Essential documents for estate planning and will preparation include a valid will outlining asset distribution and an advance healthcare directive specifying medical wishes. Financial statements, property deeds, insurance policies, and beneficiary designations must be gathered to ensure accurate asset transfer. Legal identification and power of attorney documents are also necessary to authorize representatives to act on behalf of the estate.

What Documents Are Needed for Estate Planning and Will Preparation?

| Number | Name | Description |

|---|---|---|

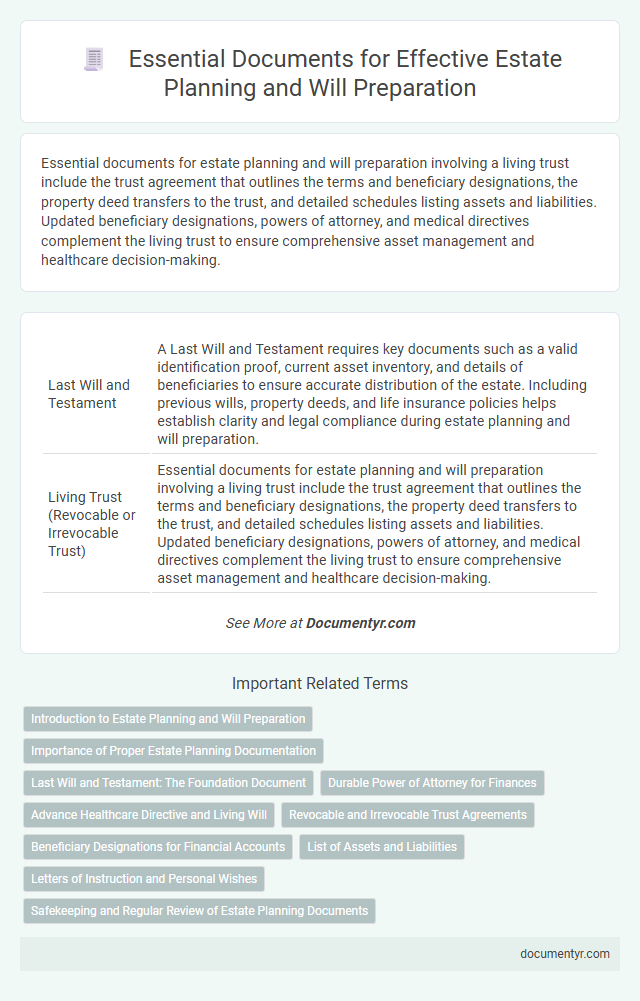

| 1 | Last Will and Testament | A Last Will and Testament requires key documents such as a valid identification proof, current asset inventory, and details of beneficiaries to ensure accurate distribution of the estate. Including previous wills, property deeds, and life insurance policies helps establish clarity and legal compliance during estate planning and will preparation. |

| 2 | Living Trust (Revocable or Irrevocable Trust) | Essential documents for estate planning and will preparation involving a living trust include the trust agreement that outlines the terms and beneficiary designations, the property deed transfers to the trust, and detailed schedules listing assets and liabilities. Updated beneficiary designations, powers of attorney, and medical directives complement the living trust to ensure comprehensive asset management and healthcare decision-making. |

| 3 | Durable Power of Attorney | Durable Power of Attorney is a crucial document in estate planning that grants a designated person authority to manage financial and legal affairs if the principal becomes incapacitated. Including this document ensures continuity in decision-making and protects assets by clearly outlining the agent's powers and limitations. |

| 4 | Health Care Power of Attorney | A Health Care Power of Attorney is a critical document in estate planning that designates an individual to make medical decisions on behalf of the principal if they become incapacitated. This document ensures that health care preferences are respected and legally documented, safeguarding the principal's wishes during medical emergencies. |

| 5 | Living Will (Advance Healthcare Directive) | A Living Will, or Advance Healthcare Directive, is essential in estate planning to specify medical treatment preferences when incapacitated, requiring documents such as the signed and notarized directive form along with any physician's statements or medical power of attorney forms. Including this document ensures clear guidance for healthcare providers and legal authorities, preventing disputes and preserving the testator's healthcare choices. |

| 6 | HIPAA Authorization Form | HIPAA Authorization Forms are critical in estate planning to grant designated individuals access to medical records, ensuring healthcare decisions align with the decedent's wishes. Including this form facilitates seamless communication between financial planners, healthcare providers, and executors, safeguarding privacy while enabling informed estate and will preparation. |

| 7 | Beneficiary Designation Forms | Beneficiary designation forms are essential documents in estate planning that specify who will receive assets such as retirement accounts, life insurance policies, and payable-on-death bank accounts upon the account holder's death. Ensuring these forms are accurately completed and regularly updated prevents probate delays and overrides conflicting instructions in wills. |

| 8 | Letter of Intent | A Letter of Intent in estate planning serves as a non-binding document that outlines the testator's wishes, providing guidance to executors and beneficiaries on asset distribution and personal messages. Essential documents alongside include the will, trust agreements, power of attorney, and health care directives to ensure comprehensive and legally sound estate management. |

| 9 | Guardianship Designation Document | The Guardianship Designation Document is essential in estate planning to appoint a legal guardian for minor children, ensuring their care aligns with the testator's wishes. This document must be clearly drafted, signed, and notarized to be legally enforceable and integrated within the will or as a separate, standalone record. |

| 10 | Financial Information List | Essential financial documents for estate planning and will preparation include bank statements, investment account summaries, retirement account details, life insurance policies, mortgage and loan documents, property deeds, and a comprehensive list of assets and liabilities. Accurate records of these documents ensure proper distribution of financial assets and facilitate smooth legal processes. |

| 11 | Personal Property Memorandum | A Personal Property Memorandum details specific distribution of tangible assets such as jewelry, artwork, and family heirlooms within an estate plan, providing clarity and reducing disputes. This document complements the will by itemizing personal belongings and is typically referenced to ensure precise allocation of personal property. |

| 12 | Digital Asset Instruction Document | A Digital Asset Instruction Document is essential for estate planning as it provides clear directions on accessing and managing digital assets such as online accounts, cryptocurrencies, and digital files. Including this document ensures executors and beneficiaries can securely handle digital property according to the owner's wishes, preventing potential access issues or loss of valuable digital content. |

| 13 | Funeral and Burial Instructions | Funeral and burial instructions in estate planning require a detailed document specifying preferences for cremation, burial, or memorial services, often including the selection of a funeral home, type of casket or urn, and desired ceremony details. Incorporating this document alongside wills and powers of attorney ensures that personal wishes are legally recognized and eases the emotional and financial burden on surviving family members. |

| 14 | Trust Funding Documents | Trust funding documents, including deeds, transfer forms, and account statements, are essential for properly transferring assets into a trust during estate planning. These documents ensure legal ownership is updated, facilitating the smooth management and distribution of trust assets according to the will. |

| 15 | Deeds for Real Estate | Deeds for real estate are essential documents in estate planning and will preparation, as they legally transfer property ownership and must accurately reflect the current owner to avoid disputes. Including properly executed and recorded deeds ensures that real estate assets are distributed according to the decedent's wishes and helps streamline probate proceedings. |

| 16 | Life Insurance Policies | Life insurance policies are essential documents in estate planning and will preparation, serving as key assets that provide financial security to beneficiaries. Including detailed policy information, beneficiary designations, and ownership records ensures these assets are accurately accounted for and distributed according to the decedent's wishes. |

| 17 | Retirement Account Statements | Retirement account statements, including 401(k), IRA, and pension plan documents, are essential for accurate estate planning and will preparation to ensure the proper transfer of assets. These statements provide detailed information on account balances, beneficiary designations, and potential tax implications critical for effective distribution. |

| 18 | Business Succession Plan | Key documents for estate planning and will preparation with a focus on business succession include a comprehensive business succession plan, the last will and testament specifying asset distribution, power of attorney for financial decisions, and a buy-sell agreement outlining ownership transfer. Incorporating financial statements, business valuation reports, shareholder agreements, and tax planning documents ensures a seamless transition and protection of business interests. |

| 19 | Tax Returns and Financial Statements | Tax returns and financial statements are essential documents for estate planning and will preparation, providing a clear overview of income, assets, liabilities, and tax obligations. Accurate tax returns from previous years help identify potential estate tax liabilities, while detailed financial statements ensure the correct allocation and valuation of assets in the will. |

Introduction to Estate Planning and Will Preparation

Estate planning and will preparation are essential processes that help individuals manage and distribute their assets upon death. Proper documentation ensures clarity and legal compliance, minimizing disputes among heirs.

- Last Will and Testament - A legal document that specifies the distribution of assets and guardianship of minor children after death.

- Durable Power of Attorney - Grants a designated person authority to manage financial and legal matters if the individual becomes incapacitated.

- Living Trust - A trust established during a person's lifetime to hold and manage assets, avoiding probate and providing privacy.

Importance of Proper Estate Planning Documentation

What documents are essential for effective estate planning and will preparation?

Proper estate planning documentation ensures the clear distribution of assets and minimizes legal disputes among heirs. Key documents include a last will and testament, power of attorney, advance healthcare directive, and a living trust, each serving a specific role in managing your estate and healthcare decisions.

Last Will and Testament: The Foundation Document

The Last Will and Testament is the cornerstone document in estate planning, specifying how assets should be distributed after death. This legal instrument provides clear instructions to ensure the decedent's wishes are honored and reduces potential disputes among heirs.

- Legal Declaration - It formally appoints an executor to manage the estate and carry out the will's directives.

- Asset Distribution - The will details the beneficiaries and how property, investments, and finances are to be allocated.

- Guardianship Provisions - It may name guardians for minor children, ensuring their care aligns with the testator's intentions.

Preparing a comprehensive Last Will and Testament is essential for effective estate management and securing your family's financial future.

Durable Power of Attorney for Finances

Durable Power of Attorney for Finances is a critical document in estate planning that grants a trusted individual the authority to manage financial matters on your behalf if you become incapacitated. This document ensures continuous management of assets, bill payments, and financial decision-making without court intervention. Including a Durable Power of Attorney for Finances in your will preparation provides peace of mind that your financial affairs will be handled according to your wishes.

Advance Healthcare Directive and Living Will

Estate planning requires specific documents to ensure your wishes are honored, particularly in healthcare decisions. Two critical documents are the Advance Healthcare Directive and the Living Will.

The Advance Healthcare Directive allows you to designate a healthcare proxy to make medical decisions if you become incapacitated. The Living Will outlines your preferences for medical treatment in situations where you cannot communicate your wishes.

Revocable and Irrevocable Trust Agreements

Estate planning requires specific documents to ensure your assets are managed according to your wishes. Key documents include revocable and irrevocable trust agreements, which dictate how your estate will be handled during and after your lifetime.

Revocable trust agreements allow you to retain control over your assets and make changes as needed, providing flexibility in managing your estate. Irrevocable trust agreements transfer ownership permanently, offering potential tax benefits and asset protection. Both types of trusts serve critical roles in comprehensive will preparation and overall estate planning strategies.

Beneficiary Designations for Financial Accounts

Beneficiary designations for financial accounts are crucial documents in estate planning and will preparation. These designations determine who receives assets from accounts such as retirement plans, life insurance policies, and payable-on-death bank accounts upon the account holder's death. Ensuring beneficiary forms are up-to-date and consistent with the will helps avoid probate delays and potential disputes among heirs.

List of Assets and Liabilities

Estate planning and will preparation require a comprehensive list of assets and liabilities to ensure accurate distribution of your estate. This list should detail all valuable properties, financial accounts, and outstanding debts.

Assets may include real estate, bank accounts, investments, retirement funds, and personal property. Liabilities encompass mortgages, loans, credit card balances, and other financial obligations.

Letters of Instruction and Personal Wishes

Estate planning requires careful documentation to ensure that your personal wishes are respected and your assets are distributed according to your intentions. Letters of instruction play a crucial role in guiding your executor and loved ones through your final wishes beyond the legal terms of a will.

- Letters of Instruction provide detailed personal guidance - These letters offer specific directions about funeral arrangements, care for dependents, and passwords or account details not included in the will.

- Personal wishes clarify non-legal preferences - They communicate values and desires about how your estate should be managed and how personal possessions should be handled.

- Inclusion in estate planning ensures smoother execution - Letters of instruction and documented personal wishes help minimize confusion and disputes among heirs and executors after your passing.

What Documents Are Needed for Estate Planning and Will Preparation? Infographic