Students applying for FAFSA need to gather key documents such as their Social Security number, driver's license, and prior year tax returns or tax transcripts. They must also provide records of untaxed income, current bank statements, and investment information. Accurate documentation ensures proper completion and timely processing of the federal student aid application.

What Documents Does a Student Need for FAFSA (Free Application for Federal Student Aid)?

| Number | Name | Description |

|---|---|---|

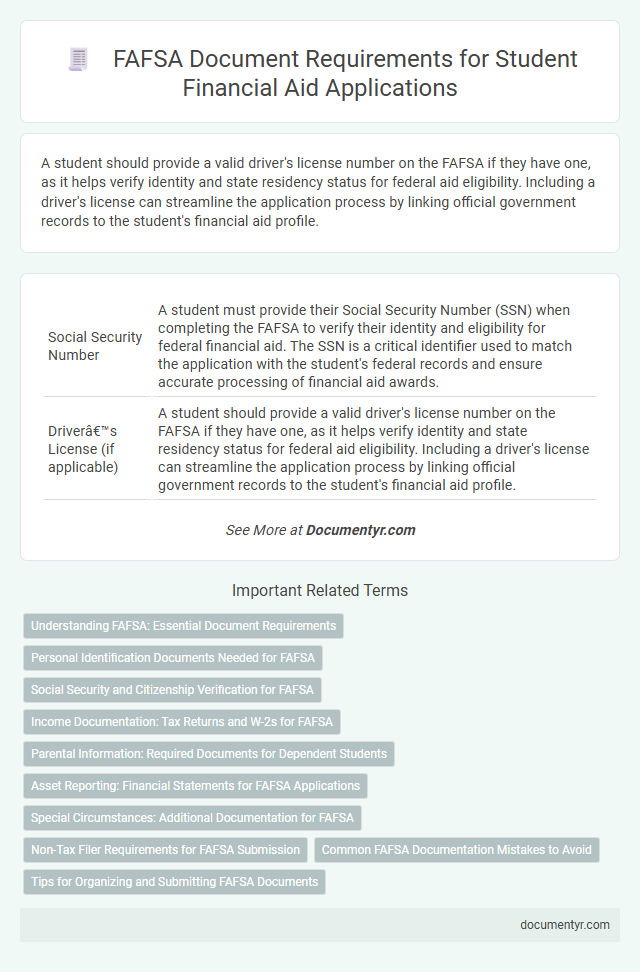

| 1 | Social Security Number | A student must provide their Social Security Number (SSN) when completing the FAFSA to verify their identity and eligibility for federal financial aid. The SSN is a critical identifier used to match the application with the student's federal records and ensure accurate processing of financial aid awards. |

| 2 | Driver’s License (if applicable) | A student should provide a valid driver's license number on the FAFSA if they have one, as it helps verify identity and state residency status for federal aid eligibility. Including a driver's license can streamline the application process by linking official government records to the student's financial aid profile. |

| 3 | Alien Registration Number (if not a U.S. citizen) | Students who are not U.S. citizens must provide their Alien Registration Number (A-Number) on the FAFSA to verify their eligible noncitizen status for federal financial aid. The A-Number is found on immigration documents such as Form I-551 (Green Card), Form I-94, or employment authorization cards. |

| 4 | Federal Income Tax Returns (IRS Form 1040) | Federal Income Tax Returns (IRS Form 1040) are essential for completing the FAFSA as they provide accurate information on a student's and their family's taxable income, which directly impacts financial aid eligibility. Students must include signed copies of their IRS Form 1040 or use the IRS Data Retrieval Tool to transfer tax data seamlessly into the FAFSA application. |

| 5 | W-2 Forms | Students applying for FAFSA must submit W-2 forms from all employers to verify earned income, which helps determine eligibility for federal financial aid. Collecting accurate W-2 forms ensures the reported income matches IRS records, streamlining the application process and reducing verification delays. |

| 6 | Records of Untaxed Income | Records of untaxed income required for FAFSA include child support received, housing, food or living allowances paid to members of the military or clergy, veterans' noneducation benefits, and other untaxed income such as workers' compensation or disability benefits. Providing accurate documentation of these amounts ensures proper calculation of the Expected Family Contribution (EFC) for financial aid eligibility. |

| 7 | Bank Statements | Bank statements required for FAFSA provide proof of savings and financial assets, which help determine a student's Expected Family Contribution (EFC). These documents must show the current balances in checking, savings, and investment accounts as of the date specified on the FAFSA form. |

| 8 | Records of Investments | Students must provide detailed records of investments when submitting the FAFSA, including documentation of stocks, bonds, mutual funds, real estate investments (excluding the primary residence), and any trusts or custodial accounts. Accurate reporting of the current market value and associated income from these investments is crucial for determining financial aid eligibility. |

| 9 | FSA ID (for electronic signature) | Students need to create an FSA ID, which serves as their electronic signature for the FAFSA application, requiring their Social Security number, email address, and a personal password. This secure login verifies identity and allows students to sign and submit the FAFSA online, track application status, and access federal student aid information. |

| 10 | Parents’ Social Security Numbers | Parents' Social Security Numbers are essential for completing the FAFSA, as they verify the identity and financial information needed to assess eligibility for federal student aid. Accurate submission of these numbers helps expedite the application process and ensures correct calculation of the Expected Family Contribution (EFC). |

| 11 | Parents’ Federal Tax Returns and W-2s | Parents' Federal Tax Returns and W-2s are essential documents for completing the FAFSA, as they provide accurate income information used to determine the student's Expected Family Contribution (EFC). These forms include IRS Form 1040 and all W-2 wage statements, which verify earned income and tax liabilities necessary for calculating federal student aid eligibility. |

| 12 | Records of Other Assets (e.g., stocks, bonds, real estate) | Students must provide detailed records of other assets, including current statements for stocks, bonds, mutual funds, and real estate holdings, as these values impact the Expected Family Contribution (EFC) on the FAFSA. Accurate documentation of asset ownership and market values is essential to ensure proper financial aid eligibility assessment by federal and institutional agencies. |

| 13 | Records of Child Support Received or Paid | Records of child support received or paid should include official court documents or a legal separation agreement detailing amounts and payment history to accurately report on the FAFSA. Providing these records ensures the correct calculation of the Expected Family Contribution (EFC) and eligibility for federal student aid. |

| 14 | Documentation of Other Financial Aid Received | Students applying for FAFSA must provide documentation of other financial aid received, including award letters from scholarships, grants, and work-study programs, to ensure accurate assessment of their total financial aid package. This information helps the FAFSA determine the correct amount of federal aid eligibility by accounting for all resources contributing to the student's education funding. |

| 15 | Proof of Selective Service Registration (males, if applicable) | Male students aged 18 to 25 must provide proof of Selective Service registration when submitting the Free Application for Federal Student Aid (FAFSA), which can be verified with a Selective Service registration number, a copy of the registration confirmation, or a status information letter obtained from the Selective Service System. Failure to submit this documentation may result in ineligibility for federal student aid until registration is confirmed. |

Understanding FAFSA: Essential Document Requirements

Filling out the FAFSA (Free Application for Federal Student Aid) requires specific documents to verify financial and personal information. Understanding these essential document requirements streamlines the application process and maximizes aid eligibility.

Students need their Social Security number, driver's license (if applicable), and federal income tax returns. Additional documents include W-2 forms, records of untaxed income, and bank statements to accurately report financial status.

Personal Identification Documents Needed for FAFSA

To complete the FAFSA (Free Application for Federal Student Aid), personal identification documents are essential. These documents verify your identity and eligibility for federal student aid programs.

Key personal identification documents include a valid Social Security card or number, a government-issued photo ID such as a driver's license or passport, and your Alien Registration Number if you are not a U.S. citizen. You will need your most recent federal income tax returns, W-2 forms, and records of untaxed income for accurate financial information. Having these documents ready ensures a smooth and accurate FAFSA application process.

Social Security and Citizenship Verification for FAFSA

| Document Type | Purpose | Details |

|---|---|---|

| Social Security Card | Social Security Number Verification | Required to confirm your Social Security Number (SSN) matches federal records. The SSN must be valid and assigned to you. |

| U.S. Birth Certificate | Proof of U.S. Citizenship | Used to verify U.S. citizenship status if you were born in the United States or a U.S. territory. |

| U.S. Passport | Proof of U.S. Citizenship | Accepted as evidence of citizenship if valid and unexpired. |

| Certificate of Naturalization | Proof of Citizenship for Naturalized Citizens | Documents your status if you became a U.S. citizen after birth. |

| Certificate of U.S. Citizenship | Proof of Citizenship | Issued by U.S. Citizenship and Immigration Services (USCIS) as evidence of citizenship. |

| Permanent Resident Card (Green Card) | Proof of Eligible Non-Citizen Status | Required if you are not a citizen but qualify for federal student aid as an eligible non-citizen. |

Income Documentation: Tax Returns and W-2s for FAFSA

Income documentation is crucial when completing the FAFSA (Free Application for Federal Student Aid). Tax returns, specifically the IRS Form 1040, provide essential financial information required to determine eligibility for federal aid. W-2 forms from employers verify earned income and must be submitted along with tax returns to support the FAFSA application process.

Parental Information: Required Documents for Dependent Students

Completing the FAFSA requires specific parental documents to verify financial information for dependent students. Accurate submissions ensure eligibility for federal student aid programs.

- Parental Tax Returns - Recent IRS tax transcripts or signed tax returns confirm reported income and tax filing status.

- Proof of Income - W-2 forms or current pay stubs provide verification of parental earnings outside of tax returns.

- Social Security Numbers - Including parental Social Security numbers ensures proper identification and processing of the FAFSA application.

Asset Reporting: Financial Statements for FAFSA Applications

What financial statements are required for asset reporting on the FAFSA application? Students must provide accurate records of their and their parents' current assets, including bank statements and investment account summaries. These documents help determine the Expected Family Contribution (EFC) for federal financial aid eligibility.

Special Circumstances: Additional Documentation for FAFSA

Special circumstances may require additional documentation when completing the FAFSA. Examples include proof of dependency override, legal guardianship papers, or documentation of household size changes. You must provide these documents to ensure an accurate assessment of your financial aid eligibility.

Non-Tax Filer Requirements for FAFSA Submission

When submitting the FAFSA as a non-tax filer, specific documents are essential to verify financial information. These documents ensure eligibility for federal student aid without a tax return.

- Proof of Income - Submit W-2 forms or other records of earned income to confirm your financial status.

- IRS Verification of Non-Filing Letter - Obtain this letter from the IRS to prove no tax return was filed for the relevant tax year.

- Statement of Non-Filing - Provide a signed statement explaining the absence of a tax return and detailing your income sources.

Gathering these documents accurately supports a smooth FAFSA submission process for non-tax filers.

Common FAFSA Documentation Mistakes to Avoid

Filing the FAFSA requires accurate documentation to ensure eligibility for federal student aid. Common documents include your Social Security number, federal income tax returns, and records of untaxed income.

Students often make mistakes by submitting incomplete information or using outdated tax data. Avoid errors by gathering current financial records and double-checking every detail before submission.

What Documents Does a Student Need for FAFSA (Free Application for Federal Student Aid)? Infographic