To apply for a car loan, you typically need to provide proof of identity, such as a driver's license or passport, and proof of income including recent pay stubs or tax returns. Lenders also require documentation of your residence, like utility bills or lease agreements, along with your credit history or credit report. Vehicle-specific documents, such as the car's title or purchase agreement, may be necessary to finalize the loan process.

What Documents Are Needed for Car Loan Application?

| Number | Name | Description |

|---|---|---|

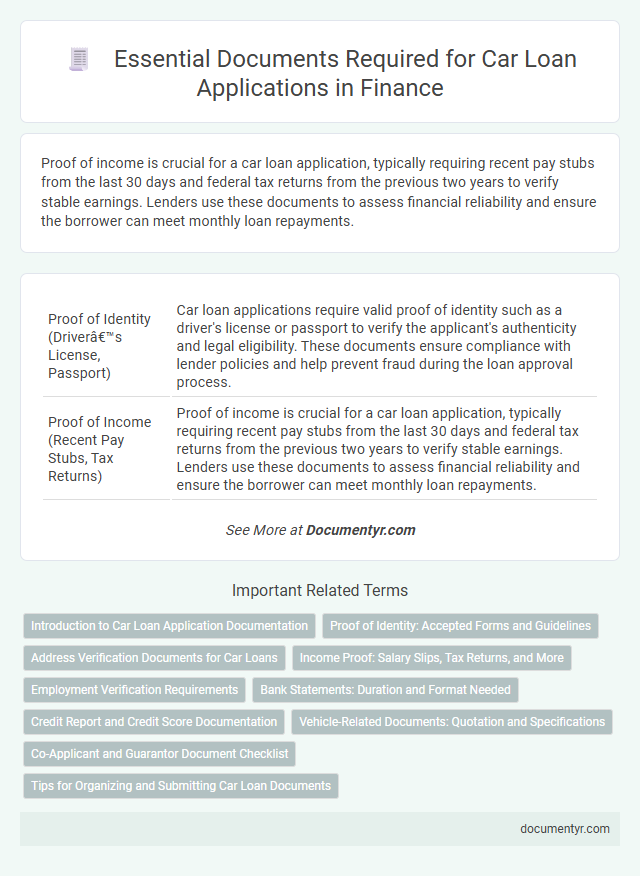

| 1 | Proof of Identity (Driver’s License, Passport) | Car loan applications require valid proof of identity such as a driver's license or passport to verify the applicant's authenticity and legal eligibility. These documents ensure compliance with lender policies and help prevent fraud during the loan approval process. |

| 2 | Proof of Income (Recent Pay Stubs, Tax Returns) | Proof of income is crucial for a car loan application, typically requiring recent pay stubs from the last 30 days and federal tax returns from the previous two years to verify stable earnings. Lenders use these documents to assess financial reliability and ensure the borrower can meet monthly loan repayments. |

| 3 | Proof of Employment (Employment Verification Letter, Employer Contact) | Proof of employment is critical for a car loan application and generally includes an employment verification letter outlining job title, salary, and length of employment, which lenders use to assess income stability. Lenders may also directly contact the employer to confirm these details, ensuring the applicant's ability to repay the loan. |

| 4 | Proof of Residency (Utility Bill, Lease Agreement) | Proof of residency for a car loan application commonly includes a recent utility bill or a valid lease agreement, both serving as official verification of your current address. Lenders require these documents to confirm your residential stability and mitigate the risk of loan default. |

| 5 | Credit Report or Credit Score | A credit report or credit score is essential for a car loan application, as lenders use it to assess the applicant's creditworthiness and determine loan eligibility. These documents typically include detailed credit history, outstanding debts, and payment behavior, directly impacting interest rates and loan terms. |

| 6 | Vehicle Information (Purchase Agreement, Bill of Sale, Vehicle Registration) | Vehicle information documents essential for a car loan application include the purchase agreement, bill of sale, and vehicle registration, which verify the details and ownership status of the vehicle. Accurate submission of these documents helps lenders assess the car's value and ensures compliance with loan underwriting requirements. |

| 7 | Proof of Insurance | Proof of insurance is a critical document required for a car loan application, demonstrating that the vehicle will be adequately covered against potential damages or liabilities. Lenders typically require a valid insurance policy that meets their minimum coverage criteria before approving the loan. |

| 8 | Bank Statements | Bank statements are crucial for car loan applications as they verify income consistency and financial stability over recent months. Lenders typically require at least three to six months of bank statements to assess the applicant's ability to make timely loan repayments. |

| 9 | Down Payment Proof (Receipt, Bank Statement) | Car loan applications require down payment proof such as a receipt or a bank statement showing the transaction to verify the source and amount of the initial payment. Lenders use these documents to assess financial stability and confirm the borrower's commitment to the loan. |

| 10 | Trade-In Documentation (Title, Registration, Loan Payoff Information) | Trade-in documentation for a car loan application must include the vehicle title to prove ownership, registration papers for current vehicle details, and loan payoff information if there is an existing lien balance. These documents ensure accurate trade-in value assessment and streamline the loan approval process by confirming clear title transfer and outstanding debt obligations. |

Introduction to Car Loan Application Documentation

Applying for a car loan requires submitting specific documents to verify identity, income, and financial stability. Proper documentation ensures a smooth and efficient approval process.

- Proof of Identity - A government-issued ID such as a driver's license or passport confirms the applicant's identity.

- Proof of Income - Recent pay stubs, tax returns, or bank statements demonstrate the applicant's ability to repay the loan.

- Credit Information - Credit reports or scores help lenders assess creditworthiness and risk.

Having these documents prepared in advance accelerates the car loan application process.

Proof of Identity: Accepted Forms and Guidelines

Proof of identity is a crucial requirement for a car loan application to verify the applicant's legal status. Accepted forms typically include government-issued identification such as a driver's license, passport, or state ID card.

Financial institutions also require documents to meet specific guidelines, such as being current and unexpired. Some lenders may accept additional forms like Social Security cards or resident permits depending on their policies.

Address Verification Documents for Car Loans

Address verification is a crucial part of the car loan application process to confirm the borrower's residential stability. Lenders require valid proof of address to assess the applicant's eligibility and mitigate risk.

Commonly accepted address verification documents include utility bills, bank statements, and government-issued ID cards with current addresses. Lease agreements and property tax receipts also serve as reliable proof for car loan applications.

Income Proof: Salary Slips, Tax Returns, and More

Applying for a car loan requires submitting various documents to verify your financial stability. Income proof is crucial to demonstrate your ability to repay the loan.

- Salary Slips - Recent salary slips provide evidence of your monthly income and employment status.

- Tax Returns - Income tax returns confirm your annual earnings and financial consistency over time.

- Bank Statements - Bank statements showcase your cash flow and savings, supporting your financial reliability.

Employment Verification Requirements

Employment verification is a critical part of the car loan application process. Lenders require proof of stable income to assess your ability to repay the loan.

Documents typically needed include recent pay stubs, employer contact information, and sometimes a letter verifying employment status. Bank statements may also be requested to confirm consistent income deposits. Self-employed applicants might need tax returns and profit-and-loss statements to satisfy employment verification requirements.

Bank Statements: Duration and Format Needed

What duration of bank statements is required for a car loan application? Lenders typically ask for bank statements covering the last three to six months to assess your financial stability. These statements should be official and detailed, showing consistent income and expenses.

In what format should bank statements be submitted for a car loan application? Most banks prefer statements in PDF format to ensure authenticity and ease of review. Paper statements or digitally downloaded statements from your online banking portal are commonly accepted formats.

Credit Report and Credit Score Documentation

When applying for a car loan, lenders require a detailed credit report to assess your financial history and repayment behavior. A credit report includes information on past loans, payment timeliness, outstanding debts, and any defaults, which directly impacts loan approval chances. Providing an updated credit score documentation helps lenders quickly evaluate your creditworthiness and determines the interest rate offered for the car loan.

Vehicle-Related Documents: Quotation and Specifications

Vehicle-related documents are essential for a car loan application, specifically the quotation and specifications. The quotation provides the loan provider with the exact price of the vehicle, including any taxes or fees. Specifications detail the car's make, model, year, and features, ensuring accurate assessment of the loan request.

Co-Applicant and Guarantor Document Checklist

Applying for a car loan requires submitting specific documents to verify identity, income, and creditworthiness. Co-applicants and guarantors must provide additional paperwork to support the loan application process effectively.

- Identity Proof - Valid government-issued ID such as a passport, driver's license, or Aadhaar card confirms the co-applicant or guarantor's identity.

- Address Proof - Utility bills, rental agreements, or bank statements verify the residential address of the co-applicant or guarantor.

- Income Proof - Recent salary slips, income tax returns, or bank statements demonstrate financial capability to repay the loan.

What Documents Are Needed for Car Loan Application? Infographic