCA/CRS Self-Certification Forms (for tax residency compliance) | Providing FATCA and CRS Self-Certification Forms is essential when opening a joint bank account to verify each account holder's tax residency status and ensure compliance with international tax regulations. These documents enable the financial institution to report accurate information to tax authorities under FATCA and CRS frameworks, preventing tax evasion and facilitating global transparency. |

Introduction to Joint Bank Account Documentation

Opening a joint bank account involves submitting specific documents to verify the identity and consent of all account holders. Proper documentation helps ensure security and compliance with banking regulations.

- Identification Proof - Valid government-issued IDs such as passports or driver's licenses confirm your and co-applicants' identities.

- Address Proof - Recent utility bills, rental agreements, or bank statements establish the residential address of all applicants.

- Signature Verification - Signatures from all account holders are required to authorize transactions and manage the joint account securely.

Key Identification Documents Required

| Document Type | Purpose | Details |

|---|---|---|

| Valid Government-Issued ID | Proof of Identity | Passport, Driver's License, or National ID Card |

| Proof of Address | Confirm Residential Address | Utility Bill, Bank Statement, or Lease Agreement (usually dated within last 3 months) |

| Social Security Number (SSN) or Tax Identification Number (TIN) | Tax and Identification Purposes | Required for verification and compliance with financial regulations |

| Signature Verification Document | Authenticate Account Holder | Specimen signature card or digitally captured signature |

| Joint Account Application Form | Formal Request to Open Account | Completed and signed by all account holders |

| Additional Identification | Enhanced Security and Verification | Secondary ID such as Employee ID or Student Card if required by the bank |

Your identity and compliance with these document requirements smooth the process of opening a joint bank account.

Proof of Address and Residency Criteria

Proof of address is a crucial document required to open a joint bank account, verifying the residence of all account holders. Acceptable documents include utility bills, lease agreements, or government-issued correspondence, typically dated within the last three months. Banks also require residency criteria to be met, ensuring applicants legally reside in the country where the account is being opened.

Employment and Income Verification Papers

To open a joint bank account, employment and income verification papers are essential for confirming the financial stability of all account holders. Common documents include recent pay stubs, employment letters, and tax returns, which help banks assess the income sources. These papers ensure compliance with financial regulations and protect against fraudulent activities.

Relationship Proof for Account Holders

What relationship proofs are required to open a joint bank account? Banks typically request documents that verify the nature of the relationship between account holders, such as marriage certificates, proof of partnership, or birth certificates for family members. Providing valid relationship proof ensures smoother account setup and compliance with banking regulations.

Essential Tax Identification Requirements

Opening a joint bank account requires specific documents to verify the identity and tax status of both account holders. Essential tax identification documents ensure compliance with financial regulations and facilitate accurate reporting to tax authorities.

- Tax Identification Number (TIN) - Both parties must provide their TIN to confirm their tax obligations and enable proper account registration.

- Social Security Number (SSN) or Equivalent - This unique identifier is necessary for tax reporting and identity verification purposes in many jurisdictions.

- Tax Residency Certificate - Some banks require proof of tax residency to determine applicable tax laws and reporting requirements for the account holders.

Verification Steps for Non-Residents

Opening a joint bank account requires specific documentation to verify the identities of all account holders, especially for non-residents. Compliance with international banking regulations makes these verification steps essential for security and transparency.

- Valid Identification Documents - Government-issued passports or national ID cards must be presented to confirm identity.

- Proof of Address - Recent utility bills, bank statements, or rental agreements demonstrate residential status.

- Tax Identification Number (TIN) - Submission of a foreign tax ID ensures compliance with cross-border tax regulations.

You must provide all required documents to meet the bank's verification criteria and avoid delays in account opening.

Special Considerations for Business Joint Accounts

Opening a joint bank account for business purposes requires specific documentation beyond personal identification. Essential documents typically include valid identification, proof of address, and the business registration certificate or partnership agreement.

Special considerations for business joint accounts involve submitting tax identification numbers and business licenses to comply with regulatory requirements. Banks may also require a resolution from the business owners authorizing the opening of the joint account and defining account access rights for each partner.

Common Challenges in Documentation Process

Opening a joint bank account requires specific documents such as valid identification, proof of address, and Social Security numbers for all account holders. Financial institutions may also request additional paperwork depending on their policies and the account type.

Common challenges in the documentation process include mismatched information between documents, expired identification, and incomplete forms. Both parties must ensure their documents are current and consistent to avoid delays. Your careful preparation can streamline account approval and prevent unnecessary complications.

What Documents Are Necessary for Opening a Joint Bank Account? Infographic