Lenders require several key documents for debt consolidation loan approval, including proof of income such as pay stubs or tax returns to verify repayment ability. Credit reports and statements from existing debts help assess financial health and outstanding obligations. Identification documents like a government-issued ID and proof of residence are also essential to confirm borrower identity and address.

What Documents Are Necessary for Debt Consolidation Loan Approval?

| Number | Name | Description |

|---|---|---|

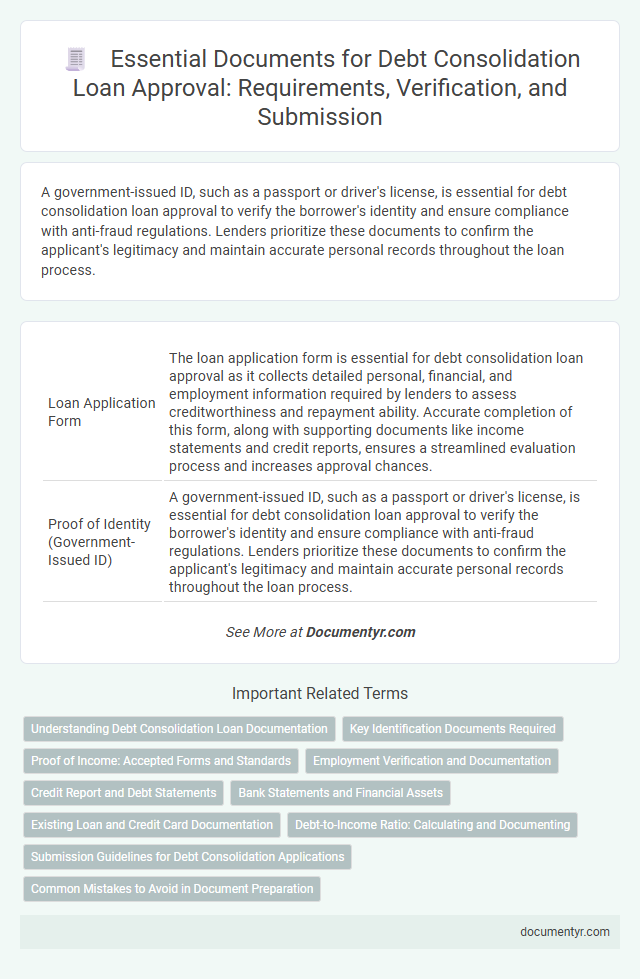

| 1 | Loan Application Form | The loan application form is essential for debt consolidation loan approval as it collects detailed personal, financial, and employment information required by lenders to assess creditworthiness and repayment ability. Accurate completion of this form, along with supporting documents like income statements and credit reports, ensures a streamlined evaluation process and increases approval chances. |

| 2 | Proof of Identity (Government-Issued ID) | A government-issued ID, such as a passport or driver's license, is essential for debt consolidation loan approval to verify the borrower's identity and ensure compliance with anti-fraud regulations. Lenders prioritize these documents to confirm the applicant's legitimacy and maintain accurate personal records throughout the loan process. |

| 3 | Proof of Address (Utility Bill, Lease Agreement) | Lenders require proof of address, such as a recent utility bill or lease agreement, to verify the borrower's residence for debt consolidation loan approval. These documents help confirm identity and ensure accurate credit risk assessment by providing valid, up-to-date address information. |

| 4 | Proof of Income (Recent Pay Stubs, Tax Returns) | Lenders require proof of income through recent pay stubs and tax returns to verify the borrower's ability to repay a debt consolidation loan, ensuring financial stability and reducing default risk. Providing accurate and up-to-date income documentation expedites loan approval and increases trust with the lending institution. |

| 5 | Employment Verification Letter | An Employment Verification Letter is crucial for debt consolidation loan approval as it confirms the borrower's job status, income, and length of employment, ensuring reliable income to repay the loan. Lenders require this document to assess financial stability and reduce default risk by verifying consistent employment and salary details directly from the employer. |

| 6 | Bank Statements | Bank statements are essential for debt consolidation loan approval as they provide lenders with a clear record of your income, expenses, and financial stability over the past 2-3 months. These documents help assess your cash flow and verify your ability to manage and repay the consolidated debt effectively. |

| 7 | Credit Report | A comprehensive credit report is essential for debt consolidation loan approval as it provides lenders with detailed insights into your credit history, outstanding debts, payment patterns, and credit score. This document enables the lender to assess your creditworthiness, evaluate risk, and determine suitable loan terms tailored to your financial circumstances. |

| 8 | List of Outstanding Debts | A comprehensive list of outstanding debts including credit card balances, personal loans, medical bills, and any other liabilities is essential for debt consolidation loan approval to assess your total debt burden. Accurate documentation such as statements and payoff amounts for each debt allows lenders to evaluate your financial obligations and design an effective consolidation plan. |

| 9 | Debt Statements (Credit Card, Personal Loan Statements) | Debt consolidation loan approval requires submitting up-to-date debt statements, including credit card and personal loan statements, to verify outstanding balances and payment history. These documents enable lenders to assess your total debt load and financial responsibility for accurate risk evaluation. |

| 10 | Asset Documentation (if collateral is required) | Debt consolidation loan approval requires comprehensive asset documentation, including recent mortgage statements, property deeds, vehicle titles, and investment account statements to verify collateral value. Lenders also typically demand proof of ownership and current appraisals or valuations to assess the security of the loan against these assets. |

| 11 | Social Security Number Documentation | Lenders require a valid Social Security Number (SSN) as essential documentation to verify the borrower's identity and credit history during debt consolidation loan approval. Accurate SSN documentation enables financial institutions to perform credit checks and assess eligibility efficiently. |

| 12 | Proof of Residence | Proof of residence is a critical document for debt consolidation loan approval, typically requiring utility bills, lease agreements, or mortgage statements dated within the last three months to verify the applicant's current address. Lenders use this information to assess stability and reduce the risk of fraud during the credit evaluation process. |

| 13 | Debt Settlement or Payment History | Lenders require detailed documentation of your debt settlement agreements and payment history to assess your creditworthiness for a debt consolidation loan. Comprehensive records, including past payment receipts, settlement letters, and credit reports, provide critical evidence of your financial responsibility and repayment behavior. |

| 14 | Financial Statement or Budget Form | A detailed financial statement or budget form is essential for debt consolidation loan approval, providing lenders with a clear overview of your income, expenses, assets, and liabilities to assess your repayment capacity. Accurate documentation of monthly cash flow and outstanding debts improves the likelihood of securing favorable loan terms by demonstrating fiscal responsibility and stability. |

| 15 | Authorization to Obtain Credit Report | Lenders require an Authorization to Obtain Credit Report to assess the borrower's creditworthiness during debt consolidation loan approval, enabling access to detailed credit history and scores from credit bureaus. This document ensures compliance with privacy laws and verifies the applicant's financial reliability before finalizing the loan terms. |

Understanding Debt Consolidation Loan Documentation

| Document | Description | Purpose |

|---|---|---|

| Proof of Income | Recent pay stubs, tax returns, or bank statements | Verifies steady income to ensure repayment capacity |

| Credit Report | Detailed record of your credit history | Assesses creditworthiness and risk for loan approval |

| List of Existing Debts | Statements or bills for current loans, credit cards, and other debts | Allows lender to evaluate total debt for consolidation |

| Identification Documents | Government-issued ID such as driver's license or passport | Confirms borrower identity and legal eligibility |

| Proof of Residence | Utility bills or lease agreements | Verifies current address for communication and verification |

| Debt Repayment Plan | Outline of how the consolidated loan will be repaid | Shows your intention and ability to manage finances responsibly |

Key Identification Documents Required

Obtaining a debt consolidation loan requires submitting specific key identification documents to verify your identity and financial status. Lenders use these documents to assess eligibility and facilitate the approval process.

- Government-Issued Photo ID - A valid passport, driver's license, or state ID confirms your identity.

- Proof of Social Security Number - Social Security card or tax documents verify your SSN for credit checks.

- Proof of Residence - Utility bills, lease agreements, or bank statements establish your current address.

Proof of Income: Accepted Forms and Standards

Proof of income is a critical requirement for debt consolidation loan approval, demonstrating your ability to repay the loan. Lenders evaluate various documents to verify income sources and financial stability.

- Pay Stubs - Recent pay stubs provide evidence of consistent employment income over the past few months.

- Tax Returns - Copies of tax returns confirm income reported to the IRS, suitable for self-employed or freelance applicants.

- Bank Statements - Bank statements show direct deposits and additional income, supplementing other proof of earnings.

Providing clear, verifiable income documentation enhances the likelihood of securing approval for your debt consolidation loan.

Employment Verification and Documentation

Employment verification is a critical component of the debt consolidation loan approval process, as lenders need to assess the borrower's income stability and job status. Required documents typically include recent pay stubs, W-2 forms, and sometimes a letter from the employer confirming employment details. Providing accurate employment documentation helps demonstrate the borrower's ability to repay the loan and increases the chances of approval.

Credit Report and Debt Statements

A credit report plays a crucial role in debt consolidation loan approval by providing lenders with a detailed overview of your credit history and current financial behavior. This report helps assess creditworthiness and the risk level associated with lending.

Debt statements are essential documents that outline the outstanding balances and payment histories of existing loans or credit cards. These statements verify your total debt amount and support the lender in structuring an appropriate consolidation plan.

Bank Statements and Financial Assets

Debt consolidation loan approval relies heavily on verifying the borrower's financial stability through key documentation. Bank statements and detailed records of financial assets are critical for lenders to assess risk and repayment ability.

- Bank Statements - Provide a clear history of income, expenses, and regular financial activity over several months.

- Investment Accounts - Demonstrate available financial assets that may support loan repayment and indicate overall net worth.

- Retirement Fund Statements - Offer proof of long-term financial security and asset reserves that lenders consider for loan approval.

Existing Loan and Credit Card Documentation

What existing loan and credit card documentation is required for debt consolidation loan approval? Providing detailed statements of your current loans and credit card accounts helps lenders assess your financial standing. Accurate documentation ensures a smoother approval process for your debt consolidation loan.

Debt-to-Income Ratio: Calculating and Documenting

Debt-to-income (DTI) ratio is a critical factor lenders assess when approving a debt consolidation loan. It measures the percentage of your monthly income that goes toward debt payments.

To calculate your DTI, gather documents such as recent pay stubs, tax returns, and statements of current debts. Lenders require proof of income and debt obligations to accurately evaluate your ability to repay the loan. Providing complete and accurate documentation ensures a smoother approval process for your debt consolidation loan.

Submission Guidelines for Debt Consolidation Applications

Submitting a complete set of documents is essential for debt consolidation loan approval. Required paperwork typically includes proof of income, identification, and detailed records of existing debts.

Ensure correct formatting and timely submission of all documents to avoid delays in processing your application. Lenders may also request credit reports and bank statements to assess financial stability during the evaluation.

What Documents Are Necessary for Debt Consolidation Loan Approval? Infographic