When applying for a home equity loan, key documents include proof of income such as pay stubs or tax returns, a recent mortgage statement, and property tax bills. Lenders also require a home appraisal to determine the current market value of the property. Additionally, applicants must provide identification and documentation of outstanding debts to assess creditworthiness.

What Documents Are Required for Applying for a Home Equity Loan?

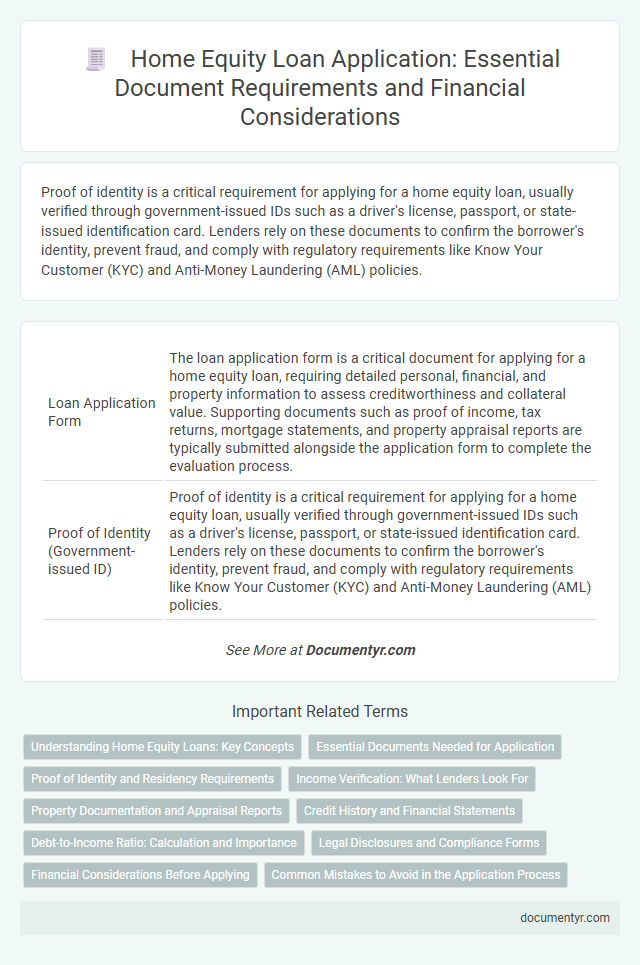

| Number | Name | Description |

|---|---|---|

| 1 | Loan Application Form | The loan application form is a critical document for applying for a home equity loan, requiring detailed personal, financial, and property information to assess creditworthiness and collateral value. Supporting documents such as proof of income, tax returns, mortgage statements, and property appraisal reports are typically submitted alongside the application form to complete the evaluation process. |

| 2 | Proof of Identity (Government-issued ID) | Proof of identity is a critical requirement for applying for a home equity loan, usually verified through government-issued IDs such as a driver's license, passport, or state-issued identification card. Lenders rely on these documents to confirm the borrower's identity, prevent fraud, and comply with regulatory requirements like Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. |

| 3 | Proof of Income (Pay Stubs, Tax Returns, W-2s/1099s) | Lenders require proof of income documents such as recent pay stubs, tax returns from the past two years, and W-2 or 1099 forms to verify your financial stability when applying for a home equity loan. These documents help assess your ability to repay the loan by providing detailed records of your earnings and employment status. |

| 4 | Proof of Employment | Proof of employment is a crucial document when applying for a home equity loan, as lenders require verification of consistent income to assess repayment ability. Commonly accepted proofs include recent pay stubs, W-2 forms, employer contact information, or a letter of employment confirming job status and salary. |

| 5 | Credit Report/Authorization to Pull Credit | A credit report and authorization to pull credit are essential documents required when applying for a home equity loan, as lenders use these to assess the borrower's creditworthiness and financial stability. Providing written consent for a credit check enables lenders to evaluate credit scores, outstanding debts, and repayment history to determine loan eligibility and interest rates. |

| 6 | Recent Bank Statements | Recent bank statements are crucial for applying for a home equity loan as they provide lenders with evidence of your current financial status and cash flow stability. These statements verify income consistency and help assess your ability to repay the loan, making them a key component of the loan documentation process. |

| 7 | Mortgage Statement (Existing Mortgage Documentation) | A Mortgage Statement is a crucial document when applying for a home equity loan, providing detailed information about the existing mortgage balance, interest rate, and payment history. Lenders use this documentation to assess the borrower's current loan obligations and determine available equity for additional borrowing. |

| 8 | Property Deed | The most critical document required for applying for a home equity loan is the property deed, which establishes legal ownership and is used by lenders to verify the borrower's claim to the property. This deed must be clear of liens or encumbrances to ensure the loan is secured against the home equity. |

| 9 | Homeowners Insurance Policy | A current homeowners insurance policy is essential when applying for a home equity loan to protect the property securing the loan and satisfy lender requirements. This document verifies that the home is insured against potential damages, minimizing financial risk for both borrower and lender throughout the loan term. |

| 10 | Property Tax Statements | Property tax statements are essential documents required for applying for a home equity loan as they verify the property's assessed value and confirm that taxes are current. Lenders use these statements to assess the homeowner's financial responsibility and ensure the property is free from outstanding tax liens. |

| 11 | Recent Property Appraisal or Assessor’s Valuation | A recent property appraisal or assessor's valuation is essential for applying for a home equity loan as it establishes the current market value of the property, affecting the loan amount and terms. Lenders rely on this valuation to ensure the collateral sufficiently covers the loan risk based on up-to-date real estate market conditions. |

| 12 | Debt Information (List of Current Debts/Liabilities) | A detailed list of current debts and liabilities, including outstanding credit card balances, personal loans, auto loans, and other financial obligations, is essential when applying for a home equity loan to assess the applicant's repayment capacity. Lenders require accurate documentation of these debts, such as recent statements or payoff letters, to evaluate overall financial health and determine loan eligibility. |

| 13 | Social Security Number (SSN Verification) | Lenders require official documents to verify your Social Security Number (SSN) when applying for a home equity loan, such as a Social Security card, W-2 form, or tax returns. Accurate SSN verification is crucial for credit checks and identity confirmation in the loan approval process. |

| 14 | Homeowners Association (HOA) Documents (if applicable) | Homeowners Association (HOA) documents, including the declaration, bylaws, financial statements, and meeting minutes, are required for applying for a home equity loan when the property is part of an HOA; these documents help lenders assess the property's legal status and the borrower's financial obligations. Lenders use HOA documents to verify any outstanding dues or special assessments that could impact the loan eligibility and repayment capacity. |

| 15 | Divorce Decree or Separation Agreement (if applicable) | A Divorce Decree or Separation Agreement is required when applying for a home equity loan if the property title or financial obligations are affected by the marital status. Lenders use these documents to verify ownership rights, financial responsibilities, and ensure accurate debt assessment related to the applicant's home equity. |

| 16 | Bankruptcy or Foreclosure Documents (if applicable) | When applying for a home equity loan, providing bankruptcy discharge papers or foreclosure documentation is crucial if you have a prior history of financial distress. Lenders require these documents to assess your creditworthiness and verify the resolution of past credit issues, ensuring compliance with underwriting standards. |

Understanding Home Equity Loans: Key Concepts

Understanding home equity loans involves recognizing the key documents necessary for application. You will need proof of income, such as pay stubs or tax returns, to verify your ability to repay the loan. Lenders also require information about your home's value and existing mortgage statements to assess equity and eligibility.

Essential Documents Needed for Application

Applying for a home equity loan requires specific documentation to verify financial stability and property value. Providing complete and accurate papers speeds up the approval process and helps lenders assess risk effectively.

- Proof of Income - Recent pay stubs, tax returns, or W-2 forms verify your ability to repay the loan.

- Property Documentation - A current mortgage statement and property deed confirm ownership and equity available.

- Credit History - A credit report and credit score help lenders evaluate your creditworthiness.

Proof of Identity and Residency Requirements

Applying for a home equity loan requires submitting specific documents to verify your identity and residency. Lenders use these documents to ensure compliance with legal and financial regulations.

- Proof of Identity - Valid government-issued ID such as a passport, driver's license, or state ID confirms who you are.

- Proof of Residency - Utility bills, lease agreements, or mortgage statements serve as evidence of your current residence.

- Additional Residency Verification - Some lenders may request recent bank statements or tax returns showing your address.

Providing accurate identity and residency documents speeds up the home equity loan application process.

Income Verification: What Lenders Look For

Income verification is a critical component lenders evaluate when approving a home equity loan. Lenders typically require recent pay stubs, W-2 forms, and tax returns to assess a borrower's financial stability. Consistent income and employment history increase the chances of loan approval and favorable terms.

Property Documentation and Appraisal Reports

When applying for a home equity loan, providing comprehensive property documentation is essential. These documents include the original property deed, mortgage statements, and property tax receipts to verify ownership and lien status.

Appraisal reports are critical in the loan assessment process as they establish the current market value of the property. An independent, professional appraisal helps lenders determine loan eligibility and the maximum amount available based on your home's equity.

Credit History and Financial Statements

When applying for a home equity loan, lenders require detailed credit history to assess your borrowing reliability and risk. A strong credit score and consistent payment record increase the chances of loan approval.

Financial statements are essential to verify your income, assets, and liabilities, providing a clear picture of your financial stability. Common documents include pay stubs, tax returns, and bank statements, which support your loan application.

Debt-to-Income Ratio: Calculation and Importance

When applying for a home equity loan, lenders require specific documents to assess your financial health, focusing heavily on the debt-to-income (DTI) ratio. This ratio measures your monthly debt payments against your gross monthly income.

Key documents include recent pay stubs, tax returns, and credit statements that help calculate the DTI ratio accurately. The DTI ratio is crucial because it indicates your ability to manage additional loan payments without financial strain. Lenders typically prefer a DTI ratio below 43%, ensuring borrowers can comfortably repay the home equity loan.

Legal Disclosures and Compliance Forms

| Document Type | Description | Purpose |

|---|---|---|

| Loan Estimate | Provides a detailed breakdown of loan terms, estimated interest rates, monthly payments, and closing costs. | Ensures transparency in loan costs and terms before commitment. |

| Closing Disclosure | Final statement of loan terms, closing costs, and cash required to close, delivered at least three days before closing. | Confirms all loan details and legal terms prior to signing. |

| Truth-in-Lending Disclosure (TIL) | Outlines the annual percentage rate (APR), finance charges, amount financed, and total payments over the loan term. | Facilitates understanding of the true cost of borrowing. |

| Good Faith Estimate (GFE) | Estimates loan-related fees and closing costs provided early in the application process. | Helps compare loan offers and costs from different lenders. |

| Privacy Policy Notice | Discloses how personal and financial information is collected, used, and protected by the lender. | Complies with federal privacy laws and protects borrower data. |

| Right to Rescind Notice | Informs about the borrower's three-day period to cancel the loan after closing without penalty. | Provides a legal safeguard for borrower protection. |

| Regulation Z Compliance Forms | Documentation required to confirm adherence to the Truth in Lending Act requirements. | Ensures lender transparency and borrower rights. |

Financial Considerations Before Applying

What financial documents are necessary to apply for a home equity loan? Lenders typically require proof of income, such as recent pay stubs or tax returns, to assess your ability to repay the loan. Bank statements and a detailed list of your current debts help evaluate your overall financial health.

What Documents Are Required for Applying for a Home Equity Loan? Infographic