To resolve a credit card dispute, you need to provide key documents such as your credit card statement highlighting the disputed transaction and any receipts or proof of payment. Also include any correspondence with the merchant, such as emails or letters, that support your claim. Submitting a formal dispute letter or form to your credit card issuer is often required to initiate the investigation process.

What Documents Are Needed for Credit Card Dispute Resolution?

| Number | Name | Description |

|---|---|---|

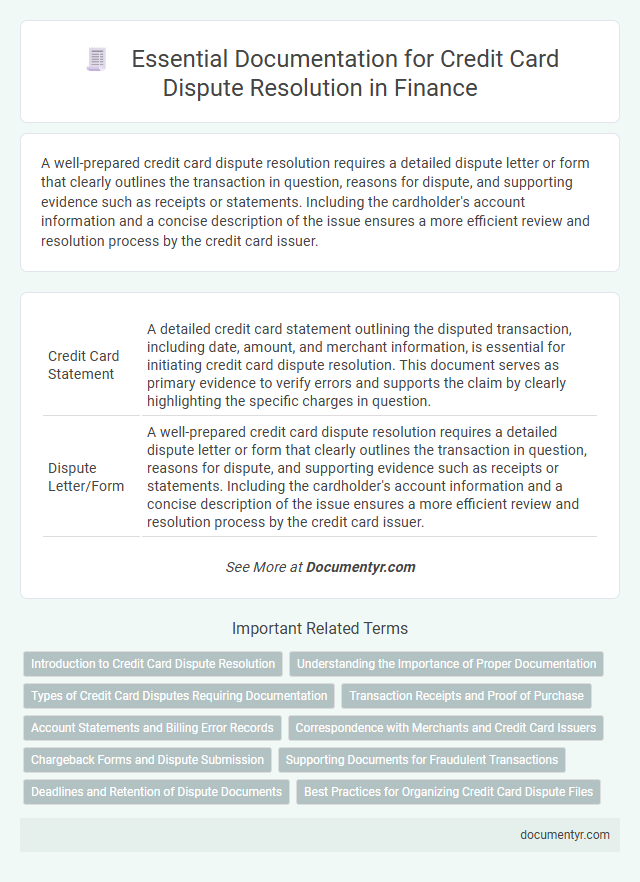

| 1 | Credit Card Statement | A detailed credit card statement outlining the disputed transaction, including date, amount, and merchant information, is essential for initiating credit card dispute resolution. This document serves as primary evidence to verify errors and supports the claim by clearly highlighting the specific charges in question. |

| 2 | Dispute Letter/Form | A well-prepared credit card dispute resolution requires a detailed dispute letter or form that clearly outlines the transaction in question, reasons for dispute, and supporting evidence such as receipts or statements. Including the cardholder's account information and a concise description of the issue ensures a more efficient review and resolution process by the credit card issuer. |

| 3 | Proof of Transaction (Receipts, Invoices) | Proof of transaction, such as receipts and invoices, is essential for credit card dispute resolution as it validates the authenticity of the disputed charge and helps the card issuer assess the legitimacy of the claim. Providing detailed documentation with transaction dates, merchant information, and payment amounts increases the likelihood of a favorable dispute outcome. |

| 4 | Communication Records (Emails, Messages, Call Logs) | Communication records such as emails, text messages, and call logs are essential documents for credit card dispute resolution, as they provide verifiable evidence of interactions with the merchant or credit card issuer. These records help establish timelines and confirm agreements, facilitating the validation of dispute claims and expediting the resolution process. |

| 5 | Merchant Response/Correspondence | Merchant response or correspondence in credit card dispute resolution typically requires submission of transaction receipts, proof of delivery, and any communication records between the merchant and the cardholder to verify the legitimacy of the charge. Detailed invoices, refund policies, and signed agreements may also be requested to support the merchant's position during dispute investigations. |

| 6 | Fraud or Error Affidavit | To resolve a credit card dispute involving fraud or error, submitting a detailed Fraud or Error Affidavit is essential, documenting the unauthorized transaction and explaining the error with date, amount, and merchant details. Supporting evidence such as transaction receipts, bank statements, and correspondence with the merchant enhances the accuracy and speed of dispute resolution. |

| 7 | Police Report (for Fraud Cases) | A police report is a crucial document for credit card dispute resolution in fraud cases, serving as official evidence that a fraudulent transaction was reported to law enforcement. Submitting this report along with transaction details and the credit card statement enhances the validity of the claim and accelerates the dispute investigation process. |

| 8 | Proof of Return/Refund Documentation | Proof of return or refund documentation such as receipts, return shipping confirmation, and refund transaction records are essential for substantiating a credit card dispute involving returned items. Providing these documents helps demonstrate the merchant's acknowledgment of the return and supports the cardholder's claim for a refund. |

| 9 | Identification Documents (ID, Passport) | Identification documents such as a government-issued ID or passport are essential for credit card dispute resolution to verify the cardholder's identity and prevent fraudulent claims. These documents help financial institutions authenticate the dispute request, ensuring compliance with regulatory requirements and safeguarding against unauthorized transactions. |

| 10 | Signed Transaction Authorization | Signed transaction authorization is crucial for credit card dispute resolution as it provides evidence that the cardholder approved the specific purchase. Including original receipts or digital signatures linked to the transaction helps verify authenticity and supports the dispute claim with the issuer. |

| 11 | Chargeback Reference Number | Providing the Chargeback Reference Number is essential for credit card dispute resolution as it enables precise tracking and verification of the transaction in question. Along with this unique identifier, submitting the original transaction receipt, cardholder statement, and any relevant correspondence ensures a comprehensive review and expedites the chargeback process. |

| 12 | Tracking/Shipping Information (for Delivery Disputes) | For credit card dispute resolution involving delivery disputes, essential documents include tracking numbers, shipping confirmation emails, and delivery receipts to verify the transaction status. These materials provide clear evidence of the shipment timeline and delivery outcome, supporting the claim's validity during the dispute process. |

| 13 | Completed Bank Dispute Form | A completed bank dispute form serves as the primary document required for initiating a credit card dispute resolution, detailing transaction discrepancies and supporting the claim. This form must be accurately filled out with pertinent information such as transaction dates, amounts, and explanations for the dispute to expedite verification and resolution. |

| 14 | Supporting Photographs or Documents | Supporting photographs or documents are essential for credit card dispute resolution, including transaction receipts, billing statements, and evidence of returned merchandise. Clear images of damaged goods, canceled contracts, or correspondence with merchants strengthen the case by providing concrete proof of the disputed charge. |

| 15 | Cardholder’s Written Explanation | A detailed cardholder's written explanation is essential for credit card dispute resolution, providing a clear, concise account of the transaction in question and the reasons for contesting it. This document should include the date, merchant name, transaction amount, and specific issues such as unauthorized charges, billing errors, or goods not received to support the dispute claim effectively. |

Introduction to Credit Card Dispute Resolution

| Introduction to Credit Card Dispute Resolution | |

|---|---|

| Credit card dispute resolution is a process designed to protect cardholders from unauthorized or incorrect charges. When you notice discrepancies on your credit card statement, initiating a dispute helps in addressing errors efficiently. Understanding the documentation required is essential to ensure a smooth and successful resolution. | |

| Document Type | Purpose |

| Credit Card Statement | Provides evidence of the disputed transaction, including date and amount. |

| Receipts or Transaction Records | Supports your claim by showing the correct transaction amount or proof of non-purchase. |

| Correspondence with Merchant | Demonstrates efforts to resolve the issue directly with the seller, which can strengthen your dispute case. |

| Dispute Form | Official form submitted to your credit card issuer outlining details of the dispute. |

| Proof of Refund or Credit (if applicable) | Confirms that a refund was promised or partially processed by the merchant. |

Understanding the Importance of Proper Documentation

Proper documentation is crucial in credit card dispute resolution as it provides clear evidence supporting your claim. Without the right documents, disputing a charge can become challenging and may result in a delayed or unfavorable outcome.

Key documents include transaction receipts, billing statements, and any communication with the merchant. These papers help verify the transaction details and demonstrate discrepancies or errors that justify the dispute.

Types of Credit Card Disputes Requiring Documentation

Credit card dispute resolution often requires specific documentation depending on the dispute type. Common types include unauthorized transactions, billing errors, and goods or services not received, each necessitating distinct evidence such as receipts, communication records, or proof of return. You should prepare these documents promptly to ensure a smooth and efficient resolution process.

Transaction Receipts and Proof of Purchase

What documents are essential for credit card dispute resolution? Transaction receipts are critical as they provide direct evidence of the purchase, detailing the date, amount, and merchant name. Proof of purchase, such as invoices or confirmation emails, supports your claim by verifying the transaction's legitimacy and terms.

Account Statements and Billing Error Records

Account statements and billing error records are essential documents for resolving credit card disputes effectively. These documents provide clear evidence of transactions and discrepancies needed to support your claim.

- Account Statements - Detailed monthly records showing all transactions on your credit card account, vital for identifying unauthorized or incorrect charges.

- Billing Error Records - Documentation highlighting disputed charges, including any written communication with the creditor about the discrepancies.

- Supporting Transaction Receipts - Receipts or invoices that verify the legitimacy of transactions and help clarify disputed amounts on your statement.

Correspondence with Merchants and Credit Card Issuers

Correspondence with merchants and credit card issuers is crucial for credit card dispute resolution. Collect all emails, letters, and messages exchanged regarding the transaction in question to support your claim. These documents help verify communication efforts and provide evidence during the dispute process.

Chargeback Forms and Dispute Submission

Credit card dispute resolution requires specific documentation to initiate the process effectively. The primary documents include chargeback forms and detailed evidence supporting the claim.

Chargeback forms must be accurately completed to outline the nature of the dispute and transaction details. Proper dispute submission involves providing receipts, transaction records, and any communication with the merchant to support the claim.

Supporting Documents for Fraudulent Transactions

Supporting documents for fraudulent transaction disputes are crucial to validate your claim. These documents help the credit card issuer investigate and resolve the issue efficiently.

Credit card statements highlighting the disputed transactions provide clear evidence of unauthorized charges. A police report or fraud affidavit can strengthen your case by officially documenting the incident. Any communication with merchants or third parties related to the fraudulent activity should also be included to support your claim.

Deadlines and Retention of Dispute Documents

Timely submission of dispute documents is crucial for effective credit card dispute resolution. Proper retention of these documents ensures evidence is available throughout the process.

- Dispute Filing Deadline - You must submit all relevant documents within 60 days from the date of the billing statement containing the disputed charge.

- Documentation Requirements - Essential documents include transaction receipts, statements, correspondence with the merchant, and any proof supporting your claim.

- Retention Period - Keep copies of dispute-related documents for at least one year after the resolution to address any potential follow-up inquiries or claims.

What Documents Are Needed for Credit Card Dispute Resolution? Infographic