An executor needs several critical documents to settle an estate, including the original will, death certificate, and grant of probate or letters of administration. Financial statements, bank account details, insurance policies, and property titles are essential to manage and distribute assets effectively. Tax returns and creditor information must also be gathered to ensure all liabilities are settled before finalizing the estate.

What Documents Does an Executor Need to Settle an Estate?

| Number | Name | Description |

|---|---|---|

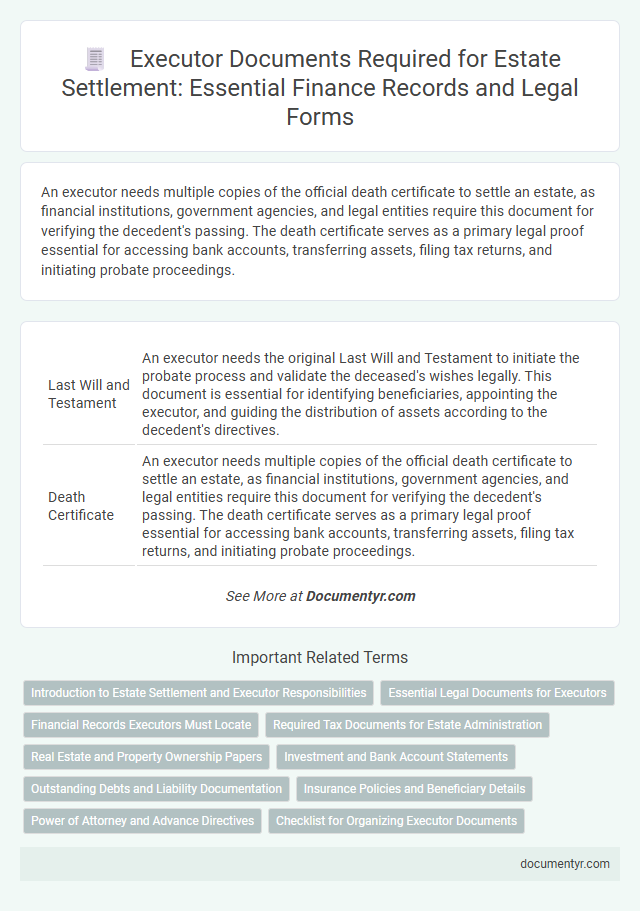

| 1 | Last Will and Testament | An executor needs the original Last Will and Testament to initiate the probate process and validate the deceased's wishes legally. This document is essential for identifying beneficiaries, appointing the executor, and guiding the distribution of assets according to the decedent's directives. |

| 2 | Death Certificate | An executor needs multiple copies of the official death certificate to settle an estate, as financial institutions, government agencies, and legal entities require this document for verifying the decedent's passing. The death certificate serves as a primary legal proof essential for accessing bank accounts, transferring assets, filing tax returns, and initiating probate proceedings. |

| 3 | Probate Petition | The executor must file a probate petition with the local probate court, including the original will, the deceased's death certificate, and a comprehensive inventory of assets and liabilities. This document initiates the probate process, granting the executor legal authority to manage and distribute the estate according to court supervision. |

| 4 | Letters Testamentary | Letters Testamentary authorize the executor to manage and distribute estate assets, serving as official proof of their legal authority granted by the probate court. These documents are essential for accessing bank accounts, settling debts, and transferring property titles during the estate settlement process. |

| 5 | Trust Documents | Executors need trust documents such as the original trust agreement, any amendments, and a certification of trust to verify the terms and the trustee's authority. These documents ensure proper management and distribution of assets held in the trust as part of the estate settlement process. |

| 6 | Beneficiary Designations | An executor must gather and review all beneficiary designations from life insurance policies, retirement accounts, and pension plans to ensure assets are distributed according to the deceased's wishes. These documents are crucial as they often override wills and dictate direct transfers to named beneficiaries. |

| 7 | Financial Account Statements | Executors require comprehensive financial account statements, including bank accounts, investment portfolios, retirement accounts, and credit card statements, to accurately assess and manage the estate's assets and liabilities. These documents are essential for verifying account balances, facilitating asset distribution, and ensuring proper tax filings during the estate settlement process. |

| 8 | Life Insurance Policies | An executor needs the original life insurance policy, the insured's death certificate, and the beneficiary designation forms to settle an estate efficiently. Verification documents including policy statements and contact details for the insurance company are essential to claim benefits and distribute proceeds according to the decedent's wishes. |

| 9 | Real Estate Deeds | An executor needs the original real estate deed to verify property ownership and facilitate the transfer of the estate's assets to beneficiaries. This deed, along with the will and probate court documents, is essential to settle the estate and clear the title for the heirs. |

| 10 | Mortgage Statements | Mortgage statements are essential documents an executor needs to accurately assess outstanding debts and manage payments during estate settlement, ensuring all liens are accounted for before asset distribution. These statements provide detailed information on loan balances, interest rates, and payment histories critical for verifying financial obligations tied to the deceased's property. |

| 11 | Property Tax Statements | An executor must obtain current property tax statements to verify outstanding taxes and facilitate accurate estate valuation and settlement. These documents ensure that all property tax liabilities are accounted for before distributing assets to beneficiaries. |

| 12 | Vehicle Titles | To settle an estate, an executor must obtain the original vehicle titles along with the deceased's death certificate to transfer ownership legally. Vehicle titles serve as crucial legal documents that verify ownership and are required to retitle or sell vehicles as part of estate administration. |

| 13 | Investment Account Statements | Investment account statements are essential documents for an executor to accurately assess and manage the deceased's financial portfolio, including stocks, bonds, mutual funds, and other securities. These statements provide detailed records of account balances, transaction history, dividends, and fees that are crucial for valuing the estate and facilitating proper distribution according to the will or trust. |

| 14 | Retirement Account Statements (IRA, 401k, etc.) | Retirement account statements, such as IRA and 401(k) documents, are essential for an executor to accurately assess the deceased's financial assets and determine beneficiary distributions. These statements provide detailed account balances, transaction history, and beneficiary designations crucial for the estate settlement process. |

| 15 | Credit Card Statements | Executors need credit card statements to verify outstanding debts and ensure accurate payment of all liabilities from the estate. These documents help track recent transactions and identify any fraudulent charges, essential for proper estate settlement and financial accountability. |

| 16 | Loan Documents | Executors must gather all loan documents, including mortgage agreements, personal loans, and lines of credit, to accurately assess outstanding debts on the estate. These documents are essential for notifying lenders, arranging payments, and ensuring the estate is settled according to legal and financial obligations. |

| 17 | Outstanding Bills | Executors need to gather all outstanding bills, including utility invoices, credit card statements, mortgage payments, and medical expenses, to accurately determine the estate's liabilities. These documents ensure proper debt settlement and prevent potential legal complications during estate distribution. |

| 18 | Tax Returns | An executor needs the decedent's final federal and state income tax returns, including Form 1040 and any relevant schedules, to accurately report income up to the date of death. Estate tax returns such as Form 706 and any applicable state estate tax filings are also essential for calculating and settling tax obligations. |

| 19 | Tax Identification Number (EIN) for Estate | An Executor needs to obtain a Tax Identification Number (EIN) for the estate to file estate tax returns, open estate bank accounts, and manage financial transactions on behalf of the deceased. The EIN serves as the estate's unique taxpayer identification with the IRS, distinct from the decedent's Social Security Number, enabling proper reporting and payment of taxes. |

| 20 | Medical Bills | To settle an estate, an executor needs detailed medical bills and records to verify outstanding healthcare expenses incurred before death. These documents are essential for accurately paying debts and ensuring compliance with estate settlement regulations. |

| 21 | Funeral Expenses Receipts | Executors must gather funeral expenses receipts to verify payments and reimbursements related to the deceased's final arrangements, ensuring accurate accounting in the estate settlement process. These receipts are essential for tax reporting, expense validation, and preventing disputes among beneficiaries regarding funeral cost distributions. |

| 22 | Appraisals of Assets | Executors need detailed appraisals of all tangible and intangible assets to accurately determine the estate's value for probate and tax purposes. Comprehensive valuation reports for real estate, investments, personal property, and business interests ensure precise asset distribution and compliance with legal requirements. |

| 23 | Business Ownership Documents | Executors managing estates with business interests must gather key ownership documents such as shareholder agreements, stock certificates, partnership agreements, and business tax returns to accurately assess and transfer assets. These documents ensure the executor can verify ownership stakes, determine valuation, and comply with legal and tax obligations essential for settling the estate. |

| 24 | List of Personal Property | An executor settling an estate needs a detailed list of personal property, including bank statements, investment portfolios, insurance policies, and titles for vehicles or real estate. This documentation ensures accurate valuation and distribution of assets according to the will and legal requirements. |

| 25 | Creditor Notices and Claims | Executors must gather creditor notices and claims, including formal notifications sent to creditors and any submitted claims against the estate, to identify outstanding debts and verify creditor legitimacy. Proper documentation of these notices and claims ensures the executor can resolve valid debts, protect estate assets, and comply with legal obligations during the probate process. |

| 26 | Receipts for Disbursements | Receipts for disbursements are essential for executors to provide proof of payments made from the estate, including debts, taxes, and administrative expenses. These documents ensure accurate accounting and transparency during the estate settlement process, facilitating court approval and beneficiary trust. |

| 27 | Final Accounting Statements | Final accounting statements are critical for executors to ensure accurate tracking of all estate assets, liabilities, income, and expenses during the probate process. These documents provide a detailed financial summary required by courts to verify proper distribution and help prevent disputes among beneficiaries. |

| 28 | Court Orders or Judgments | Court orders or judgments are essential documents an executor must obtain to validate authority for estate settlement, including probate orders confirming the executor's legal right to administer the deceased's assets. These official rulings also facilitate the transfer of title, resolution of disputes, and approval of estate distributions in compliance with state laws and probate court requirements. |

| 29 | Release and Receipt Forms from Beneficiaries | Executors must obtain Release and Receipt Forms from beneficiaries to legally confirm the distribution of assets and protect against future claims during estate settlement. These documents serve as proof that beneficiaries have received their inheritances, ensuring clear closure of the estate administration process. |

Introduction to Estate Settlement and Executor Responsibilities

Settling an estate involves a series of crucial steps that ensure the proper distribution of assets and payment of liabilities. Executors play a key role in managing this process efficiently and legally.

You will need several important documents to fulfill your responsibilities as an executor, including the original will, death certificate, and financial statements. These documents help verify the decedent's assets, debts, and legal claims to ensure accurate estate administration.

Essential Legal Documents for Executors

| Document | Description | Purpose |

|---|---|---|

| Death Certificate | Official document issued by a government authority confirming the decedent's death. | Required to initiate estate settlement and access financial accounts. |

| Last Will and Testament | Legal document outlining the deceased's wishes for asset distribution and executor appointment. | Provides instructions for distributing assets and designates the executor. |

| Grant of Probate | Court-issued document authorizing the executor to administer the estate. | Enables access to estate assets and legal authority to settle debts and distribute property. |

| Letters of Administration | Issued when no will exists, appointing an administrator to manage the estate. | Authorizes estate settlement if the deceased left no valid will. |

| Estate Inventory | Comprehensive list of all assets and liabilities belonging to the estate. | Helps determine the estate's total value and manage asset distribution accurately. |

| Tax Returns and Documentation | Documentation of income and estate taxes that must be filed. | Ensures compliance with tax regulations and proper settlement of any owed taxes. |

| Bank and Financial Statements | Records of all financial accounts, investments, and liabilities. | Essential for identifying and managing estate funds. |

| Property Titles and Deeds | Legal documents proving ownership of real estate assets. | Required to transfer property to beneficiaries. |

| Insurance Policies | Documents detailing life, health, and property insurance policies. | Necessary to claim benefits and cover liabilities. |

| Funeral and Burial Documents | Receipts and contracts related to funeral arrangements. | Used to settle outstanding expenses of the estate. |

Financial Records Executors Must Locate

Executors must gather a comprehensive set of financial records to effectively settle an estate. These documents provide a clear picture of the deceased's assets, liabilities, and financial obligations.

Key financial records include bank statements, investment account details, and recent tax returns. Executors should locate property deeds, mortgage statements, and loan documents to understand real estate holdings and debts. Insurance policies, retirement account statements, and outstanding bills are essential to ensure all claims and expenses are addressed.

Required Tax Documents for Estate Administration

An executor must gather key tax documents to accurately settle an estate, including the decedent's final income tax returns, estate tax returns, and any prior years' tax filings. These documents help determine the estate's liabilities and ensure all taxes are paid correctly. You will also need records of income earned by the estate after the decedent's death to complete fiduciary tax returns.

Real Estate and Property Ownership Papers

Executors must gather specific real estate and property ownership documents to effectively settle an estate. Proper documentation ensures legal transfer and accurate appraisal of the decedent's assets.

- Property Deeds - Legal documents proving ownership of real estate, necessary for title transfer and sale processing.

- Mortgage Statements - Records showing any outstanding loans on the property, crucial for debt settlement and financial accounting.

- Property Tax Records - Documents indicating paid or unpaid property taxes, important for resolving tax obligations tied to the estate.

Collecting these documents helps the executor manage estate assets with clarity and legal compliance.

Investment and Bank Account Statements

To settle an estate, an executor requires comprehensive investment and bank account statements to accurately assess the deceased's financial holdings. These documents provide a detailed record of assets, transactions, and account balances necessary for asset distribution and tax purposes. Ensuring you gather all relevant statements streamlines the estate settlement process and prevents potential financial discrepancies.

Outstanding Debts and Liability Documentation

An executor must gather all necessary documents related to outstanding debts and liabilities to ensure proper estate settlement. Accurate documentation helps in verifying debts and protects the executor from personal liability.

- Creditor Statements - Detailed records from creditors outlining the outstanding amounts owed by the deceased.

- Loan Agreements - Original contracts and terms for any personal or mortgage loans still active at the time of death.

- Medical Bills and Invoices - Final statements for healthcare expenses incurred before passing, which must be accounted for in the estate.

Insurance Policies and Beneficiary Details

Insurance policies and beneficiary details play a critical role in the estate settlement process. These documents help verify claims and ensure the proper distribution of assets according to the deceased's wishes.

- Insurance Policy Documents - These include life insurance policies and any riders, which detail the coverage and terms necessary for filing claims.

- Beneficiary Designation Forms - These forms specify the individuals or entities entitled to receive insurance proceeds, facilitating accurate asset transfer.

- Proof of Death Certificate - Required to initiate claims on insurance policies, this document confirms the policyholder's passing to the insurance company.

Power of Attorney and Advance Directives

An executor requires specific documents to settle an estate efficiently. Key among these are the Power of Attorney and Advance Directives, which provide legal authority and clarity on the deceased's wishes.

The Power of Attorney document grants the executor the ability to manage financial and legal matters on behalf of the deceased before their passing. Advance Directives outline critical decisions regarding healthcare and end-of-life care, guiding executors in honoring the decedent's preferences.

What Documents Does an Executor Need to Settle an Estate? Infographic