First-time home loan applicants must provide proof of identity, income verification, and employment details to establish creditworthiness. Essential documents include government-issued IDs, recent pay stubs, bank statements, tax returns, and credit reports. Lenders may also require proof of address and details of any existing debts to assess financial stability.

What Documents Are Needed for First-Time Home Loan Applications?

| Number | Name | Description |

|---|---|---|

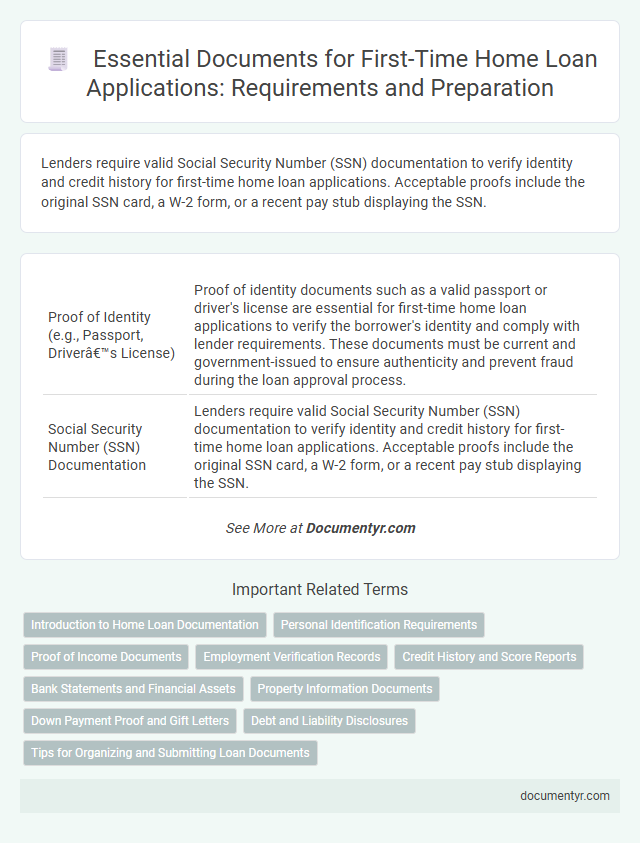

| 1 | Proof of Identity (e.g., Passport, Driver’s License) | Proof of identity documents such as a valid passport or driver's license are essential for first-time home loan applications to verify the borrower's identity and comply with lender requirements. These documents must be current and government-issued to ensure authenticity and prevent fraud during the loan approval process. |

| 2 | Social Security Number (SSN) Documentation | Lenders require valid Social Security Number (SSN) documentation to verify identity and credit history for first-time home loan applications. Acceptable proofs include the original SSN card, a W-2 form, or a recent pay stub displaying the SSN. |

| 3 | Proof of Income (Recent Pay Stubs) | Recent pay stubs, typically from the last 30 days, serve as critical proof of income for first-time home loan applications, demonstrating consistent earnings to lenders. Providing these documents helps verify employment status and monthly income, directly influencing loan approval and interest rate decisions. |

| 4 | Tax Returns (Last Two Years) | Lenders require tax returns from the last two years to verify income stability and assess repayment capacity in first-time home loan applications. These documents provide critical insights into earnings, deductions, and financial behavior, ensuring accurate risk evaluation and loan approval. |

| 5 | W-2 or 1099 Forms (Last Two Years) | Lenders require W-2 or 1099 forms from the last two years to verify income stability and employment history for first-time home loan applicants, ensuring accurate assessment of repayment ability. These documents provide essential proof of earnings, critical for calculating debt-to-income ratios and qualifying loan limits. |

| 6 | Bank Statements (Last Two–Three Months) | Providing bank statements from the last two to three months is crucial for first-time home loan applicants as they demonstrate consistent income flow, spending habits, and financial stability to lenders. These statements help verify employment income, track deposits, and assess the applicant's ability to manage finances and repay the loan. |

| 7 | Proof of Employment (Employment Verification Letter) | An Employment Verification Letter is essential for first-time home loan applicants to confirm stable income and job status, typically provided by the employer on official letterhead detailing the applicant's position, salary, and duration of employment. Lenders rely on this document to assess creditworthiness and repayment ability, making it a critical component of the underwriting process. |

| 8 | Credit Report Authorization | Credit report authorization is a critical document in first-time home loan applications, allowing lenders to access and evaluate an applicant's credit history for risk assessment. This authorization enables verification of credit scores, outstanding debts, and payment history, which significantly influence loan approval decisions and interest rates. |

| 9 | Debt Statements (Credit Cards, Loans) | Debt statements for credit cards and loans are essential documents for first-time home loan applications, providing lenders with a detailed overview of existing financial obligations and creditworthiness. These statements typically include outstanding balances, minimum monthly payments, interest rates, and payment history, enabling accurate assessment of debt-to-income ratios and repayment capacity. |

| 10 | Asset Documentation (Investment & Retirement Account Statements) | Investment and retirement account statements are essential asset documentation in first-time home loan applications, verifying the borrower's financial stability and ability to cover down payments or reserves. Lenders typically require recent statements, usually from the last two to three months, detailing account balances and transaction history to assess the applicant's net worth and liquidity. |

| 11 | Rental History (Lease Agreements, Rent Receipts) | For first-time home loan applications, providing rental history through lease agreements and rent receipts demonstrates financial responsibility and consistent payment behavior to lenders. These documents validate stability in housing expenses, helping to establish creditworthiness and improve loan approval chances. |

| 12 | Gift Letter (if Receiving Down Payment Assistance) | A Gift Letter is required for first-time home loan applicants receiving down payment assistance to verify the funds are a genuine gift and not a loan. This letter must include the donor's information, the gift amount, and a statement confirming no repayment is expected, ensuring compliance with lender and underwriting guidelines. |

| 13 | Purchase Agreement (Signed Sales Contract) | A signed Purchase Agreement (Sales Contract) is a critical document in first-time home loan applications as it verifies the agreed-upon price and terms between the buyer and seller, enabling lenders to assess loan eligibility accurately. This contract must clearly outline property details, purchase price, and contingencies, serving as a foundational reference for loan underwriting and appraisal processes. |

| 14 | Proof of Down Payment (Source Verification) | Evidence of down payment source is crucial for first-time home loan applicants, requiring documents such as recent bank statements, gift letters, or sale agreements to verify legitimate funds. Lenders insist on these proofs to assess financial stability and ensure compliance with anti-money laundering regulations. |

| 15 | Homeowners Insurance Information | Homeowners insurance information is essential for first-time home loan applications, as lenders require proof of coverage to protect their investment against risks like fire, theft, or natural disasters. Applicants must provide an insurance declaration page or policy binder demonstrating adequate coverage limits and the lender named as the mortgagee. |

Introduction to Home Loan Documentation

Applying for a first-time home loan requires submitting various essential documents to verify your financial background and identity. Understanding these requirements simplifies the approval process and speeds up your loan application.

- Proof of Identity - Valid government-issued ID such as a passport or driver's license confirms your identity.

- Income Verification - Recent pay stubs, tax returns, or bank statements demonstrate your ability to repay the loan.

- Credit History - A credit report provides lenders with your borrowing and repayment behavior.

Personal Identification Requirements

| Document Type | Description | Purpose |

|---|---|---|

| Government-Issued Photo ID | Valid passport, driver's license, or state ID card | Verify applicant's identity and legal age |

| Social Security Number (SSN) or Tax ID | Social Security card or IRS-issued Tax Identification Number document | Confirm social security status and facilitate credit check |

| Proof of Address | Utility bill, lease agreement, or bank statement with current address | Confirm residence location and maintain contact information |

| Birth Certificate | Certified copy of birth certificate | Supplement to verify identity and date of birth |

| Residency Status Documents | Permanent resident card, visa, or naturalization certificate | Confirm legal residency status if not a citizen |

Proof of Income Documents

Proof of income documents are essential for first-time home loan applications to verify the borrower's financial stability. Commonly required documents include recent pay stubs, tax returns from the past two years, and bank statements showing consistent income deposits. Self-employed applicants must provide profit and loss statements along with IRS Form 1099 or business tax returns for accurate income assessment.

Employment Verification Records

Employment verification records are essential documents required during first-time home loan applications. Lenders rely on these records to confirm your job status, income stability, and ability to repay the loan.

Common employment verification documents include recent pay stubs, employer contact information, and an employment verification letter. These documents help mortgage underwriters assess your financial reliability and job continuity. Providing accurate and up-to-date records can expedite the loan approval process and improve your chances of securing favorable loan terms.

Credit History and Score Reports

Credit history and score reports play a crucial role in first-time home loan applications. Lenders use these documents to assess an applicant's financial reliability and repayment ability.

Required documents include credit reports from major bureaus such as Experian, Equifax, and TransUnion. These reports provide detailed information about past loans, credit card usage, and payment history, influencing loan approval decisions.

Bank Statements and Financial Assets

Bank statements are crucial for first-time home loan applications as they provide lenders with a clear overview of your income flow and spending habits. These documents typically need to cover the last three to six months to validate your financial stability and repayment capacity. Financial assets, including investment accounts, savings, and retirement funds, must also be documented to demonstrate your ability to cover down payments and reserves.

Property Information Documents

Property information documents are essential for first-time home loan applications, providing lenders with detailed insights about the asset involved. These documents verify key property details and ensure that the loan is secured against a legitimate and valuable asset.

- Title Deed - Proves ownership and legal rights over the property to ensure clear title transfer.

- Sale Agreement - Outlines the terms and conditions agreed upon between the buyer and seller.

- Property Tax Receipts - Confirms up-to-date payment of property taxes indicating no outstanding liabilities.

Down Payment Proof and Gift Letters

What documents are necessary to prove the down payment for a first-time home loan application? Lenders require bank statements or investment account summaries to verify that the down payment funds are available and sourced appropriately. Providing clear proof of these funds helps ensure a smoother loan approval process.

How do gift letters affect your home loan application? A gift letter must be included if part of the down payment is a monetary gift from a family member or friend. This letter confirms that the money is a gift, not a loan, and that repayment is not expected, which lenders require to assess the loan risk accurately.

Debt and Liability Disclosures

Debt and liability disclosures are critical components of first-time home loan applications. These documents provide lenders with a clear picture of your existing financial obligations, impacting loan eligibility and terms.

Typical disclosures include credit card balances, outstanding loans, alimony, and other recurring debts. Accurate and complete reporting of these liabilities helps ensure a smoother loan approval process and avoids potential delays.

What Documents Are Needed for First-Time Home Loan Applications? Infographic