To complete the FAFSA financial aid application, you need several key documents, including your Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Students and parents must also provide information about assets, bank statements, and investment records. Gathering these documents ensures accurate financial information is submitted for eligibility determination.

What Documents are Needed for FAFSA Financial Aid Application?

| Number | Name | Description |

|---|---|---|

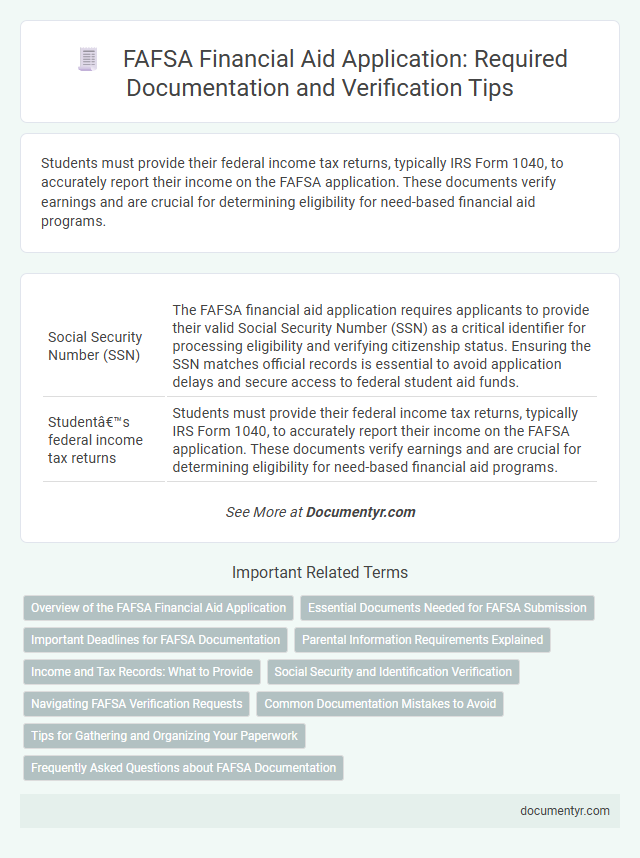

| 1 | Social Security Number (SSN) | The FAFSA financial aid application requires applicants to provide their valid Social Security Number (SSN) as a critical identifier for processing eligibility and verifying citizenship status. Ensuring the SSN matches official records is essential to avoid application delays and secure access to federal student aid funds. |

| 2 | Student’s federal income tax returns | Students must provide their federal income tax returns, typically IRS Form 1040, to accurately report their income on the FAFSA application. These documents verify earnings and are crucial for determining eligibility for need-based financial aid programs. |

| 3 | Parent(s)’ federal income tax returns | Parent(s)' federal income tax returns, including IRS Form 1040, are essential for completing the FAFSA financial aid application as they provide verified income information used to calculate the Expected Family Contribution (EFC). These documents ensure accurate assessment of financial need by detailing adjusted gross income, tax paid, and relevant tax credits. |

| 4 | W-2 forms for student and parent(s) | FAFSA financial aid applications require W-2 forms from both the student and their parent(s) to verify income earned through employment during the previous tax year. These W-2 forms provide essential wage and tax information, enabling accurate assessment of financial need for federal student aid eligibility. |

| 5 | Records of untaxed income | Records of untaxed income required for the FAFSA financial aid application include child support received, interest income reported on tax returns, and veteran's non-education benefits. Accurate documentation of these amounts ensures the correct calculation of Expected Family Contribution (EFC) and eligibility for federal student aid. |

| 6 | Bank statements | Bank statements are essential for the FAFSA financial aid application as they provide a detailed record of your current liquid assets, reflecting your family's financial stability and cash flow. Accurate bank statements help the FAFSA assess your Expected Family Contribution (EFC) by verifying account balances and identifying available funds for college expenses. |

| 7 | Investment records | Investment records required for the FAFSA financial aid application include recent statements for stocks, bonds, mutual funds, certificates of deposit, and real estate investments, excluding the primary residence. Accurate reporting of these documents ensures precise calculation of the Expected Family Contribution (EFC), which is crucial for determining financial aid eligibility. |

| 8 | Alien Registration Number (if not a U.S. citizen) | Applicants who are not U.S. citizens must provide their Alien Registration Number (A-Number) when applying for FAFSA financial aid, as this identifier verifies their eligible non-citizen status. Alongside the A-Number, required documents include permanent resident cards or other immigration documents such as I-94 forms, which confirm lawful presence for aid qualification. |

| 9 | FSA ID for student | The Federal Student Aid (FSA) ID serves as a crucial electronic signature for students completing the FAFSA financial aid application, requiring a valid Social Security number, email address, and date of birth for creation. Students must ensure their FSA ID is created and activated before submitting the FAFSA form to securely access and sign their financial aid documents electronically. |

| 10 | FSA ID for parent | Parents must create an FSA ID as a secure login to electronically sign the FAFSA form and access federal student aid information. Essential documents for the FSA ID include the parent's Social Security number, email address, and a personal identification number (PIN) to verify identity and complete the FAFSA financial aid application. |

| 11 | Records of child support received | Records of child support received, including official court orders and payment history, are essential documents for the FAFSA financial aid application to accurately report income and household resources. Providing detailed child support information ensures precise assessment of financial need and eligibility for aid programs. |

| 12 | Records of other financial assets | FAFSA financial aid applications require detailed records of other financial assets, including current bank statements, investment account summaries, and documentation of any trusts or real estate holdings. Ensuring accurate and up-to-date information on savings, stocks, bonds, and other assets helps determine the Expected Family Contribution (EFC) and eligibility for need-based aid. |

| 13 | Driver’s license (if applicable) | A valid driver's license serves as an important form of identification when completing the FAFSA financial aid application, verifying the applicant's identity and residency status. Including a driver's license number can streamline the application process and support eligibility verification for federal student aid programs. |

| 14 | Records of any additional income sources | Records of any additional income sources required for the FAFSA financial aid application include recent pay stubs, self-employment income statements, rental income records, and documentation of untaxed income such as child support or Social Security benefits. Accurate reporting of all supplemental income ensures proper calculation of expected family contribution and eligibility for federal aid programs. |

Overview of the FAFSA Financial Aid Application

The FAFSA financial aid application requires specific documents to accurately assess eligibility for federal student aid. Understanding the necessary paperwork streamlines the application process and improves your chances of receiving financial support.

- Social Security Number - Required to verify identity and citizenship status for aid qualification.

- Federal Income Tax Returns - Needed to report income and tax information for both the student and parents, if applicable.

- Asset Records - Documentation of savings, investments, and other financial resources to determine financial need.

Essential Documents Needed for FAFSA Submission

| Document | Description | Purpose |

|---|---|---|

| Social Security Number (SSN) | Valid SSN issued by the Social Security Administration | Identification and verification for FAFSA processing |

| Federal Income Tax Returns | IRS Tax Return Transcript or IRS Data Retrieval Tool output | Income verification for Expected Family Contribution (EFC) calculation |

| W-2 Forms and Other Records of Income | W-2 wage statements and 1099 forms | Supplement income information for tax year reported |

| Driver's License (if applicable) | State-issued driver's license number | Identity verification, especially for dependent students |

| Alien Registration Number (if applicable) | Documentation for eligible non-citizens, such as Permanent Resident Card | Proof of eligible noncitizen status for FAFSA eligibility |

| Untaxed Income Records | Documentation of untaxed income such as Social Security benefits, child support | Complete financial picture for aid eligibility assessment |

| Current Bank Statements | Recent checking and savings account statements | Verification of assets and savings |

| Records of Investments | Statements showing stocks, bonds, real estate (excluding primary residence) | Assessment of family assets excluding primary home |

| List of Colleges | Names and Federal School Codes of colleges being applied to | Ensures FAFSA data is sent to chosen institutions |

| Parent/Student FSA ID | Federal Student Aid ID for electronic signature | Authentication and electronic signing of FAFSA application |

Important Deadlines for FAFSA Documentation

To complete the FAFSA financial aid application, you need documents such as your Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Important deadlines for submitting FAFSA documentation vary by state and school, but the federal deadline is typically June 30th each year. Missing these deadlines can result in reduced financial aid eligibility or ineligibility for certain grants and scholarships.

Parental Information Requirements Explained

What parental information documents are required for the FAFSA financial aid application? You must provide accurate details about your parents' income and tax filings. Documents such as your parents' recent tax returns, W-2 forms, and records of untaxed income are essential to complete the application accurately.

Income and Tax Records: What to Provide

Submitting accurate income and tax records is essential for completing the FAFSA financial aid application. These documents verify your financial situation to determine your eligibility for federal student aid.

- IRS Tax Return Transcript - This is the official record of your federal tax return, requested directly from the IRS to confirm income details.

- W-2 Forms - These forms report your annual wages and taxes withheld from employers, providing proof of income.

- Records of Untaxed Income - Documentation such as child support received or veterans' benefits must be included to reflect total income accurately.

Social Security and Identification Verification

The FAFSA financial aid application requires applicants to provide social security information for identity verification and eligibility confirmation. A valid Social Security Number (SSN) is essential to complete the FAFSA form accurately.

Applicants must also submit government-issued identification, such as a driver's license or passport, to verify their identity. These documents ensure the authenticity of the applicant's information and support the processing of financial aid awards.

Navigating FAFSA Verification Requests

When navigating FAFSA verification requests, gather key documents such as your federal tax returns, W-2 forms, and proof of any untaxed income. Financial aid offices may also require documentation of household size, number of family members in college, and recent bank statements. Promptly submitting these materials ensures accurate processing and avoids delays in receiving your financial aid package.

Common Documentation Mistakes to Avoid

Completing the FAFSA financial aid application requires several key documents, including your Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Providing accurate and complete documentation ensures a smoother application process and maximizes your aid eligibility.

Common documentation mistakes to avoid include submitting outdated tax returns, entering incorrect Social Security numbers, and omitting required income information. Inaccurate details can lead to delays or denials of your financial aid application. Double-check all documents and verify entries before submission to prevent these errors.

Tips for Gathering and Organizing Your Paperwork

Gather all necessary documents to ensure a smooth FAFSA financial aid application process. Key paperwork includes your Social Security number, federal income tax returns, W-2 forms, and bank statements.

Organize your documents digitally or in labeled folders for quick reference during the application. Keep copies of submitted forms and notes on any follow-up communications for future use.

What Documents are Needed for FAFSA Financial Aid Application? Infographic