Essential documents for setting up a trust fund include the trust deed or agreement, which outlines the terms and conditions of the trust. Identification documents for the settlor, trustees, and beneficiaries are also required to verify identities and ensure legal compliance. Financial statements or asset documentation may be necessary to specify which assets are being transferred into the trust.

What Documents Are Necessary for Setting Up a Trust Fund?

| Number | Name | Description |

|---|---|---|

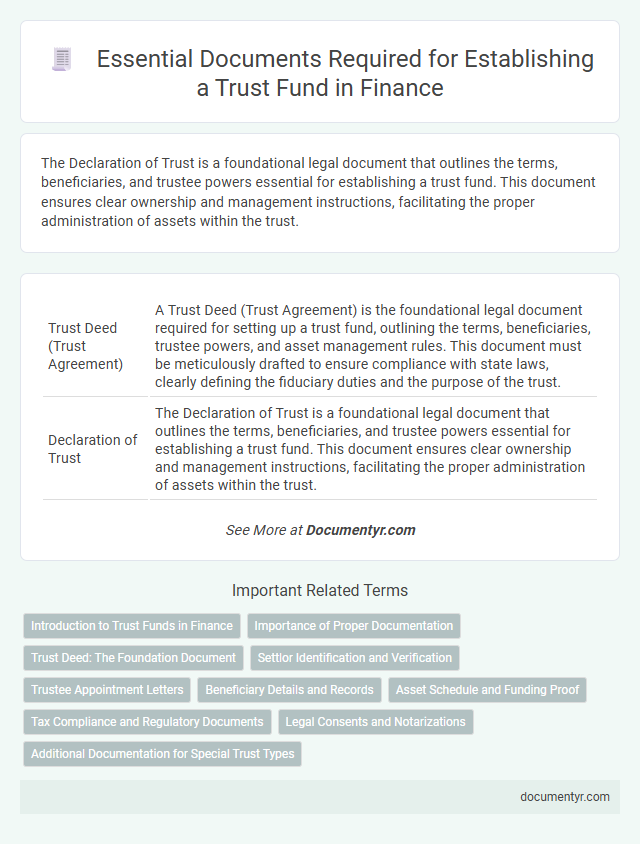

| 1 | Trust Deed (Trust Agreement) | A Trust Deed (Trust Agreement) is the foundational legal document required for setting up a trust fund, outlining the terms, beneficiaries, trustee powers, and asset management rules. This document must be meticulously drafted to ensure compliance with state laws, clearly defining the fiduciary duties and the purpose of the trust. |

| 2 | Declaration of Trust | The Declaration of Trust is a foundational legal document that outlines the terms, beneficiaries, and trustee powers essential for establishing a trust fund. This document ensures clear ownership and management instructions, facilitating the proper administration of assets within the trust. |

| 3 | Letter of Wishes | A Letter of Wishes complements the trust deed by providing non-binding guidance to trustees on the settlor's intentions and preferences for asset distribution. This document is essential for clarifying the settlor's desires without altering the legal terms of the trust fund. |

| 4 | Schedule of Assets | The schedule of assets is a crucial document when setting up a trust fund, detailing all property, investments, and financial accounts to be included in the trust. Accurate asset valuation and comprehensive listing ensure proper management and protect beneficiaries' interests throughout the trust's duration. |

| 5 | Trustee Appointment Letter | A Trustee Appointment Letter is a crucial document that formally designates the individual or entity responsible for managing the trust fund according to the settlor's instructions. This letter outlines the trustee's duties, powers, and responsibilities, ensuring legal clarity and effective administration of the trust assets. |

| 6 | Settlor Identification Documents | Settlor identification documents required for setting up a trust fund typically include government-issued photo IDs such as a passport or driver's license, proof of address via utility bills or bank statements, and sometimes tax identification numbers like a Social Security Number or Taxpayer Identification Number. These documents verify the settlor's identity, residency, and tax status, ensuring compliance with anti-money laundering regulations and trust establishment requirements. |

| 7 | Beneficiary Identification Documents | Beneficiary identification documents necessary for setting up a trust fund include valid government-issued photo IDs such as passports or driver's licenses, Social Security numbers or tax identification numbers, and proof of address through utility bills or bank statements. These documents verify the identity and eligibility of beneficiaries, ensuring compliance with legal and financial regulations during trust establishment. |

| 8 | Trustee Acceptance Letter | A Trustee Acceptance Letter is essential for setting up a trust fund as it formally confirms the trustee's agreement to administer the trust in accordance with its terms and fiduciary duties. This document safeguards the trust's integrity by establishing the trustee's commitment and legal responsibility. |

| 9 | Tax Identification Forms | Setting up a trust fund requires submitting tax identification forms such as the IRS Form SS-4 to obtain an Employer Identification Number (EIN), which is essential for tax reporting and compliance. Trust beneficiaries and trustees must also provide Social Security numbers or Individual Taxpayer Identification Numbers (ITINs) for accurate tax documentation and reporting. |

| 10 | Power of Attorney (if applicable) | Establishing a trust fund requires key documents including the trust deed, identification proofs, and possibly a Power of Attorney if the grantor appoints an agent to manage trust affairs. The Power of Attorney must be notarized and clearly specify the scope of authority to ensure legal compliance and operational clarity in trust administration. |

| 11 | Memorandum of Guidance | The Memorandum of Guidance is a critical document for setting up a trust fund, outlining the settlor's specific instructions and intentions for asset management and distribution. It complements the trust deed by providing detailed guidance to trustees, ensuring adherence to the settlor's wishes and legal requirements in financial planning. |

| 12 | Banking Account Opening Forms | Banking account opening forms for setting up a trust fund require essential documentation such as the trust deed, identification documents of the trustee(s) and beneficiaries, and the Employer Identification Number (EIN) issued by the IRS. Financial institutions may also request a certification of trust and proof of address to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. |

| 13 | Registration Certificate (if required by jurisdiction) | A Registration Certificate is a critical document for setting up a trust fund in jurisdictions where registration is mandatory, serving as official proof that the trust has been legally recognized by relevant authorities. This certificate ensures compliance with local laws and facilitates the trust's ability to operate within the regulated financial framework. |

| 14 | Legal Counsel Opinion Letter | A Legal Counsel Opinion Letter is essential in establishing a trust fund as it validates the trust's compliance with applicable laws and confirms the proper execution of trust documents. This letter provides assurance to trustees and beneficiaries by certifying the trust's legality and the soundness of its financial arrangements. |

| 15 | Trust Registration Form (if required) | The Trust Registration Form is a critical document required in many jurisdictions to legally establish a trust fund, ensuring compliance with local laws and regulations. This form typically includes detailed information about the trust's settlor, trustees, beneficiaries, and the trust's purpose, facilitating proper registration and recognition by tax authorities and regulatory bodies. |

| 16 | Compliance & KYC Documents | Key compliance and KYC documents required for setting up a trust fund include valid identification proofs such as passports or government-issued ID cards, proof of address, and detailed information about the settlor, trustees, and beneficiaries. Financial institutions also require anti-money laundering (AML) declarations, tax identification numbers (TIN), and potentially source of funds documentation to ensure regulatory compliance and prevent fraudulent activities. |

| 17 | Trust Property Transfer Documents | Trust property transfer documents crucial for setting up a trust fund include deeds, titles, and bills of sale that officially convey asset ownership to the trust. These documents ensure legal transfer of real estate, personal property, or financial instruments, establishing the trust's control over the designated assets. |

| 18 | Notarization/Apostille Certificates | Notarization or apostille certificates are essential documents for setting up a trust fund, as they authenticate the trust deed and other legal paperwork, ensuring their legitimacy both domestically and internationally. These certified documents prevent disputes and facilitate smooth asset management by validating the signatures and identities involved in the trust agreement. |

Introduction to Trust Funds in Finance

Setting up a trust fund is a strategic financial move that helps protect and manage assets for future beneficiaries. Trust funds require specific legal documents to establish the terms, trustees, and beneficiaries clearly. Understanding the necessary paperwork ensures your trust is created accurately and serves its intended purpose effectively.

Importance of Proper Documentation

What documents are necessary for setting up a trust fund? Proper documentation ensures the legal validity and clarity of the trust's terms. These documents protect your assets and clearly outline the responsibilities of trustees and beneficiaries.

Why is the importance of proper documentation critical in establishing a trust fund? Accurate and complete documents minimize disputes and provide clear guidance for managing trust assets. They comply with state laws, safeguarding your trust's integrity and purpose.

Trust Deed: The Foundation Document

| Document | Description | Significance |

|---|---|---|

| Trust Deed | The primary legal document establishing the trust fund. It outlines the trust's purpose, the trustee's powers, and the beneficiaries' rights. | Serves as the foundation document for your trust fund, defining all key terms and ensuring the trust operates according to your intentions. |

| Identification Documents | Copies of valid identification such as passports or driver's licenses for trustees and beneficiaries. | Necessary for legal verification and to comply with anti-money laundering regulations. |

| Asset Documentation | Records proving ownership of assets transferred into the trust, such as property deeds, bank statements, or investment certificates. | Important for accurately funding the trust and confirming asset transfer. |

| Letter of Wishes | An optional document that provides guidance to trustees on how to manage the trust discreetly. | Helps trustees understand your personal preferences without altering the legal terms in the trust deed. |

Settlor Identification and Verification

Setting up a trust fund requires careful settlor identification and verification to ensure legal compliance and prevent fraud. Primary documents include a valid government-issued ID such as a passport or driver's license to confirm the settlor's identity.

Proof of address is often necessary, typically in the form of utility bills or bank statements dated within the last three months. Additional documents may include the settlor's Social Security number or tax identification number for further verification.

Trustee Appointment Letters

Setting up a trust fund requires specific documents to ensure legal and financial clarity, with trustee appointment letters being essential. These letters formally designate the trustee responsible for managing the trust's assets and duties.

The trustee appointment letter outlines the powers, responsibilities, and limitations of the trustee. It must be signed by the grantor and accepted by the trustee to be valid. Your careful preparation of this document guarantees proper trust administration and compliance with the trust deed.

Beneficiary Details and Records

Establishing a trust fund requires thorough documentation, with a critical focus on beneficiary details and records to ensure clear asset allocation. Accurate beneficiary information helps prevent disputes and facilitates smooth trust administration.

- Beneficiary Identification - Legal names, birthdates, and contact information of all beneficiaries must be accurately recorded for proper trust management.

- Proof of Identity - Copies of government-issued IDs or passports verify beneficiary identities and comply with legal standards.

- Beneficiary Designation Forms - Formal documents specifying beneficiary rights and interests clarify their entitlements within the trust fund.

Maintaining comprehensive and updated beneficiary records is essential for transparent and compliant trust fund operations.

Asset Schedule and Funding Proof

Setting up a trust fund requires specific documentation to ensure legal compliance and accurate asset management. Key documents include an asset schedule and proof of funding, which detail the trust's financial foundation and resources.

- Asset Schedule - A comprehensive list detailing all assets transferred into the trust, including real estate, securities, and personal property.

- Funding Proof - Documentation such as bank statements or transfer receipts validating the actual funding of the trust's assets.

- Trust Agreement - The legal document establishing the trust, outlining terms, beneficiaries, and trustee powers, supporting the asset schedule and funding proof.

Tax Compliance and Regulatory Documents

Establishing a trust fund requires specific tax compliance documents to ensure lawful financial management and reporting. These documents include the trust's taxpayer identification number and relevant IRS forms such as Form SS-4 for Employer Identification Number (EIN) application.

Regulatory documents are essential to validate the trust's legal standing and adherence to jurisdictional requirements. You must also prepare the trust deed, notarized and signed, along with any state-specific registration filings.

Legal Consents and Notarizations

Setting up a trust fund requires specific legal consents and notarizations to ensure validity and compliance with financial regulations. Your trust document must be properly authorized to protect all parties involved.

- Trust Agreement - This foundational document outlines the terms, beneficiaries, and management of the trust and requires notarization to affirm authenticity.

- Consent Forms from Trustees and Beneficiaries - Explicit legal consents ensure that all relevant parties agree to the trust's terms and their roles.

- Notarized Identification Documents - Valid government-issued IDs from the grantor and trustees must be notarized to verify identity and prevent fraud.

What Documents Are Necessary for Setting Up a Trust Fund? Infographic