To open a Roth IRA, you need a valid government-issued photo ID such as a driver's license or passport to verify your identity. Proof of address, like a recent utility bill or bank statement, is typically required to establish residency. You will also need your Social Security number and bank account information to fund and manage your Roth IRA effectively.

What Documents Are Required for Opening a Roth IRA?

| Number | Name | Description |

|---|---|---|

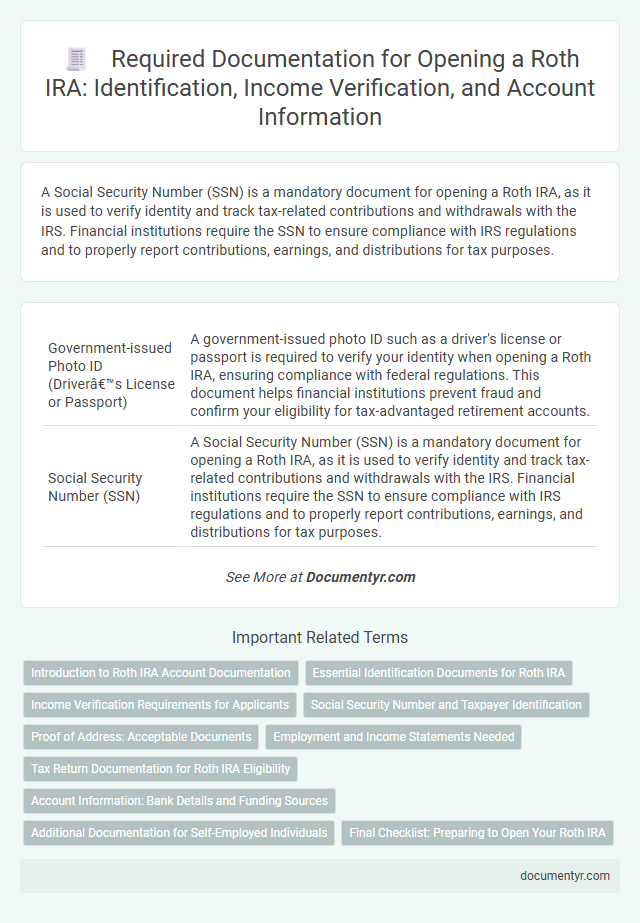

| 1 | Government-issued Photo ID (Driver’s License or Passport) | A government-issued photo ID such as a driver's license or passport is required to verify your identity when opening a Roth IRA, ensuring compliance with federal regulations. This document helps financial institutions prevent fraud and confirm your eligibility for tax-advantaged retirement accounts. |

| 2 | Social Security Number (SSN) | A Social Security Number (SSN) is a mandatory document for opening a Roth IRA, as it is used to verify identity and track tax-related contributions and withdrawals with the IRS. Financial institutions require the SSN to ensure compliance with IRS regulations and to properly report contributions, earnings, and distributions for tax purposes. |

| 3 | Proof of Address (Utility Bill or Bank Statement) | A valid Proof of Address, such as a recent utility bill or bank statement dated within the last three months, is essential for opening a Roth IRA to verify the account holder's residential information. Financial institutions require this documentation to comply with federal regulations and prevent identity fraud during the account setup process. |

| 4 | Employment Information (Employer Name and Address) | When opening a Roth IRA, providing accurate employment information such as your employer's name and address is essential for verifying income eligibility and processing contributions. Financial institutions use this data to comply with IRS regulations and facilitate tax reporting requirements related to retirement accounts. |

| 5 | Beneficiary Designation Form | The Beneficiary Designation Form is essential for opening a Roth IRA, as it specifies who will inherit the account assets in the event of the holder's death. This document ensures the proper transfer of funds to chosen beneficiaries, helping to avoid probate and maintain tax advantages associated with the Roth IRA. |

| 6 | Bank Account Information (for Funding) | To open a Roth IRA, providing bank account information is essential for funding the account, including the bank name, routing number, and account number. This data enables seamless electronic transfers or direct deposits to initiate and maintain contributions in compliance with IRS regulations. |

| 7 | Income Verification (if required) | Income verification for opening a Roth IRA typically requires recent pay stubs, W-2 forms, or tax returns to confirm earned income eligibility and contribution limits. Self-employed individuals may need to provide 1099 forms or profit and loss statements to substantiate their income. |

| 8 | IRA Application Form | The IRA application form is a critical document required to open a Roth IRA, capturing essential personal information such as name, Social Security number, and employment details. This form also requires details about the beneficiary designation and investment choices to ensure compliance with IRS regulations and proper account setup. |

| 9 | W-2 Form or 1099 Form (for income documentation, if applicable) | Required documents for opening a Roth IRA typically include income verification such as a W-2 form for salaried employees or a 1099 form for self-employed individuals and freelancers. These income documents help confirm eligibility based on IRS contribution limits and ensure accurate account setup. |

| 10 | Proof of Age (Birth Certificate, if required) | To open a Roth IRA, proof of age is essential and can typically be verified with a birth certificate or a government-issued ID such as a passport or driver's license. Financial institutions require this documentation to confirm the account holder is at least 18 years old and eligible to open the account independently. |

Introduction to Roth IRA Account Documentation

Opening a Roth IRA requires specific documentation to verify your identity and financial information. These documents ensure compliance with IRS regulations and protect your retirement savings.

You will need proof of identification, such as a government-issued ID, and your Social Security number. Financial documents like your bank account details are essential to fund and manage your Roth IRA account effectively.

Essential Identification Documents for Roth IRA

Opening a Roth IRA requires submitting key identification documents to verify your identity and eligibility. These essential documents ensure compliance with financial regulations and protect your retirement savings.

- Valid Government-Issued ID - A driver's license or passport is necessary to confirm your identity.

- Social Security Number - Your Social Security card or a tax document showing your SSN must be provided for tax reporting purposes.

- Proof of Address - Utility bills or bank statements are commonly used to verify your residential address.

Gathering these identification documents beforehand simplifies the Roth IRA account opening process.

Income Verification Requirements for Applicants

Income verification is a crucial step when opening a Roth IRA to ensure eligibility. Financial institutions require specific documents to confirm your earned income.

- Recent Pay Stubs - These documents provide proof of your current employment income and are typically requested to verify your earnings.

- Tax Returns - Most institutions ask for your latest IRS tax returns to validate your reported income over the past year.

- W-2 or 1099 Forms - These forms detail your income sources from employers or clients and support income verification for Roth IRA contributions.

Social Security Number and Taxpayer Identification

What documents are required for opening a Roth IRA regarding identification? A valid Social Security Number (SSN) or Taxpayer Identification Number (TIN) is essential to open a Roth IRA account. These numbers verify your identity and ensure proper tax reporting to the IRS.

Proof of Address: Acceptable Documents

Proof of address is a crucial requirement when opening a Roth IRA. Acceptable documents typically include a recent utility bill, a bank statement, or a government-issued document such as a driver's license. These documents must clearly display the applicant's name and current address to verify residency accurately.

Employment and Income Statements Needed

| Document Type | Description | Purpose |

|---|---|---|

| Proof of Identity | Government-issued ID such as a passport or driver's license | To verify your identity and comply with federal regulations |

| Employment Verification | Recent pay stubs or employer's letter confirming your current job status | To confirm your active employment status required for Roth IRA eligibility |

| Income Statements | Tax returns (Form 1040), W-2 forms, or 1099 forms | To verify earned income which is necessary for contribution limits |

| Social Security Number | Your Social Security card or equivalent documentation | Required for tax reporting and to establish your account |

Tax Return Documentation for Roth IRA Eligibility

To open a Roth IRA, providing recent tax return documentation is essential for verifying eligibility. The IRS requires proof of earned income, typically found on Form 1040, to ensure contributions fall within income limits. Accurate tax return records help financial institutions confirm compliance with Roth IRA income thresholds.

Account Information: Bank Details and Funding Sources

Opening a Roth IRA requires providing detailed account information, including your bank details for funding purposes. Accurate bank account numbers and routing information ensure seamless transactions and contributions to your IRA.

Funding sources must be clearly identified, verifying the origin of contributions to comply with IRS regulations. Linking a checking or savings account helps automate deposits and maintain consistent investment growth in the Roth IRA.

Additional Documentation for Self-Employed Individuals

Opening a Roth IRA requires specific identification and financial documents to verify eligibility and income. Self-employed individuals must provide extra documentation to confirm their business status and income source.

- Proof of Self-Employment - Recent tax returns including Schedule C or Schedule SE demonstrate your self-employed income.

- Business License or Registration - Official documents verifying the existence and legitimacy of your business.

- Income Statements - Profit and loss statements or bank statements showing consistent business earnings.

What Documents Are Required for Opening a Roth IRA? Infographic