Filing for Chapter 7 bankruptcy requires submitting several key documents, including a detailed list of current income, assets, liabilities, and monthly living expenses. Debtors must also provide recent tax returns, pay stubs, a statement of financial affairs, and credit counseling certificates. Accurate and complete documentation is essential to ensure the court can thoroughly evaluate the debtor's financial situation and determine eligibility for Chapter 7 relief.

What Documents are Necessary for Filing Bankruptcy Chapter 7?

| Number | Name | Description |

|---|---|---|

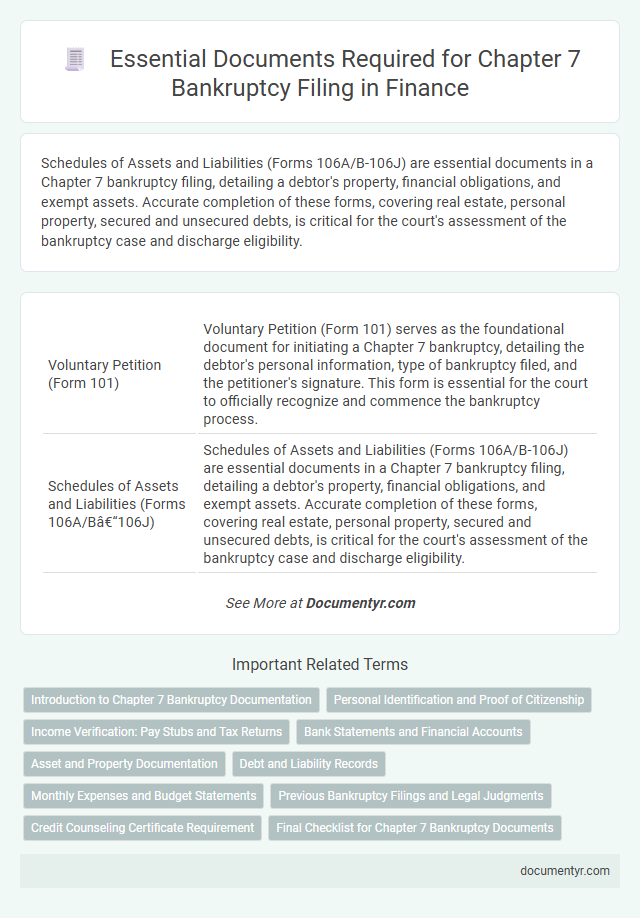

| 1 | Voluntary Petition (Form 101) | Voluntary Petition (Form 101) serves as the foundational document for initiating a Chapter 7 bankruptcy, detailing the debtor's personal information, type of bankruptcy filed, and the petitioner's signature. This form is essential for the court to officially recognize and commence the bankruptcy process. |

| 2 | Schedules of Assets and Liabilities (Forms 106A/B–106J) | Schedules of Assets and Liabilities (Forms 106A/B-106J) are essential documents in a Chapter 7 bankruptcy filing, detailing a debtor's property, financial obligations, and exempt assets. Accurate completion of these forms, covering real estate, personal property, secured and unsecured debts, is critical for the court's assessment of the bankruptcy case and discharge eligibility. |

| 3 | Statement of Financial Affairs (Form 107) | The Statement of Financial Affairs (Form 107) is a critical document in Chapter 7 bankruptcy, requiring detailed disclosure of the debtor's income, expenses, debts, transfers, and financial transactions over the past several years. Accurate completion of Form 107 enables the bankruptcy trustee to assess the debtor's financial history and determine eligibility for Chapter 7 relief. |

| 4 | Statement of Current Monthly Income (Form 122A-1) | The Statement of Current Monthly Income (Form 122A-1) is a critical document in Chapter 7 bankruptcy filings, providing detailed disclosure of the debtor's average monthly income over the past six months to determine eligibility for the means test. Accurate completion of Form 122A-1 ensures compliance with bankruptcy court requirements and influences whether a debtor qualifies for Chapter 7 liquidation or must file under Chapter 13. |

| 5 | Means Test Calculation (Form 122A-2, if required) | Filing for Chapter 7 bankruptcy requires submitting the Means Test Calculation on Form 122A-2 when applicable, which assesses disposable income to determine eligibility. Completing this form accurately necessitates detailed documentation of income, monthly expenses, and financial obligations from the past six months. |

| 6 | Creditor Matrix | The Creditor Matrix is a crucial document in Chapter 7 bankruptcy filings, listing all creditors and their addresses to ensure proper notification of the bankruptcy case. Accurate and comprehensive creditor information is essential to avoid dismissal or delays in the bankruptcy process. |

| 7 | Certificate of Credit Counseling | Filing for Chapter 7 bankruptcy requires submitting a Certificate of Credit Counseling obtained from an approved agency within 180 days before filing, demonstrating completion of a mandatory financial education course. This document is essential to prove compliance with federal requirements and avoid dismissal of the bankruptcy case. |

| 8 | Pay Stubs (Proof of Income, last 60 days) | Submitting the last 60 days of pay stubs as proof of income is crucial for Chapter 7 bankruptcy filing to verify current earnings and assess eligibility for debt discharge. These documents help the court evaluate your financial situation accurately and ensure compliance with bankruptcy requirements. |

| 9 | Federal and State Tax Returns (last 2 years) | Filing Chapter 7 bankruptcy requires submitting the last two years of federal and state tax returns to provide a comprehensive financial overview to the bankruptcy court. These documents verify income, identify potential exemptions, and assist in accurately assessing the debtor's financial status for discharge eligibility. |

| 10 | Bank Statements | Bank statements are essential documents for filing Chapter 7 bankruptcy, providing a detailed record of all account transactions over the past six months to verify income, expenses, and assets. These statements help trustees assess the debtor's financial activity and ensure accurate disclosure of funds during the bankruptcy process. |

| 11 | Real Estate Deeds and Mortgage Statements | Real estate deeds and mortgage statements are critical documents in a Chapter 7 bankruptcy filing, as they verify property ownership and outstanding loan amounts, helping the court assess secured debts. Accurate submission of these documents ensures proper valuation of assets and protection of debtor rights during asset liquidation. |

| 12 | Vehicle Titles and Loan Statements | Vehicle titles and loan statements are crucial documents when filing Chapter 7 bankruptcy, as they provide proof of ownership and details on outstanding debts secured by vehicles. Accurate submission of these documents enables the bankruptcy trustee to assess asset exemptions and determine which debts can be discharged. |

| 13 | Retirement Account Statements | Retirement account statements are essential documents when filing Chapter 7 bankruptcy, providing detailed records of assets such as 401(k), IRA, or pension plans to determine exempt and non-exempt property. Accurate and current statements ensure bankruptcy trustees properly assess the debtor's financial situation and protect retirement funds from liquidation. |

| 14 | Life Insurance Policies | Life insurance policies must be disclosed when filing for Chapter 7 bankruptcy as they are considered assets, with the cash surrender value often subject to liquidation to repay creditors. Providing detailed information including policy statements, beneficiary designations, and the current cash value is essential for accurate asset assessment during the bankruptcy process. |

| 15 | Divorce Decrees or Marital Settlement Agreements | Divorce decrees or marital settlement agreements are essential documents in Chapter 7 bankruptcy filings as they detail the division of assets and liabilities, which directly impact the debtor's financial obligations and discharge eligibility. Courts require these documents to accurately assess the debtor's current financial status, including alimony or child support obligations that influence the bankruptcy estate. |

| 16 | Child Support or Alimony Documentation | Child support or alimony documentation required for Chapter 7 bankruptcy includes court orders, payment history, and any modifications reflecting the current obligations. Providing accurate records ensures the bankruptcy trustee correctly accounts for these non-dischargeable debts during asset evaluation. |

| 17 | Recent Bills and Collection Letters | Recent bills and collection letters must be compiled and submitted as part of the Chapter 7 bankruptcy filing to provide a comprehensive record of outstanding debts and creditors. These documents help the bankruptcy trustee verify liabilities and assess the debtor's financial situation accurately. |

| 18 | List of Monthly Living Expenses | The list of monthly living expenses required for filing Chapter 7 bankruptcy includes detailed documentation of housing costs, utilities, transportation expenses, food and clothing, medical and dental bills, and other essential personal expenses. Accurately itemizing these costs on official bankruptcy forms such as the means test (Form 122A-2) helps the court assess the debtor's financial situation and eligibility for Chapter 7 relief. |

| 19 | Property Valuations or Appraisals | Property valuations or appraisals are essential documents in Chapter 7 bankruptcy filings to accurately disclose the current market value of assets, ensuring proper classification and potential liquidation. Accurate appraisals of real estate, vehicles, and other significant property support the trustee's assessment and help determine exemptions and distributions. |

| 20 | Occupancy Lease or Rental Agreements | Occupancy lease or rental agreements are essential documents in Chapter 7 bankruptcy filings as they provide proof of residence and clarify the debtor's contractual obligations related to housing expenses. These agreements help the court assess the debtor's liabilities and determine the treatment of secured versus unsecured claims within the bankruptcy process. |

Introduction to Chapter 7 Bankruptcy Documentation

Filing for Chapter 7 bankruptcy requires submitting specific documents to the court. These documents provide a clear picture of your financial situation and ensure the process proceeds smoothly.

The necessary paperwork includes a petition, schedules of assets and liabilities, and a statement of financial affairs. Accurate documentation helps protect your rights and facilitates the discharge of eligible debts.

Personal Identification and Proof of Citizenship

When filing for Chapter 7 bankruptcy, personal identification documents are essential to verify your identity and ensure proper processing. You must provide a valid government-issued photo ID, such as a driver's license or passport, to confirm your identity. Proof of citizenship or lawful residency, like a birth certificate, passport, or permanent resident card, is also required to proceed with your bankruptcy case.

Income Verification: Pay Stubs and Tax Returns

Filing for Chapter 7 bankruptcy requires submitting accurate income verification documents to prove your financial status. Pay stubs from the last six months and complete federal tax returns for the previous two years are essential for this process. These documents help the bankruptcy trustee assess your eligibility and ensure a smooth filing experience.

Bank Statements and Financial Accounts

Filing for Chapter 7 bankruptcy requires precise documentation of your financial status, highlighting the importance of bank statements and detailed financial accounts. These documents provide a clear snapshot of your assets, liabilities, and cash flow for the court.

- Recent Bank Statements - Typically, the last six months of bank statements are required to verify your financial transactions and balances.

- Financial Account Summaries - Comprehensive overviews of checking, savings, retirement, and investment accounts must be included to disclose all assets.

- Transaction History - Detailed transaction records within your financial accounts are necessary for assessing your spending and income patterns.

Asset and Property Documentation

Filing for Chapter 7 bankruptcy requires detailed documentation of your assets and properties. These documents help the court assess your financial situation accurately.

Essential asset and property documentation includes recent bank statements, titles to vehicles, and deeds to real estate. You must also provide valuation reports or appraisals for high-value items like jewelry or art. Accurate records ensure a smooth bankruptcy process and protect your rights throughout the case.

Debt and Liability Records

| Document Type | Description | Purpose in Chapter 7 Filing |

|---|---|---|

| Credit Card Statements | Monthly statements detailing outstanding balances, payments, and interest charges | Demonstrates unsecured debt and total liabilities |

| Loan Agreements | Official contracts for personal, auto, student, or payday loans | Provides proof of debt obligations and creditor information |

| Mortgage Statements | Statements showing principal, interest, escrow balances, and payment history | Establishes secured debt and collateral details |

| Medical Bills | Invoices from healthcare providers reflecting outstanding amounts | Verifies unsecured debt related to medical expenses |

| Collection Notices | Communications from debt collectors outlining owed amounts | Confirms debts in default and potential liabilities |

| Judgments and Court Orders | Legal documents indicating court-ordered debt payments | Documents any legally enforceable liabilities |

| Payoff Statements | Statements that specify the total outstanding amount to settle a debt | Clarifies exact debt amounts owed at the time of filing |

| Tax Debt Records | Documentation of unpaid federal, state, or local taxes | Details tax-related liabilities that impact bankruptcy eligibility |

Monthly Expenses and Budget Statements

What documents related to monthly expenses and budget statements are necessary for filing Chapter 7 bankruptcy? Detailed records of your monthly living expenses, such as rent, utilities, food, transportation, and medical costs, must be provided. Budget statements showing your income versus expenditures help demonstrate your financial situation accurately.

Previous Bankruptcy Filings and Legal Judgments

When filing for Chapter 7 bankruptcy, it is essential to provide detailed records of any previous bankruptcy filings. This includes case numbers, filing dates, and the outcomes of those cases to ensure accurate legal processing.

Legal judgments involving the debtor must also be documented thoroughly. Courts require copies of any outstanding judgments to assess the full scope of the debtor's liabilities before proceeding with the Chapter 7 filing.

Credit Counseling Certificate Requirement

Filing for Chapter 7 bankruptcy requires submitting specific documents to initiate the process. One crucial document is the Credit Counseling Certificate, which verifies that you have completed mandatory credit counseling.

- Credit Counseling Certificate - Proof that you completed a credit counseling session within 180 days before filing is mandatory.

- Certificate Provider - The counseling must be completed through an approved credit counseling agency authorized by the U.S. Trustee Program.

- Filing Requirement - Without this certificate, the bankruptcy court will reject or delay your Chapter 7 bankruptcy filing.

What Documents are Necessary for Filing Bankruptcy Chapter 7? Infographic