To set up a 529 college savings plan, a parent typically needs proof of identity such as a government-issued ID, their Social Security number or Taxpayer Identification Number, and the beneficiary's Social Security number. They must also provide proof of residency and bank account details for contributions. Some plans may require additional documentation like a birth certificate for the beneficiary or proof of guardianship if the parent is not the legal guardian.

What Documents Does a Parent Need to Set Up a 529 College Savings Plan?

| Number | Name | Description |

|---|---|---|

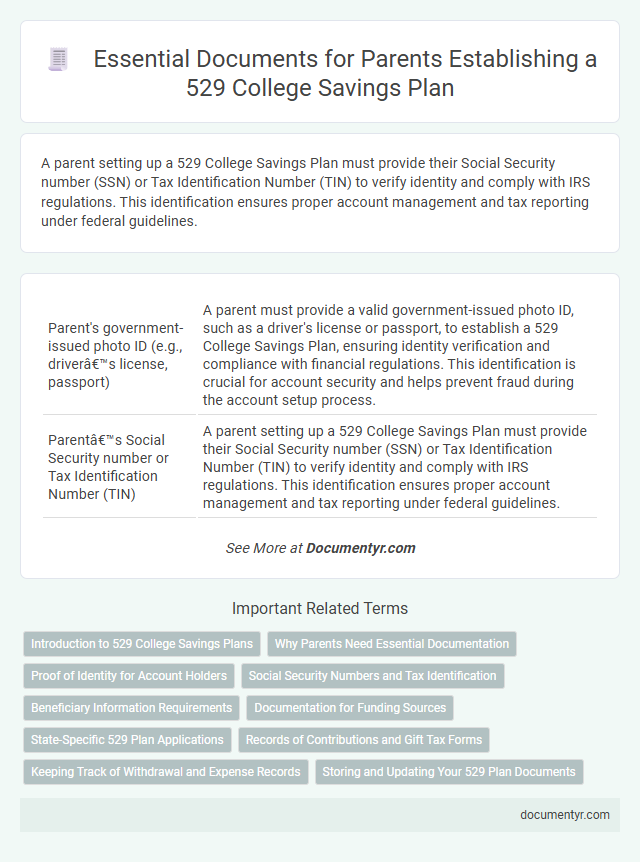

| 1 | Parent's government-issued photo ID (e.g., driver’s license, passport) | A parent must provide a valid government-issued photo ID, such as a driver's license or passport, to establish a 529 College Savings Plan, ensuring identity verification and compliance with financial regulations. This identification is crucial for account security and helps prevent fraud during the account setup process. |

| 2 | Parent’s Social Security number or Tax Identification Number (TIN) | A parent setting up a 529 College Savings Plan must provide their Social Security number (SSN) or Tax Identification Number (TIN) to verify identity and comply with IRS regulations. This identification ensures proper account management and tax reporting under federal guidelines. |

| 3 | Beneficiary’s (student’s) Social Security number or Tax Identification Number (TIN) | To set up a 529 college savings plan, parents must provide the beneficiary's Social Security number (SSN) or Tax Identification Number (TIN) for accurate identification and tax reporting purposes. This information is essential for linking the account to the student and ensuring compliance with IRS regulations. |

| 4 | Beneficiary’s birth certificate (optional but sometimes requested) | To set up a 529 College Savings Plan, parents generally need the beneficiary's Social Security number, but some states may also request the beneficiary's birth certificate as an optional verification document. Providing the birth certificate can help confirm the beneficiary's identity and support the application process, especially if discrepancies arise with other identification. |

| 5 | Parent’s banking information (routing and account numbers) | To set up a 529 college savings plan, parents need to provide their banking information, including the routing number and account number, to enable initial funding and future contributions. Accurate bank details ensure seamless electronic transfers and automatic deductions for consistent plan financing. |

| 6 | Proof of address (utility bill, lease agreement, or similar document) | Proof of address is a critical document required to establish a 529 college savings plan, typically evidenced by a recent utility bill, lease agreement, or similar official document that verifies the parent's residential address. This documentation ensures compliance with state regulations and helps secure the account under the correct jurisdiction for tax benefits and legal purposes. |

| 7 | Completed 529 College Savings Plan application form | A completed 529 College Savings Plan application form is required to establish the account, containing essential information about the account owner, beneficiary, and investment preferences. This form must be accurately filled out and signed to initiate the plan and enable future tax-advantaged contributions for college expenses. |

| 8 | Successor account owner information (optional, may require name and SSN/TIN) | Setting up a 529 College Savings Plan typically requires the parent's Social Security Number (SSN) or Taxpayer Identification Number (TIN), along with the child's identifying information. Providing successor account owner details, including their name and SSN or TIN, is optional but recommended to ensure seamless management in case the original account owner becomes unable to control the plan. |

Introduction to 529 College Savings Plans

A 529 College Savings Plan is a tax-advantaged investment account designed to help parents save for their child's future education expenses. These plans offer tax-free growth and withdrawals when used for qualified education costs. Understanding the required documents is essential to successfully opening and managing a 529 plan.

Why Parents Need Essential Documentation

Setting up a 529 College Savings Plan requires specific documentation to ensure accurate account creation and compliance with financial regulations. These essential documents verify your identity and establish your authority as the account owner.

Parents typically need a valid government-issued photo ID, such as a driver's license or passport, to confirm their identity. Proof of Social Security Number or Taxpayer Identification Number is required for tax reporting purposes. Additionally, the beneficiary's information, including their Social Security Number and date of birth, must be provided to link the account correctly.

Proof of Identity for Account Holders

Proof of identity is a critical requirement when setting up a 529 college savings plan. Accurate verification ensures compliance with federal regulations and protects against fraud.

- Government-issued photo ID - Typically includes a driver's license, passport, or state ID card to verify the account holder's identity.

- Social Security Number (SSN) or Tax Identification Number (TIN) - Required to report contributions and earnings to the IRS accurately.

- Proof of residency - Utility bills or bank statements may be requested to confirm the account holder's address and state of residency.

Social Security Numbers and Tax Identification

To set up a 529 College Savings Plan, parents must provide Social Security Numbers (SSNs) for both the account owner and the beneficiary. These identification numbers are essential for tax reporting and verifying eligibility.

In cases where a Social Security Number is not available, a Tax Identification Number (TIN) may be used instead. Providing accurate SSNs or TINs ensures compliance with IRS regulations and smooth account setup.

Beneficiary Information Requirements

To set up a 529 College Savings Plan, you need to provide specific beneficiary information. This includes the beneficiary's full name, Social Security number or Tax Identification Number, and date of birth. Accurate beneficiary details ensure proper account setup and tax benefits.

Documentation for Funding Sources

What documents are required to verify funding sources when setting up a 529 college savings plan? Proof of funding sources typically includes recent bank statements or investment account statements to confirm available funds. Some plans may also require documentation such as a paycheck stub or tax return to verify the origin of the contributions.

State-Specific 529 Plan Applications

Setting up a 529 college savings plan requires parents to provide specific documentation, which varies by state. Each state's 529 plan application may have unique requirements that must be met for successful enrollment.

- Proof of Identity - Parents typically need to provide a government-issued ID, such as a driver's license or passport, for verification purposes.

- Social Security Number - Both the account owner's and beneficiary's Social Security numbers are usually required to complete the application.

- State Residency Documentation - Some states require proof of residency like a utility bill or state ID to qualify for in-state benefits or tax advantages.

Consulting the specific 529 plan's website is essential to confirm all necessary documents before applying.

Records of Contributions and Gift Tax Forms

To set up a 529 college savings plan, parents must have detailed records of all contributions made to the account. These records help track the total amount invested and ensure compliance with contribution limits set by the plan.

Gift tax forms may also be required if contributions exceed the annual exclusion amount, currently $17,000 per donor in 2024. Filing IRS Form 709 ensures proper reporting of gifts and avoids potential tax issues related to excessive contributions.

Keeping Track of Withdrawal and Expense Records

| Document Type | Purpose | Importance for Withdrawal and Expense Records |

|---|---|---|

| Birth Certificate or Government-Issued ID | Verify identity of the beneficiary and account holder | Ensures correct information for account management and withdrawal authorization |

| Social Security Number (SSN) or Tax Identification Number (TIN) | Required for tax reporting and account setup | Essential for tracking contributions, earnings, and qualified withdrawals for tax purposes |

| Proof of Residency | Determine state tax benefits and account eligibility | Helps monitor state-specific tax treatment of withdrawals and expenses |

| Bank Account Information | Link to 529 plan for funding contributions and receiving distributions | Necessary for accurate deposit and withdrawal record-keeping |

| College Admission or Enrollment Documents | Verify qualified educational expenses | Supports documentation required to justify withdrawals used for tuition and fees |

| Receipts and Invoices for Educational Expenses | Document qualified expenses such as tuition, books, room, and board | Critical for recordkeeping to ensure withdrawals align with IRS qualified expense guidelines |

| Account Statements and Withdrawal Confirmations | Track account activity and withdrawal history | Facilitates clear auditing and proof of proper use of 529 funds |

What Documents Does a Parent Need to Set Up a 529 College Savings Plan? Infographic