Gig workers need to gather several essential documents for accurate tax filing, including Form 1099-NEC or 1099-K from clients or platforms reporting income earned. Maintaining detailed records of all business-related expenses such as receipts, invoices, and mileage logs is crucial to maximize deductions. Additionally, keeping track of estimated tax payments and any relevant bank statements ensures a comprehensive and compliant tax return.

What Documents Does a Gig Worker Need for Tax Filing?

| Number | Name | Description |

|---|---|---|

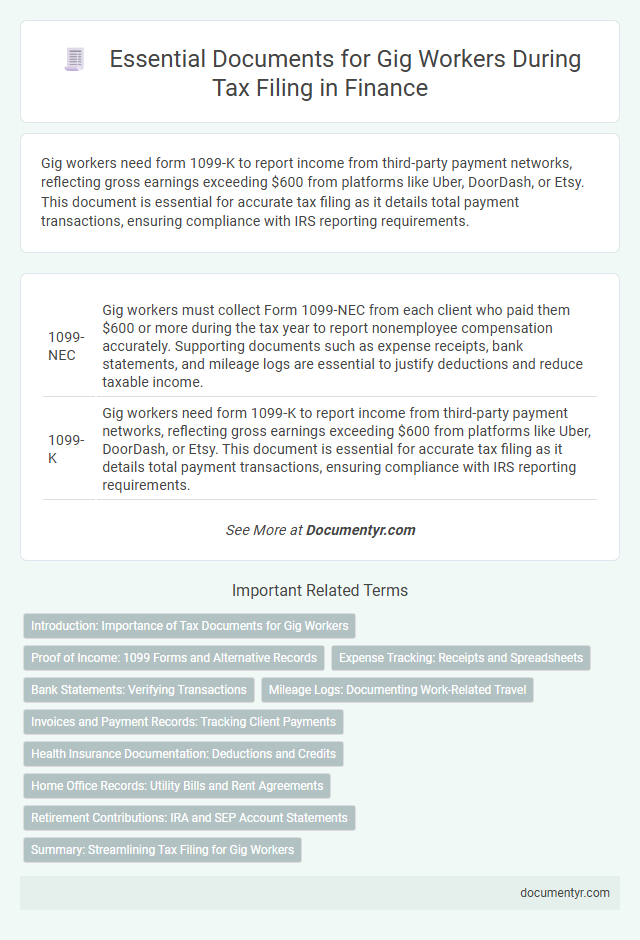

| 1 | 1099-NEC | Gig workers must collect Form 1099-NEC from each client who paid them $600 or more during the tax year to report nonemployee compensation accurately. Supporting documents such as expense receipts, bank statements, and mileage logs are essential to justify deductions and reduce taxable income. |

| 2 | 1099-K | Gig workers need form 1099-K to report income from third-party payment networks, reflecting gross earnings exceeding $600 from platforms like Uber, DoorDash, or Etsy. This document is essential for accurate tax filing as it details total payment transactions, ensuring compliance with IRS reporting requirements. |

| 3 | Schedule C (Form 1040) | Gig workers must gather income records such as 1099-NEC forms and detailed expense receipts to accurately complete Schedule C (Form 1040), which reports profit or loss from business activities. Maintaining organized documentation of business income and deductible expenses streamlines tax filing and ensures compliance with IRS requirements. |

| 4 | Schedule SE (Form 1040) | Gig workers must file Schedule SE (Form 1040) to calculate self-employment tax, which covers Social Security and Medicare contributions based on their net earnings. Essential documents for accurate filing include Form 1099-NEC for nonemployee compensation, detailed records of income and business expenses, and receipts supporting deductible costs. |

| 5 | W-2 (if applicable) | Gig workers who receive a W-2 form from an employer must include it in their tax filing to report earned wages and withheld taxes accurately. In cases where a W-2 is issued, maintaining this document alongside 1099 forms, expense records, and receipts is essential for a comprehensive and compliant tax return. |

| 6 | Bank statements | Gig workers need bank statements to accurately track income and expenses for tax filing, providing clear evidence of payments received throughout the year. These statements help reconcile earnings reported on 1099 forms and support deductions related to business expenses. |

| 7 | Expense receipts | Gig workers need to collect and organize expense receipts, including those for vehicle mileage, home office supplies, and business-related meals, to accurately report deductible expenses on their tax returns. Detailed records of these receipts support claims for tax deductions and reduce taxable income, ensuring compliance with IRS regulations. |

| 8 | Mileage log | Gig workers need to maintain a detailed mileage log to accurately track business-related vehicle expenses for tax deductions, including date, purpose, starting and ending odometer readings, and total miles driven. This documentation is essential for substantiating claims on Schedule C or Form 2106, helping to reduce taxable income and comply with IRS requirements. |

| 9 | Invoices issued | Gig workers must retain all invoices issued to clients, detailing services provided, payment amounts, and dates to accurately report income for tax filing. Properly organized invoices serve as essential proof of earnings and support claims for deductible expenses during tax preparation. |

| 10 | Payment app statements (e.g., PayPal, Venmo, Cash App) | Gig workers must retain payment app statements such as PayPal, Venmo, and Cash App records, as these documents provide essential proof of income and transaction details necessary for accurate tax filing. These statements help verify reported earnings and ensure compliance with IRS requirements for self-employment income reporting. |

| 11 | Previous year's tax return | A gig worker should gather the previous year's tax return as it provides crucial information for accurate reporting, including income details, deductions, and credits claimed. This document serves as a reference for consistency and helps in verifying estimated tax payments and carryover losses. |

| 12 | Home office expense records | Gig workers must maintain accurate home office expense records, including utility bills, rent or mortgage statements, property tax receipts, and home insurance documents to claim deductions accurately. These records support the percentage of home used exclusively and regularly for business purposes, crucial for maximizing tax benefits under IRS guidelines. |

| 13 | Health insurance documentation (Form 1095-A, if purchased through marketplace) | Gig workers who purchased health insurance through the marketplace must include Form 1095-A when filing taxes to report premium tax credits and verify coverage. This documentation is essential for accurately reconciling advance premium subsidies and ensuring compliance with IRS health coverage reporting requirements. |

| 14 | Retirement contribution records | Gig workers must gather all retirement contribution records, including documentation of SEP IRA, SIMPLE IRA, or solo 401(k) contributions made throughout the tax year. These records are essential for accurately reporting deductible retirement savings and maximizing tax benefits when filing annual tax returns. |

| 15 | Quarterly estimated tax payment records (Form 1040-ES) | Gig workers must maintain accurate quarterly estimated tax payment records using Form 1040-ES to ensure timely reporting of self-employment income and avoid penalties. These documents detail income projections, payment amounts, and due dates, serving as critical evidence during annual tax filing and IRS verification. |

| 16 | State tax documents (if applicable) | Gig workers must collect state-specific tax documents such as Form 1099-NEC or 1099-MISC if issued by local clients, along with any state income tax withholding statements. Maintaining records of estimated state tax payments and consulting state tax authority guidelines ensures accurate filing and compliance with state tax regulations. |

Introduction: Importance of Tax Documents for Gig Workers

Tax documents are essential for accurately reporting income and expenses as a gig worker. Proper documentation helps ensure compliance with tax laws and prevents potential penalties.

Understanding which documents to gather simplifies the filing process and maximizes your deductions. Having organized records supports claims during any IRS reviews or audits.

Proof of Income: 1099 Forms and Alternative Records

Gig workers must gather specific documents to accurately report income for tax filing. The primary proof of income includes 1099 forms issued by clients or gig platforms.

Form 1099-NEC reports non-employee compensation, while Form 1099-K covers payments processed through third-party networks. In cases where 1099s are not provided, alternative records such as bank statements, invoices, and payment app summaries support income verification.

Expense Tracking: Receipts and Spreadsheets

Gig workers must maintain accurate records of their income and expenses for tax filing purposes. Keeping receipts for all business-related purchases is essential to substantiate deductions and reduce taxable income. Utilizing spreadsheets to organize and track these expenses improves accuracy and simplifies the tax preparation process.

Bank Statements: Verifying Transactions

| Document | Purpose | Details |

|---|---|---|

| Bank Statements | Verifying Transactions | Bank statements provide a detailed record of income and expenses for gig workers. They help verify transaction amounts, dates, and sources, ensuring accurate reporting of earnings. These records support income verification from multiple platforms and validate deductible expenses. |

Mileage Logs: Documenting Work-Related Travel

Mileage logs are essential for gig workers to accurately document work-related travel expenses for tax filing. Proper record-keeping of miles driven can maximize deductible expenses and reduce taxable income.

- Mileage Log Accuracy - Maintaining detailed records of each trip, including date, purpose, and miles driven, ensures compliance with tax regulations.

- Standard Mileage Rate - The IRS updates the allowable deduction per mile annually, making it important to track current rates for accurate claims.

- Supporting Documentation - Including receipts for fuel, tolls, and parking alongside mileage logs strengthens the validity of your deductions during an audit.

Consistently updated mileage logs provide critical evidence of your business-related travel necessary for precise tax reporting.

Invoices and Payment Records: Tracking Client Payments

Invoices and payment records are essential documents for a gig worker when filing taxes. These records provide a clear trail of income earned from various clients throughout the tax year.

Maintaining detailed invoices helps track the payment dates, amounts, and services rendered, ensuring accurate reporting of income. Payment records, such as bank statements or payment platform summaries, support verification of received funds. Organizing these documents simplifies the preparation of tax returns and minimizes errors or omissions.

Health Insurance Documentation: Deductions and Credits

Health insurance documentation plays a crucial role in tax filing for gig workers. Proper records help maximize deductions and tax credits available under current laws.

- Form 1095-A - This form reports coverage through the Health Insurance Marketplace and is essential to claim the Premium Tax Credit.

- Proof of Health Insurance Payments - Receipts or bank statements showing premiums paid allow for possible deductions on self-employed health insurance.

- Form 8962 - Used to reconcile any advance Premium Tax Credit payments and calculate the exact credit amount on your tax return.

Home Office Records: Utility Bills and Rent Agreements

What home office records are essential for a gig worker's tax filing? Utility bills and rent agreements serve as key documents to validate your home office expenses. Maintaining these records helps accurately claim deductions related to your workspace.

Retirement Contributions: IRA and SEP Account Statements

Gig workers must gather accurate IRA and SEP account statements to report retirement contributions correctly during tax filing. These documents detail contributions and earnings, essential for claiming deductions or meeting required minimum distributions. Maintaining organized records ensures compliance with IRS regulations and helps optimize tax benefits related to retirement savings.

What Documents Does a Gig Worker Need for Tax Filing? Infographic