Filing for personal bankruptcy requires submitting key documents such as recent pay stubs, a detailed list of assets and liabilities, and a credit counseling certificate. It is essential to gather federal tax returns from the past two years, proof of income, and a complete inventory of all debts, including secured and unsecured obligations. These documents provide the bankruptcy court with a clear financial picture to assess eligibility and plan debt relief.

What Documents Are Necessary for a Personal Bankruptcy Filing?

| Number | Name | Description |

|---|---|---|

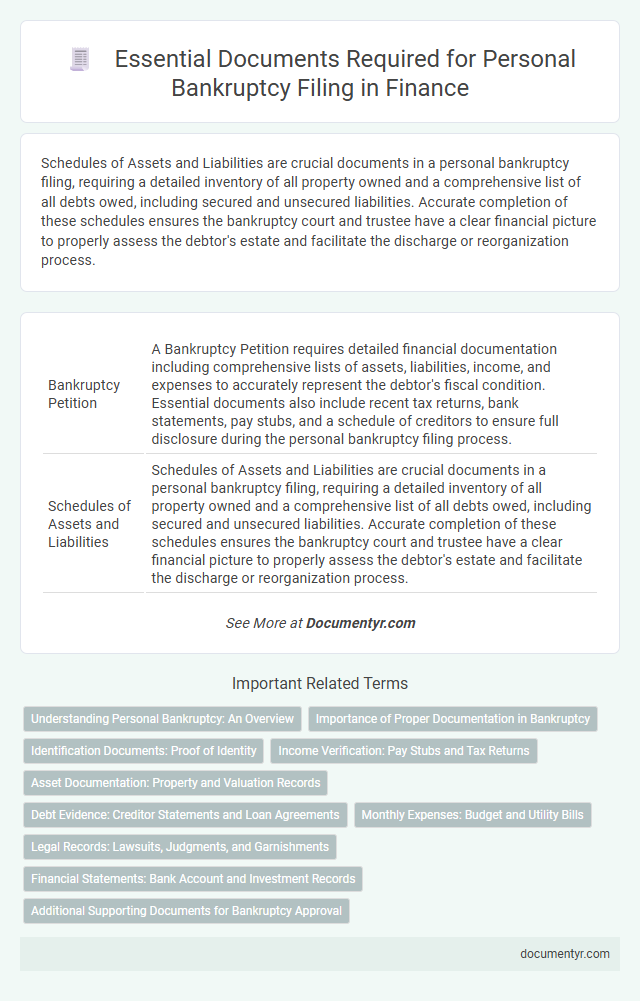

| 1 | Bankruptcy Petition | A Bankruptcy Petition requires detailed financial documentation including comprehensive lists of assets, liabilities, income, and expenses to accurately represent the debtor's fiscal condition. Essential documents also include recent tax returns, bank statements, pay stubs, and a schedule of creditors to ensure full disclosure during the personal bankruptcy filing process. |

| 2 | Schedules of Assets and Liabilities | Schedules of Assets and Liabilities are crucial documents in a personal bankruptcy filing, requiring a detailed inventory of all property owned and a comprehensive list of all debts owed, including secured and unsecured liabilities. Accurate completion of these schedules ensures the bankruptcy court and trustee have a clear financial picture to properly assess the debtor's estate and facilitate the discharge or reorganization process. |

| 3 | Statement of Financial Affairs | The Statement of Financial Affairs is a critical document in personal bankruptcy filings, detailing income sources, property transfers, and recent financial transactions to provide a comprehensive overview of the debtor's financial history. Accurate completion of this form, following the guidelines set by the U.S. Bankruptcy Court, is essential for trustees and creditors to assess the debtor's financial situation and ensure transparency during the bankruptcy process. |

| 4 | Creditor Matrix | The creditor matrix is a critical document listing all creditors, their addresses, and contact information needed for a personal bankruptcy filing to ensure proper notification and claim processing. Accurate compilation of this list directly impacts the efficiency of the bankruptcy case and the protection of debtor rights under U.S. bankruptcy law. |

| 5 | Proof of Income (Pay Stubs) | Proof of income, primarily through recent pay stubs, is essential in a personal bankruptcy filing to verify the debtor's earnings and assess their repayment ability. Lenders and courts require these documents to accurately evaluate financial status, ensuring transparency and compliance with bankruptcy regulations. |

| 6 | Tax Returns (Past 2 Years) | Tax returns from the past two years are essential documents for a personal bankruptcy filing, as they provide a detailed record of income, expenses, and financial activity necessary for accurately assessing the debtor's financial situation. Bankruptcy trustees rely on these tax returns to verify income sources, identify potential assets, and ensure compliance with legal requirements during the case evaluation process. |

| 7 | Bank Statements | Bank statements are essential documents for a personal bankruptcy filing, providing detailed records of your financial transactions, account balances, and spending history over the required periods. These statements help bankruptcy trustees verify your income, assets, and expenditures to assess your financial situation accurately and ensure compliance with legal filing requirements. |

| 8 | Credit Counseling Certificate | A Credit Counseling Certificate, issued after completing a mandatory financial education course, is essential for a personal bankruptcy filing as it verifies the debtor's attempt to seek credit counseling within 180 days before filing. Courts require this document to ensure the debtor has explored alternatives to bankruptcy, making it a critical component of both Chapter 7 and Chapter 13 bankruptcy petitions. |

| 9 | Statement of Current Monthly Income | The Statement of Current Monthly Income (SCMI) is a critical document in personal bankruptcy filings, detailing all sources of the debtor's monthly income to assess repayment ability under Chapter 13 or eligibility for Chapter 7. Accurate completion of the SCMI, supported by pay stubs, tax returns, and other income proofs, ensures compliance with bankruptcy court requirements and influences the case's outcome. |

| 10 | Statement of Intention (Chapter 7 only) | A Statement of Intention is a crucial document in Chapter 7 bankruptcy filings, outlining a debtor's plans for secured debts, such as whether they intend to surrender, redeem, or reaffirm the collateral. This document must be filed within 30 days after submitting the bankruptcy petition to inform the trustee and creditors of the debtor's intentions regarding secured property. |

| 11 | Documentation of Expenses | Accurate documentation of monthly living expenses, including utility bills, rent or mortgage statements, and grocery receipts, is crucial for a personal bankruptcy filing to demonstrate financial hardship. Detailed records of medical expenses, transportation costs, and insurance payments further ensure a comprehensive review during the bankruptcy process. |

| 12 | Vehicle Titles | Vehicle titles are crucial documents required for a personal bankruptcy filing, serving as proof of ownership and detailing any liens on the vehicle. Submitting accurate vehicle titles helps the bankruptcy trustee assess assets and determine the impact on the repayment plan or discharge eligibility. |

| 13 | Mortgage Statements | Mortgage statements are essential documents in a personal bankruptcy filing, as they provide detailed information about outstanding loan balances, payment history, interest rates, and escrow accounts. Including accurate mortgage statements ensures the bankruptcy court can assess secured debts properly and determine the appropriate treatment of the mortgage in the bankruptcy plan. |

| 14 | Retirement Account Statements | Retirement account statements, including 401(k), IRA, and pension plan documents, are essential for a personal bankruptcy filing as they detail exempt assets and income sources. Accurate and up-to-date statements help bankruptcy trustees evaluate financial status and determine which retirement funds are protected under bankruptcy exemptions. |

| 15 | Investment Account Statements | Investment account statements are crucial documents in a personal bankruptcy filing as they provide a detailed record of asset holdings, transactions, and market values necessary for accurate financial disclosure. These statements help trustees assess the debtor's net worth and determine the distribution of assets to creditors. |

| 16 | Divorce Decrees or Child Support Orders (if applicable) | Divorce decrees and child support orders are essential documents in a personal bankruptcy filing as they provide clear evidence of financial obligations and liabilities. Including these legal papers ensures accurate assessment of debts, aiding the court in determining dischargeable and non-dischargeable obligations under bankruptcy law. |

| 17 | Life Insurance Policies | Life insurance policies must be disclosed during a personal bankruptcy filing as they are considered assets that could impact the bankruptcy estate. Providing detailed documentation such as policy statements, beneficiary designations, and cash surrender value reports ensures accurate assessment and proper treatment under bankruptcy law. |

| 18 | Real Estate Deeds | Real estate deeds are essential documents in a personal bankruptcy filing, as they provide proof of property ownership and detail any liens or encumbrances on the property. Accurate submission of these deeds ensures proper asset valuation and protects the debtor's rights during the bankruptcy process. |

| 19 | Loan Agreements | Loan agreements detailing outstanding balances, payment schedules, and creditor information are essential documents for a personal bankruptcy filing, as they provide clear evidence of debt obligations. Including these agreements helps the bankruptcy trustee evaluate the debtor's liabilities accurately and determine the scope of dischargeable debts. |

| 20 | Collection Letters or Lawsuits | Collection letters and lawsuits related to outstanding debts are crucial documents in a personal bankruptcy filing because they provide evidence of claims and creditor actions. Including these legal notices helps establish the validity and amount of debts, ensuring accurate debt disclosure to the bankruptcy court. |

Understanding Personal Bankruptcy: An Overview

Filing for personal bankruptcy requires submitting specific financial documents to the court. Understanding what is needed can streamline the process and protect your interests.

- Income Documentation - Pay stubs, tax returns, and income statements demonstrate your financial status and earning capacity.

- Asset Records - Property deeds, vehicle titles, and bank statements list your possessions and savings for asset evaluation.

- Debt Information - Credit card statements, loan agreements, and creditor correspondence detail your outstanding liabilities.

Gathering these documents accurately helps ensure a smoother personal bankruptcy filing experience.

Importance of Proper Documentation in Bankruptcy

Proper documentation is crucial when filing for personal bankruptcy as it ensures accurate representation of your financial situation. Essential documents include income statements, tax returns, debt records, and a list of assets and liabilities.

Submitting comprehensive financial documents helps your attorney and the court evaluate your case effectively, potentially expediting the bankruptcy process. Missing or incomplete paperwork can lead to delays, case dismissal, or unfavorable rulings.

Identification Documents: Proof of Identity

What identification documents are necessary to prove your identity during a personal bankruptcy filing? Reliable proof of identity is essential to verify the filer's legal status and prevent fraud. Commonly accepted documents include a valid government-issued photo ID such as a driver's license or passport.

Income Verification: Pay Stubs and Tax Returns

| Document Type | Description | Purpose in Bankruptcy Filing |

|---|---|---|

| Pay Stubs | Recent pay stubs from your employer, typically covering the last 3 months. | Verify current income to assess repayment capability and calculate disposable income for the bankruptcy trustee. |

| Tax Returns | Complete federal income tax returns from the past two years, including all schedules and attachments. | Document historical income patterns and financial status, assisting in debt evaluation and eligibility for different bankruptcy chapters. |

Asset Documentation: Property and Valuation Records

Asset documentation plays a critical role in a personal bankruptcy filing, particularly property and valuation records. Precise and thorough records ensure accurate assessment and fair treatment of your assets during the process.

- Property Deeds - These documents establish ownership of real estate, demonstrating legal claims to property involved in the bankruptcy.

- Appraisal Reports - Independent valuations offer a current market value for properties, crucial for accurate asset assessment.

- Mortgage Statements - Recent mortgage statements detail outstanding loan balances and payment histories affecting equity calculations.

Debt Evidence: Creditor Statements and Loan Agreements

Debt evidence is a critical component in a personal bankruptcy filing, establishing the validity and extent of financial obligations. Creditor statements and loan agreements serve as primary documentation to verify outstanding debts.

- Creditor Statements - These documents provide an itemized account of outstanding balances and payment history from each creditor.

- Loan Agreements - Legal contracts outlining the terms and conditions of borrowed funds, including repayment schedules and interest rates.

- Supporting Debt Documentation - Additional papers such as billing statements or collection notices may be required to corroborate creditor claims.

Monthly Expenses: Budget and Utility Bills

Monthly expenses play a crucial role in a personal bankruptcy filing. Budget statements and utility bills help demonstrate your financial obligations and cash flow.

Include detailed records of all regular payments such as rent, electricity, water, and internet bills. A clear budget outlining income versus expenses provides transparency to the court. These documents support the assessment of your financial situation and repayment ability.

Legal Records: Lawsuits, Judgments, and Garnishments

Legal records such as lawsuits, judgments, and garnishments are crucial documents for a personal bankruptcy filing. These documents provide detailed information about your outstanding debts and creditor claims. Including accurate legal records ensures the bankruptcy process reflects all financial obligations accurately.

Financial Statements: Bank Account and Investment Records

Financial statements are crucial documents in a personal bankruptcy filing, providing a clear overview of your monetary situation. Bank account statements reveal your cash flow, deposits, and withdrawals over a specified period, helping to identify accessible funds and financial activity.

Investment records detail ownership of stocks, bonds, mutual funds, and retirement accounts, indicating assets that may affect bankruptcy proceedings. These documents enable the court and trustee to assess your financial standing accurately and determine asset exemptions.

What Documents Are Necessary for a Personal Bankruptcy Filing? Infographic