To apply for student financial aid through FAFSA, you need your Social Security number, driver's license (if applicable), and most recent federal income tax returns, W-2s, or other records of money earned. Information on your bank statements, untaxed income, and current mortgage or rental property expenses may also be required. Ensuring all documentation is accurate and readily available helps streamline the FAFSA application process and maximize your financial aid eligibility.

What Documents Are Necessary to Apply for Student Financial Aid (FAFSA)?

| Number | Name | Description |

|---|---|---|

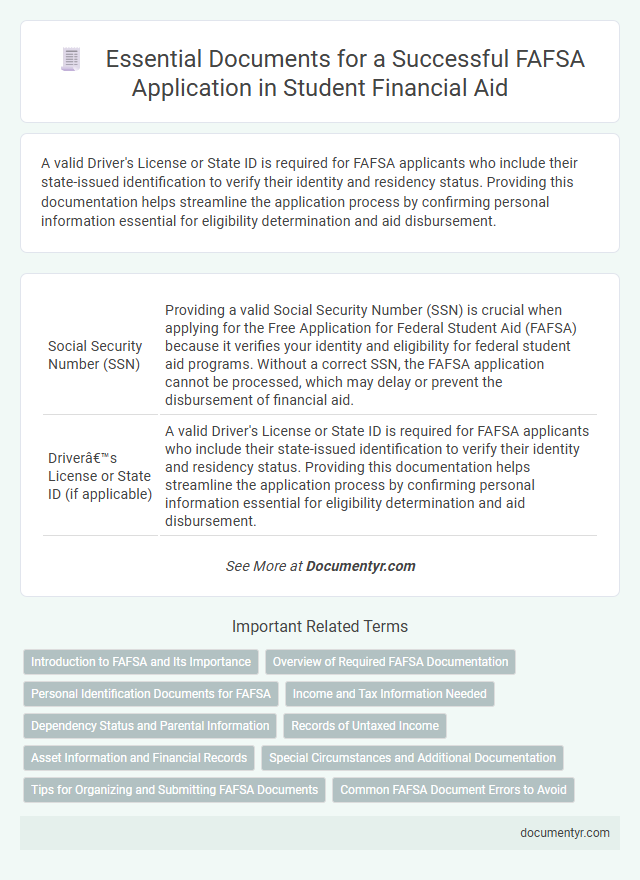

| 1 | Social Security Number (SSN) | Providing a valid Social Security Number (SSN) is crucial when applying for the Free Application for Federal Student Aid (FAFSA) because it verifies your identity and eligibility for federal student aid programs. Without a correct SSN, the FAFSA application cannot be processed, which may delay or prevent the disbursement of financial aid. |

| 2 | Driver’s License or State ID (if applicable) | A valid Driver's License or State ID is required for FAFSA applicants who include their state-issued identification to verify their identity and residency status. Providing this documentation helps streamline the application process by confirming personal information essential for eligibility determination and aid disbursement. |

| 3 | Alien Registration Number (for non-U.S. citizens) | Applicants who are not U.S. citizens must provide their Alien Registration Number (A-Number) when applying for student financial aid through the FAFSA to verify their eligible noncitizen status. This key document, along with other immigration information such as Form I-94 or Permanent Resident Card, ensures accurate determination of financial aid eligibility for noncitizen students. |

| 4 | Federal Income Tax Returns (IRS Form 1040, 1040A, or 1040EZ) | Federal Income Tax Returns, such as IRS Form 1040, 1040A, or 1040EZ, are essential documents for applying for student financial aid through FAFSA, as they provide accurate income data required to determine eligibility. These forms must include detailed information on adjusted gross income, tax paid, and other relevant financial details necessary for the federal aid assessment. |

| 5 | W-2 Forms | W-2 forms are essential documents for completing the Free Application for Federal Student Aid (FAFSA), as they provide verified information about a student's and their parents' earned income. Accurate W-2 data ensures the proper calculation of the Expected Family Contribution (EFC), which directly influences financial aid eligibility and award amounts. |

| 6 | Records of Untaxed Income (e.g., child support received, interest income, veterans non-education benefits) | Records of untaxed income required for FAFSA include documentation of child support received, interest income statements, and veterans non-education benefits such as disability or death pension letters. Accurate reporting of these untaxed income sources ensures proper calculation of the Expected Family Contribution (EFC) and eligibility for federal financial aid programs. |

| 7 | Bank Statements | Bank statements are essential for the FAFSA application process because they provide accurate records of your current financial assets, including checking and savings account balances. These documents help determine your family's ability to contribute to educational expenses by verifying available funds and liquid assets. |

| 8 | Investment Records (stocks, bonds, real estate, etc.) | Accurate investment records, including statements for stocks, bonds, mutual funds, real estate properties, and other assets, are essential for completing the FAFSA application and determining financial aid eligibility. These documents provide crucial information about asset values and income generated, directly impacting the Expected Family Contribution (EFC) calculation. |

| 9 | Records of Current Business and Farm Assets (if applicable) | Records of current business and farm assets, including balance sheets and valuation reports, are required for FAFSA applicants owning such properties to accurately report their net worth. These documents ensure precise asset assessment, impacting the Expected Family Contribution (EFC) calculation for student financial aid eligibility. |

| 10 | FSA ID (for electronic signature) | The FSA ID is a crucial electronic signature required to complete and submit the Free Application for Federal Student Aid (FAFSA) securely online. Applicants must create an FSA ID using a valid Social Security Number, email address, and a memorable username and password to verify their identity and access federal student aid information. |

| 11 | Parent(s)’ Financial Documents (if dependent) | Parent(s)' financial documents required for completing the FAFSA include recent federal income tax returns (Form 1040), W-2 forms, records of untaxed income, and current bank statements to verify assets. Additionally, parents should provide documentation of Social Security benefits, child support received, and any other relevant financial information to ensure accurate aid assessment. |

Introduction to FAFSA and Its Importance

The Free Application for Federal Student Aid (FAFSA) is a crucial form used to determine eligibility for federal, state, and institutional financial aid. Completing the FAFSA accurately can open doors to grants, scholarships, work-study, and low-interest student loans. Understanding the required documents helps applicants submit their FAFSA efficiently and avoid delays in the financial aid process.

Overview of Required FAFSA Documentation

| Document | Description | Purpose |

|---|---|---|

| Social Security Number (SSN) | Valid SSN issued by the Social Security Administration | Identifies the student and their dependents for the FAFSA application |

| Driver's License (if applicable) | State-issued driver's license | Provides additional identification information |

| Federal Income Tax Returns | Student's and parents' (if dependent) IRS Form 1040 | Verifies income and tax details to determine financial need |

| IRS Data Retrieval Tool (DRT) | Optional online tool linked within FAFSA | Allows automatic import of tax return data to reduce errors |

| W-2 Wage and Tax Statements | Documentation showing income earned from employment | Supports reported income figures on financial aid application |

| Records of Untaxed Income | Examples include child support, veterans' benefits, or untaxed Social Security benefits | Ensures all income sources are accounted for in eligibility assessment |

| Asset Records | Bank statements, investment records, and other asset documentation | Assesses available financial resources that affect aid decisions |

| Proof of Citizenship or Eligible Non-Citizen Status | U.S. birth certificate, passport, or permanent resident card | Confirms eligibility for federal financial aid programs |

Personal Identification Documents for FAFSA

Personal identification documents are essential for completing the FAFSA application accurately. Valid identification verifies your identity and ensures your financial aid is processed without delays.

Required documents typically include a government-issued ID such as a driver's license, state ID, or passport. Your Social Security card is also necessary to confirm your citizenship or eligible noncitizen status.

Income and Tax Information Needed

Applying for student financial aid through FAFSA requires accurate income and tax information. Gathering these documents beforehand ensures a smoother application process.

- Federal tax returns - Submit your IRS Form 1040 to report annual income and tax details.

- W-2 forms - Collect W-2 statements to verify wages earned from employers.

- Records of untaxed income - Include documents related to untaxed income like child support or veterans' benefits.

Having these income and tax documents ready helps complete the FAFSA form accurately and efficiently.

Dependency Status and Parental Information

Applying for student financial aid through FAFSA requires specific documentation related to your dependency status and parental information. Properly gathering these documents ensures accurate submission and eligibility assessment.

- Proof of Dependency Status - Documents like a birth certificate or court documents verify whether you are considered a dependent or independent student.

- Parental Income Information - Parents' recent tax returns, W-2 forms, or IRS tax transcripts provide essential income data for dependent students.

- Parental Marital Status - Information about parental marital status affects which parents' financial details must be reported on the FAFSA.

Records of Untaxed Income

What records of untaxed income are necessary to apply for student financial aid through FAFSA? Applicants must gather documents that report untaxed income such as child support received, veterans noneducation benefits, and military or clergy allowances. These records ensure accurate reporting, which directly affects eligibility and aid amounts.

Asset Information and Financial Records

To apply for student financial aid through FAFSA, asset information is crucial. This includes current balances of checking, savings, and investment accounts.

Financial records such as recent tax returns and W-2 forms are also necessary. Documentation of untaxed income like child support or veterans' benefits must be provided.

Special Circumstances and Additional Documentation

Applying for student financial aid through FAFSA requires specific documentation to verify eligibility, especially under special circumstances. Gathering all necessary records ensures a smoother application process and accurate financial assessment.

- Special Circumstances Documentation - Includes statements of unusual expenses, loss of income, or changes in family status affecting financial need.

- Additional Tax Information - May require IRS tax return transcripts or verification of non-filing to confirm income details.

- Supporting Legal Documents - Court orders, divorce decrees, or letters from social services may be needed to validate family or custodial situations.

Tips for Organizing and Submitting FAFSA Documents

Gather essential documents such as your Social Security number, federal income tax returns, W-2 forms, and bank statements before starting the FAFSA application. Organize these papers in a dedicated folder and create digital backups to ensure easy access during the submission process. Accurate and complete documentation speeds up application approval and helps secure maximum financial aid eligibility.

What Documents Are Necessary to Apply for Student Financial Aid (FAFSA)? Infographic