Essential documents for inheritance tax filing include the original will, death certificate, and a detailed inventory of the deceased's assets and liabilities. Financial statements, property deeds, and valuation reports ensure accurate assessment of the estate's value. Executors must also provide tax returns and any relevant correspondence with tax authorities to comply with legal requirements.

What Documents Are Essential for Inheritance Tax Filing?

| Number | Name | Description |

|---|---|---|

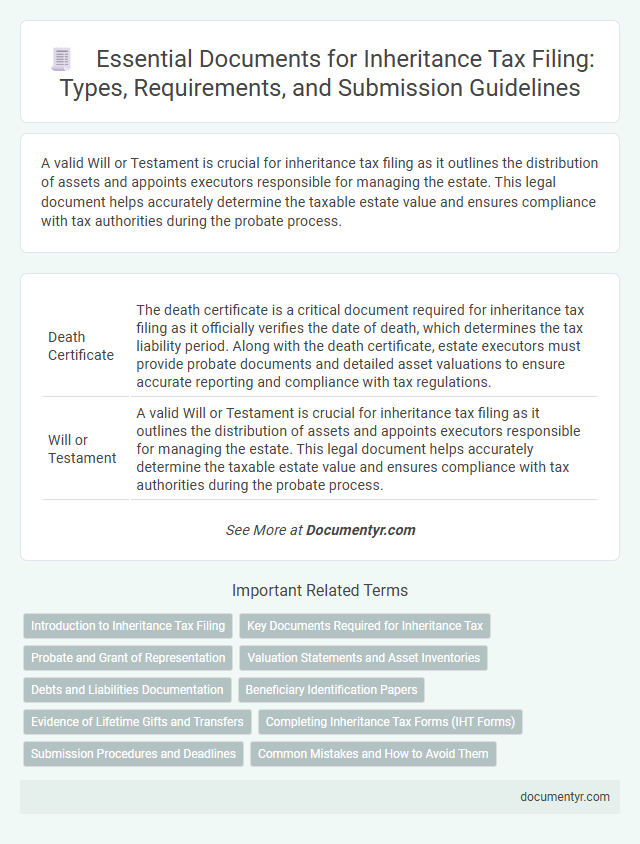

| 1 | Death Certificate | The death certificate is a critical document required for inheritance tax filing as it officially verifies the date of death, which determines the tax liability period. Along with the death certificate, estate executors must provide probate documents and detailed asset valuations to ensure accurate reporting and compliance with tax regulations. |

| 2 | Will or Testament | A valid Will or Testament is crucial for inheritance tax filing as it outlines the distribution of assets and appoints executors responsible for managing the estate. This legal document helps accurately determine the taxable estate value and ensures compliance with tax authorities during the probate process. |

| 3 | Grant of Probate | The Grant of Probate is a crucial document required for inheritance tax filing, as it legally authorizes the executor to manage and distribute the deceased's estate. Essential supporting documents include the original will, death certificate, detailed asset valuations, and financial statements to accurately assess the estate's value for tax purposes. |

| 4 | Letters of Administration | Letters of Administration serve as a critical legal document granting executors the authority to manage and distribute the deceased's estate, which is essential for accurate inheritance tax filing. This document verifies the appointed administrator's legitimacy, ensuring proper valuation of assets and timely submission of tax returns to HM Revenue & Customs. |

| 5 | Inheritance Tax Return Form (e.g., IHT205, IHT400) | The Inheritance Tax Return Form, such as IHT205 or IHT400, is essential for filing inheritance tax, detailing the estate's value and liabilities to HMRC. IHT205 is used for simpler estates below the tax threshold, while IHT400 is required for more complex estates exceeding the threshold or involving exemptions and reliefs. |

| 6 | Estate Valuation Reports | Estate valuation reports are critical for inheritance tax filing as they provide an accurate assessment of the total value of the deceased's assets, including real estate, investments, and personal property. These reports ensure compliance with tax regulations by detailing asset appraisals and liabilities, forming the basis for calculating the correct inheritance tax amount due. |

| 7 | Property Appraisal Documents | Property appraisal documents are crucial for inheritance tax filing as they provide an accurate valuation of real estate assets, ensuring the reported value aligns with market conditions. These documents typically include professional appraisals, recent sales comparables, and property tax assessments, which collectively support precise tax calculation and compliance. |

| 8 | Bank Statements | Bank statements are essential for inheritance tax filing as they provide detailed records of the deceased's financial transactions, account balances, and liquid assets at the time of death. These documents help accurately assess the estate's value, ensure all taxable assets are accounted for, and support compliance with HMRC regulations. |

| 9 | Investment Account Statements | Investment account statements are essential documents for inheritance tax filing as they provide accurate records of asset values at the date of the decedent's death, ensuring precise tax calculation. These statements detail transactions, dividends, and market values critical for determining the total estate worth and potential tax liabilities. |

| 10 | Life Insurance Policies | Life insurance policies are crucial documents for inheritance tax filing as their proceeds may be subject to taxation depending on the policyholder's estate structure and beneficiary designations. Accurate submission of these policies alongside death certificates and wills ensures compliance with HMRC regulations and helps determine the correct liability. |

| 11 | Pension Statements | Pension statements are crucial documents for inheritance tax filing as they detail the value and type of pension benefits subject to tax, including lump-sum death benefits and ongoing pension income. Accurate and up-to-date pension statements ensure the correct valuation of estates, helping to avoid underreporting and potential penalties. |

| 12 | Trust Deeds | Trust deeds are essential documents for inheritance tax filing as they detail the terms and assets of the trust, which directly impact tax calculations and liabilities. Accurate submission of these deeds ensures proper valuation of trust-held assets and compliance with HMRC requirements. |

| 13 | Share Certificates | Share certificates are essential for inheritance tax filing as they provide verifiable proof of ownership and details of the deceased's shares in companies. Accurate documentation of these certificates ensures precise valuation of share assets, which is critical for calculating the correct amount of inheritance tax. |

| 14 | Loan or Debt Statements | Loan or debt statements are essential documents for inheritance tax filing, as they accurately reflect outstanding liabilities that reduce the taxable estate value. Providing official documentation such as mortgage statements, personal loan agreements, or credit card debt summaries ensures precise calculation of net estate worth and potential tax obligations. |

| 15 | Mortgage Statements | Mortgage statements are essential documents for inheritance tax filing as they provide up-to-date information on outstanding loan balances secured against the deceased's property, which affects the net value of the estate. Accurate mortgage statements ensure proper valuation of liabilities, reducing the estate's taxable amount and preventing potential tax overpayments. |

| 16 | Gift Records (previous 7 years) | Gift records from the previous seven years are crucial for inheritance tax filing as they help determine the total value of transferred assets and assess any potential tax liabilities. Accurate documentation of these gifts, including dates, recipients, and amounts, ensures compliance with HMRC regulations and prevents penalties. |

| 17 | Business Valuation Reports | Business valuation reports are crucial documents for inheritance tax filing, providing an accurate assessment of a deceased individual's business assets for tax calculation. These reports must include detailed financial statements, asset appraisals, and market analysis to ensure compliance with tax authorities and minimize potential legal disputes. |

| 18 | Utility Bills (proof of address) | Utility bills serve as critical proof of address when filing inheritance tax, verifying the decedent's residence at the time of death. Including recent utility bills such as electricity, water, or gas statements ensures accurate identification and supports the administration of the estate during the tax assessment process. |

| 19 | Funeral Expense Receipts | Funeral expense receipts are crucial documents for inheritance tax filing as they validate deductible costs directly associated with the deceased's final arrangements, potentially reducing the taxable estate value. Proper documentation must include detailed invoices for services such as burial, cremation, transportation, and related fees to ensure compliance with tax authorities. |

| 20 | Marriage or Civil Partnership Certificate (if applicable) | The Marriage or Civil Partnership Certificate is essential for inheritance tax filing as it verifies the legal relationship between the deceased and the surviving spouse or civil partner, enabling eligibility for tax exemptions such as the spouse allowance. This document must be submitted alongside the will and death certificate to accurately assess any applicable reliefs and calculate the correct inheritance tax liability. |

Introduction to Inheritance Tax Filing

Inheritance tax filing requires accurate documentation to ensure compliance with legal requirements. Understanding which documents are essential can streamline the process and prevent delays.

- Death Certificate - An official death certificate verifies the date of death, a key detail for tax calculations.

- Will or Trust Documents - These outline asset distribution and help establish rightful heirs and tax responsibilities.

- Asset Valuation Records - Documentation of property, investments, and other assets determines the total estate value for tax purposes.

Key Documents Required for Inheritance Tax

| Document | Description | Purpose |

|---|---|---|

| Death Certificate | Official certificate issued by the government confirming the date and cause of death. | Required to prove the death of the individual whose estate is being assessed for inheritance tax. |

| Will or Testament | Legal document outlining the deceased's wishes regarding asset distribution. | Used to identify beneficiaries and verify instructions related to the estate. |

| Grant of Probate or Letters of Administration | Legal authorization obtained from a probate registry to manage the deceased's estate. | Required to access and distribute estate assets according to the will or intestacy laws. |

| Valuation Reports | Professional assessments of the estate's assets including property, investments, and valuables. | Necessary to determine the accurate value of the estate for tax calculation. |

| Bank Statements and Financial Records | Statements detailing account balances, investments, and financial transactions. | Provide detailed financial information to support asset valuations and income verification. |

| Outstanding Debts and Liabilities Documentation | Records of debts, loans, mortgages, and other liabilities owed by the deceased. | Used to calculate net estate value after deducting liabilities for inheritance tax purposes. |

| Previous Tax Returns | Copies of the deceased's personal tax returns and any prior inheritance tax filings. | Assist in verifying asset sources, income history, and tax compliance. |

Probate and Grant of Representation

Filing inheritance tax requires specific legal documents to accurately assess and process the estate. Key documents include Probate and Grant of Representation, which confirm the authority to manage the deceased's assets.

- Grant of Representation - This legal document authorizes the executor or administrator to handle the estate's financial matters.

- Probate - Probate is the official validation of the deceased's will, enabling asset distribution according to their wishes.

- Estate Inventory - A detailed list of all assets and liabilities is necessary to calculate the correct inheritance tax liability.

Submitting these documents ensures compliance with inheritance tax regulations and smooth estate administration.

Valuation Statements and Asset Inventories

What documents are essential for inheritance tax filing? Valuation statements and asset inventories form the core of the required paperwork. These documents ensure accurate reporting of the estate's value to tax authorities.

Debts and Liabilities Documentation

Accurate documentation of debts and liabilities is crucial for inheritance tax filing as it directly impacts the taxable estate value. Essential documents include outstanding loan agreements, credit card statements, and evidence of any mortgages or secured debts.

Invoices for unpaid bills and records of personal loans owed by the deceased must also be submitted to ensure all liabilities are accounted for. Properly documenting these debts can reduce the overall inheritance tax liability, preventing overpayment.

Beneficiary Identification Papers

Beneficiary identification papers are crucial for the accurate filing of inheritance tax. These documents confirm the identities of individuals entitled to inherit assets.

Essential identification papers include government-issued photo IDs such as passports or driver's licenses. Legal documents like birth certificates or marriage certificates may also be required to establish relationships. Proper verification of beneficiaries helps prevent disputes and ensures compliance with tax regulations.

Evidence of Lifetime Gifts and Transfers

Evidence of lifetime gifts and transfers is crucial for accurate inheritance tax filing. Documentation such as gift deeds, transfer receipts, and bank statements help establish the value and timing of these assets. Proper records ensure compliance with tax regulations and prevent disputes during estate valuation.

Completing Inheritance Tax Forms (IHT Forms)

Completing Inheritance Tax Forms (IHT Forms) requires gathering several essential documents, including the deceased's will, death certificate, and a detailed list of assets and liabilities. Accurate valuation reports of properties, bank statements, and investment portfolios are necessary to determine the taxable estate. You must also provide any previous tax records and proof of debts or expenses to ensure the inheritance tax filing is thorough and compliant.

Submission Procedures and Deadlines

Filing inheritance tax requires specific documents to ensure accurate reporting and timely submission. Understanding the submission procedures and deadlines is crucial to avoid penalties and legal complications.

- Death certificate - Official proof of the deceased individual's passing, necessary to initiate the inheritance tax process.

- Estate valuation report - Detailed assessment of all assets and liabilities belonging to the estate, used to determine the taxable amount.

- Tax return form and supporting documents - Completed inheritance tax forms along with bank statements, property deeds, and investment records, submitted to the tax authority within the prescribed deadline.

What Documents Are Essential for Inheritance Tax Filing? Infographic