To apply for Social Security retirement benefits, you need to provide proof of age, such as a birth certificate or passport, along with your Social Security number. Documentation of your work history, typically your W-2 forms or self-employment tax returns, is required to verify your earnings. You must also submit direct deposit information to receive your payments promptly.

What Documents are Needed to Apply for Social Security Retirement Benefits?

| Number | Name | Description |

|---|---|---|

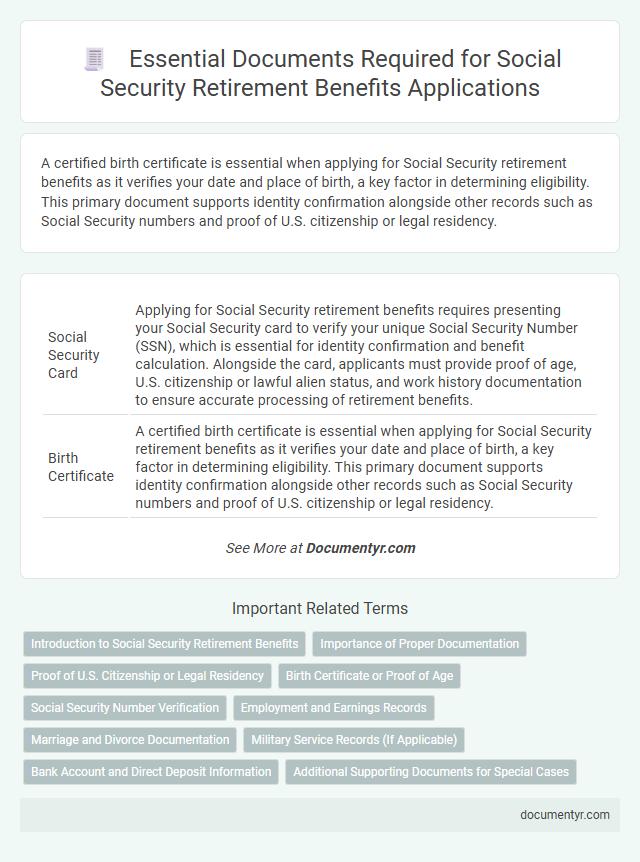

| 1 | Social Security Card | Applying for Social Security retirement benefits requires presenting your Social Security card to verify your unique Social Security Number (SSN), which is essential for identity confirmation and benefit calculation. Alongside the card, applicants must provide proof of age, U.S. citizenship or lawful alien status, and work history documentation to ensure accurate processing of retirement benefits. |

| 2 | Birth Certificate | A certified birth certificate is essential when applying for Social Security retirement benefits as it verifies your date and place of birth, a key factor in determining eligibility. This primary document supports identity confirmation alongside other records such as Social Security numbers and proof of U.S. citizenship or legal residency. |

| 3 | Proof of U.S. Citizenship or Lawful Alien Status | Documents required to prove U.S. citizenship or lawful alien status when applying for Social Security retirement benefits include a U.S. passport, a birth certificate issued by a U.S. vital statistics agency, or a Certificate of Naturalization. Lawful aliens must provide their Permanent Resident Card (Green Card) or other immigration documents such as Form I-94 or an Employment Authorization Document (EAD). |

| 4 | W-2 Forms or Self-Employment Tax Returns (most recent year) | To apply for Social Security retirement benefits, applicants must provide W-2 forms or self-employment tax returns for the most recent year to verify earnings and calculate accurate benefit amounts. These documents serve as primary evidence of income, ensuring the Social Security Administration has precise data for benefit determination. |

| 5 | Marriage Certificate (if applying as a spouse) | When applying for Social Security retirement benefits as a spouse, a certified marriage certificate is essential to verify the marital relationship. This document ensures eligibility for spousal benefits under the Social Security Administration's guidelines. |

| 6 | Divorce Decree (if applying as a divorced spouse) | A Divorce Decree is essential when applying for Social Security retirement benefits as a divorced spouse, proving the legal termination of the marriage and eligibility for benefits based on the ex-spouse's work record. This document must clearly show the marriage lasted at least ten years to qualify for spousal benefits under Social Security guidelines. |

| 7 | Military Discharge Papers (Form DD-214, if applicable) | Applicants for Social Security retirement benefits who have served in the military must provide Military Discharge Papers, specifically Form DD-214, to verify their service dates and entitlement to potential military credits. This documentation supports accurate calculation of benefits by confirming periods of active duty, which can increase Social Security eligibility and payment amounts. |

| 8 | Proof of Previous Names (legal name change document, if applicable) | Proof of previous names is required when applying for Social Security retirement benefits to verify identity and ensure accurate benefit calculation. Applicants must provide legal name change documents, such as a marriage certificate, divorce decree, or court order, if their name has changed since birth. |

| 9 | Bank Account Information (for direct deposit) | To apply for Social Security retirement benefits, applicants must provide bank account information, including the bank's routing number and account number, to set up direct deposit for seamless benefit payments. Accurate direct deposit details ensure timely and secure transfer of monthly Social Security checks directly into the retiree's bank account. |

| 10 | Proof of Age (if birth certificate unavailable) | When applying for Social Security retirement benefits without a birth certificate, acceptable proof of age documents include a U.S. passport, religious records made within five years of birth, or a military service record indicating date of birth. Other valid alternatives include early census records, a delayed birth certificate, or an adoption decree if dated shortly after birth. |

Introduction to Social Security Retirement Benefits

| Introduction to Social Security Retirement Benefits | |

|---|---|

| Social Security Retirement Benefits provide financial support to individuals who have reached the eligible age for retirement. These benefits are funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA). Understanding the required documents for application helps ensure a smooth and timely process. | |

| Document Type | Description |

| Proof of Identity | Valid government-issued identification such as a passport, driver's license, or state ID card is necessary to verify your identity when applying. |

| Social Security Number (SSN) | Your Social Security card or official documentation that confirms your SSN must be provided to link the benefit claim accurately. |

| Birth Certificate | An original or certified copy of your birth certificate validates your date of birth, which is critical in determining eligibility and retirement age. |

| Employment History | Records of previous earnings, such as W-2 forms or self-employment tax returns, establish work credits required to qualify for benefits. |

| Marriage Certificate | If claiming spousal benefits, submission of a marriage certificate may be required to confirm the relationship. |

| Direct Deposit Information | Bank account details for electronic deposit of monthly benefits ensure secure and prompt payment delivery. |

Importance of Proper Documentation

Applying for Social Security retirement benefits requires specific documents to verify identity, earnings, and eligibility. Proper documentation ensures a smooth application process and timely benefit approval.

Key documents include your Social Security card, birth certificate, and proof of U.S. citizenship or lawful residency. Providing accurate financial records like W-2 forms or self-employment tax returns is crucial for calculating benefits correctly.

Proof of U.S. Citizenship or Legal Residency

To apply for Social Security retirement benefits, applicants must provide valid proof of U.S. citizenship or legal residency. Common documents include a U.S. birth certificate, U.S. passport, or Certificate of Naturalization.

Legal residents can submit their Permanent Resident Card (Green Card) or Form I-94 Proof of Arrival/Departure. Accurate documentation ensures smooth processing and eligibility verification for Social Security benefits.

Birth Certificate or Proof of Age

Applying for Social Security retirement benefits requires submitting specific documents to verify your identity and age. One of the most critical documents is your birth certificate or an acceptable alternative as proof of age.

- Birth Certificate - The Social Security Administration primarily accepts an original or certified copy of a birth certificate to confirm your date of birth.

- Alternative Proof of Age - If a birth certificate is unavailable, documents like a passport, religious record, or early school records can serve as valid proof of age.

- Document Authenticity - Submitted documents must be original or certified copies; photocopies or notarized copies are not accepted for Social Security claims.

Social Security Number Verification

To apply for Social Security retirement benefits, verifying your Social Security Number (SSN) is essential. This step confirms your identity and eligibility for the program.

Applicants must provide a valid document displaying their SSN, such as a Social Security card or a U.S. driver's license containing the number. In some cases, a birth certificate that includes the SSN may also be accepted. Ensuring accurate SSN verification helps prevent delays in processing your retirement benefits.

Employment and Earnings Records

Accurate employment and earnings records are essential when applying for Social Security retirement benefits. These documents verify the work history and income used to calculate your benefit amount.

- W-2 Forms - Annual wage statements from employers that show the income earned and taxes paid.

- Self-Employment Tax Returns - IRS tax returns documenting earnings if you worked as an independent contractor or business owner.

- Social Security Earnings Statement - A record from the Social Security Administration summarizing reported wages and self-employment income over your career.

Providing complete employment and earnings documentation ensures eligibility verification and accurate benefit calculations.

Marriage and Divorce Documentation

When applying for Social Security retirement benefits, marriage and divorce documentation play a crucial role in verifying eligibility. A valid marriage certificate is required to prove spousal status, while final divorce decrees or annulment papers are necessary to confirm former marital relationships. These documents ensure accurate benefit determination based on personal marital history and support claims related to spousal or survivor benefits.

Military Service Records (If Applicable)

Military service records are essential when applying for Social Security retirement benefits if you have served in the armed forces. These documents verify your service periods, which can impact your benefit calculations and eligibility.

- DD Form 214 - Official discharge papers that confirm active duty service and discharge status.

- Service Personnel Records - Comprehensive documents detailing your military service history and duty assignments.

- Military Earnings Records - Records showing your wages earned during active service that contribute to your Social Security credits.

Bank Account and Direct Deposit Information

To apply for Social Security retirement benefits, you must provide your bank account and direct deposit information to ensure timely payments. This includes your account number, bank routing number, and the type of account (checking or savings). Supplying accurate banking details helps avoid payment delays and allows Social Security to deposit benefits directly into your designated account.

What Documents are Needed to Apply for Social Security Retirement Benefits? Infographic