To complete an international wire transfer, essential documents include a valid government-issued ID, the recipient's bank account details such as IBAN or SWIFT code, and the sender's bank information. Proof of the transaction purpose, like an invoice or contract, may also be required to comply with anti-money laundering regulations. Providing accurate and complete documentation ensures a smooth and timely transfer across borders.

What Documents are Necessary for an International Wire Transfer?

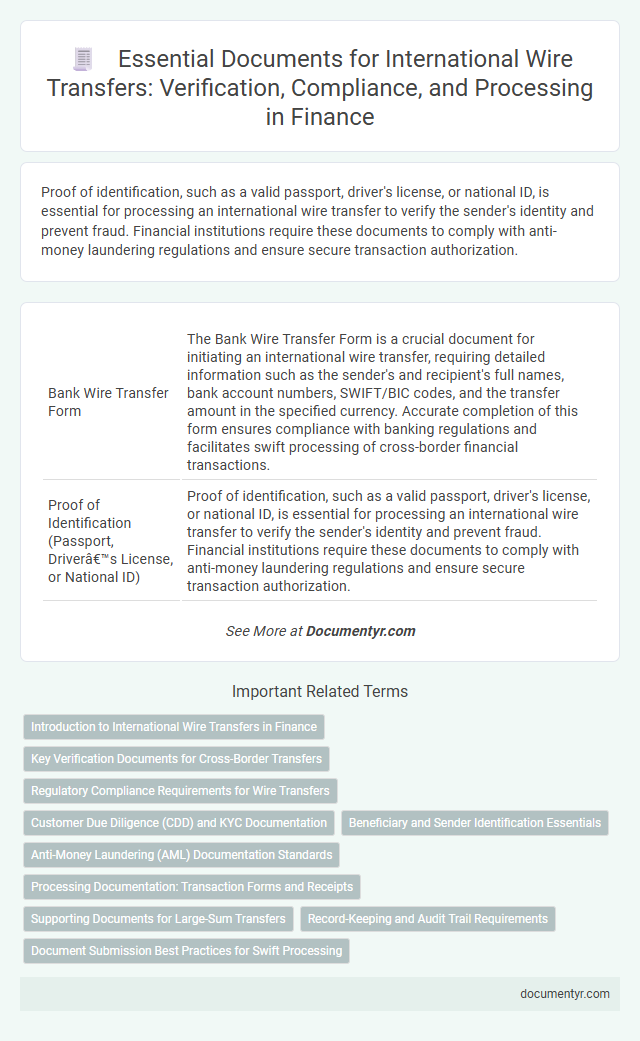

| Number | Name | Description |

|---|---|---|

| 1 | Bank Wire Transfer Form | The Bank Wire Transfer Form is a crucial document for initiating an international wire transfer, requiring detailed information such as the sender's and recipient's full names, bank account numbers, SWIFT/BIC codes, and the transfer amount in the specified currency. Accurate completion of this form ensures compliance with banking regulations and facilitates swift processing of cross-border financial transactions. |

| 2 | Proof of Identification (Passport, Driver’s License, or National ID) | Proof of identification, such as a valid passport, driver's license, or national ID, is essential for processing an international wire transfer to verify the sender's identity and prevent fraud. Financial institutions require these documents to comply with anti-money laundering regulations and ensure secure transaction authorization. |

| 3 | Proof of Address (Utility Bill, Bank Statement) | Proof of address documents such as a recent utility bill or bank statement are essential for international wire transfers to verify the sender's residency and comply with anti-money laundering regulations. Financial institutions typically require these documents to ensure transaction legitimacy and prevent fraud in cross-border payments. |

| 4 | Recipient’s Bank Account Details | Accurate recipient's bank account details, including the account number, SWIFT/BIC code, bank name, and branch address, are essential for processing an international wire transfer efficiently. Missing or incorrect information can lead to delays, additional fees, or funds being misrouted. |

| 5 | SWIFT/BIC Code | The SWIFT/BIC code is essential for identifying the recipient's bank during an international wire transfer, ensuring accurate routing of funds across global financial networks. Along with the beneficiary's account number, bank name, and address, the SWIFT/BIC code enables secure and efficient cross-border transactions. |

| 6 | International Bank Account Number (IBAN) | The International Bank Account Number (IBAN) is a critical document required for an international wire transfer, ensuring accurate identification of the recipient's bank account across borders. Including the IBAN minimizes errors and delays by providing a standardized format recognized globally within the SWIFT network. |

| 7 | Purpose of Transfer Declaration | The purpose of transfer declaration is a critical document for international wire transfers, detailing the reason for the transaction and ensuring compliance with regulatory requirements such as AML (Anti-Money Laundering) and KYC (Know Your Customer) policies. This declaration typically includes information about the sender, recipient, transfer amount, and transaction purpose, helping financial institutions verify legitimacy and facilitate smooth cross-border payments. |

| 8 | Source of Funds Declaration | A Source of Funds Declaration is essential for international wire transfers to verify the origin and legality of the transferred money, complying with anti-money laundering (AML) regulations. This document typically requires detailed information about the sender's income, business transactions, or asset sales to ensure the transaction's transparency and legitimacy. |

| 9 | Invoice or Contract (for business/payment validation) | An invoice or contract is essential for validating international wire transfers in business, serving as proof of the payment purpose and ensuring compliance with financial regulations. These documents provide detailed information on transaction amounts, parties involved, and terms of payment, which banks require to process and verify cross-border payments efficiently. |

| 10 | Anti-Money Laundering (AML) Compliance Form | An Anti-Money Laundering (AML) Compliance Form is essential for international wire transfers to verify the sender's identity and ensure the transaction is not linked to illegal activities. Financial institutions require this form to comply with global AML regulations, preventing fraud and maintaining transparency in cross-border fund movements. |

| 11 | Tax Identification Number (if required) | International wire transfers often require a Tax Identification Number (TIN) to ensure compliance with cross-border tax regulations and prevent fraud. Providing the correct TIN, such as a Social Security Number (SSN) in the U.S. or a Foreign Tax Identification Number for non-residents, facilitates smooth processing and accurate reporting to tax authorities. |

| 12 | Remittance Application Form | The Remittance Application Form is essential for initiating an international wire transfer, requiring detailed information such as sender and recipient bank details, transfer amount, currency, and purpose of the payment. Accurate completion of this document ensures compliance with financial regulations and facilitates the seamless processing of cross-border transactions. |

| 13 | Supporting Documents for Currency Exchange (if applicable) | Supporting documents for currency exchange in an international wire transfer typically include a valid identification proof, such as a passport or government-issued ID, and a transaction invoice or contract outlining the reason for the transfer. Banks may also require currency declaration forms and proof of the source of funds to comply with anti-money laundering regulations and ensure smooth processing of the exchange. |

Introduction to International Wire Transfers in Finance

What documents are necessary for an international wire transfer in finance? International wire transfers require specific documentation to ensure accuracy and compliance with banking regulations. Commonly needed documents include the sender's identification, beneficiary's bank details, and proof of funds.

Key Verification Documents for Cross-Border Transfers

International wire transfers require specific documents to ensure compliance with financial regulations and successful cross-border transactions. Key verification documents help confirm identities and validate the transfer purpose for both sending and receiving banks.

- Identification Proof - A government-issued ID such as a passport or driver's license verifies your identity for the transfer.

- Bank Account Details - Accurate recipient bank details including SWIFT/BIC code and IBAN are essential to route the funds correctly.

- Purpose of Transfer - Providing invoices, contracts, or declarations explains the reason for the transaction to satisfy regulatory checks.

Having these documents prepared will streamline the processing of your international wire transfer.

Regulatory Compliance Requirements for Wire Transfers

International wire transfers require specific documents to ensure compliance with regulatory standards. Key documents include a valid government-issued ID, the sender's bank account information, and details about the recipient's bank account.

Financial institutions mandate documentation to prevent money laundering and comply with anti-terrorism financing laws. Regulatory compliance often requires a completed wire transfer form, proof of the source of funds, and sometimes additional authorization for large transactions.

Customer Due Diligence (CDD) and KYC Documentation

International wire transfers require specific documents to complete Customer Due Diligence (CDD) and Know Your Customer (KYC) processes. Essential documents include a valid government-issued ID, proof of address, and detailed information about the source of funds. You must provide accurate KYC documentation to ensure compliance with anti-money laundering regulations and facilitate smooth transaction processing.

Beneficiary and Sender Identification Essentials

International wire transfers require precise identification of both the sender and the beneficiary to ensure security and compliance. Providing accurate documents helps avoid delays and potential legal issues.

- Valid Government-Issued ID - A passport or national ID card verifies the sender's and beneficiary's identity during the transfer process.

- Proof of Address - Utility bills or bank statements confirm the residency of both parties, supporting regulatory compliance.

- Bank Account Details - The beneficiary's bank name, account number, and SWIFT/BIC code are essential for accurate fund routing.

Anti-Money Laundering (AML) Documentation Standards

| Document | Description | AML Relevance |

|---|---|---|

| Identification Proof | Government-issued ID such as passport or driver's license required for sender and recipient verification. | Ensures compliance with Know Your Customer (KYC) regulations to prevent identity fraud. |

| Source of Funds Declaration | Documentation or statement explaining the origin of the funds being transferred. | Verifies legitimacy of funds, mitigating risks associated with money laundering. |

| Purpose of Transfer | A detailed explanation or contract specifying the reason for the international transaction. | Helps financial institutions assess risk and comply with Anti-Money Laundering (AML) monitoring. |

| Recipient Information | Full name, address, bank details, and account number of the beneficiary. | Facilitates the tracking of funds and ensures transparency in transaction flow. |

| Transaction Records | Receipts or transaction histories related to the wire transfer. | Supports auditing and investigations in case of suspicious activity. |

| Compliance Declaration | Signed document affirming adherence to AML policies and sanctions screening. | Confirms legal responsibility and commitment to regulatory standards. |

Ensuring your international wire transfer meets AML documentation standards protects against financial crimes and regulatory breaches.

Processing Documentation: Transaction Forms and Receipts

International wire transfers require specific processing documentation to ensure accuracy and compliance. Transaction forms must include detailed information such as sender and recipient bank details, SWIFT or IBAN codes, and the exact transfer amount. Receipts serve as proof of payment, confirming that the transaction has been processed and providing a reference for tracking purposes.

Supporting Documents for Large-Sum Transfers

International wire transfers require specific documentation to comply with regulatory standards, especially for large-sum transfers. Ensuring you have the correct supporting documents can prevent delays and facilitate smooth processing.

- Identification Documents - Valid government-issued ID such as a passport or driver's license is necessary to verify your identity.

- Proof of Source of Funds - Bank statements, pay stubs, or sale agreements demonstrate the origin of the transferred money.

- Purpose of Transfer - An invoice, contract, or letter explaining the reason for the transfer helps satisfy compliance and anti-money laundering regulations.

Record-Keeping and Audit Trail Requirements

International wire transfers require specific documentation to ensure compliance with financial regulations and maintain a clear audit trail. Essential documents include the sender's identification, beneficiary details, and transaction purpose statements.

Record-keeping plays a crucial role in verifying the legitimacy of the transfer and preventing fraud or money laundering. Banks and financial institutions retain transfer records such as SWIFT messages, payment confirmations, and correspondence between parties. These documents support transparency and facilitate auditing by regulatory authorities.

What Documents are Necessary for an International Wire Transfer? Infographic