Life insurance applications typically require essential documents such as government-issued identification, proof of income, and medical records to assess the applicant's health status. Financial documents like tax returns and bank statements may also be necessary to determine the appropriate coverage amount. Accurate and complete documentation ensures a smoother underwriting process and faster policy approval.

What Documents Are Required for Life Insurance Applications?

| Number | Name | Description |

|---|---|---|

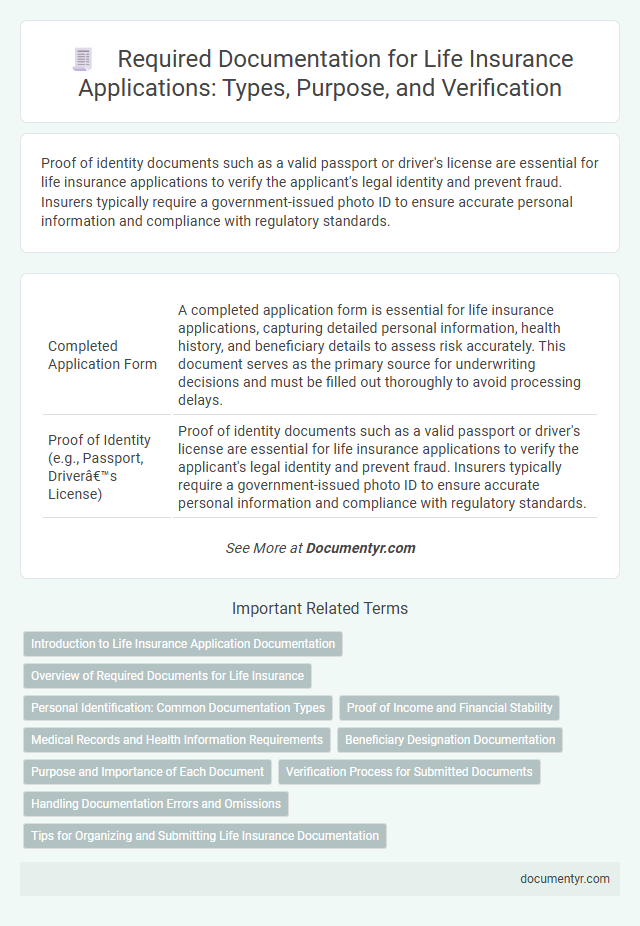

| 1 | Completed Application Form | A completed application form is essential for life insurance applications, capturing detailed personal information, health history, and beneficiary details to assess risk accurately. This document serves as the primary source for underwriting decisions and must be filled out thoroughly to avoid processing delays. |

| 2 | Proof of Identity (e.g., Passport, Driver’s License) | Proof of identity documents such as a valid passport or driver's license are essential for life insurance applications to verify the applicant's legal identity and prevent fraud. Insurers typically require a government-issued photo ID to ensure accurate personal information and compliance with regulatory standards. |

| 3 | Proof of Address (e.g., Utility Bill, Bank Statement) | Proof of address is a critical document for life insurance applications, typically validated through utility bills or bank statements dated within the last three months to confirm the applicant's residential address. Insurers require these documents to verify identity, reduce fraud risk, and comply with regulatory Know Your Customer (KYC) standards. |

| 4 | Income Proof (e.g., Salary Slips, Tax Returns) | Income proof documents such as recent salary slips and tax returns are essential for life insurance applications to verify the applicant's financial stability and ensure accurate premium assessment. These records help insurers evaluate risk and determine appropriate coverage limits based on consistent income evidence. |

| 5 | Medical Examination Report | Life insurance applications typically require a medical examination report that includes detailed health information such as blood pressure, cholesterol levels, medical history, and current medications to assess the applicant's risk profile accurately. This report, conducted by a licensed healthcare professional, is crucial for underwriting decisions and determining appropriate premium rates. |

| 6 | Medical Records/History | Life insurance applications often require detailed medical records and history, including recent physician reports, results of medical examinations, prescription drug information, and hospitalization records. Insurers review these documents to assess risk factors such as chronic conditions, past surgeries, and family medical history, which directly influence policy approval and premium rates. |

| 7 | Age Proof (e.g., Birth Certificate) | Life insurance applications require age proof documents such as a birth certificate, passport, or government-issued ID to verify the applicant's age accurately, which is crucial for determining premium rates and eligibility. Providing authentic age proof ensures smooth processing of the policy and prevents future disputes related to claim settlements. |

| 8 | Photograph (Passport Size) | A passport-size photograph is a mandatory document for life insurance applications, serving as a key personal identification tool to verify the applicant's identity. Insurers typically require the photograph to meet specific size and quality standards to ensure accurate record-keeping and fraud prevention. |

| 9 | Nominee Details Document | Nominee details documents for life insurance applications typically include the nominee's full name, date of birth, relationship to the policyholder, and government-issued identity proof such as a passport or Aadhaar card. Accurate submission of these documents ensures clear beneficiary designation and smooth claim processing. |

| 10 | Existing Policy Details (if applicable) | Applicants must provide existing life insurance policy details, including the policy number, insurer name, coverage amount, and current beneficiary information to facilitate underwriting and ensure accurate risk assessment. These documents enable insurers to verify prior coverage, avoid duplication, and tailor new policies effectively. |

| 11 | Employment Details/Verification Letter | Life insurance applications require an employment verification letter to confirm the applicant's current job status, income, and length of employment, ensuring accurate risk assessment. This document typically includes the employer's contact information, the applicant's job title, salary, and employment duration, which are critical for underwriting decisions. |

| 12 | Bank Account Information | Life insurance applications require bank account information such as account number, bank name, and branch details to facilitate premium payments and policy payouts. Accurate bank details ensure seamless transactions and timely processing of claims. |

| 13 | Foreign Residency Documents (if applicable) | Life insurance applications requiring foreign residency documents typically demand valid passports, proof of address such as utility bills or rental agreements, and immigration status verification like visas or resident permits. These documents establish identity, residency compliance, and ensure eligibility under jurisdiction-specific insurance regulations. |

| 14 | Consent/Declaration Form | The Consent/Declaration Form in life insurance applications verifies the applicant's authorization for data collection and medical examinations, ensuring legal compliance and protection against misinformation. It must be accurately completed and signed to expedite policy processing and validate the insurer's risk assessment. |

Introduction to Life Insurance Application Documentation

What documents are required for life insurance applications? Life insurance application documentation ensures the insurer accurately assesses risk and validates your identity. These documents typically include personal identification, medical records, and financial information.

Overview of Required Documents for Life Insurance

| Document Type | Description | Purpose |

|---|---|---|

| Proof of Identity | Government-issued ID such as a passport, driver's license, or national ID card | Verifies your identity to prevent fraud and confirm eligibility |

| Proof of Age | Birth certificate or valid identification showing date of birth | Determines age which directly impacts premium rates and eligibility |

| Medical Records | Health questionnaires, medical exam reports, or detailed physician statements | Assesses health condition to calculate risk and premium accurately |

| Proof of Income | Pay stubs, tax returns, or bank statements | Evaluates financial status to recommend appropriate coverage amount |

| Beneficiary Information | Full name, relationship, and contact details of beneficiaries | Designates who will receive the insurance benefits upon your passing |

| Policy Application Form | Completed and signed life insurance application document | Official request that initiates the underwriting and approval process |

Personal Identification: Common Documentation Types

Personal identification is a crucial component of life insurance applications to verify your identity and prevent fraud. Providing accurate identification documents speeds up the approval process and ensures compliance with regulatory standards.

- Government-Issued Photo ID - Common examples include a valid passport, driver's license, or state ID card to confirm your identity and date of birth.

- Social Security Number (SSN) - Required for identity verification and to check your financial and medical history during underwriting.

- Proof of Address - Documents such as utility bills or bank statements demonstrate your residential address, helping insurers validate your personal information.

Proof of Income and Financial Stability

Proof of income and financial stability are critical components of life insurance applications to assess risk and coverage limits. Applicants must provide accurate documentation to ensure the insurer can verify their financial standing and income sources.

- Recent Pay Stubs - These demonstrate current earnings and employment status.

- Tax Returns - Tax documents provide a comprehensive view of annual income and financial consistency.

- Bank Statements - Statements confirm savings, investments, and overall financial health.

Submitting these documents promptly helps expedite the underwriting process and approval of the life insurance policy.

Medical Records and Health Information Requirements

Life insurance applications require detailed medical records to assess the applicant's health status accurately. These documents typically include recent medical examinations, laboratory test results, and a history of any pre-existing conditions.

Applicants must also provide comprehensive health information such as medication usage, past surgeries, and family medical history. Insurers use this data to evaluate risk and determine appropriate premium rates.

Beneficiary Designation Documentation

Life insurance applications require specific documents to ensure proper processing and beneficiary designation. Beneficiary designation documentation is crucial for directing the policy proceeds to the intended recipients.

The primary document for beneficiary designation is the completed beneficiary designation form provided by the insurance company. This form specifies the individuals or entities who will receive the death benefit, along with their contact details and relationship to the insured. It is essential to keep this documentation updated to reflect any changes in personal circumstances or preferences.

Purpose and Importance of Each Document

Life insurance applications require identification documents such as a government-issued ID to verify the applicant's identity and prevent fraud. Medical records and health history forms provide critical information for assessing risk and determining premium rates. Financial documents like income statements ensure the applicant's ability to pay premiums and validate the policy's coverage amount.

Verification Process for Submitted Documents

The verification process for life insurance applications involves a thorough review of submitted documents to confirm the applicant's identity and eligibility. Key documents typically include proof of identity, proof of address, and medical records.

Insurance companies cross-check these documents with official databases to ensure authenticity and prevent fraud. Medical reports are evaluated by underwriters to assess risk and determine policy terms and premiums.

Handling Documentation Errors and Omissions

Life insurance applications require key documents such as proof of identity, medical records, and financial statements to verify eligibility and risk factors. Handling documentation errors and omissions is crucial to prevent delays or denials of coverage. You should carefully review all submitted paperwork and promptly correct any inaccuracies to ensure a smooth approval process.

What Documents Are Required for Life Insurance Applications? Infographic