For accurate crypto asset reporting on taxes, individuals must gather transaction records, including buy and sell confirmations, wallet addresses, and dates of each trade. Forms such as IRS Form 8949 and Schedule D are essential for reporting capital gains and losses. Maintaining detailed documentation of all crypto transactions ensures compliance and simplifies the tax filing process.

What Documents Are Required for Crypto Asset Reporting on Taxes?

| Number | Name | Description |

|---|---|---|

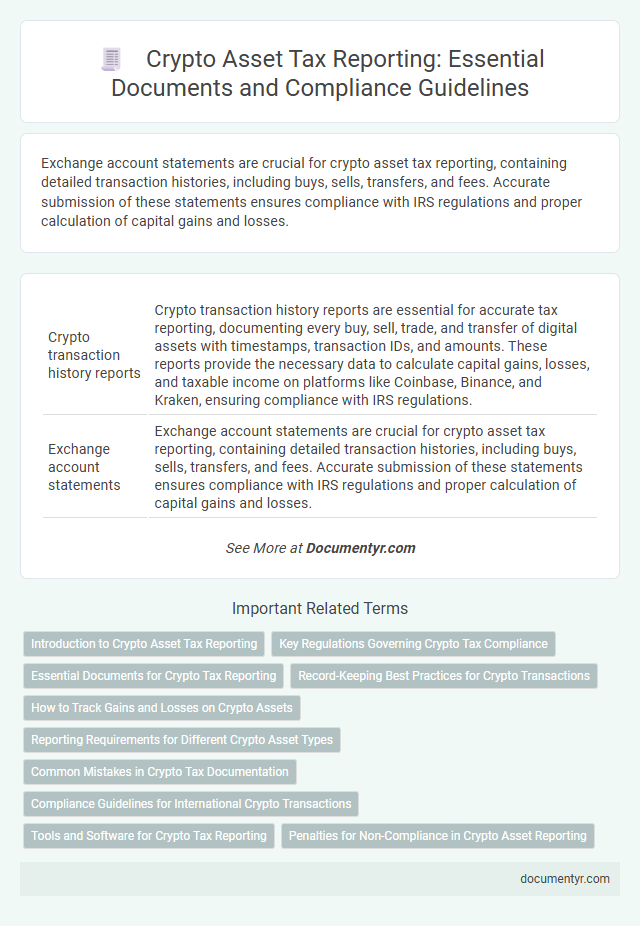

| 1 | Crypto transaction history reports | Crypto transaction history reports are essential for accurate tax reporting, documenting every buy, sell, trade, and transfer of digital assets with timestamps, transaction IDs, and amounts. These reports provide the necessary data to calculate capital gains, losses, and taxable income on platforms like Coinbase, Binance, and Kraken, ensuring compliance with IRS regulations. |

| 2 | Exchange account statements | Exchange account statements are crucial for crypto asset tax reporting, containing detailed transaction histories, including buys, sells, transfers, and fees. Accurate submission of these statements ensures compliance with IRS regulations and proper calculation of capital gains and losses. |

| 3 | Wallet transaction logs | Wallet transaction logs are essential for accurately reporting crypto asset activities on taxes, capturing detailed records of all buys, sells, transfers, and swaps. These logs provide crucial data such as transaction dates, amounts, wallet addresses, and transaction IDs, enabling precise calculation of capital gains and losses for tax compliance. |

| 4 | Form 1099-B (Proceeds from Broker and Barter Exchange Transactions) | Form 1099-B reports proceeds from crypto asset transactions executed through brokers or barter exchanges, detailing sales, cost basis, and transaction dates essential for accurate tax reporting. Taxpayers must obtain this form to reconcile capital gains or losses on crypto trades with IRS requirements, ensuring compliance and avoiding penalties. |

| 5 | Form 1099-K (Payment Card and Third Party Network Transactions) | Form 1099-K reports payment card transactions and third-party network payments exceeding $600, crucial for accurately reporting crypto asset income to the IRS. Taxpayers must include this document to reconcile reported crypto transactions and ensure compliance with IRS requirements for digital asset taxation. |

| 6 | Form 1099-MISC (Miscellaneous Income) | Form 1099-MISC is essential for reporting miscellaneous income from crypto transactions like staking rewards, airdrops, and crypto payments received, ensuring accurate tax compliance. Taxpayers must gather this form from platforms or issuers that report such income to the IRS to correctly declare their crypto asset earnings. |

| 7 | Form 8949 (Sales and Other Dispositions of Capital Assets) | Form 8949 requires detailed documentation of each crypto asset transaction, including dates acquired and sold, cost basis, sale proceeds, and gain or loss to accurately report capital asset dispositions. Taxpayers must retain records such as exchange transaction history, wallet addresses, and cost documentation to ensure compliance and proper calculation of taxable events. |

| 8 | Schedule D (Capital Gains and Losses) | Schedule D requires detailed records of all cryptocurrency transactions, including dates of acquisition and sale, purchase prices, sale proceeds, and cost basis to accurately report capital gains and losses. Supporting documents such as Form 1099-B from exchanges, transaction histories, and wallet statements are essential for reconciling figures and ensuring compliance with IRS tax regulations on crypto assets. |

| 9 | Records of crypto mining rewards | Records of crypto mining rewards must include detailed transaction histories, wallet addresses, dates of receipt, and the fair market value of mined assets at the time they were received. Accurate documentation of mining rewards is essential for calculating taxable income and ensuring compliance with tax authorities. |

| 10 | Records of airdrops and forks | Records of airdrops and forks are critical for accurate crypto asset tax reporting, requiring documentation such as transaction histories, wallet addresses, and timestamps from blockchain explorers. These records help determine the fair market value of received assets at the time of receipt, which is necessary for calculating taxable income or capital gains. |

| 11 | Staking income statements | Staking income statements are essential for accurately reporting crypto earnings on taxes, detailing the amount of cryptocurrency earned, transaction dates, and fair market value at the time of receipt. These documents help taxpayers comply with IRS regulations by providing verifiable records of staking rewards, which are considered taxable income. |

| 12 | Gift or donation documentation | Gift or donation documentation for crypto asset tax reporting must include the date of the transfer, the fair market value of the cryptocurrency at the time of the gift, and the recipient's details. Maintaining records such as gift letters, transaction receipts, and blockchain confirmations is essential to accurately report and substantiate non-taxable events or potential charitable deductions. |

| 13 | Purchase receipts and invoices | Purchase receipts and invoices are essential documents for crypto asset reporting on taxes, serving as proof of acquisition cost and transaction dates. Accurate records of these documents enable precise calculation of capital gains, losses, and cost basis for tax compliance. |

| 14 | Documents showing fair market value at the time of acquisition/disposition | Documents required for crypto asset tax reporting must include records such as transaction histories from exchanges, wallet statements, and purchase receipts that clearly indicate the fair market value at the time of acquisition or disposition. Accurate reporting depends on these documents reflecting the market price in USD or applicable currency at the specific date to ensure compliance with IRS guidelines. |

| 15 | Tax software crypto import files (CSV, XLS, etc.) | Tax software for crypto asset reporting requires import files such as CSV or XLS formats containing detailed transaction histories, including dates, amounts, wallet addresses, and types of trades. Accurate and comprehensive data files ensure precise calculation of capital gains, losses, income, and tax liabilities, streamlining IRS compliance. |

Introduction to Crypto Asset Tax Reporting

Crypto asset tax reporting requires accurate documentation to comply with tax regulations. Understanding the necessary documents helps ensure proper reporting and avoid penalties.

Key documents include transaction records, wallet statements, and exchange reports. These records provide detailed information on purchases, sales, trades, and income from crypto assets.

Key Regulations Governing Crypto Tax Compliance

Understanding the key regulations governing crypto tax compliance is essential for accurate reporting of your crypto assets. Various documents must be collected to meet tax authorities' requirements effectively.

- Transaction Records - Detailed logs of all crypto buy, sell, exchange, and transfer activities are essential for calculating gains and losses.

- Wallet and Exchange Statements - Statements from crypto wallets and exchanges provide authenticated evidence of holdings and transaction history.

- Cost Basis Documentation - Records showing the original purchase price of assets help determine taxable events and capital gains accurately.

Ensuring you maintain comprehensive documentation aligns with regulations such as IRS Notice 2014-21 and relevant international tax guidelines.

Essential Documents for Crypto Tax Reporting

Crypto asset reporting on taxes requires accurate documentation to ensure compliance with tax regulations. Keeping organized records simplifies the reporting process and helps avoid potential penalties.

- Transaction History - A detailed record of all crypto purchases, sales, exchanges, and transfers including dates, amounts, and transaction IDs.

- Wallet Statements - Reports from your digital wallets showing balances and activity to verify holdings and movements of crypto assets.

- Exchange Reports - Summarized tax documents from cryptocurrency exchanges that outline gains, losses, and income generated from trading.

Record-Keeping Best Practices for Crypto Transactions

Accurate record-keeping is essential for crypto asset reporting on taxes, including transaction histories, purchase and sale dates, and amounts in fiat currency. Maintaining detailed documentation such as wallet statements, exchange records, and receipts helps ensure compliance with tax regulations. Utilizing dedicated bookkeeping software can streamline tracking and improve accuracy throughout the reporting process.

How to Track Gains and Losses on Crypto Assets

What documents are required for crypto asset reporting on taxes? Taxpayers must gather transaction histories, purchase receipts, and exchange records to accurately report crypto activities. These documents help track cost basis, dates, and values essential for tax calculations.

How can gains and losses on crypto assets be tracked effectively? Using detailed transaction logs from wallets and exchanges enables precise tracking of crypto gains and losses. Software tools that integrate with exchanges automate cost basis calculations and generate taxable gain reports.

Reporting Requirements for Different Crypto Asset Types

| Crypto Asset Type | Required Documents | Key Reporting Requirements |

|---|---|---|

| Cryptocurrency (e.g., Bitcoin, Ethereum) |

|

Report capital gains and losses; disclose income from mining or staking rewards if applicable. |

| Stablecoins |

|

Include any realized gains or losses from stablecoin trades or conversions in your taxable income. |

| Non-Fungible Tokens (NFTs) |

|

Report profits or losses from NFT sales; report income if NFTs are sold as part of a business activity. |

| DeFi Tokens and Yield Farming Rewards |

|

Report all earnings as income; track gains or losses from any DeFi token disposals. |

| Crypto Mining Income |

|

Include the fair market value of mined crypto as income when received; deduct related expenses where applicable. |

Common Mistakes in Crypto Tax Documentation

Accurate crypto asset reporting requires several key documents such as transaction histories, wallet addresses, and records of purchases and sales. Proper documentation ensures compliance with tax regulations and helps avoid costly errors.

Common mistakes in crypto tax documentation include failing to report all transactions, mixing personal and business wallets, and not keeping detailed records of trades and transfers. Overlooking these errors can lead to inaccurate tax filings and potential penalties. You should maintain meticulous records to support your tax reports and verify all digital asset activities.

Compliance Guidelines for International Crypto Transactions

Reporting crypto assets on taxes requires specific documentation to ensure compliance with international regulations. Accurate records help meet the guidelines for cross-border crypto transactions.

- Transaction Records - Detailed logs of all cryptocurrency trades, including dates, amounts, and counterparties, are essential for tax reporting.

- Proof of Identity - Valid identification documents are necessary to verify your identity in compliance with global tax authorities.

- International Tax Forms - Forms such as the IRS Form 8938 or equivalent declarations are required to disclose foreign crypto assets and transactions.

Tools and Software for Crypto Tax Reporting

Accurate crypto asset reporting on taxes requires gathering transaction histories, wallet statements, and exchange records. These documents provide essential data for calculating gains, losses, and taxable events.

Specialized crypto tax software such as CoinTracker, Koinly, and CryptoTrader.Tax streamline the reporting process by integrating with wallets and exchanges. These tools automatically aggregate transactions, generate tax reports, and ensure compliance with IRS regulations.

What Documents Are Required for Crypto Asset Reporting on Taxes? Infographic