To complete the FAFSA student aid application, applicants must provide their Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Parents' financial information is also required for dependent students, including their tax returns and income details. Accurate documentation ensures the correct calculation of Expected Family Contribution (EFC) and eligibility for federal student aid.

What Documents Are Required for FAFSA Student Aid Application?

| Number | Name | Description |

|---|---|---|

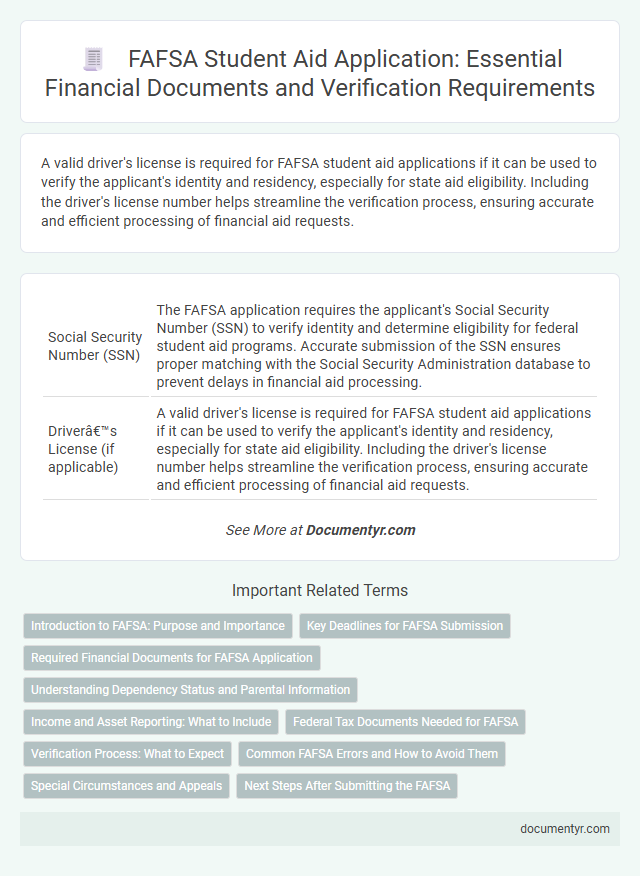

| 1 | Social Security Number (SSN) | The FAFSA application requires the applicant's Social Security Number (SSN) to verify identity and determine eligibility for federal student aid programs. Accurate submission of the SSN ensures proper matching with the Social Security Administration database to prevent delays in financial aid processing. |

| 2 | Driver’s License (if applicable) | A valid driver's license is required for FAFSA student aid applications if it can be used to verify the applicant's identity and residency, especially for state aid eligibility. Including the driver's license number helps streamline the verification process, ensuring accurate and efficient processing of financial aid requests. |

| 3 | Alien Registration Number (for non-U.S. citizens) | Non-U.S. citizens applying for FAFSA student aid must provide their Alien Registration Number (A-Number) as proof of eligible immigration status, which is crucial for confirming eligibility for federal financial aid. This A-Number is typically found on immigration documents such as the Permanent Resident Card (Green Card) or Employment Authorization Document. |

| 4 | Federal income tax returns (IRS 1040, 1040A, or 1040EZ) | Federal income tax returns such as IRS Form 1040, 1040A, or 1040EZ are essential documents for the FAFSA student aid application, providing crucial income and tax information to determine eligibility for federal aid. Accurate submission of these tax returns ensures proper calculation of the Expected Family Contribution (EFC), directly impacting the amount of financial aid awarded. |

| 5 | W-2 forms | W-2 forms are essential documents for the FAFSA student aid application as they provide detailed information about a student's and their parents' annual wages and tax withholdings needed to determine financial aid eligibility. Including accurate W-2 forms ensures that the FAFSA calculates the Expected Family Contribution (EFC) correctly, directly impacting the amount of federal student aid awarded. |

| 6 | Records of untaxed income | FAFSA student aid applications require documentation of untaxed income such as child support received, veterans' non-education benefits, and untaxed portions of pensions. Accurate records from tax returns and official statements ensure proper reporting, impacting aid eligibility and award calculations. |

| 7 | Bank statements | Bank statements are required for the FAFSA student aid application to verify the applicant's and their family's current financial assets and liquidity. Accurate bank statements provide essential data on cash, savings, and checking account balances, which directly impact the Expected Family Contribution (EFC) calculation for federal student aid eligibility. |

| 8 | Investment records | FAFSA student aid applications require detailed investment records, including current statements for stocks, bonds, mutual funds, and other investment accounts. Accurate documentation of real estate investments, trust funds, and any other assets is essential to determine the Expected Family Contribution (EFC) accurately. |

| 9 | FSA ID (for electronic signature) | The FAFSA student aid application requires an FSA ID, which serves as an electronic signature to verify identity and access federal student aid information securely. Applicants must create their FSA ID using a valid Social Security number, email address, and a unique password to complete the online FAFSA submission. |

| 10 | Records of other financial assets | FAFSA student aid application requires detailed records of other financial assets including savings accounts, investments, stocks, bonds, and real estate holdings not used as a primary residence. Accurate documentation of these assets is essential to determine eligibility and expected family contribution for federal student aid. |

| 11 | Records of child support received or paid | FAFSA requires accurate records of child support received or paid to assess financial aid eligibility, including official court orders, payment receipts, and legal agreements. These documents help verify reported amounts and ensure correct calculation of the Expected Family Contribution (EFC). |

| 12 | Records of welfare benefits (if applicable) | Records of welfare benefits, such as Supplemental Nutrition Assistance Program (SNAP) statements or Temporary Assistance for Needy Families (TANF) documentation, are essential for accurately completing the FAFSA application. Providing these records ensures correct reporting of household income and eligibility for need-based federal student aid programs. |

| 13 | Parent(s)’ financial documents (if dependent student) | Dependent students must submit their parent(s)' federal tax returns, W-2 forms, recent pay stubs, and records of untaxed income such as Social Security benefits or child support when applying for FAFSA. Accurate documentation of assets, including bank statements and investment records, is essential to determine the Expected Family Contribution (EFC) for federal student aid eligibility. |

Introduction to FAFSA: Purpose and Importance

What documents are required for the FAFSA student aid application? The Free Application for Federal Student Aid (FAFSA) is essential for students seeking financial assistance for college. Understanding the necessary documents ensures a smooth and accurate application process.

Key Deadlines for FAFSA Submission

To complete the FAFSA student aid application, you need documents such as your Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. You may also need your parents' financial information if you are a dependent student.

Key deadlines for FAFSA submission vary by state and school, but the federal deadline is typically June 30 of the academic year. Submitting your FAFSA as early as possible helps maximize your chances of receiving financial aid.

Required Financial Documents for FAFSA Application

For the FAFSA student aid application, specific financial documents are essential to verify income and assets. Accurate submission of these documents ensures eligibility for federal student aid programs.

Required financial documents for the FAFSA application include your Social Security number and federal income tax returns from the previous year. Additional necessary documents are W-2 forms, records of untaxed income, and bank statements reflecting current balances. These documents help assess financial need and determine the correct aid amount.

Understanding Dependency Status and Parental Information

Understanding your dependency status is crucial when applying for FAFSA student aid, as it determines whose financial information must be reported. Accurate parental information ensures the application reflects your family's financial situation correctly, impacting aid eligibility.

- Proof of Identity - A valid Social Security number or Alien Registration Number is required to verify your identity for FAFSA.

- Dependency Status Documentation - Documents such as birth certificates or legal guardianship papers may be necessary to confirm your dependency status.

- Parental Financial Records - Parents' tax returns, W-2 forms, and other income statements are required if you are classified as a dependent student on FAFSA.

Income and Asset Reporting: What to Include

For the FAFSA student aid application, income and asset reporting requires recent tax returns, W-2 forms, and records of untaxed income. Include information on savings, investments, and business or farm assets to accurately reflect financial status. Your accurate documentation ensures proper assessment of eligibility for financial aid.

Federal Tax Documents Needed for FAFSA

Completing the FAFSA student aid application requires specific federal tax documents to verify financial information accurately. These documents help determine eligibility for federal financial aid programs.

- IRS Tax Return Transcript - Provides the IRS-verified tax filing information required to complete the FAFSA accurately.

- W-2 Forms - Shows income earned from employers, necessary to verify wages reported on the FAFSA.

- IRS Verification of Nonfiling Letter - Confirms that no federal tax return was filed for individuals who did not meet filing requirements.

Verification Process: What to Expect

The FAFSA verification process requires students to submit specific financial documents to confirm the accuracy of their application. Commonly requested documents include tax returns, W-2 forms, and proof of income.

Expect the verification to involve detailed reviews by the financial aid office, which may request additional paperwork. Responding promptly with accurate documents ensures timely processing of student aid.

Common FAFSA Errors and How to Avoid Them

Applying for FAFSA student aid requires accurate documentation to avoid delays in processing and potential loss of benefits. Common FAFSA errors often stem from missing or incorrect information in these documents.

- Social Security Number - Ensure the number matches your official card to prevent identity verification issues.

- Tax Returns - Use the correct tax year documentation to provide precise income data and avoid miscalculations.

- Dependency Status Documentation - Accurately determine and report your dependency status to receive the correct aid amount.

Double-checking these documents and entries helps avoid common FAFSA errors and ensures a smoother application process.

Special Circumstances and Appeals

FAFSA student aid applications require standard documents such as tax returns, W-2 forms, and Social Security numbers. For special circumstances like loss of income or family changes, applicants must provide additional documentation such as letters explaining the situation, recent pay stubs, or court orders. Appeals for financial aid adjustments often need formal letters, updated financial records, and sometimes professional third-party statements to support the case.

What Documents Are Required for FAFSA Student Aid Application? Infographic