To open a high-yield savings account, you need to provide a valid government-issued photo ID, such as a passport or driver's license, and proof of address like a utility bill or bank statement. Most banks also require your Social Security number for identity verification and tax reporting purposes. Additionally, linking an external checking account may be necessary for funding the savings account and enabling easy transfers.

What Documents Are Required for Opening a High-Yield Savings Account?

| Number | Name | Description |

|---|---|---|

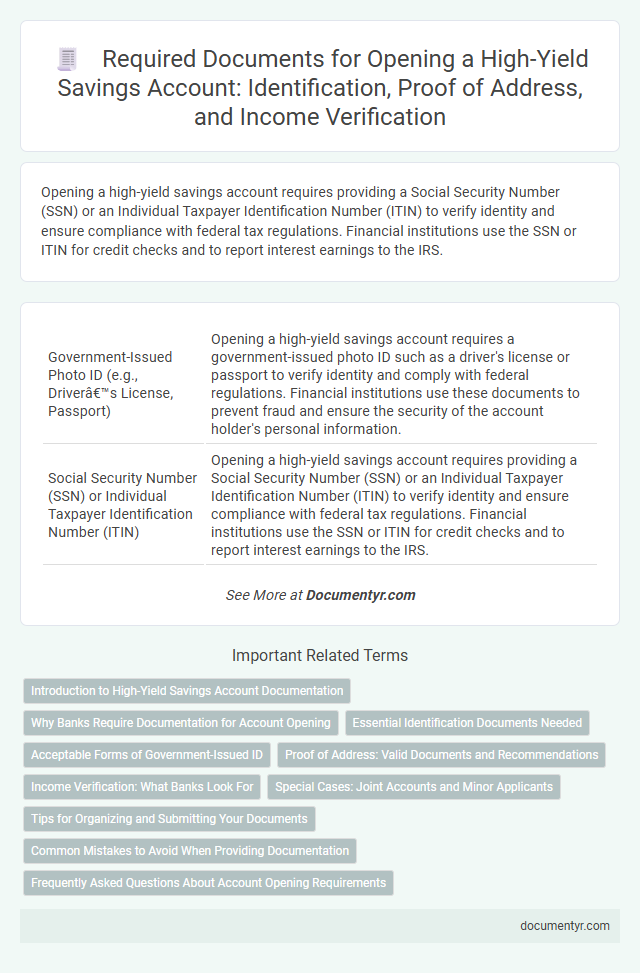

| 1 | Government-Issued Photo ID (e.g., Driver’s License, Passport) | Opening a high-yield savings account requires a government-issued photo ID such as a driver's license or passport to verify identity and comply with federal regulations. Financial institutions use these documents to prevent fraud and ensure the security of the account holder's personal information. |

| 2 | Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) | Opening a high-yield savings account requires providing a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) to verify identity and ensure compliance with federal tax regulations. Financial institutions use the SSN or ITIN for credit checks and to report interest earnings to the IRS. |

| 3 | Proof of Address (e.g., Utility Bill, Lease Agreement, Bank Statement) | Proof of address is a critical document for opening a high-yield savings account, commonly provided through recent utility bills, lease agreements, or bank statements that clearly display the applicant's name and current residential address. Financial institutions use these documents to verify identity and comply with anti-money laundering regulations, ensuring the accuracy of client information before account approval. |

| 4 | Employment or Income Verification (optional/if required) | Employment or income verification for opening a high-yield savings account may include recent pay stubs, W-2 forms, or tax returns to confirm financial stability and comply with bank policies. Some institutions require these documents to assess eligibility, while others may waive this step depending on the applicant's overall financial profile. |

| 5 | Existing Bank Account Information (for funding/ACH transfers) | When opening a high-yield savings account, providing existing bank account information is essential for seamless funding and ACH transfers, typically including your bank's routing number and your account number. Verifying this information ensures secure, direct transfers between accounts and facilitates easy deposits and withdrawals. |

| 6 | Completed Account Application Form | A completed account application form is essential for opening a high-yield savings account, providing the bank with personal details such as full name, address, Social Security number, and employment information. This form verifies identity, ensures compliance with banking regulations like the USA PATRIOT Act, and initiates the account setup process. |

| 7 | Proof of Residency Status (for non-citizens, if applicable) | Non-citizens must provide valid proof of residency status such as a passport with a valid visa, a green card, or a temporary resident identification card when opening a high-yield savings account. Financial institutions may also require utility bills or lease agreements as supplementary proof of residence to verify the applicant's address. |

| 8 | Business Registration Documents (for business accounts) | Business registration documents, including articles of incorporation, business licenses, and employer identification number (EIN) certificates, are essential for opening a high-yield savings account for business purposes. These documents verify the legal status and legitimacy of the business entity, satisfying bank compliance and regulatory requirements. |

| 9 | Employer Identification Number (EIN) (for business accounts) | To open a high-yield savings account for a business, providing an Employer Identification Number (EIN) issued by the IRS is essential for verifying the entity's legal status and tax identification. This unique nine-digit number enables banks to process account applications accurately and ensures compliance with federal regulations. |

Introduction to High-Yield Savings Account Documentation

Introduction to High-Yield Savings Account Documentation |

|

|---|---|

| Opening a high-yield savings account involves submitting specific documentation to verify identity and establish your financial profile. These requirements ensure compliance with banking regulations and protect your funds while enabling access to higher interest rates compared to standard savings accounts. | |

| Document Type | Description |

| Government-Issued ID | Valid forms include a passport, driver's license, or state ID card to confirm your identity and prevent fraud. |

| Proof of Address | Documents such as utility bills, bank statements, or lease agreements showing your current residential address. |

| Social Security Number (SSN) or Tax Identification Number (TIN) | Required for tax reporting purposes and identity verification as mandated by federal regulations. |

| Initial Deposit Information | Details or evidence of your initial fund transfer or deposit to activate the account. |

| Contact Information | Includes a valid phone number and email address to facilitate communication and account management. |

Why Banks Require Documentation for Account Opening

Banks require specific documents to verify the identity and address of individuals opening a high-yield savings account. This verification process helps prevent fraud, money laundering, and complies with regulatory requirements such as the USA PATRIOT Act. Providing accurate documentation ensures account security and smooth transaction processing for the customer.

Essential Identification Documents Needed

Opening a high-yield savings account requires submitting specific essential identification documents to verify your identity and ensure regulatory compliance. Financial institutions prioritize these documents to protect against fraud and confirm your eligibility.

- Government-Issued Photo ID - A valid passport, driver's license, or state ID card is mandatory for identity verification.

- Social Security Number (SSN) or Tax Identification Number (TIN) - This number is used for tax reporting and confirming your identity.

- Proof of Address - A recent utility bill, lease agreement, or bank statement verifies your residential address.

Acceptable Forms of Government-Issued ID

Opening a high-yield savings account requires submitting acceptable forms of government-issued identification to verify your identity. Commonly accepted IDs include a valid passport, a state-issued driver's license, or a government-issued identification card. These documents must be current, unexpired, and feature a clear photo to meet banking regulations.

Proof of Address: Valid Documents and Recommendations

Proof of address is a crucial requirement when opening a high-yield savings account. Financial institutions usually accept documents that clearly display your current residential address.

Valid documents include utility bills, bank statements, lease agreements, and government-issued letters dated within the last three months. It is recommended to provide documents with consistent name and address details to avoid processing delays.

Income Verification: What Banks Look For

Income verification is a crucial step when opening a high-yield savings account to assess your financial stability. Banks require specific documents to confirm your income sources and ensure compliance with regulatory standards.

- Recent Pay Stubs - Banks request recent pay stubs to verify consistent employment income and earnings amount.

- Tax Returns - Annual tax returns provide a comprehensive view of income history and financial reliability.

- Bank Statements - Bank statements help track income deposits and overall financial activity for further validation.

Special Cases: Joint Accounts and Minor Applicants

Opening a high-yield savings account requires specific documents, especially in special cases such as joint accounts and minor applicants. These accounts often involve additional verification to ensure compliance with banking regulations.

For joint accounts, both applicants must provide valid identification, such as government-issued IDs, and proof of address like utility bills or bank statements. Minor applicants require a combination of the minor's identification, usually a birth certificate or Social Security number, along with the guardian's valid ID. Banks also often request parental or guardian consent forms to authorize account management on behalf of the minor.

Tips for Organizing and Submitting Your Documents

Opening a high-yield savings account requires specific documents to verify your identity and financial information. Proper organization and timely submission of these documents ensure a smooth account setup process.

- Valid Identification - Provide a government-issued ID such as a passport or driver's license to confirm your identity.

- Proof of Address - Submit a recent utility bill or bank statement showing your current residential address.

- Social Security Number - Include your Social Security card or tax documents for tax reporting and verification purposes.

Keep all documents clear, legible, and ready for upload or physical submission to avoid delays in account approval.

Common Mistakes to Avoid When Providing Documentation

What documents are required for opening a high-yield savings account? Common documents include a valid government-issued ID, Social Security number, and proof of address. Providing clear and current documents ensures a smooth approval process.

What are common mistakes to avoid when submitting documentation for a high-yield savings account? Avoid submitting expired identification, mismatched addresses, or incomplete forms. These errors can delay account opening or result in rejection by financial institutions.

What Documents Are Required for Opening a High-Yield Savings Account? Infographic