A home mortgage application requires several key documents, including proof of income such as pay stubs, tax returns, and W-2 forms to verify financial stability. Applicants must also provide identification, bank statements to demonstrate savings and asset management, and credit history reports to assess creditworthiness. Additional paperwork like employment verification letters and details of any existing debts may be necessary to complete the mortgage approval process efficiently.

What Documents Are Needed for a Home Mortgage Application?

| Number | Name | Description |

|---|---|---|

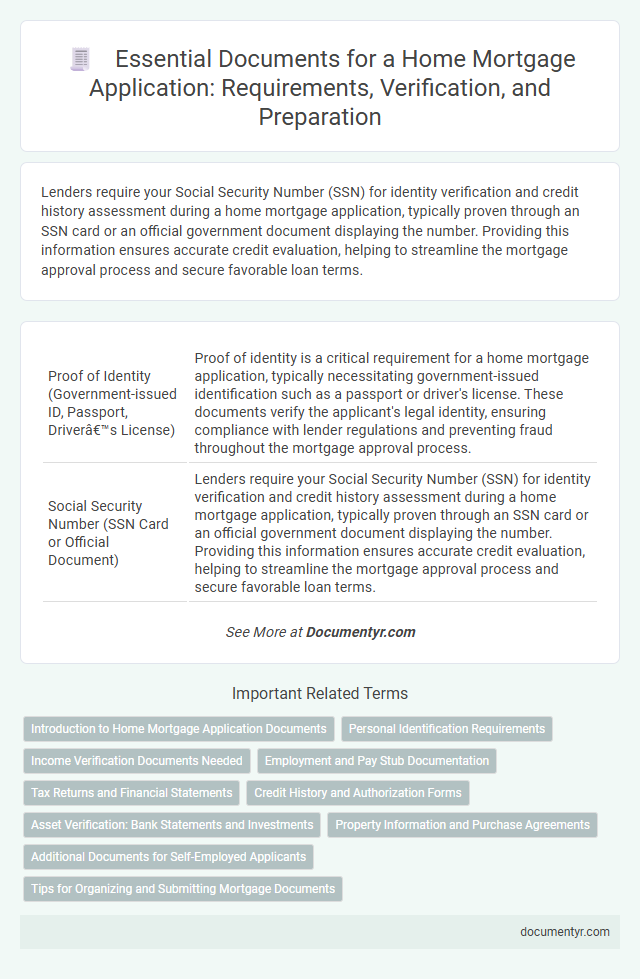

| 1 | Proof of Identity (Government-issued ID, Passport, Driver’s License) | Proof of identity is a critical requirement for a home mortgage application, typically necessitating government-issued identification such as a passport or driver's license. These documents verify the applicant's legal identity, ensuring compliance with lender regulations and preventing fraud throughout the mortgage approval process. |

| 2 | Social Security Number (SSN Card or Official Document) | Lenders require your Social Security Number (SSN) for identity verification and credit history assessment during a home mortgage application, typically proven through an SSN card or an official government document displaying the number. Providing this information ensures accurate credit evaluation, helping to streamline the mortgage approval process and secure favorable loan terms. |

| 3 | Proof of Income (Recent Pay Stubs) | Recent pay stubs are essential for a home mortgage application as they provide lenders with verified evidence of your current income and employment stability. These documents, typically covering the last 30 days, help assess your ability to meet monthly mortgage payments and qualify for the loan. |

| 4 | W-2 Forms (Last 2 Years) | Lenders require W-2 forms from the last two years to verify consistent employment income and assess borrower reliability for a home mortgage application. These documents provide critical proof of earnings, enabling accurate evaluation of the applicant's financial stability and debt-to-income ratio. |

| 5 | Tax Returns (Last 2 Years, All Schedules) | Lenders require tax returns from the last 2 years, including all schedules, to verify income consistency and assess financial stability for home mortgage applications. These documents provide a comprehensive view of your earnings, deductions, and tax obligations, helping underwriters evaluate your repayment capacity. |

| 6 | Bank Statements (Last 2-3 Months, All Accounts) | Bank statements from the last 2-3 months for all accounts provide lenders detailed insight into your financial health, verifying consistent income and tracking spending habits. These documents are crucial to assess your ability to manage mortgage payments and identify any irregularities or large deposits that require explanation. |

| 7 | Employment Verification Letter | An employment verification letter is essential for a home mortgage application as it confirms the borrower's current job status, income, and length of employment, helping lenders assess financial stability. This document typically includes the employer's contact information, job title, salary details, and employment dates, ensuring accurate verification of income and job reliability. |

| 8 | Proof of Assets (Retirement Accounts, Investment Statements) | Proof of assets for a home mortgage application includes recent retirement account statements, such as IRAs or 401(k)s, and comprehensive investment statements detailing stocks, bonds, and mutual funds. Lenders require these documents to verify the borrower's financial stability and ability to cover down payments or closing costs. |

| 9 | Credit Report and Score Authorization | Lenders require credit report and score authorization to assess the applicant's creditworthiness and risk profile during the mortgage application process. This authorization allows them to obtain detailed credit information from bureaus, which is crucial for verifying financial stability and determining loan eligibility. |

| 10 | Gift Letter (If Applicable, for Gift Funds) | A Gift Letter is required when a borrower uses gift funds as part of their home mortgage down payment, detailing the donor's name, relationship to the borrower, gift amount, and a statement that the funds are a gift with no repayment expected. Lenders use this document to verify that the gift is not a loan, ensuring compliance with mortgage underwriting guidelines. |

| 11 | Debt Information (Current Loan Statements, Credit Card Statements) | Lenders require current loan statements and credit card statements to accurately assess your debt obligations during a home mortgage application, ensuring a clear picture of your monthly liabilities. These documents provide critical data on outstanding balances, payment histories, and credit utilization, which directly influence loan approval and interest rates. |

| 12 | Rental History (Lease Agreement, Landlord Reference) | Rental history documents such as a signed lease agreement and a landlord reference are essential for a home mortgage application, as they demonstrate the applicant's ability to meet monthly payment obligations consistently. These records provide lenders with evidence of financial responsibility and repayment reliability outside of traditional credit accounts. |

| 13 | Divorce Decree (If Applicable) | A divorce decree is essential for a home mortgage application when it impacts financial obligations such as alimony, child support, or asset division, providing lenders with a clear understanding of ongoing liabilities. This document helps verify your financial stability and ensures that mortgage approval reflects the current legal and financial status post-divorce. |

| 14 | Bankruptcy / Discharge Papers (If Applicable) | Bankruptcy and discharge papers are critical for home mortgage applications, as they provide lenders with detailed records of past financial difficulties and confirm the legal resolution of bankruptcy. These documents help mortgage underwriters assess creditworthiness and determine eligibility by verifying that the applicant has settled previous debts in accordance with court orders. |

| 15 | Self-Employment Documentation (Profit & Loss Statements, 1099s) | Self-employed individuals must provide detailed profit and loss statements along with copies of all relevant 1099 forms to verify income consistency and financial stability during a home mortgage application. Lenders require these documents to assess earnings, cash flow, and to ensure accurate debt-to-income ratio calculations for mortgage qualification. |

| 16 | Purchase Agreement (Signed Sales Contract for the Home) | The Purchase Agreement, or signed sales contract for the home, is essential in a home mortgage application as it outlines the agreed-upon terms, sale price, and conditions between buyer and seller. This document provides the lender with verification of the property details and confirms the buyer's commitment, enabling accurate mortgage approval and loan processing. |

| 17 | Homeowners Insurance Information | Homeowners insurance information is essential for a home mortgage application as it protects the property against risks like fire, theft, and natural disasters, ensuring the lender's investment is secured. Borrowers must provide a valid insurance policy declaration page that includes the coverage amount, policy number, insurer details, and effective dates to comply with lender requirements. |

| 18 | Proof of Down Payment Source | Lenders require proof of down payment source to verify that funds are legitimate and not borrowed, typically through recent bank statements, gift letters, or sale of assets documentation. Providing clear, verifiable evidence of the down payment origin helps streamline mortgage approval and ensures compliance with underwriting guidelines. |

| 19 | Residency Documentation (Green Card, Visa, or Permanent Resident Card, if applicable) | Residency documentation required for a home mortgage application typically includes a Green Card, Visa, or Permanent Resident Card to verify the applicant's legal status. Lenders use these documents to assess eligibility and comply with federal lending regulations, ensuring lawful residency throughout the loan process. |

Introduction to Home Mortgage Application Documents

What documents are essential for a home mortgage application? Securing a home mortgage requires submitting specific financial and personal documents. These documents help lenders assess creditworthiness and the ability to repay the loan.

Personal Identification Requirements

When applying for a home mortgage, providing valid personal identification is essential to verify your identity and comply with lender requirements. Commonly accepted documents include a government-issued photo ID such as a passport or driver's license. Mortgage lenders may also request a Social Security card to confirm your social security number and support credit verification.

Income Verification Documents Needed

Income verification is a crucial part of the home mortgage application process. Lenders require proof of your financial stability to assess your ability to repay the loan.

- Pay Stubs - Recent pay stubs usually covering the last 30 days demonstrate your current income.

- Tax Returns - Federal tax returns for the past two years provide a comprehensive view of your income history.

- W-2 Forms - W-2 statements from the last two years confirm employment income reported to the IRS.

- Bank Statements - Statements show consistent deposits and help verify overall financial activity.

- Profit and Loss Statements - Self-employed borrowers must supply these documents to prove income stability.

Having these documents ready speeds up the mortgage approval process.

Employment and Pay Stub Documentation

Employment verification is a critical component of your home mortgage application. Lenders require proof of stable and consistent income to assess your ability to repay the loan.

Recent pay stubs are essential documents, typically covering the last 30 days of earnings. These pay stubs provide detailed information on your current salary, bonuses, and deductions, helping lenders evaluate your financial stability.

Tax Returns and Financial Statements

| Document Type | Description | Purpose in Mortgage Application |

|---|---|---|

| Tax Returns | Complete copies of recent federal tax returns, typically covering the last two years, including W-2s and 1099s. | Verify income stability, identify sources of income, and assess overall financial health to determine mortgage eligibility. |

| Financial Statements | Detailed records such as bank statements, investment accounts, retirement accounts, and proof of assets. | Provide evidence of assets, savings, and the ability to cover down payment and closing costs. |

Credit History and Authorization Forms

Applying for a home mortgage requires detailed documentation to verify financial stability. Two critical components are your credit history and authorization forms, which lenders use to assess your loan eligibility.

- Credit History Report - This document provides a comprehensive view of your creditworthiness, including past loans, repayment behavior, and outstanding debts.

- Credit Authorization Form - You must sign this form to give the lender permission to access your credit reports during the loan evaluation process.

- Credit Score Review - Lenders use your credit score derived from your credit history to determine risk and set mortgage terms accordingly.

Asset Verification: Bank Statements and Investments

Asset verification is a critical part of the home mortgage application process, requiring detailed documentation of financial resources. Bank statements and investment accounts provide clear proof of your available assets and financial stability.

- Recent Bank Statements - Lenders require 2 to 3 months of bank statements to verify consistent income deposits and available funds.

- Investment Account Statements - Statements from stocks, bonds, mutual funds, and retirement accounts demonstrate additional financial reserves.

- Proof of Liquid Assets - Documentation must show assets are accessible for down payments and closing costs without liquidity restrictions.

Property Information and Purchase Agreements

Property information is essential for a home mortgage application, including details such as the property's address, type, and estimated value. Accurate data helps lenders assess the loan risk and determine eligibility.

Purchase agreements provide proof of the transaction and include key terms like the sale price, closing date, and contingencies. Lenders use this document to verify purchase intent and financial commitments. You must submit a signed and fully executed purchase agreement to complete the application process.

Additional Documents for Self-Employed Applicants

Applying for a home mortgage requires submitting various financial documents, especially for self-employed applicants. Lenders need these additional documents to verify your income stability and financial health.

Self-employed individuals must provide recent tax returns, including all schedules, for the past two years. Profit and loss statements and bank statements are also essential to demonstrate consistent cash flow and business viability.

What Documents Are Needed for a Home Mortgage Application? Infographic