Small business grants typically require a detailed business plan outlining objectives, market analysis, and financial projections. Applicants must provide proof of business ownership, such as registration certificates, along with tax identification numbers and financial statements like balance sheets and income statements. Some grant programs also request personal identification documents and a demonstration of how the grant will be used to achieve specific business goals.

What Documents are Needed for Small Business Grants?

| Number | Name | Description |

|---|---|---|

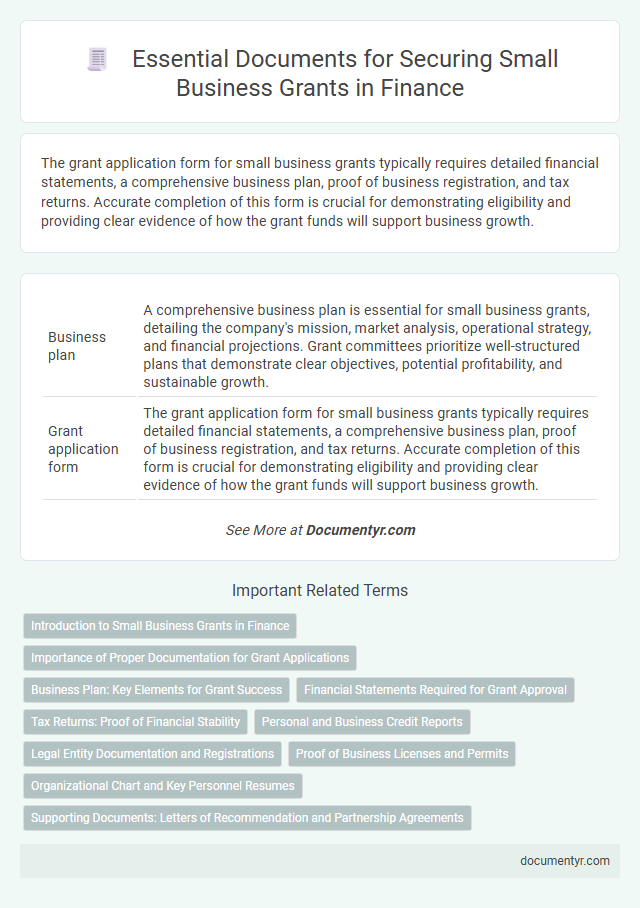

| 1 | Business plan | A comprehensive business plan is essential for small business grants, detailing the company's mission, market analysis, operational strategy, and financial projections. Grant committees prioritize well-structured plans that demonstrate clear objectives, potential profitability, and sustainable growth. |

| 2 | Grant application form | The grant application form for small business grants typically requires detailed financial statements, a comprehensive business plan, proof of business registration, and tax returns. Accurate completion of this form is crucial for demonstrating eligibility and providing clear evidence of how the grant funds will support business growth. |

| 3 | Executive summary | An executive summary for small business grant applications typically requires a concise overview of the business plan, including the mission statement, target market, and financial projections. Essential documents often include tax returns, business licenses, and proof of ownership to demonstrate eligibility and fiscal responsibility. |

| 4 | Proof of business registration | Proof of business registration is a critical document for small business grant applications, typically including a valid business license, articles of incorporation, or a certificate of formation depending on the business structure. Lenders or grant providers often require official government-issued documentation that verifies the legitimacy and legal status of the business to ensure eligibility for funding. |

| 5 | Tax identification number (TIN/EIN) | A Tax Identification Number (TIN), commonly referred to as an Employer Identification Number (EIN), is essential for small business grant applications as it verifies the legal identity of the business to federal agencies. Grant providers require the EIN to ensure accurate tax reporting and eligibility, making it a critical document alongside financial statements and business licenses. |

| 6 | Financial statements (balance sheet, income statement, cash flow statement) | Small business grants typically require comprehensive financial statements, including a balance sheet, income statement, and cash flow statement, to demonstrate the business's financial health and viability. These documents provide grantors with essential data on assets, liabilities, profitability, and liquidity, ensuring informed funding decisions. |

| 7 | Bank statements | Bank statements are essential documents for small business grant applications, providing proof of financial stability and cash flow management over a specific period. Lenders and grant providers use these statements to verify income, expenses, and the overall financial health of the business. |

| 8 | Personal and business tax returns | Small business grants require personal and business tax returns to verify financial stability and ownership legitimacy, with at least the past two years' tax filings typically submitted. These documents provide essential proof of income, expenses, and compliance with tax regulations, ensuring eligibility for grant programs targeting small enterprises. |

| 9 | Profit and loss statements | Profit and loss statements are essential documents required for small business grant applications as they provide a detailed summary of revenues, expenses, and net income over a specific period, demonstrating the business's financial performance and viability. Accurate and up-to-date profit and loss statements help grant reviewers assess the profitability and sustainability of the enterprise, influencing funding decisions. |

| 10 | Budget proposal | A detailed budget proposal for small business grants must clearly outline projected expenses, including operational costs, salaries, equipment, and marketing, ensuring alignment with the grant's funding guidelines. Accurate financial documentation such as profit and loss statements, cash flow forecasts, and previous tax returns strengthens the proposal's credibility and demonstrates fiscal responsibility to grant providers. |

| 11 | Resumes of key management | Resumes of key management highlight experience and qualifications critical for small business grant approval, showcasing leadership capacity and relevant expertise. Detailed CVs demonstrate the team's ability to execute the business plan, increasing the likelihood of securing funding from grant providers. |

| 12 | Articles of incorporation or organization | Articles of incorporation or organization serve as crucial legal documents verifying a small business's formation and legitimacy, often required to apply for small business grants. These documents detail the company's name, structure, and purpose, providing grantors with essential information to assess eligibility and compliance. |

| 13 | Business licenses and permits | Small business grant applications typically require valid business licenses and permits to verify the legal operation of the enterprise within its jurisdiction. These documents confirm compliance with local, state, and federal regulations, ensuring eligibility for funding opportunities. |

| 14 | Ownership and affiliation documentation | Small business grant applications typically require ownership documentation such as articles of incorporation, partnership agreements, or sole proprietorship registration to verify business legitimacy. Affiliation documentation may include evidence of any parent companies, subsidiaries, or business networks that demonstrate the applicant's business structure and relationships. |

| 15 | DUNS number | Small business grants often require a DUNS number, a unique nine-digit identifier assigned by Dun & Bradstreet to track business credit and financial history. This number is essential for verifying business legitimacy and is frequently requested alongside financial statements, tax returns, and a detailed business plan during the grant application process. |

| 16 | Project narrative or proposal | The project narrative or proposal for small business grants must clearly outline the business goals, detailed budget, timeline, and expected outcomes to demonstrate feasibility and impact. Comprehensive documentation should include market analysis, project objectives, implementation strategies, and measurable success indicators to enhance grant approval chances. |

| 17 | Letters of support or recommendation | Letters of support or recommendation for small business grants must demonstrate credible endorsement from industry experts, community leaders, or business partners to strengthen the application. These documents often include detailed descriptions of the applicant's business potential, leadership qualities, and the anticipated impact of the grant-funded project. |

| 18 | Evidence of matching funds | Evidence of matching funds for small business grants typically includes bank statements, loan approval letters, or investment documents that demonstrate available capital corresponding to the grant requirements. Providing clear proof of financial contributions from the business owner or third-party investors ensures compliance with grant eligibility criteria and supports the application process. |

| 19 | List of board members and officers | Small business grant applications often require a detailed list of board members and officers, including names, titles, and contact information, to verify organizational leadership and governance. This documentation supports the grant review process by demonstrating transparent management structures and accountability within the business entity. |

| 20 | Organizational chart | An organizational chart is essential for small business grant applications as it visually outlines the company's structure, showing key management roles and reporting lines to demonstrate operational efficiency and leadership clarity. This documentation supports grant providers in assessing the business's governance and capacity to manage funds effectively. |

| 21 | Current debt schedule | A current debt schedule is essential for small business grant applications, detailing all outstanding loans, credit lines, interest rates, and payment terms. This document provides lenders with a clear overview of the business's financial obligations and helps assess its creditworthiness and repayment capacity. |

| 22 | Lease or property agreements | Lease or property agreements are essential documents for small business grants as they verify the physical location of the business and demonstrate operational stability. These agreements provide grantors with proof of legal occupancy and financial obligations related to the premises, influencing eligibility and funding decisions. |

| 23 | Supplier or vendor contracts | Supplier or vendor contracts are essential documents for small business grants as they demonstrate ongoing business relationships and confirm operational capacity. These contracts provide evidence of revenue streams and help grant reviewers assess the viability and scalability of the business. |

| 24 | Proof of citizenship or residency | Proof of citizenship or residency, such as a valid passport, driver's license, or government-issued ID, is essential for small business grant applications to verify the applicant's legal status. Documentation like a Social Security card, utility bills, or lease agreements may also be required to confirm residency within the jurisdiction offering the grant. |

| 25 | Previous grant award documentation (if applicable) | Previous grant award documentation is essential for small business grant applications as it verifies prior funding, demonstrates responsible fund management, and highlights the business's track record in meeting grant objectives. Key documents include award letters, financial reports, progress updates, and compliance certificates from earlier grants, which collectively strengthen the application by showcasing credibility and successful project execution. |

Introduction to Small Business Grants in Finance

What documents are needed to apply for small business grants in finance?

Small business grants provide financial support without the need for repayment, helping entrepreneurs grow their ventures. Essential documents showcase the business's legitimacy, financial health, and purpose for the grant funds.

Importance of Proper Documentation for Grant Applications

Proper documentation is crucial for small business grant applications to demonstrate eligibility and financial responsibility. Organized and accurate documents increase the chances of securing funding by establishing credibility.

- Business Plan - A detailed business plan outlines your goals, strategies, and financial projections.

- Financial Statements - Accurate profit and loss statements, balance sheets, and cash flow reports showcase financial health.

- Legal Documentation - Incorporation papers, tax identification numbers, and licenses verify your business's legal status.

Business Plan: Key Elements for Grant Success

Securing small business grants requires a well-prepared business plan that clearly outlines your goals and strategies. This document serves as a critical tool to demonstrate your business's potential and financial viability to grant providers.

- Executive Summary - A concise overview of your business objectives and the purpose of the grant request.

- Market Analysis - Detailed research on your target market, industry trends, and competitive landscape.

- Financial Projections - Realistic forecasts of revenue, expenses, and cash flow to prove your business's sustainability.

Your business plan is essential for convincing grant organizations of your readiness and capacity to use funds effectively.

Financial Statements Required for Grant Approval

Small business grant applications typically require comprehensive financial statements to demonstrate the business's financial health and viability. Key documents include balance sheets, income statements, and cash flow statements, which provide a clear overview of assets, liabilities, revenue, and expenses. Lenders and grant committees use these statements to assess the business's ability to manage funds and achieve intended outcomes effectively.

Tax Returns: Proof of Financial Stability

Tax returns serve as critical proof of financial stability when applying for small business grants. These documents provide a detailed record of your business's income, expenses, and overall financial health over a specified period.

Grant providers rely on tax returns to verify the legitimacy and sustainability of your operations. Submitting accurate and up-to-date tax returns enhances your eligibility by demonstrating consistent financial management.

Personal and Business Credit Reports

Obtaining small business grants requires careful preparation of several key documents, including credit reports. Your personal and business credit reports play a critical role in demonstrating financial responsibility to grant providers.

- Personal Credit Report - This document shows your individual credit history, which lenders use to assess your financial reliability and risk level.

- Business Credit Report - This report details the credit profile and financial behavior of your business, reflecting its creditworthiness and stability.

- Credit Score Summary - A clear summary of credit scores helps grant evaluators quickly understand your financial status and history.

Legal Entity Documentation and Registrations

Small business grants require specific legal entity documentation to verify the legitimacy of the applicant. These documents confirm the business's legal structure and registration status.

Essential legal entity documentation includes business licenses, articles of incorporation, and partnership agreements. Registration with relevant local, state, or federal agencies must be proven through tax identification numbers or business registration certificates. Accurate and up-to-date legal documentation enhances the chances of grant approval.

Proof of Business Licenses and Permits

| Document Type | Description | Importance for Small Business Grants |

|---|---|---|

| Business License | Official authorization issued by a local, state, or federal government granting permission to operate a business legally within a specific jurisdiction. | Validates the business's legal existence and eligibility to receive grant funds. Most grant providers require a current business license to ensure compliance with local regulations. |

| Industry-Specific Permits | Special permits related to the nature of the business, such as health permits, environmental permits, or zoning approvals necessary to conduct certain activities. | Confirms that the business meets sector-specific regulatory requirements, which can be critical in grant application reviews to assess risk and legitimacy. |

| Renewal Certificates | Documentation confirming that business licenses and permits are up to date and have not expired. | Demonstrates ongoing compliance and active operation status, often mandatory in grant evaluation criteria. |

| Proof of Registration with Relevant Authorities | Evidence showing the business is registered with municipal, state, or federal bodies, such as a Secretary of State or Department of Revenue registration. | Supports trustworthiness and legitimacy, necessary to pass administrative reviews and qualify for funding. |

Organizational Chart and Key Personnel Resumes

Small business grants often require an organizational chart to clearly display the company's structure and reporting relationships. Including key personnel resumes highlights the expertise and qualifications of your management team, which strengthens your application. These documents demonstrate your business's capacity to execute its plans effectively and build trust with grant providers.

What Documents are Needed for Small Business Grants? Infographic