An executor needs key documents such as the original will, death certificate, and court-issued letters testamentary to begin the estate settlement process. Financial statements, tax returns, insurance policies, and property deeds are also essential for accurately valuing and managing the estate's assets. Gathering beneficiary information and creditor claims is crucial to ensure proper distribution and debt resolution.

What Documents Does an Executor Need for Estate Settlement?

| Number | Name | Description |

|---|---|---|

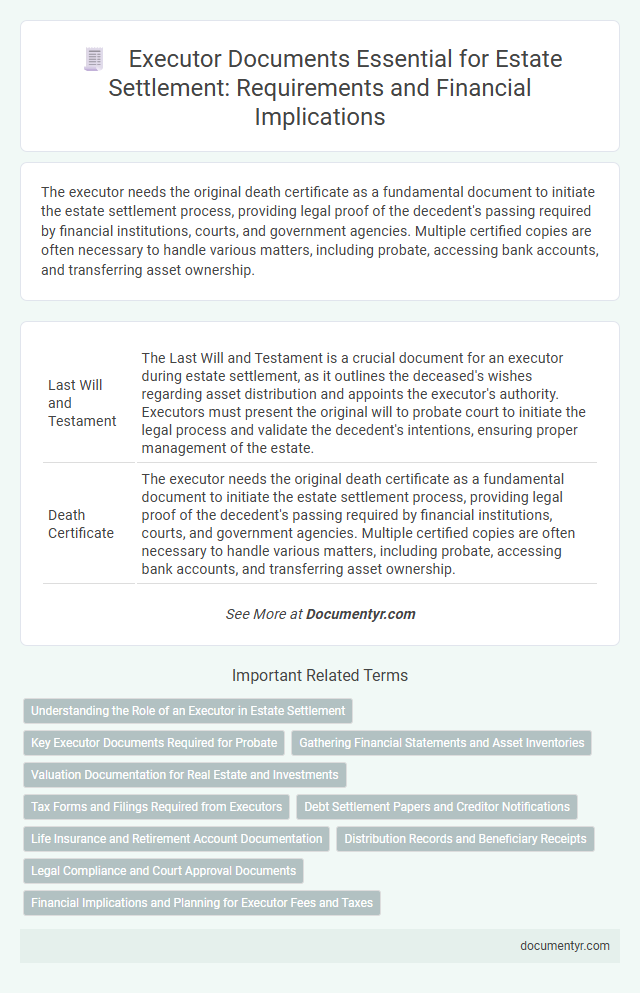

| 1 | Last Will and Testament | The Last Will and Testament is a crucial document for an executor during estate settlement, as it outlines the deceased's wishes regarding asset distribution and appoints the executor's authority. Executors must present the original will to probate court to initiate the legal process and validate the decedent's intentions, ensuring proper management of the estate. |

| 2 | Death Certificate | The executor needs the original death certificate as a fundamental document to initiate the estate settlement process, providing legal proof of the decedent's passing required by financial institutions, courts, and government agencies. Multiple certified copies are often necessary to handle various matters, including probate, accessing bank accounts, and transferring asset ownership. |

| 3 | Trust Documents | Trust documents essential for estate settlement include the trust agreement, any amendments, and a certification of trust, which detail the terms and the trustee's powers. These documents verify the executor's authority to manage trust assets and facilitate the proper transfer of property according to the grantor's wishes. |

| 4 | Letters Testamentary | Letters Testamentary serve as the legal document granting an executor the authority to administer and settle a deceased person's estate, providing proof to banks, financial institutions, and courts. Executors must present these letters along with the deceased's will, death certificate, and asset inventories to access accounts and distribute assets according to the estate plan. |

| 5 | Probate Court Petition | The executor must submit a probate court petition to initiate estate settlement, including the deceased's original will, death certificate, and a detailed list of assets and liabilities. This petition formalizes the executor's authority and allows the court to oversee the distribution of the estate according to legal requirements. |

| 6 | Asset Inventory List | An executor needs a comprehensive asset inventory list detailing all financial accounts, real estate properties, personal valuables, and digital assets to accurately assess the estate's value. This inventory is essential for probate court submissions, tax filings, and efficient distribution of assets to beneficiaries. |

| 7 | Property Deeds | Executors need original property deeds to verify ownership and transfer real estate assets during estate settlement. These documents are essential for updating title records, satisfying probate requirements, and facilitating the legal transfer of property to beneficiaries. |

| 8 | Vehicle Titles | Executors require vehicle titles to transfer ownership of any vehicles owned by the deceased during estate settlement, ensuring clear legal transfer and accurate asset valuation. These documents must be collected along with the will, death certificate, and other financial records to facilitate timely and compliant distribution of estate assets. |

| 9 | Bank Statements | Executors require comprehensive bank statements from all accounts held by the deceased to track financial transactions, verify account balances, and identify outstanding debts or income during the estate settlement process. These statements are critical for preparing accurate inventories, coordinating asset distribution, and resolving any tax obligations with the estate. |

| 10 | Investment Account Statements | Investment account statements are essential documents for an executor during estate settlement as they provide detailed records of assets, transactions, dividends, and account balances necessary for accurate valuation and distribution. These statements must be collected from financial institutions managing stocks, bonds, mutual funds, and retirement accounts to ensure comprehensive reporting and compliance with probate requirements. |

| 11 | Retirement Account Statements | Retirement account statements are essential documents an executor requires for accurate estate settlement, providing detailed information on 401(k), IRA, and pension fund balances. These statements help verify asset values, identify beneficiaries, and facilitate the proper distribution of retirement funds according to the decedent's wishes and legal requirements. |

| 12 | Life Insurance Policies | Executors need original life insurance policies, policyholder identification, and beneficiary designation forms to claim life insurance benefits during estate settlement. These documents ensure proper verification and timely distribution of proceeds according to the decedent's wishes and state regulations. |

| 13 | Outstanding Bills and Debts List | Executors require a comprehensive list of outstanding bills and debts, including credit card statements, utility bills, mortgage documents, and personal loans, to accurately assess the estate's liabilities. This documentation ensures proper debt settlement and prevents future legal complications during the probate process. |

| 14 | Tax Returns (Federal and State) | Executors must gather the deceased's federal and state tax returns, including the final individual income tax return (Form 1040) and any applicable estate tax returns (Form 706) to ensure accurate reporting and settlement. These documents are essential for calculating tax liabilities, claiming refunds, and providing the IRS and state tax authorities with the necessary information to close the estate. |

| 15 | Business Ownership Papers | Executors managing estate settlement must secure business ownership documents, including stock certificates, partnership agreements, operating agreements, and shareholder records, to accurately transfer business interests. These documents establish ownership, clarify valuation, and facilitate the legal transfer of business assets. |

| 16 | Credit Card Statements | Executors require credit card statements to verify outstanding debts, track expenses, and reconcile the deceased's financial obligations during estate settlement. These statements provide crucial evidence for identifying liabilities and ensuring accurate distribution of assets to beneficiaries. |

| 17 | Loan Documents | Executors require loan documents such as mortgage agreements, personal loan contracts, and outstanding credit agreements to accurately assess and settle the estate's liabilities. These documents ensure proper debt repayment, prevent creditor disputes, and facilitate the clear transfer of estate assets to beneficiaries. |

| 18 | Social Security Statements | Executors require Social Security Statements to verify the deceased's benefit history and calculate survivor benefits accurately during estate settlement. These documents are crucial for ensuring proper distribution of Social Security payments and finalizing financial accounts tied to the estate. |

| 19 | Marriage Certificate | An executor needs the marriage certificate to verify the deceased's marital status, which affects asset distribution and beneficiary claims during estate settlement. This document ensures proper identification of the surviving spouse and supports the validation of legal rights in the probate process. |

| 20 | Birth Certificates (for heirs/beneficiaries) | Executors need birth certificates of heirs or beneficiaries to verify their identity and establish legal entitlement to the estate during settlement. These documents are essential for validating relationships and ensuring accurate distribution of assets according to the will or state law. |

| 21 | Beneficiary Designations | Executor requires official beneficiary designations from life insurance policies, retirement accounts, and payable-on-death assets to accurately distribute estate assets according to the decedent's intentions. These documents ensure that designated beneficiaries receive their entitled portions without probate delays, streamlining the estate settlement process. |

| 22 | Funeral and Burial Receipts | Funeral and burial receipts are essential documents an executor must collect to provide proof of expenses incurred during the estate settlement process. These receipts validate costs for services such as funeral home arrangements, burial plots, and related expenses, ensuring accurate reimbursement from the estate. |

| 23 | Appraisal Reports (real estate, valuables) | Appraisal reports are essential documents an executor needs for estate settlement, providing professional valuations of real estate and valuable personal property to establish accurate asset values. These reports ensure fair distribution among beneficiaries and compliance with tax authorities by reflecting the current market worth of estate assets. |

| 24 | Mortgage Statements | Mortgage statements are essential documents an executor needs for estate settlement to accurately identify outstanding debts tied to the deceased's property. These statements provide current loan balances, payment histories, and lender contact information, enabling proper financial management and timely mortgage payments during the probate process. |

| 25 | Utility Bills | Executors need current utility bills such as electricity, water, gas, and phone statements to verify ongoing expenses and facilitate account closures or transfers during estate settlement. These documents help ensure all outstanding payments are made, preventing service interruptions and accurately reflecting liabilities in the estate inventory. |

| 26 | Medical Bills | Executors require detailed medical bills to accurately account for debts in the estate settlement process, ensuring all outstanding healthcare expenses are paid before asset distribution. These documents include hospital invoices, physician fees, prescription receipts, and long-term care costs, which must be verified for legitimacy and completeness. |

| 27 | Creditor Notifications | Executors must gather and send creditor notifications to all known creditors, including documented proof of debts such as outstanding bills, loans, and credit accounts, to legally validate and settle claims against the estate. Properly filed creditor notifications ensure the estate's liabilities are accurately accounted for, preventing future disputes during probate. |

| 28 | Disbursement Receipts | Disbursement receipts are essential documents an executor needs for estate settlement to provide a detailed record of all payments made from the estate, ensuring transparency and accountability to beneficiaries and courts. These receipts typically include proof of expenses such as funeral costs, debts, taxes, and administrative fees, which are critical for accurate accounting and final estate distribution. |

| 29 | Estate Accounting Records | Estate accounting records must include detailed inventories of all assets and liabilities, bank statements, receipts for expenses paid, records of income received by the estate, and documentation of distributions made to beneficiaries. Accurate and comprehensive estate accounting documents are essential for executor compliance with probate court requirements and maintaining transparency with heirs and creditors. |

| 30 | Consent/Waiver Forms from Heirs | Consent and waiver forms from heirs are crucial documents an executor needs to demonstrate that beneficiaries agree to waive their rights to contest the will or any part of the estate, streamlining the settlement process. These legally binding forms reduce the risk of disputes, expedite probate proceedings, and provide clear evidence of heir approval essential for smooth asset distribution. |

| 31 | Court Orders | Executors require verified court orders such as Letters Testamentary or Letters of Administration to legally manage and settle the estate, granting them authority to access assets and pay debts. These official documents from the probate court are essential for validating executor rights in financial institutions and during asset distribution. |

Understanding the Role of an Executor in Estate Settlement

Understanding the role of an executor is essential for efficient estate settlement. Executors manage the distribution of assets and ensure all legal and financial obligations are met.

- Death Certificate - Official proof of death required to initiate the probate process and access financial accounts.

- Will and Testament - Legal document that outlines the deceased's wishes and guides asset distribution.

- Financial Statements - Documents such as bank statements, investment portfolios, and property deeds needed to identify and value estate assets.

Key Executor Documents Required for Probate

Executors require specific documents to effectively manage estate settlement and probate processes. These documents ensure legal compliance and facilitate asset distribution.

Key executor documents include the original will, death certificate, and letters testamentary or letters of administration. Financial statements, property deeds, and tax returns are also essential for accurate estate valuation and debt settlement.

Gathering Financial Statements and Asset Inventories

Gathering financial statements is crucial for an executor to accurately assess the estate's value. These include bank statements, investment account summaries, and recent tax returns.

Creating a comprehensive asset inventory helps identify all property, valuables, and debts associated with the estate. Copies of deeds, titles, insurance policies, and appraisal reports provide essential documentation. You must also obtain statements for retirement accounts and outstanding loans to ensure thorough settlement.

Valuation Documentation for Real Estate and Investments

What valuation documentation is required for real estate during estate settlement?

Accurate appraisals and property tax assessments are essential to establish the fair market value of real estate. These documents help ensure the estate is properly valued for tax and distribution purposes.

What investment valuation records are necessary for estate settlement?

You need detailed statements, brokerage reports, and independent valuations of stocks, bonds, and other investments. This documentation confirms the current worth of all financial assets within the estate.

Tax Forms and Filings Required from Executors

Executors play a crucial role in managing the deceased's financial affairs, which includes handling tax responsibilities meticulously. Proper documentation and timely tax filings ensure legal compliance and smooth estate settlement.

- Form 1041 - U.S. Income Tax Return for Estates and Trusts - Executors must file this form to report income earned by the estate during administration.

- Form 706 - Estate Tax Return - Required if the estate exceeds the federal estate tax exemption threshold, this form calculates estate tax owed.

- Final Individual Income Tax Return (Form 1040) - Executors file this for the deceased's income up to the date of death, ensuring all personal taxes are settled.

Debt Settlement Papers and Creditor Notifications

| Document Type | Description | Purpose |

|---|---|---|

| Debt Settlement Papers | Official agreements or records showing repayment plans, settlements, or clearance of the deceased's outstanding debts. | Verify that all debts have been properly identified and settled to prevent any future liabilities on the estate. |

| Creditor Notifications | Formal notices sent to all known creditors informing them of the decedent's passing and providing instructions on submitting claims. | Ensure all creditors have the opportunity to present their claims against the estate, which is crucial for accurate debt reconciliation. |

When managing estate settlement, it is essential for you as an executor to organize these documents carefully. Proper handling of debt settlement papers and creditor notifications ensures legal compliance and smooth distribution of assets to heirs.

Life Insurance and Retirement Account Documentation

Settling an estate requires specific documentation to access life insurance and retirement accounts. Having these documents organized expedites the distribution process and ensures compliance with legal requirements.

- Life Insurance Policies - Original policy documents verify coverage and beneficiary details.

- Death Certificate - Certified copies are mandatory for claim submissions on life insurance and retirement accounts.

- Retirement Account Statements - Recent statements confirm account balances and beneficiary designations.

Your attention to gathering these documents will streamline the estate settlement process.

Distribution Records and Beneficiary Receipts

Distribution records are essential documents that detail the allocation of estate assets to beneficiaries. These records provide a transparent account of transactions made during the estate settlement process.

Beneficiary receipts serve as proof that assets or funds have been transferred to the rightful heirs. Maintaining these receipts helps prevent disputes and ensures accountability throughout the distribution phase.

Legal Compliance and Court Approval Documents

To ensure legal compliance during estate settlement, an executor must gather key documents such as the original will, death certificate, and letters testamentary issued by the probate court. Court approval documents include petitions for probate, inventory of estate assets, and final accounting reports submitted for judicial review. You will need these records to manage the estate properly and fulfill fiduciary duties according to state laws.

What Documents Does an Executor Need for Estate Settlement? Infographic