Immigrants opening a bank account in the US typically need identification documents such as a valid passport, visa, or permanent resident card (Green Card). Banks may also require proof of address, like a utility bill or rental agreement, and a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Providing these documents ensures compliance with federal regulations and smooth account setup.

What Documents Does an Immigrant Need for Bank Account Opening in the US?

| Number | Name | Description |

|---|---|---|

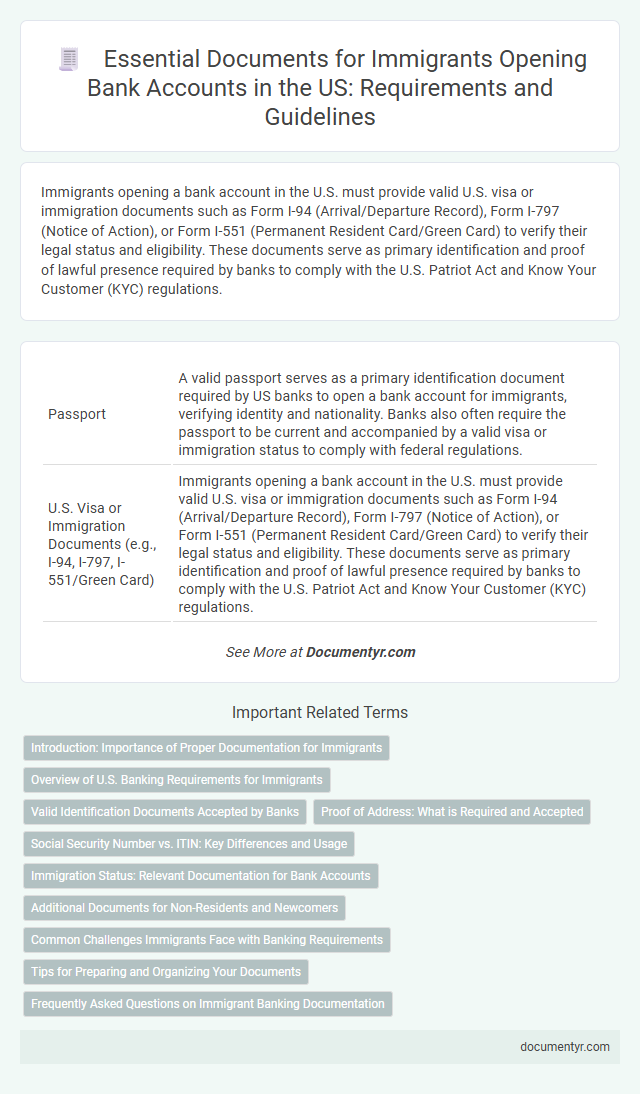

| 1 | Passport | A valid passport serves as a primary identification document required by US banks to open a bank account for immigrants, verifying identity and nationality. Banks also often require the passport to be current and accompanied by a valid visa or immigration status to comply with federal regulations. |

| 2 | U.S. Visa or Immigration Documents (e.g., I-94, I-797, I-551/Green Card) | Immigrants opening a bank account in the U.S. must provide valid U.S. visa or immigration documents such as Form I-94 (Arrival/Departure Record), Form I-797 (Notice of Action), or Form I-551 (Permanent Resident Card/Green Card) to verify their legal status and eligibility. These documents serve as primary identification and proof of lawful presence required by banks to comply with the U.S. Patriot Act and Know Your Customer (KYC) regulations. |

| 3 | Government-Issued Photo ID (foreign or U.S. driver’s license, consular ID) | Immigrants must present a government-issued photo ID such as a foreign passport, U.S. driver's license, or consular ID to open a bank account in the U.S., ensuring identity verification and compliance with federal regulations. These documents authenticate residency status and identity, facilitating secure account access and financial transactions. |

| 4 | Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) | Immigrants in the US typically need a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) to open a bank account, as these identifiers verify identity and facilitate tax reporting. Banks require a valid SSN or ITIN along with government-issued identification to comply with federal regulations and prevent fraud. |

| 5 | Proof of Address (utility bill, lease agreement, bank statement) | Immigrants opening a bank account in the US must provide proof of address, which typically includes documents such as a utility bill, lease agreement, or a recent bank statement that clearly displays their name and current residential address. These documents help banks verify the applicant's physical domicile to comply with federal regulations and reduce fraud risk. |

| 6 | Employment Authorization Document (EAD) | An Employment Authorization Document (EAD) serves as an essential identification and work authorization proof for immigrants opening bank accounts in the US, verifying legal permission to work and reside. Banks typically require the EAD along with secondary identification like a passport or Social Security Number to comply with federal regulations and prevent fraud. |

| 7 | Birth Certificate (less common, for identification) | A birth certificate, while less commonly used, can serve as a valid form of identification for immigrants opening a bank account in the US, especially when combined with other documents such as a passport or visa. Banks may require additional proof of identity and residency alongside the birth certificate to comply with federal regulations like the USA PATRIOT Act. |

| 8 | Secondary Form of ID (credit/debit card, student ID, etc.) | A secondary form of identification such as a credit or debit card, student ID, or employment authorization document is often required by US banks to verify identity during the account opening process. These secondary IDs complement primary documents like a passport or visa, ensuring compliance with federal regulations and helping to prevent identity fraud. |

| 9 | Home Country National ID (where accepted) | Immigrants opening a bank account in the US may be required to present a valid Home Country National ID, accepted by certain banks as part of their identity verification process alongside passport and visa documentation. This national ID serves to substantiate personal identity and residency status, streamlining the account opening while complying with the USA PATRIOT Act and anti-money laundering regulations. |

| 10 | Bank Reference Letter (for some banks) | Some US banks require immigrants to provide a bank reference letter, which serves as proof of good financial standing from their previous bank abroad. This document helps establish trust and smooths the account opening process by verifying the individual's banking history and reliability. |

Introduction: Importance of Proper Documentation for Immigrants

Opening a bank account in the US requires specific documentation, especially for immigrants. Proper documentation ensures a smooth verification process and access to essential financial services.

- Identity Verification - You must provide valid government-issued identification to prove your identity.

- Proof of Immigration Status - Documents such as a visa, green card, or work permit are necessary to confirm legal residency.

- Address Verification - Providing a recent utility bill or lease agreement helps verify your US residential address.

Overview of U.S. Banking Requirements for Immigrants

Opening a bank account in the U.S. as an immigrant requires specific documentation to meet federal and institutional regulations. Understanding these essential requirements ensures a smooth account setup process.

- Proof of Identity - Valid government-issued identification such as a passport or consular ID card is needed to verify your identity.

- Proof of Address - Documents like utility bills or rental agreements prove your U.S. residential address for account registration.

- Immigration Status Documents - Visa, Employment Authorization Document (EAD), or Permanent Resident Card confirm your legal status in the country.

These documents help banks comply with the USA PATRIOT Act and Anti-Money Laundering laws when opening your account.

Valid Identification Documents Accepted by Banks

Immigrants opening a bank account in the US must provide valid identification documents to comply with banking regulations. Banks verify identity through government-issued IDs to ensure security and prevent fraud.

- Passport - A valid foreign passport is widely accepted as a primary form of identification by most US banks.

- Permanent Resident Card (Green Card) - This card serves as proof of legal residency and is essential for immigrants seeking banking services.

- Employment Authorization Document (EAD) - The EAD allows immigrants to prove legal work status and is accepted for identity verification.

Proof of Address: What is Required and Accepted

Proof of address is a crucial requirement for immigrants opening a bank account in the US. Banks typically require documents that confirm residency and address accuracy.

Accepted proofs of address include utility bills, lease agreements, or government-issued letters dated within the last three months. Some banks may also accept a letter from a shelter or an employer confirming the address details.

Social Security Number vs. ITIN: Key Differences and Usage

Opening a bank account in the US as an immigrant requires specific identification documents, with the Social Security Number (SSN) and Individual Taxpayer Identification Number (ITIN) being the most critical. Banks use these numbers to verify identity and ensure compliance with federal regulations.

The SSN is issued by the Social Security Administration for individuals authorized to work in the US, serving as a primary identifier for tax and employment purposes. The ITIN, issued by the IRS, allows individuals without work authorization to file taxes but does not grant work eligibility.

Immigration Status: Relevant Documentation for Bank Accounts

Opening a bank account in the US requires specific documents that verify your immigration status. Banks require these documents to comply with federal regulations and ensure identity verification.

Relevant documentation for immigrants includes a valid passport, visa, or Employment Authorization Document (EAD). Some banks may also request a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Proof of address and a completed application form are commonly required for account opening.

Additional Documents for Non-Residents and Newcomers

| Document Type | Description | Purpose |

|---|---|---|

| Valid Passport | Government-issued passport with photo identification | Primary identification to verify identity |

| Visa or Immigration Status Proof | Documents such as a visa, I-94 form, or work permit | Confirms legal status in the United States |

| Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) | SSN is preferred; ITIN is acceptable for tax reporting purposes | Required for tax identification and compliance |

| Proof of U.S. Address | Utility bill, lease agreement, or bank statement showing U.S. address | Verifies residential address within the United States |

| Additional Documents for Non-Residents and Newcomers |

|

Supports authentication and establishes banking history for individuals without extensive U.S. records |

Common Challenges Immigrants Face with Banking Requirements

What documents are required for immigrants to open a bank account in the US? Immigrants typically need identification such as a passport, proof of address, and a Social Security Number or Individual Taxpayer Identification Number. Banks may also request immigration status documents like a visa or work permit.

What common challenges do immigrants face when meeting banking requirements? Many immigrants struggle with providing acceptable forms of identification and proof of address due to differing documentation standards in their home countries. Language barriers and unfamiliarity with the US banking system often complicate the account opening process.

Tips for Preparing and Organizing Your Documents

Immigrants opening a bank account in the US must prepare key documents such as a valid passport, proof of address, and an Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN). Organize these documents in advance to streamline the account opening process and avoid delays. Keep certified copies of all documents and bring both originals and duplicates to the bank for verification.

What Documents Does an Immigrant Need for Bank Account Opening in the US? Infographic