Small business grant applications typically require a detailed business plan, financial statements including income statements and balance sheets, and tax returns to verify financial stability. Supporting documents such as proof of business registration, identification, and a clear description of how the grant funds will be used are essential to demonstrate eligibility. Providing accurate and thorough documentation increases the chances of securing funding for business growth and development.

What Documents Are Needed for Small Business Grant Applications?

| Number | Name | Description |

|---|---|---|

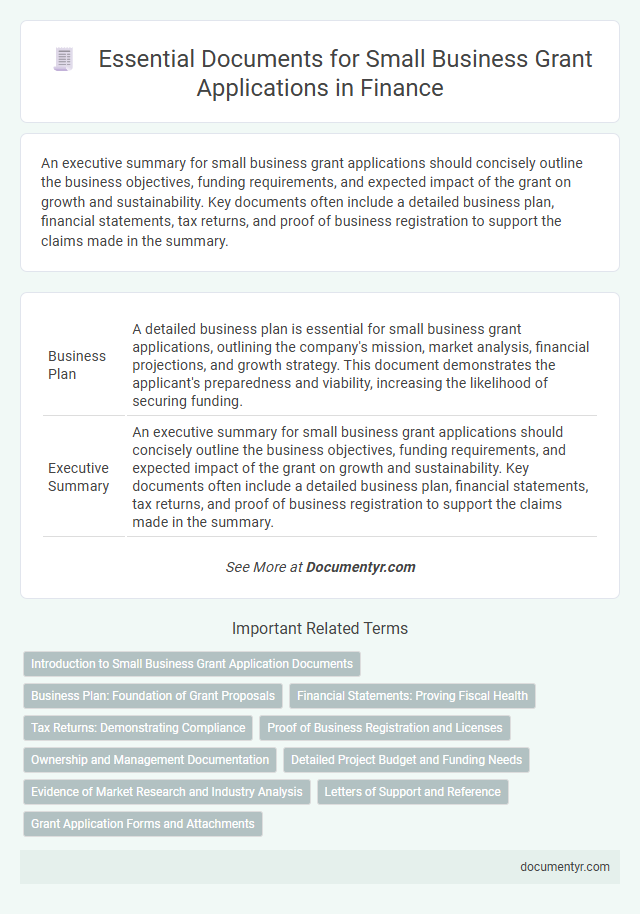

| 1 | Business Plan | A detailed business plan is essential for small business grant applications, outlining the company's mission, market analysis, financial projections, and growth strategy. This document demonstrates the applicant's preparedness and viability, increasing the likelihood of securing funding. |

| 2 | Executive Summary | An executive summary for small business grant applications should concisely outline the business objectives, funding requirements, and expected impact of the grant on growth and sustainability. Key documents often include a detailed business plan, financial statements, tax returns, and proof of business registration to support the claims made in the summary. |

| 3 | Grant Application Form | The grant application form for small business funding typically requires detailed financial statements, a business plan, tax returns, and proof of business registration. Accurate completion of this form is essential to demonstrate eligibility and secure grant approval. |

| 4 | Cover Letter | A cover letter for small business grant applications should include a concise summary of the business's purpose, funding needs, and how the grant will be utilized to achieve specific goals. Key elements include business identification, a clear statement of funding amount requested, and a compelling narrative aligning the grant's objectives with the business's mission and growth plans. |

| 5 | Proof of Business Registration | Proof of business registration is a crucial document for small business grant applications, including official certificates from government agencies such as the Secretary of State or local business licensing authorities. This documentation verifies the legal existence of the business and is often required alongside tax identification numbers and business operation permits. |

| 6 | Articles of Incorporation | Articles of Incorporation serve as a fundamental legal document required for small business grant applications, proving the business's official registration and corporate structure. Lenders and grant providers rely on this document to verify legitimacy, ownership details, and compliance with state regulations before awarding funds. |

| 7 | Employer Identification Number (EIN) | Small business grant applications typically require an Employer Identification Number (EIN) to verify the legitimacy and tax status of the business. The EIN serves as a federal tax identification number, essential for tracking payroll, filing taxes, and establishing eligibility for government grants. |

| 8 | Owner Identification (ID, Passport, etc.) | Small business grant applications typically require owner identification documents such as a valid government-issued ID or passport to verify the applicant's identity. These documents ensure compliance with eligibility criteria and prevent fraud in the grant approval process. |

| 9 | Financial Statements (Balance Sheet, Income Statement, Cash Flow Statement) | Small business grant applications typically require comprehensive financial statements, including a balance sheet, income statement, and cash flow statement, to demonstrate the company's financial health and viability. These documents provide detailed insights into assets, liabilities, revenue, expenses, and cash management, which are critical for grant evaluators to assess the applicant's operational stability and funding needs. |

| 10 | Bank Statements | Bank statements are essential documents in small business grant applications as they provide proof of financial activity, cash flow, and business stability over a specific period. These statements help grantors assess the applicant's ability to manage funds and demonstrate ongoing operational viability. |

| 11 | Business License(s) | Small business grant applications typically require valid business license(s) to verify the legitimacy and legal operation of the enterprise within its jurisdiction. Providing updated copies of all relevant business licenses ensures compliance with local regulations and strengthens the application's credibility with grant providers. |

| 12 | Tax Returns (Business and Personal) | Small business grant applications often require both business and personal tax returns to verify financial stability and assess eligibility. Providing accurate tax documents, including IRS Form 1040 for personal returns and Form 1120 or 1065 for business returns, ensures transparency and supports the application's credibility. |

| 13 | Profit and Loss Statement | A Profit and Loss Statement is a critical document for small business grant applications, providing lenders and grantors with a clear overview of the company's revenue, expenses, and net profit over a specific period. Accurate Profit and Loss Statements demonstrate the business's financial health and profitability, which are essential for assessing eligibility and the potential success of the grant funding. |

| 14 | Budget Proposal | A detailed budget proposal is essential for small business grant applications, outlining projected expenses such as equipment, salaries, and operational costs to demonstrate financial planning and justification for funding. This document should include itemized cost estimates, timelines, and expected outcomes to ensure transparency and increase the likelihood of grant approval. |

| 15 | Letter of Reference or Recommendation | A Letter of Reference or Recommendation for small business grant applications should highlight the applicant's financial responsibility, business acumen, and community impact. This document typically comes from credible sources such as industry experts, previous grantors, or business mentors to strengthen the application's credibility and increase the likelihood of funding approval. |

| 16 | Resume(s) of Owner(s)/Key Staff | Resume(s) of Owner(s) and key staff play a crucial role in small business grant applications by showcasing relevant expertise and leadership capabilities that align with grant criteria. Detailed resumes highlighting professional experience, qualifications, and prior achievements strengthen the applicant's credibility and increase the chances of securing funding. |

| 17 | Project Description/Proposal | A detailed project description or proposal for small business grant applications must clearly outline the business objectives, target market, and implementation timeline, emphasizing measurable outcomes and aligned budget plans. Including specific details such as anticipated financial impact, community benefits, and sustainability strategies enhances the proposal's credibility and competitiveness in the finance sector. |

| 18 | Use of Funds Statement | A Use of Funds Statement in small business grant applications details the specific ways grant money will be allocated, emphasizing expenses such as payroll, equipment, and operational costs to demonstrate responsible financial planning. Including a clear and detailed Use of Funds Statement improves the likelihood of approval by assuring grantors of the applicant's strategic funding approach. |

| 19 | Organizational Chart | An organizational chart is essential for small business grant applications as it visually represents the company's structure, showcasing key roles and reporting lines to demonstrate management capabilities. Including this document helps grant reviewers assess the business's operational framework and leadership, increasing the likelihood of funding approval. |

| 20 | Lease Agreement or Proof of Business Location | A valid lease agreement or official proof of business location, such as a utility bill or property tax statement, is essential for small business grant applications to verify the operational address. These documents confirm the physical presence of the business, which is often a key eligibility criterion for funding agencies. |

| 21 | Recent Utility Bills (Proof of Address) | Recent utility bills serve as essential proof of address in small business grant applications, verifying the applicant's operational location. Lenders and grantors rely on these documents to confirm the legitimacy and physical presence of the business. |

| 22 | Minority/Women/Veteran Certification (if applicable) | Small business grant applications often require Minority/Women/Veteran Certification to verify eligibility, including official documents such as certification letters from recognized agencies like the National Minority Supplier Development Council or the Department of Veterans Affairs. Supporting paperwork typically includes proof of business ownership, demographic documentation, and relevant identification to establish minority, women, or veteran status. |

| 23 | Debt Schedule | A detailed debt schedule is essential for small business grant applications, outlining all current liabilities, including loans, credit lines, and payment terms. This document helps grantors assess the financial health and debt management capability of the business. |

| 24 | Partnership Agreements (if applicable) | Partnership agreements are crucial for small business grant applications as they legally define the roles, responsibilities, and ownership stakes of each partner involved, ensuring clarity and transparency for grant providers. Including a detailed, signed partnership agreement can significantly strengthen the application by demonstrating organized governance and commitment among partners. |

| 25 | Insurance Certificates | Insurance certificates are essential for small business grant applications as they provide proof of liability coverage and risk management, ensuring the business meets funding requirements. These documents typically include general liability, workers' compensation, and property insurance certificates, demonstrating compliance and financial stability to grant providers. |

| 26 | Vendor/Supplier Agreements | Vendor and supplier agreements are essential documents for small business grant applications, demonstrating established business relationships and procurement capabilities. These contracts provide proof of cost commitments and supply chain reliability, which strengthen the grant proposal's credibility. |

Introduction to Small Business Grant Application Documents

Small business grant applications require specific documents to verify eligibility and support the funding request. These documents demonstrate your business's credibility, financial health, and purpose for the grant.

Common documents include a detailed business plan, financial statements, and proof of business registration. Proper preparation of these materials increases the chances of securing grant funding for growth and development.

Business Plan: Foundation of Grant Proposals

A comprehensive business plan is essential for small business grant applications as it outlines the company's vision, goals, and strategies. It serves as the foundation of grant proposals by demonstrating the viability and potential impact of the business to funding organizations. Key components include market analysis, financial projections, and a clear description of products or services.

Financial Statements: Proving Fiscal Health

Financial statements play a critical role in small business grant applications by demonstrating the company's fiscal health. These documents provide evidence of the business's ability to manage funds responsibly and generate revenue.

- Balance Sheet - Shows assets, liabilities, and equity to illustrate the company's financial position at a specific point in time.

- Income Statement - Details revenue, expenses, and profits over a period to highlight operational success and profitability.

- Cash Flow Statement - Tracks inflows and outflows of cash to reveal liquidity and the ability to sustain daily operations.

Submitting accurate and up-to-date financial statements increases the likelihood of securing small business grant funding.

Tax Returns: Demonstrating Compliance

Tax returns are critical documents when applying for small business grants because they demonstrate financial compliance and stability. These records provide grantors with proof of your business income, expenses, and tax obligations. Submitting accurate and up-to-date tax returns strengthens your grant application by showcasing responsible financial management.

Proof of Business Registration and Licenses

Submitting accurate documents is crucial for small business grant applications. Proof of business registration and licenses validates your business legitimacy.

- Proof of Business Registration - Official registration documents confirm your business is legally recognized by local, state, or federal authorities.

- Business Licenses - Valid licenses demonstrate compliance with industry regulations and permit operating legally within your sector.

- Registration Number - A unique business registration or tax identification number links your application to government databases for verification.

Ownership and Management Documentation

Small business grant applications typically require detailed ownership and management documentation to verify the legitimacy of the business. These documents establish who controls and runs the company, which helps grant providers assess eligibility.

Common ownership documents include business registration certificates, articles of incorporation, and ownership structure statements. Management documentation often involves resumes of key executives, organizational charts, and proof of managerial roles. Providing accurate and comprehensive ownership and management records strengthens the grant application and increases the chances of approval.

Detailed Project Budget and Funding Needs

What documents are essential for small business grant applications focusing on detailed project budgets and funding needs? A comprehensive project budget outlines all projected expenses, ensuring transparency and accuracy. Clear documentation of funding requirements demonstrates the business's financial strategy and supports the grant proposal's credibility.

Evidence of Market Research and Industry Analysis

Evidence of market research is essential for small business grant applications to demonstrate a clear understanding of target customers and demand. Detailed data on customer demographics, preferences, and buying behavior strengthen your application.

Industry analysis provides insights into competitive landscape, market trends, and growth potential. Including industry reports and competitor evaluations highlights your business's position and viability within the sector.

Letters of Support and Reference

| Document Type | Description | Importance in Small Business Grant Applications |

|---|---|---|

| Letters of Support | Official letters from community leaders, business partners, or organizations endorsing the applicant's project or business mission. | Demonstrates external validation and community backing, increasing the credibility and trustworthiness of the grant proposal. |

| Reference Letters | Personal or professional testimonials from clients, previous employers, or industry experts emphasizing the applicant's qualifications, work ethic, and business potential. | Highlights the applicant's reputation and reliability, providing grantors with confidence in the applicant's ability to manage funds and successfully execute the business plan. |

What Documents Are Needed for Small Business Grant Applications? Infographic