Essential documents for filing self-employed taxes include income records such as 1099 forms, invoices, and bank statements that detail earnings throughout the tax year. Expense documentation like receipts, mileage logs, and bills for business-related costs helps maximize deductions and reduce taxable income. Keeping organized financial records ensures accurate reporting and compliance with tax regulations.

What Documents Are Essential for Filing Self-Employed Taxes?

| Number | Name | Description |

|---|---|---|

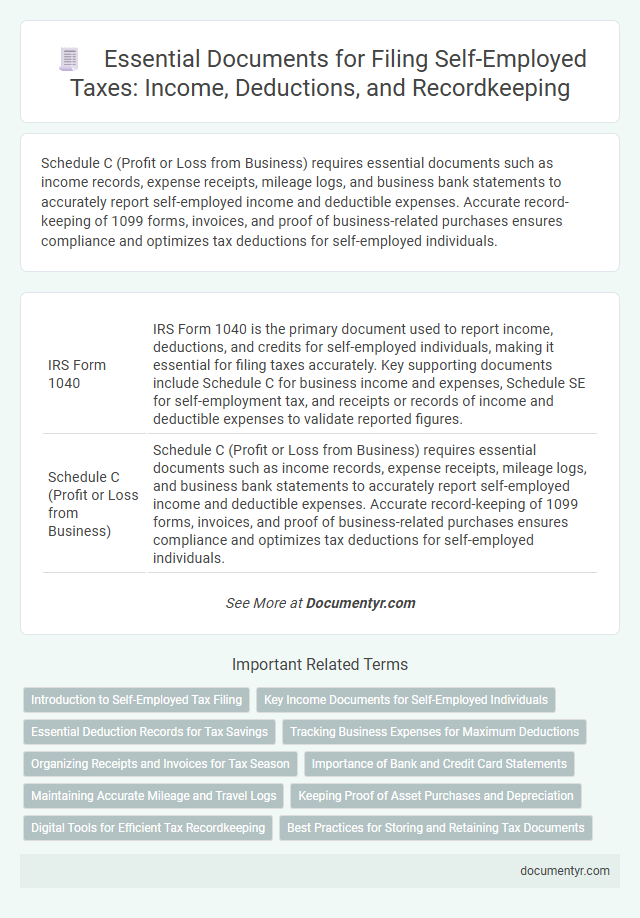

| 1 | IRS Form 1040 | IRS Form 1040 is the primary document used to report income, deductions, and credits for self-employed individuals, making it essential for filing taxes accurately. Key supporting documents include Schedule C for business income and expenses, Schedule SE for self-employment tax, and receipts or records of income and deductible expenses to validate reported figures. |

| 2 | Schedule C (Profit or Loss from Business) | Schedule C (Profit or Loss from Business) requires essential documents such as income records, expense receipts, mileage logs, and business bank statements to accurately report self-employed income and deductible expenses. Accurate record-keeping of 1099 forms, invoices, and proof of business-related purchases ensures compliance and optimizes tax deductions for self-employed individuals. |

| 3 | Schedule SE (Self-Employment Tax) | Schedule SE (Self-Employment Tax) is essential for calculating Social Security and Medicare taxes on net earnings from self-employment, requiring accurate reporting of income and expenses from Form 1040 Schedule C or Schedule F. Supporting documents include detailed profit and loss statements, 1099-MISC or 1099-NEC forms, and records of business expenses to substantiate deductions and ensure proper tax liability. |

| 4 | Form 1099-NEC (Nonemployee Compensation) | Form 1099-NEC is essential for self-employed taxpayers to report income received from nonemployee compensation, ensuring accurate tax filing and compliance with IRS requirements. Along with expense receipts and profit/loss statements, this form provides critical documentation for calculating taxable income and deductible business expenses. |

| 5 | Form 1099-MISC (Miscellaneous Income) | Form 1099-MISC is crucial for self-employed individuals to report miscellaneous income earned from clients or businesses that paid $600 or more during the tax year. Accurate submission of this form, along with supporting financial records such as invoices and expense receipts, ensures compliance with IRS requirements and helps maximize deductible expenses. |

| 6 | Form 1099-K (Payment Card and Third Party Network Transactions) | Form 1099-K reports payment card and third-party network transactions, essential for accurately documenting income from credit card payments and online platforms. Including this form when filing self-employed taxes ensures compliance with IRS requirements and proper income reporting for business activities. |

| 7 | Form 8829 (Expenses for Business Use of Your Home) | Form 8829 is essential for self-employed individuals claiming deductions for business use of their home, requiring accurate records of mortgage interest, rent, utilities, and direct expenses related to the workspace. Keeping detailed documentation, including receipts and utility bills, supports the calculation of allowable home office expenses and maximizes tax deductions. |

| 8 | Business income statements | Business income statements such as profit and loss statements, invoices, and bank statements are essential for accurately reporting earnings and expenses on self-employed tax returns. These documents provide the detailed financial evidence required to calculate taxable income and support deductions claimed during tax filing. |

| 9 | Business expense receipts | Business expense receipts are crucial for accurately claiming deductions and reducing taxable income when filing self-employed taxes, as they provide verifiable proof of costs related to office supplies, travel, equipment, and other deductible expenses. Maintaining organized records of these receipts supports compliance with IRS regulations and facilitates smoother audits or reviews. |

| 10 | Bank statements | Bank statements are essential for filing self-employed taxes as they provide accurate records of income and expenses essential for calculating net profit. These documents help verify reported earnings, track deductible expenses, and support tax return accuracy during IRS audits. |

| 11 | Mileage logs | Mileage logs are essential for self-employed tax filings as they provide detailed records of business-related vehicle use, allowing accurate deduction claims for mileage expenses. Maintaining comprehensive logs with dates, mileage, and trip purposes ensures compliance with IRS requirements and maximizes potential tax savings. |

| 12 | Asset purchase records | Asset purchase records including receipts, invoices, and contracts are essential for accurately reporting depreciation and capital gains on self-employed tax returns. Maintaining organized documentation of all business asset acquisitions helps ensure compliance with IRS requirements and maximizes allowable deductions. |

| 13 | Depreciation schedules | Depreciation schedules are essential documents for self-employed tax filing as they detail the allocation of an asset's cost over its useful life, enabling accurate deduction claims. Properly maintained schedules support the calculation of allowable depreciation expenses, reducing taxable income and ensuring compliance with IRS regulations. |

| 14 | Prior year tax returns | Prior year tax returns are essential documents for filing self-employed taxes, providing a comprehensive record of income, deductions, and credits that inform accurate current-year reporting. Securing these returns ensures consistency in financial data, aids in identifying carryover amounts, and supports claim substantiation during tax audits. |

| 15 | Estimated tax payment records (Form 1040-ES) | Estimated tax payment records, specifically Form 1040-ES, are essential documents for filing self-employed taxes as they detail quarterly tax payments made throughout the year, helping to accurately calculate total tax liability and avoid penalties. Keeping organized records of these payments ensures precise reporting of income and expenses, facilitating smooth IRS processing and audit readiness. |

| 16 | Health insurance documents (Form 1095-A, 1095-B, or 1095-C) | Health insurance documents such as Form 1095-A, 1095-B, or 1095-C are essential for filing self-employed taxes as they provide proof of coverage required for the Premium Tax Credit and compliance with the Affordable Care Act. These forms detail coverage periods and any Marketplace subsidies received, directly impacting potential tax credits or penalties. |

| 17 | Retirement plan contribution statements | Retirement plan contribution statements, including forms for SEP IRA, SIMPLE IRA, and Solo 401(k), are essential documents for accurately reporting and maximizing tax deductions as a self-employed individual. These statements verify deductible contributions and ensure compliance with IRS limits, directly impacting taxable income calculations. |

| 18 | Receipts for business purchases | Receipts for business purchases are essential for accurately documenting deductible expenses when filing self-employed taxes, as they provide proof of costs incurred in generating business income. Maintaining organized records of receipts helps ensure compliance with IRS requirements and can maximize tax deductions by substantiating claims for supplies, equipment, and other operational expenses. |

| 19 | Loan statements related to business | Loan statements related to business are essential for filing self-employed taxes as they provide detailed records of interest paid, principal repayments, and loan balances, which can impact deductible expenses and overall financial reporting. Maintaining accurate and organized loan documentation helps ensure proper calculation of business expenses and supports claims during IRS audits. |

| 20 | State and local tax documents | State and local tax documents essential for filing self-employed taxes include sales tax permits, use tax forms, and local business licenses. Accurate records of estimated tax payments and any state-specific deductions or credits ensure compliance and optimize tax liability. |

Introduction to Self-Employed Tax Filing

Filing taxes as a self-employed individual involves gathering specific documents to ensure accuracy and compliance. Essential records include income statements, expense receipts, and records of business-related transactions. Understanding these documents simplifies the process and helps optimize tax deductions.

Key Income Documents for Self-Employed Individuals

What key income documents are essential for self-employed individuals when filing taxes? Self-employed individuals must gather accurate income records to ensure proper tax reporting. Key documents include 1099-MISC forms, invoices, and bank statements that reflect all received payments.

Essential Deduction Records for Tax Savings

Filing self-employed taxes requires thorough documentation to maximize deductions and ensure compliance. Essential deduction records include receipts, invoices, and bank statements related to business expenses.

Maintaining accurate mileage logs, home office expenses, and records of professional services can significantly reduce taxable income. You should keep organized files of all relevant financial documents throughout the tax year for optimal tax savings.

Tracking Business Expenses for Maximum Deductions

Tracking business expenses is crucial for maximizing deductions when filing self-employed taxes. Essential documents include receipts, invoices, and bank statements that verify your expenses throughout the tax year. Maintaining organized records ensures accurate reporting and helps reduce taxable income effectively.

Organizing Receipts and Invoices for Tax Season

| Document Type | Description | Importance for Tax Filing |

|---|---|---|

| Receipts | Proof of business expenses such as office supplies, equipment purchases, and travel costs. | Essential to claim deductions and reduce taxable income. |

| Invoices | Records of services rendered or products sold, detailing amounts owed by clients. | Crucial for reporting income accurately and verifying earnings. |

| Bank Statements | Documents showing deposits, withdrawals, and business-related transactions. | Helps reconcile income and expenses during tax calculation. |

| Expense Logs | Detailed records categorizing all business expenses over the tax year. | Facilitates organized tracking of deductible costs. |

| 1099 Forms | Income statements provided by clients or third parties for non-employee compensation. | Required to verify reported self-employment income with IRS records. |

| Tax Deductions Documentation | Receipts and statements relating to deductible expenses like home office, mileage, and professional services. | Supports claims for reducing taxable income and maximizing refunds. |

Organizing receipts and invoices ahead of tax season ensures you have accurate records to file self-employed taxes efficiently and avoid errors or missed deductions.

Importance of Bank and Credit Card Statements

Bank and credit card statements provide a detailed record of income and expenses, which is crucial for accurate self-employed tax filing. These documents help verify reported earnings and support deductions claimed on tax returns.

Maintaining organized statements reduces errors and simplifies the audit process by providing clear financial evidence. Accurate records from bank and credit card statements ensure compliance with tax regulations and optimize tax liability management.

Maintaining Accurate Mileage and Travel Logs

Maintaining accurate mileage and travel logs is critical for self-employed tax filings. These records support deductions related to business travel and help ensure compliance with IRS regulations.

- Mileage Log - A detailed record of dates, destinations, purpose, and miles driven for each business trip.

- Receipts for Travel Expenses - Documentation of expenses such as fuel, parking, tolls, and vehicle maintenance directly tied to business travel.

- Vehicle Information - Records including make, model, purchase date, and total miles driven annually to substantiate business use percentage.

Accurate and organized mileage and travel documentation reduces audit risk and maximizes eligible deductible expenses for the self-employed.

Keeping Proof of Asset Purchases and Depreciation

Keeping proof of asset purchases is crucial for accurately filing self-employed taxes. Receipts, invoices, and purchase agreements serve as evidence for deductible expenses related to business assets.

Depreciation documentation includes records of the asset's purchase date, cost, and useful life to calculate yearly depreciation accurately. Maintaining detailed asset logs and depreciation schedules can optimize tax deductions. These documents support claims during audits and ensure compliance with tax regulations.

Digital Tools for Efficient Tax Recordkeeping

Efficient tax recordkeeping is crucial for self-employed individuals to ensure accurate and timely filing. Utilizing digital tools streamlines the collection and organization of essential tax documents.

- Income Tracking Software - These tools automatically compile earnings from multiple sources, simplifying income documentation for tax filing.

- Receipt Scanning Apps - Mobile applications digitize and categorize receipts, reducing manual errors and loss of physical documents.

- Cloud-Based Accounting Platforms - These platforms offer secure storage and real-time access to financial records, enabling better tax preparation and compliance.

What Documents Are Essential for Filing Self-Employed Taxes? Infographic