Small business tax filing requires essential documents such as income statements, expense receipts, and bank statements to accurately report financial activity. Maintaining organized records of payroll forms, payroll tax filings, and estimated tax payments ensures compliance with tax regulations. Proper documentation of deductions, including receipts for business expenses and mileage logs, helps optimize tax returns and minimize liabilities.

What Documents Are Necessary for Small Business Tax Filing?

| Number | Name | Description |

|---|---|---|

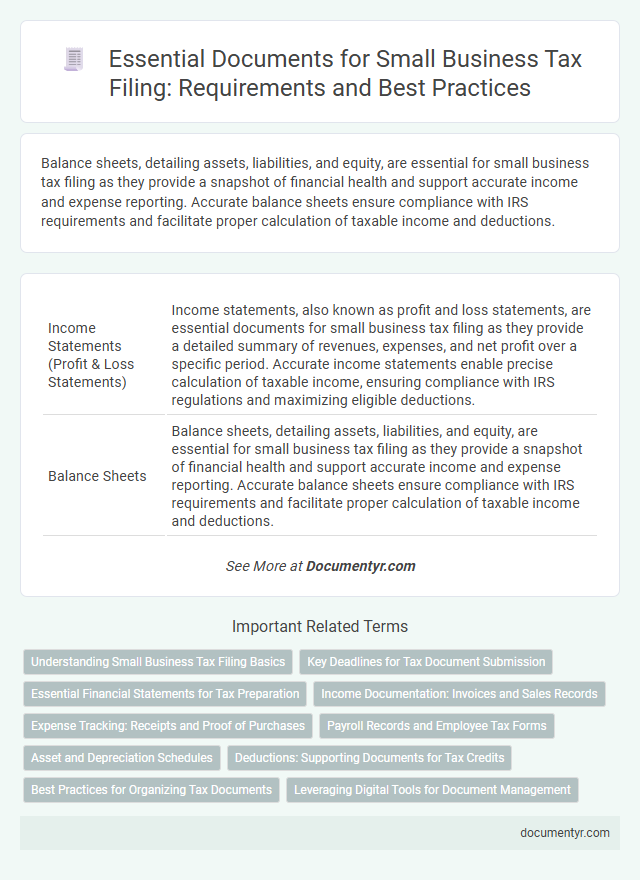

| 1 | Income Statements (Profit & Loss Statements) | Income statements, also known as profit and loss statements, are essential documents for small business tax filing as they provide a detailed summary of revenues, expenses, and net profit over a specific period. Accurate income statements enable precise calculation of taxable income, ensuring compliance with IRS regulations and maximizing eligible deductions. |

| 2 | Balance Sheets | Balance sheets, detailing assets, liabilities, and equity, are essential for small business tax filing as they provide a snapshot of financial health and support accurate income and expense reporting. Accurate balance sheets ensure compliance with IRS requirements and facilitate proper calculation of taxable income and deductions. |

| 3 | Bank Statements | Bank statements are essential for small business tax filing as they provide accurate records of income, expenses, and cash flow throughout the fiscal year. These documents help verify reported transactions, reconcile accounts, and support deductions, ensuring compliance with IRS regulations and minimizing audit risks. |

| 4 | Cash Flow Statements | Cash flow statements are essential for small business tax filing as they provide a detailed record of cash inflows and outflows, enabling accurate reporting of income and expenses. Including cash flow statements alongside profit and loss statements and balance sheets ensures compliance with tax regulations and facilitates precise calculation of taxable income. |

| 5 | Expense Receipts | Expense receipts are essential for small business tax filing as they provide verifiable proof of deductible business expenses, ensuring accurate reporting and compliance with IRS regulations. Organizing receipts by category, date, and vendor helps streamline the tax preparation process and maximizes potential deductions. |

| 6 | Sales Invoices | Sales invoices are essential documents for small business tax filing as they provide detailed records of revenue generated, including transaction dates, customer information, and amounts charged. Maintaining accurate and organized sales invoices supports proper income reporting and substantiates deductions during tax audits, ensuring compliance with tax regulations. |

| 7 | Payroll Records | Payroll records, including employee wage details, tax withholdings, and benefits deductions, are essential for accurate small business tax filing and compliance with IRS regulations. Maintaining comprehensive payroll documentation ensures proper reporting of wages, tax liabilities, and supports deductions during tax preparation. |

| 8 | Tax ID (EIN) Documentation | Small business tax filing requires the Employer Identification Number (EIN) documentation as a critical identifier for federal tax purposes, enabling accurate reporting and compliance with IRS regulations. This document connects business activities to tax obligations, facilitating payroll, tax payments, and access to business credit. |

| 9 | Previous Year Tax Returns | Previous year tax returns provide essential reference data for accurate small business tax filing, ensuring consistency in reported income, deductions, and credits. Maintaining organized copies of these returns helps verify carryover amounts, depreciation schedules, and prior tax payments to support current-year documentation. |

| 10 | 1099 Forms | Small business tax filing requires accurate collection of 1099 forms, including 1099-MISC for independent contractors and 1099-NEC for non-employee compensation, to report payments exceeding $600. Maintaining organized records of these documents ensures compliance with IRS regulations and facilitates accurate income and expense reporting. |

| 11 | W-2 Forms | Small business tax filing requires W-2 forms to report employee wages and tax withholdings accurately to the IRS, ensuring compliance with federal tax regulations. These forms must be collected from all employees and submitted alongside payroll records and employer tax returns to avoid penalties. |

| 12 | Depreciation Schedules | Depreciation schedules are essential documents for small business tax filing, detailing asset costs, useful lives, and accumulated depreciation to accurately calculate deductible expenses. Properly maintained schedules ensure compliance with IRS regulations and optimize tax benefits by systematically reducing taxable income over the asset's lifespan. |

| 13 | Asset Purchase Records | Asset purchase records are essential for small business tax filing, as they provide detailed documentation of asset acquisition costs, dates, and descriptions necessary for accurate depreciation and capital expense reporting. Maintaining organized invoices, purchase agreements, and payment receipts ensures compliance with IRS regulations and supports potential audit requirements. |

| 14 | Loan Documentation | Loan documentation, including promissory notes, loan agreements, and payment schedules, is essential for small business tax filing to accurately report interest expenses and liabilities. Maintaining thorough records of loan disbursements and repayments ensures compliance with IRS regulations and supports deductions on the business tax return. |

| 15 | Business Licenses | Business licenses, including state and local permits, are essential documents for small business tax filing to verify legal operation status and facilitate proper tax classification. These licenses ensure compliance with regulatory requirements and help accurately report taxable activities to federal and state tax authorities. |

| 16 | Lease Agreements | Lease agreements are essential documents for small business tax filing as they provide proof of business property expenses and help substantiate deductions related to rent and lease payments. Accurate records of signed lease contracts, rent payment receipts, and any amendments ensure compliance with tax regulations and support claims for deductible expenses. |

| 17 | Inventory Records | Accurate inventory records are essential for small business tax filing as they directly impact cost of goods sold and taxable income calculations. Detailed documentation such as purchase invoices, stock counts, and valuation reports must be maintained to comply with IRS regulations and support deductions. |

| 18 | Credit Card Statements | Credit card statements are essential documents for small business tax filing as they provide detailed records of business expenses and purchases, ensuring accurate deduction claims and expense tracking. Maintaining organized statements helps verify transactions during audits and supports the legitimacy of reported expenses to tax authorities. |

| 19 | Quarterly Estimated Tax Payment Receipts | Quarterly estimated tax payment receipts are essential documents for small business tax filing, serving as proof of timely tax payments made throughout the fiscal year. Maintaining accurate records of these receipts ensures proper credit for payments and helps avoid penalties or interest charges during tax assessments. |

| 20 | Tax Deduction Documentation | Small business tax filing requires thorough tax deduction documentation such as receipts, invoices, bank statements, and mileage logs to substantiate expenses claimed on deductions like office supplies, travel, and vehicle use. Maintaining organized records including payroll documents, lease agreements, and contracts ensures accurate reporting and compliance with IRS guidelines, minimizing audit risks. |

| 21 | IRS Correspondence | Small business tax filing requires careful organization of IRS correspondence including tax notices, audit letters, and payment reminders to ensure accurate record-keeping and compliance. Retaining documents such as Form 1099s, W-2s, and prior tax returns helps verify reported income and deductions, reducing the risk of IRS penalties. |

| 22 | Retirement Plan Contributions Records | Retirement plan contributions records, including Form 5498 and annual statements from IRA, 401(k), or SEP accounts, are essential for accurately reporting deductible contributions and ensuring compliance with IRS limits. Maintaining detailed documentation helps small businesses claim eligible tax credits and deductions related to employee retirement benefits. |

| 23 | Health Insurance Premium Records | Health insurance premium records are essential for small business tax filing as they verify deductible expenses and potential credits under the Affordable Care Act. Maintaining detailed documentation of monthly premiums paid for employees' health coverage ensures accurate reporting and compliance with IRS requirements. |

| 24 | Partner/Shareholder Agreements | Partner/shareholder agreements are essential documents for small business tax filing because they outline profit distribution, ownership percentages, and decision-making authority, directly impacting tax reporting and liability. Accurate submission of these agreements along with financial statements helps ensure compliance with IRS regulations and proper allocation of income and deductions among partners or shareholders. |

Understanding Small Business Tax Filing Basics

Understanding the basics of small business tax filing is essential for accurate and timely submissions. Proper documentation ensures compliance with tax regulations and helps maximize deductions.

- Income Records - Maintain all sales receipts, invoices, and bank statements to report gross income accurately.

- Expense Documentation - Collect receipts, bills, and statements for business expenses such as supplies, rent, and utilities.

- Tax Forms and Identification Numbers - Gather necessary forms like Schedule C and have your Employer Identification Number (EIN) or Social Security Number ready for filing.

Your organized records streamline the tax filing process and reduce the risk of errors or audits.

Key Deadlines for Tax Document Submission

Small business tax filing requires essential documents such as income statements, expense records, and payroll summaries to ensure accurate reporting. Key deadlines include April 15th for individual sole proprietors using Schedule C and March 15th for S corporations and partnerships to submit their returns. Meeting these deadlines prevents penalties and ensures compliance with IRS regulations for timely tax document submission.

Essential Financial Statements for Tax Preparation

Accurate tax filing for small businesses requires specific financial documents to ensure compliance and maximize deductions. Essential financial statements include the income statement, balance sheet, and cash flow statement, which provide a comprehensive view of your business's financial health.

The income statement details revenues and expenses, critical for calculating taxable income. The balance sheet outlines assets, liabilities, and equity, helping to verify financial position, while the cash flow statement tracks cash inflows and outflows, ensuring accuracy in reporting.

Income Documentation: Invoices and Sales Records

Income documentation is crucial for small business tax filing, with invoices and sales records serving as primary evidence of revenue. These documents provide a clear trail of your business earnings throughout the fiscal year.

Invoices detail the amounts billed to clients or customers, including dates, services or products provided, and payment terms. Maintaining accurate sales records ensures you report all income correctly to tax authorities. Proper organization of these documents helps avoid discrepancies and simplifies tax preparation.

Expense Tracking: Receipts and Proof of Purchases

Maintaining accurate expense tracking is crucial for small business tax filing. Receipts and proof of purchases serve as essential documents for verifying deductible expenses. Organizing these records helps ensure compliance with tax regulations and supports claims during audits.

Payroll Records and Employee Tax Forms

What payroll records are necessary for small business tax filing? Payroll records must include detailed information about employee wages, hours worked, and tax withholdings. Maintaining accurate payroll documentation ensures compliance with tax regulations and simplifies the filing process.

Which employee tax forms are essential for small business tax submissions? Common forms include W-2s for reporting wages and taxes withheld, and W-4s for tracking employee withholding allowances. Properly completed employee tax forms help verify payroll tax obligations and support accurate tax reporting.

How can you organize these documents effectively for tax filing? Keep all payroll records and employee tax forms systematically filed by year and employee name. Organized documentation facilitates smooth tax preparation and supports audits if they occur.

Asset and Depreciation Schedules

Accurate asset and depreciation schedules are essential documents for small business tax filing. These schedules detail the cost, value, and lifespan of business assets, which directly impact deductible depreciation expenses.

Maintaining organized records of asset acquisitions and depreciation calculations ensures compliance with IRS regulations. Your tax filings benefit from clear documentation, minimizing errors and maximizing allowable deductions.

Deductions: Supporting Documents for Tax Credits

| Deduction Category | Necessary Supporting Documents | Purpose |

|---|---|---|

| Business Expenses | Receipts, invoices, bank statements | Verify deductible operational costs such as office supplies, utilities, and rent |

| Employee Salaries and Wages | Payroll records, W-2 and 1099 forms, employment contracts | Document salary payments and contractor compensation for labor deductions |

| Home Office Deduction | Mortgage interest statements, property tax records, utility bills | Validate portion of home used exclusively for business operations |

| Vehicle Expenses | Mileage logs, fuel receipts, maintenance records | Establish business use percentage for personal or company vehicles |

| Equipment and Asset Purchases | Purchase invoices, depreciation schedules, lease agreements | Confirm eligible asset purchases for depreciation and deduction claims |

| Tax Credits | Credit application forms, proof of eligibility, receipts related to qualifying activities | Support claims for credits such as the Work Opportunity Tax Credit or Research & Development Credit |

| Interest and Loan Payments | Loan agreements, interest statements, bank payment records | Validate deductible interest expenses on business loans and lines of credit |

| Charitable Contributions | Donation receipts, acknowledgment letters from charities | Document qualifying charitable donations for deduction purposes |

Best Practices for Organizing Tax Documents

Properly organizing tax documents is crucial for accurate small business tax filing. Maintaining clear records helps streamline the filing process and ensures you meet all tax obligations.

- Gather Income Statements - Collect all sales receipts, invoices, and bank statements showing your business income during the tax year.

- Maintain Expense Records - Keep detailed documentation of business expenses such as receipts, bills, and proof of payments for deductions.

- Organize Payroll and Tax Forms - Store payroll reports, employee tax forms, and copies of filed tax returns in a secure, accessible location.

What Documents Are Necessary for Small Business Tax Filing? Infographic