To set up a Health Savings Account (HSA), individuals must provide a valid form of identification such as a driver's license or passport and proof of enrollment in a high-deductible health plan (HDHP). Employers may require additional documentation like Social Security numbers and completed HSA application forms. Maintaining compliance with IRS regulations also necessitates keeping records of contributions and eligible medical expenses for tax purposes.

What Documents Are Required for Health Savings Account Setup?

| Number | Name | Description |

|---|---|---|

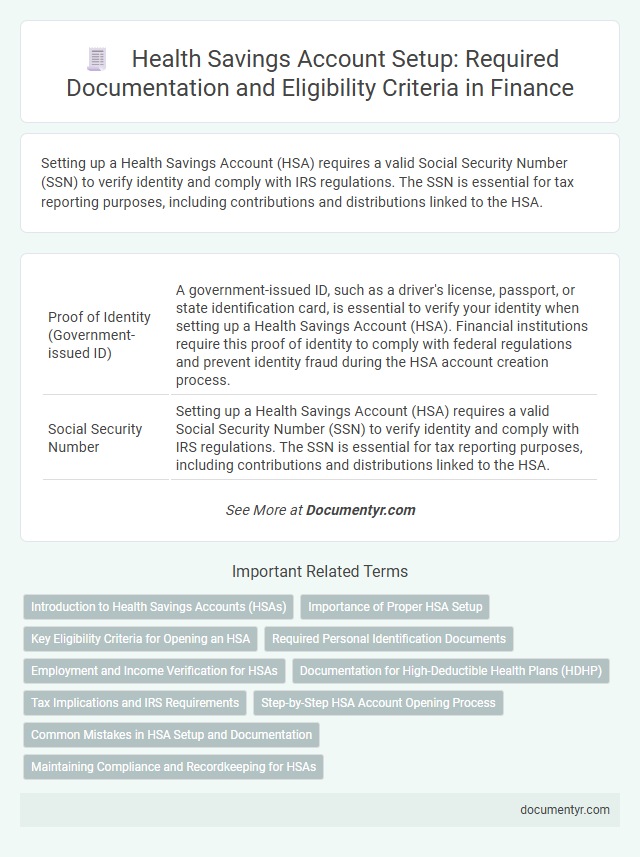

| 1 | Proof of Identity (Government-issued ID) | A government-issued ID, such as a driver's license, passport, or state identification card, is essential to verify your identity when setting up a Health Savings Account (HSA). Financial institutions require this proof of identity to comply with federal regulations and prevent identity fraud during the HSA account creation process. |

| 2 | Social Security Number | Setting up a Health Savings Account (HSA) requires a valid Social Security Number (SSN) to verify identity and comply with IRS regulations. The SSN is essential for tax reporting purposes, including contributions and distributions linked to the HSA. |

| 3 | Proof of Address (Utility Bill, Lease Agreement) | Proof of address documents required for Health Savings Account setup typically include a recent utility bill or a valid lease agreement, verifying the account holder's residential information. These documents must display the current address, date, and account holder's name to meet financial institution compliance standards. |

| 4 | Employer Information (if applicable) | Employers must provide detailed information such as the employer identification number (EIN), business name, and address when setting up a Health Savings Account (HSA) for employees. Documentation may also include proof of the employer's high-deductible health plan (HDHP) offering to ensure eligibility for HSA contributions. |

| 5 | Health Plan Documentation (High Deductible Health Plan Verification) | Health Savings Account (HSA) setup requires proof of enrollment in a High Deductible Health Plan (HDHP), typically verified through health plan documentation such as insurance cards or official plan statements. This documentation must clearly state the deductible amount and confirm that the plan meets IRS criteria for HDHP eligibility to qualify for HSA contributions. |

| 6 | Completed HSA Application Form | A completed HSA application form is essential for setting up a Health Savings Account, as it verifies personal information and account preferences. This form typically requires details such as the account holder's name, Social Security number, and beneficiary designation to ensure compliance with IRS regulations. |

| 7 | Enrollment or Eligibility Verification Form | Enrollment or eligibility verification forms are essential documents required to open a Health Savings Account (HSA), confirming the individual's qualification under IRS guidelines such as enrollment in a high-deductible health plan (HDHP). These forms typically include personal identification, health plan details, and signatures to validate compliance with HSA eligibility requirements and prevent tax penalties. |

| 8 | Beneficiary Designation Form | The Beneficiary Designation Form is a crucial document required for Health Savings Account (HSA) setup, ensuring that account funds are distributed according to the account holder's wishes upon their death. This form captures essential details such as the beneficiary's name, relationship, and percentage of the account to be allocated, providing legal clarity and facilitating smooth asset transfer. |

| 9 | Previous HSA or IRA Transfer/Rollover Forms (if applicable) | Documents required for Health Savings Account setup often include previous HSA or IRA transfer/rollover forms to verify the movement of funds between accounts and ensure tax compliance. These forms, such as IRS Form 1099-SA or distribution statements, provide crucial details on contributions and distributions that affect the account setup and ongoing management. |

| 10 | Taxpayer Identification Number Certification (W-9 Form) | The Taxpayer Identification Number Certification (W-9 Form) is essential for Health Savings Account (HSA) setup, verifying the account holder's Social Security Number or Employer Identification Number for tax reporting purposes. Accurate completion of Form W-9 ensures IRS compliance and facilitates proper tax reporting of contributions and distributions related to the HSA. |

Introduction to Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) offer a tax-advantaged way to save for medical expenses while reducing your taxable income. HSAs are available to individuals enrolled in high-deductible health plans (HDHPs), providing flexibility in managing healthcare costs.

When setting up an HSA, certain documents are necessary to verify eligibility and establish the account. These typically include proof of enrollment in an HDHP, personal identification, and sometimes a completed application form from the financial institution managing the HSA.

Importance of Proper HSA Setup

| Document | Description | Purpose |

|---|---|---|

| Proof of High Deductible Health Plan (HDHP) Enrollment | Official insurance documents or employer statements confirming HDHP coverage | Confirms eligibility for opening a Health Savings Account (HSA) |

| Personal Identification | Government-issued ID such as a driver's license or passport | Verifies the identity of the HSA account holder to comply with financial regulations |

| Social Security Number (SSN) or Taxpayer Identification Number (TIN) | Required identification numbers used for tax reporting purposes | Links the HSA account to the holder's tax records for accurate IRS reporting |

| Bank Account Information | Details such as routing and account numbers for linking external funding sources | Allows for seamless deposits and withdrawals related to the HSA |

| HSA Account Application Form | Completed form provided by the HSA custodian or bank | Officially initiates the HSA setup process and establishes account parameters |

Proper setup of a Health Savings Account is essential for maximizing tax benefits and ensuring compliance with IRS regulations. Accurate documentation prevents delays and errors that could impact contributions, distributions, and tax deductions. Maintaining correct records also supports audit readiness and long-term account management, reinforcing the financial advantages of HSA participation.

Key Eligibility Criteria for Opening an HSA

To open a Health Savings Account (HSA), individuals must provide specific documents verifying eligibility. Essential documents typically include a valid government-issued ID and proof of enrollment in a High Deductible Health Plan (HDHP).

Applicants must confirm they are not covered by other disqualifying health plans or enrolled in Medicare. Documentation proving these eligibility criteria ensures proper account setup and compliance with IRS regulations.

Required Personal Identification Documents

Setting up a Health Savings Account (HSA) requires specific personal identification documents to verify your identity. These documents ensure compliance with financial regulations and prevent fraud.

Typically, you must provide a government-issued photo ID such as a driver's license, passport, or state ID card. Proof of Social Security Number, like a Social Security card or tax documents, is also necessary. Some providers may request additional documentation to confirm your eligibility for an HSA.

Employment and Income Verification for HSAs

What documents are needed to verify employment and income for setting up a Health Savings Account (HSA)? Employment verification typically requires recent pay stubs, a letter from your employer, or tax returns. Income verification may involve providing W-2 forms or 1099 tax documents to confirm your eligibility for an HSA.

Documentation for High-Deductible Health Plans (HDHP)

Setting up a Health Savings Account (HSA) requires specific documentation to verify eligibility, particularly related to High-Deductible Health Plans (HDHP). Proper documentation ensures compliance with IRS regulations for HSAs.

- Proof of HDHP Coverage - A health insurance policy document or summary confirming your enrollment in a qualified high-deductible health plan.

- Plan Deductible Details - Documentation specifying the annual deductible amount meets IRS minimum requirements for an HDHP.

- Coverage Period Verification - Records indicating the effective dates of your HDHP coverage to establish eligibility periods for HSA contributions.

Collecting these documents is essential to successfully open and fund your Health Savings Account under IRS rules.

Tax Implications and IRS Requirements

To set up a Health Savings Account (HSA), individuals must provide a completed HSA application form, proof of enrollment in a High Deductible Health Plan (HDHP), and valid identification documents. The IRS mandates that the HDHP coverage meets specific deductible and out-of-pocket expense criteria to qualify for HSA contributions. Tax implications include the ability to make pre-tax contributions, tax-free growth on investments, and tax-free withdrawals for qualified medical expenses, all requiring accurate documentation to ensure compliance with IRS regulations.

Step-by-Step HSA Account Opening Process

Opening a Health Savings Account (HSA) involves submitting specific documents to verify eligibility and identity. Proper documentation ensures swift account setup and compliance with IRS regulations.

- Proof of High-Deductible Health Plan (HDHP) Coverage - A current insurance card or plan details confirming HDHP enrollment are required.

- Valid Identification - A government-issued ID, such as a driver's license or passport, must be presented for identity verification.

- Social Security Number (SSN) or Tax Identification Number (TIN) - This is necessary for tax reporting and account linking purposes.

Common Mistakes in HSA Setup and Documentation

Setting up a Health Savings Account (HSA) requires accurate documentation to ensure compliance with IRS regulations. Common mistakes in HSA setup often lead to delays and tax complications.

- Incomplete Identification Documents - Submitting outdated or partial ID proofs can prevent account verification and approval.

- Missing High Deductible Health Plan (HDHP) Proof - Failure to provide valid HDHP enrollment documents disqualifies eligibility for HSA contributions.

- Incorrect Social Security Number (SSN) - Errors in SSN entry cause processing delays and potential issues with tax reporting.

What Documents Are Required for Health Savings Account Setup? Infographic