For an FHA loan application, key documents include proof of income such as recent pay stubs, W-2 forms, and tax returns. Applicants must also provide bank statements, employment verification letters, and credit reports to demonstrate financial stability. Additionally, identification documents like a government-issued ID and Social Security number are essential for the verification process.

What Documents are Necessary for FHA Loan Application?

| Number | Name | Description |

|---|---|---|

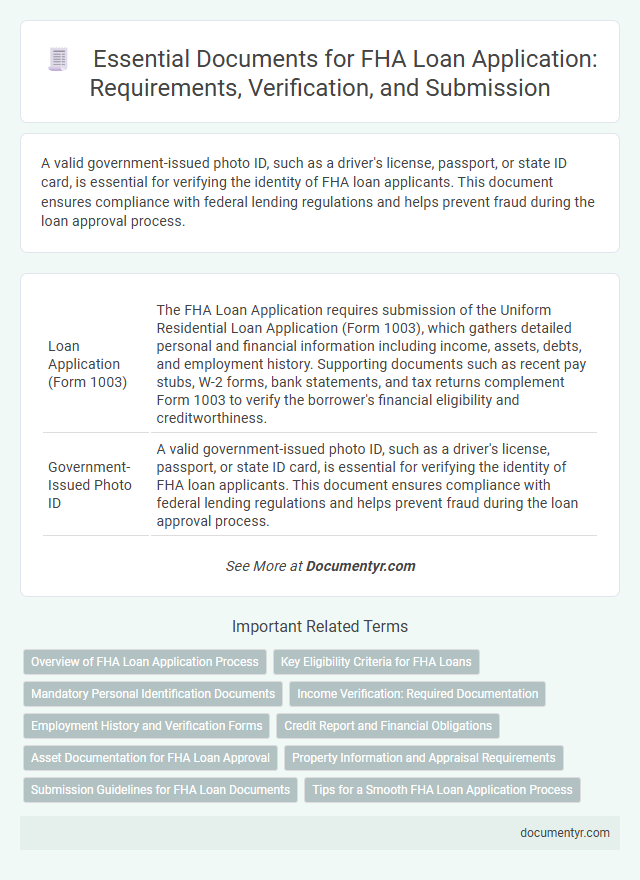

| 1 | Loan Application (Form 1003) | The FHA Loan Application requires submission of the Uniform Residential Loan Application (Form 1003), which gathers detailed personal and financial information including income, assets, debts, and employment history. Supporting documents such as recent pay stubs, W-2 forms, bank statements, and tax returns complement Form 1003 to verify the borrower's financial eligibility and creditworthiness. |

| 2 | Government-Issued Photo ID | A valid government-issued photo ID, such as a driver's license, passport, or state ID card, is essential for verifying the identity of FHA loan applicants. This document ensures compliance with federal lending regulations and helps prevent fraud during the loan approval process. |

| 3 | Social Security Card | A Social Security Card is a critical document required for an FHA loan application to verify the applicant's identity and eligibility for credit. Lenders use the Social Security number to pull credit reports, assess financial history, and confirm compliance with FHA loan guidelines. |

| 4 | Proof of Income (Pay Stubs) | Pay stubs are essential documents for an FHA loan application as they provide verifiable proof of steady income over the past 30 days, demonstrating the borrower's ability to repay the loan. Lenders typically require recent pay stubs alongside W-2 forms and tax returns to accurately assess the applicant's financial stability and employment consistency. |

| 5 | Federal Tax Returns (Last 2 Years) | Federal tax returns for the last two years are essential documents for an FHA loan application, as they provide a verified record of income and financial stability to lenders. These returns help assess the borrower's ability to repay the loan and verify consistency in earnings, crucial for underwriting decisions in FHA financing. |

| 6 | W-2 Forms (Last 2 Years) | W-2 forms from the last two years are essential for an FHA loan application as they verify the borrower's consistent income and employment history, ensuring eligibility for government-backed mortgage benefits. Lenders rely on these documents to accurately assess financial stability and income reliability. |

| 7 | Bank Statements (Last 2-3 Months) | Bank statements from the last 2-3 months are crucial for an FHA loan application as they verify consistent income deposits and assess the borrower's financial stability. These statements also help lenders evaluate available funds for down payments and closing costs, ensuring the applicant meets FHA underwriting requirements. |

| 8 | Proof of Employment (Verification Letter) | A Verification Letter for an FHA loan application must confirm the applicant's current employment status, job title, length of employment, and monthly or annual income, typically issued by the employer on company letterhead. This document is critical for lenders to assess the borrower's ability to repay the loan, ensuring compliance with FHA credit and income requirements. |

| 9 | Credit Report Authorization | Credit report authorization is a crucial document for an FHA loan application, allowing lenders to assess the borrower's credit history and score. This authorization enables the lender to verify the applicant's financial responsibility and risk level based on detailed credit data from major credit bureaus. |

| 10 | Asset Statements (Retirement, Investments) | FHA loan applications require detailed asset statements, including retirement accounts such as 401(k)s, IRAs, and pension funds, as well as investment portfolios like stocks, bonds, and mutual funds, to verify financial stability and down payment sources. These documents help lenders assess borrowers' ability to cover closing costs, mortgage payments, and reserves, ensuring eligibility for FHA loan approval. |

| 11 | Gift Letter (If Applicable) | A Gift Letter is required for FHA loan applicants using gifted funds, documenting that the money is a true gift without repayment obligations, including the donor's name, amount, relationship, and date of transfer. This letter ensures compliance with FHA guidelines and helps lenders verify the source of down payment assistance. |

| 12 | Debt Information (Statements or Bills) | To verify debt information for an FHA loan application, applicants must provide recent statements or bills for all outstanding liabilities, including credit cards, student loans, auto loans, and personal loans. Accurate documentation of monthly payments and outstanding balances is essential to assess debt-to-income ratios and ensure loan eligibility. |

| 13 | Rental History or Mortgage Statements | Providing accurate rental history or mortgage statements is essential for an FHA loan application, as these documents verify a borrower's payment reliability and financial responsibility. Lenders typically require at least 12 months of rent receipts or mortgage statements to assess consistent payment behavior and creditworthiness. |

| 14 | Proof of Down Payment | Proof of down payment for an FHA loan application requires documentation such as bank statements, gift letters, or evidence of a verified asset transfer showing funds available for the minimum 3.5% down payment. Lenders may also request recent pay stubs or tax returns to verify the source and legitimacy of the down payment funds. |

| 15 | Divorce Decree or Child Support Documents (If Applicable) | Divorce decrees are essential for FHA loan applications when they outline financial obligations or asset division, ensuring accurate debt and income verification. Child support documents must be provided to confirm ongoing payments as part of income qualification or liabilities, impacting the borrower's debt-to-income ratio. |

| 16 | Bankruptcy or Foreclosure Documents (If Applicable) | Bankruptcy or foreclosure documents required for an FHA loan application include discharge papers, bankruptcy petitions, and court judgments that detail the resolution and timeline of the proceedings. Lenders may also request a letter of explanation outlining the circumstances and evidence of financial recovery to assess creditworthiness accurately. |

| 17 | Certificate of Eligibility (For Veterans, if VA/FHA hybrid) | For an FHA loan application with a VA/FHA hybrid, the Certificate of Eligibility (COE) is a critical document proving a veteran's entitlement to VA loan benefits and eligibility status. Lenders require the COE to verify military service and ensure compliance with VA loan requirements alongside standard FHA documentation. |

| 18 | Explanation Letters (Credit Inquiries, Gaps in Employment) | Explanation letters for credit inquiries and gaps in employment are essential documents in an FHA loan application, as they clarify inconsistencies in credit reports and employment history to demonstrate financial reliability. These letters help underwriters assess the borrower's creditworthiness by providing context for additional credit checks or periods without reported income. |

| 19 | Purchase Agreement (If Buying a Home) | The Purchase Agreement is a crucial document for an FHA loan application as it outlines the terms and conditions of the home sale, including the agreed purchase price and closing date. Lenders require this agreement to verify the transaction details and ensure the loan amount aligns with the property's value and sale conditions. |

| 20 | Declaration of Residency | The Declaration of Residency is a critical document required for an FHA loan application, proving the borrower's primary residence status to qualify for government-backed mortgage benefits. This document must include current address verification, such as utility bills or lease agreements, to satisfy FHA guidelines and support the borrower's eligibility for the loan. |

Overview of FHA Loan Application Process

The FHA loan application process requires specific documents to verify your financial status and eligibility. Key documents include proof of income, such as pay stubs and tax returns, credit history reports, and identification. Lenders also require documentation of assets, employment verification, and information about any existing debts to complete the evaluation.

Key Eligibility Criteria for FHA Loans

| Document | Description |

|---|---|

| Proof of Identity | Government-issued ID such as a passport or driver's license is required to verify your identity. |

| Social Security Number | Necessary for credit checks and background verification related to the loan application process. |

| Income Verification | Recent pay stubs, W-2 forms from the past two years, and tax returns establish your ability to repay the loan. |

| Employment Verification | Contact information of your employer and employment history confirm job stability, a key FHA loan eligibility requirement. |

| Credit Report | A credit score minimum of 580 qualifies you for the lowest FHA down payment options; scores between 500-579 may require higher down payments. |

| Asset Documentation | Bank statements or other liquid asset proofs show available funds for down payment and closing costs. |

| Property Information | Details about the home you intend to purchase, including appraisal reports, ensure it meets FHA property standards. |

Mandatory Personal Identification Documents

FHA loan applications require mandatory personal identification documents to verify the applicant's identity and eligibility. Commonly requested documents include a valid government-issued photo ID such as a driver's license or passport, and the applicant's Social Security card.

Lenders may also ask for proof of residency, such as a utility bill or lease agreement, to confirm the applicant's address. These documents ensure compliance with FHA guidelines and help prevent identity fraud. Providing clear, accurate personal identification documents speeds up the FHA loan approval process significantly.

Income Verification: Required Documentation

Income verification is a critical part of the FHA loan application process to ensure you meet the lender's financial requirements. Providing accurate and complete documentation helps streamline loan approval.

- Recent Pay Stubs - Submit pay stubs from the past 30 days to verify your current earnings.

- W-2 Forms - Provide W-2 forms from the last two years to demonstrate consistent income.

- Tax Returns - Include your federal tax returns for the previous two years for comprehensive income validation.

Properly compiling these documents enhances your FHA loan application success.

Employment History and Verification Forms

Employment history and verification forms are crucial documents for an FHA loan application. These documents help demonstrate your financial stability and ability to repay the loan.

- Recent Pay Stubs - Provide proof of consistent income over the last 30 days.

- W-2 Forms - Show your earnings for the previous two years from your employer.

- Employment Verification Letter - Confirms your current job status, position, and length of employment.

Credit Report and Financial Obligations

For an FHA loan application, a thorough credit report is essential to evaluate the applicant's creditworthiness and payment history. Lenders also require detailed documentation of all financial obligations to accurately assess debt-to-income ratios.

- Credit Report - This report provides a comprehensive summary of credit accounts, payment history, and outstanding debts.

- Debt-to-Income Statement - A document outlining all monthly debt payments to calculate the borrower's financial capacity.

- Proof of Financial Obligations - Includes bills, loan statements, and recurring expenses needed to verify reported debts.

Asset Documentation for FHA Loan Approval

Asset documentation is crucial for FHA loan approval, as it verifies your financial stability and ability to cover down payments and closing costs. Lenders require detailed records to assess the availability and legitimacy of your funds.

Common documents include recent bank statements, investment account summaries, and retirement fund statements. These documents must clearly show the source and amount of your assets to meet FHA guidelines.

Property Information and Appraisal Requirements

For an FHA loan application, detailed property information is essential, including the property's address, legal description, and proof of ownership. This ensures the loan corresponds to a legitimate and qualifying residence.

An official appraisal conducted by a HUD-approved appraiser is mandatory to assess the property's market value. The appraisal must confirm the home meets FHA minimum property standards and safety requirements before loan approval.

Submission Guidelines for FHA Loan Documents

What documents are necessary for an FHA loan application? FHA loan submissions require proof of income, employment history, and credit information to evaluate the borrower's financial stability. Essential documents include pay stubs, W-2 forms, bank statements, tax returns, and a valid government-issued ID.

How should FHA loan documents be submitted? Submissions must follow strict guidelines ensuring accuracy and completeness to prevent delays in processing. Documents are typically uploaded through the lender's secure portal, or submitted as clear, legible copies in PDF format, adhering to any lender-specific requirements.

Are verification documents important for FHA loan approval? Verification documents such as employment verification letters and asset statements are crucial for confirming the applicant's financial situation. These papers aid the underwriter in assessing risk and ensuring compliance with FHA regulations.

What guidelines regulate the submission timeline for FHA loan documents? Timely submission is critical; lenders often require all documentation within 10 to 15 business days after the application. Delays can impact the loan approval process and affect closing dates, making adherence to deadlines essential.

Does the FHA require notarized documents for loan applications? The FHA generally does not mandate notarized paperwork except in specific cases like power of attorney forms. Confirm with your lender regarding any unique requirements to ensure full compliance with submission rules.

What Documents are Necessary for FHA Loan Application? Infographic