First-time homebuyers need to gather key documents for mortgage pre-approval, including proof of income such as recent pay stubs, tax returns, and W-2 forms. Lenders also require credit information, bank statements, and identification to assess financial stability and verify identity. Having these documents ready streamlines the pre-approval process and improves the chances of securing a mortgage loan.

What Documents Does a First-Time Homebuyer Need for Mortgage Pre-Approval?

| Number | Name | Description |

|---|---|---|

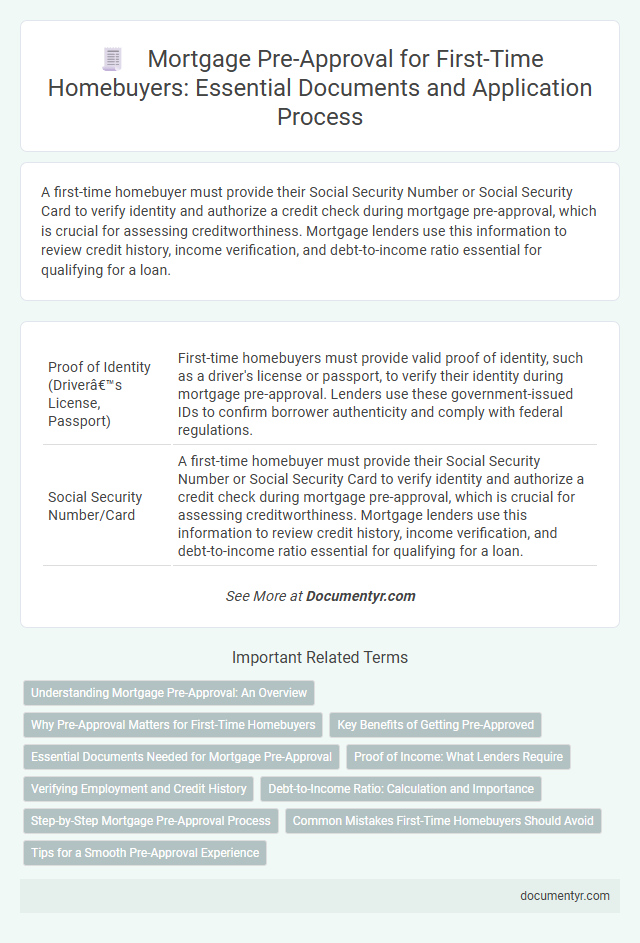

| 1 | Proof of Identity (Driver’s License, Passport) | First-time homebuyers must provide valid proof of identity, such as a driver's license or passport, to verify their identity during mortgage pre-approval. Lenders use these government-issued IDs to confirm borrower authenticity and comply with federal regulations. |

| 2 | Social Security Number/Card | A first-time homebuyer must provide their Social Security Number or Social Security Card to verify identity and authorize a credit check during mortgage pre-approval, which is crucial for assessing creditworthiness. Mortgage lenders use this information to review credit history, income verification, and debt-to-income ratio essential for qualifying for a loan. |

| 3 | Recent Pay Stubs | Recent pay stubs are essential for mortgage pre-approval as they provide proof of current income and employment stability, helping lenders assess your ability to repay the loan. Typically, lenders require pay stubs from the last 30 days showing year-to-date earnings to verify consistent income flow. |

| 4 | W-2 Forms (last 2 years) | First-time homebuyers must provide W-2 forms from the last two years to verify income and employment history during mortgage pre-approval, ensuring lenders have accurate financial information. These documents help assess consistent earnings and support the borrower's ability to repay the loan. |

| 5 | Tax Returns (last 2 years) | First-time homebuyers must provide tax returns from the last two years to verify income stability and accurate financial history during mortgage pre-approval. Lenders rely on IRS Form 1040 and W-2 statements within these returns to assess creditworthiness and debt-to-income ratio. |

| 6 | Bank Statements (last 2–3 months) | Bank statements from the last 2-3 months provide lenders with essential verification of a first-time homebuyer's income, spending habits, and financial stability, ensuring accurate assessment for mortgage pre-approval. These statements help confirm consistent income deposits, track monthly expenses, and identify any irregular transactions that could affect loan eligibility. |

| 7 | Asset Statements (Retirement, Investment Accounts) | First-time homebuyers must provide detailed asset statements including retirement accounts like 401(k)s and IRAs, as well as investment accounts such as stocks, bonds, and mutual funds, to verify financial stability during mortgage pre-approval. These documents help lenders assess the borrower's ability to cover down payments, closing costs, and demonstrate overall financial health. |

| 8 | Employment Verification Letter | An Employment Verification Letter is a crucial document for first-time homebuyers seeking mortgage pre-approval, as it confirms the borrower's current job status, income, and length of employment directly from the employer. Lenders rely on this letter to assess job stability and the borrower's ability to repay the mortgage, making it a key component in the mortgage approval process. |

| 9 | Proof of Additional Income (Bonus, Alimony, Child Support) | First-time homebuyers must provide proof of additional income, such as bonus statements, alimony agreements, or child support documentation, to strengthen their mortgage pre-approval application. Lenders require consistent records like pay stubs, court orders, or bank statements to verify the stability and legality of these supplementary income sources. |

| 10 | Credit Authorization Form | A Credit Authorization Form is essential for first-time homebuyers seeking mortgage pre-approval as it grants lenders permission to access and evaluate their credit history, ensuring accurate risk assessment. This document, alongside income verification and identification, helps streamline the approval process and establishes the buyer's creditworthiness. |

| 11 | Rent Payment History (if applicable) | First-time homebuyers should provide proof of consistent rent payment history, such as bank statements or canceled rent checks, to demonstrate financial reliability during mortgage pre-approval. Lenders use this documentation to assess payment discipline when credit history is limited or non-existent. |

| 12 | Gift Letter (for gifted down payment funds) | A Gift Letter is a crucial document for first-time homebuyers using gifted funds for their down payment, verifying that the money is a bona fide gift with no repayment obligations. Lenders require this letter to confirm the source of the funds, ensuring compliance with mortgage underwriting guidelines and preventing potential loan fraud. |

| 13 | Debt Statements (Credit Cards, Loans) | First-time homebuyers must provide detailed debt statements, including recent credit card balances and loan repayment histories, to secure mortgage pre-approval. Lenders analyze these documents to assess debt-to-income ratios and ensure borrowers can manage additional mortgage obligations. |

| 14 | Divorce Decree (if applicable) | A first-time homebuyer undergoing mortgage pre-approval must provide a divorce decree if applicable, as it verifies the legal separation and outlines financial responsibilities, including alimony or child support. This document helps lenders assess income stability and debt obligations to determine loan eligibility accurately. |

| 15 | Bankruptcy or Foreclosure Documents (if applicable) | First-time homebuyers with a history of bankruptcy or foreclosure must provide detailed court discharge papers, trustee documents, or foreclosure sale records during mortgage pre-approval to verify financial recovery. Lenders require these documents to assess risk and determine eligibility, often including timelines showing the completion of the bankruptcy or foreclosure process. |

Understanding Mortgage Pre-Approval: An Overview

Mortgage pre-approval is a critical step for first-time homebuyers seeking financing. It provides a clear estimate of the loan amount a buyer qualifies for, streamlining the home purchase process.

Understanding the documents required for pre-approval helps buyers prepare efficiently and increases the chances of loan approval.

- Proof of Income - Includes recent pay stubs, tax returns, and W-2 forms to verify steady earnings.

- Credit History - A credit report showing credit score and existing debts to assess creditworthiness.

- Identification - Government-issued ID such as a driver's license or passport to confirm identity.

Why Pre-Approval Matters for First-Time Homebuyers

Mortgage pre-approval is a critical step for first-time homebuyers seeking to understand their borrowing capacity and strengthen their offer. Lenders require specific documents to assess financial stability and creditworthiness effectively.

Key documents include proof of income such as pay stubs, tax returns, and employment verification. Bank statements and credit reports further support the pre-approval process by providing a clear financial snapshot.

Pre-approval offers several advantages, including a clearer budget and increased negotiating power with sellers. It signals to sellers that you are a serious buyer with financing arrangements partially secured.

Having your financial documents organized expedites the mortgage approval process, reducing delays during home purchase. This preparation also helps identify any potential credit issues early, allowing time for improvement before final loan approval.

Key Benefits of Getting Pre-Approved

Mortgage pre-approval requires essential documents such as proof of income, credit reports, and identification. These documents help lenders assess financial stability and determine borrowing limits. Pre-approval offers a competitive edge by showing sellers your serious intent and financial readiness.

Essential Documents Needed for Mortgage Pre-Approval

First-time homebuyers need to gather essential documents to secure mortgage pre-approval. Key documents include proof of income, such as recent pay stubs and tax returns, verification of employment, and bank statements showcasing financial stability. Lenders also require identification documents and a credit report to assess the applicant's creditworthiness accurately.

Proof of Income: What Lenders Require

| Document Type | Description | Purpose |

|---|---|---|

| Pay Stubs | Recent pay stubs covering the last 30 days | Verify current employment and income stability |

| W-2 Forms | W-2s from the past two years | Confirm annual income and employment history |

| Tax Returns | Complete federal tax returns for the last two years | Assess total income, deductions, and consistency |

| Bank Statements | Statements for the most recent 2-3 months | Review deposits, verify income sources, and check savings |

| Proof of Additional Income | Documentation of bonuses, commissions, alimony, or rental income | Supplement income verification for loan qualification |

| Employment Verification Letter | Official letter from employer confirming job status and salary | Confirm current employment details directly with employer |

| Social Security or Disability Income Statements | Official documentation of social security benefits or disability payments | Verify non-employment income streams for loan qualifying |

| Self-Employment Documentation | Profit and loss statements, 1099 forms, and business tax returns | Establish income from self-employment when standard pay stubs are unavailable |

Verifying Employment and Credit History

First-time homebuyers must provide proof of employment to secure mortgage pre-approval. Lenders typically require recent pay stubs, W-2 forms, and employment verification letters to confirm income stability.

Verifying credit history is crucial for mortgage approval. Buyers should submit credit reports and authorize lenders to review their credit scores. This information helps lenders assess financial reliability and determine loan eligibility.

Debt-to-Income Ratio: Calculation and Importance

Understanding your debt-to-income (DTI) ratio is crucial for first-time homebuyers seeking mortgage pre-approval. Lenders use this ratio to evaluate your ability to manage monthly payments and repay debts.

- Debt-to-Income Ratio Definition - The DTI ratio compares your total monthly debt payments to your gross monthly income.

- Calculation Method - Add all monthly debt payments, then divide by gross monthly income and multiply by 100 to get a percentage.

- Importance in Mortgage Pre-Approval - A lower DTI ratio increases the chances of mortgage approval and better loan terms.

Step-by-Step Mortgage Pre-Approval Process

What documents does a first-time homebuyer need for mortgage pre-approval? Lenders require specific financial documents to evaluate your creditworthiness. Preparing these documents beforehand can streamline the mortgage pre-approval process.

What is the first step in the mortgage pre-approval process? The initial step involves completing a mortgage application with detailed personal and financial information. This information helps lenders assess your eligibility and borrowing capacity.

Why is proof of income necessary for mortgage pre-approval? Income verification demonstrates your ability to repay the loan. Common documents include recent pay stubs, W-2 forms, and tax returns from the last two years.

What role do credit reports play in mortgage pre-approval? Lenders review your credit report to determine your credit score and payment history. A strong credit profile increases the chances of approval and better interest rates.

How does proof of assets impact mortgage pre-approval? Providing bank statements and investment account summaries shows you have sufficient funds for a down payment and closing costs. These documents reassure lenders about your financial stability.

What documentation is needed for employment verification? Lenders often require contact details for your employer or recent employment verification letters. Stable employment history strengthens your mortgage application.

Why are identification documents important in the mortgage pre-approval process? Government-issued IDs like a driver's license or passport confirm your identity and legal status. Accurate identification prevents delays or fraud during approval.

How do debts affect the mortgage pre-approval assessment? Lenders analyze your debt-to-income ratio by reviewing current loan statements and credit card balances. Lower debt levels improve your chances of qualifying for a mortgage.

What happens after submitting all required documents for pre-approval? Lenders review and verify submitted documents before issuing a pre-approval letter. This letter indicates the loan amount for which you qualify, helping guide your home search.

Common Mistakes First-Time Homebuyers Should Avoid

First-time homebuyers require key documents for mortgage pre-approval, including proof of income, tax returns, credit reports, and bank statements. Gathering these documents accurately streamlines the approval process and strengthens the buyer's application.

Common mistakes include submitting incomplete documents and failing to check credit scores beforehand. Avoiding these errors helps prevent delays and increases the chances of securing favorable mortgage terms.

What Documents Does a First-Time Homebuyer Need for Mortgage Pre-Approval? Infographic